Eco (Atlantic) Oil & Gas, the oil and gas exploration company focused on the offshore Atlantic Margins, is pleased today announced completion of its transaction with Africa Oil Corp. ("Africa Oil") and Africa Oil SA Corp ("AOSAC") for the sale of a 1% Participating Interest in Block 3B/4B, and replacement of a member of the board.

Block 3B/4B Update

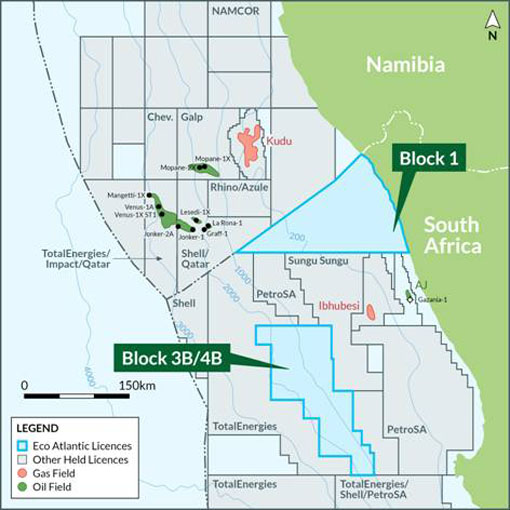

Further to the Company's announcement of 29 July 2024 and following satisfaction of all conditions precedent in regards to the Exchange Transaction (as defined below), the Company is pleased to confirm that the transaction has now completed. As detailed in the Announcement, Azinam Limited ("Azinam"), Eco's wholly owned subsidiary, agreed to sell and assign a 1% Participating Interest in Block 3B/4B offshore the Republic of South Africa, including the associated Exploration Right and Joint Operating Agreement rights ("Assigned Interest") to AOSAC in exchange for the cancellation of all common shares of no par value in the Company ("Common Shares") and warrants over Common Shares ("Warrants") held by Africa Oil (the "Exchange Transaction").

Eco has now received approval from the Government of the Republic of South Africa, under Section 11 of the Mineral and Petroleum Resources Development Act, in relation to Eco's Assignment and Share Cancellation Agreement with Azinam, Africa Oil and AOSAC. The conditions precedent to the Exchange Transaction, including requisite regulatory approvals from the Government of the Republic of South Africa, TSX Venture Exchange, applicable Canadian Securities Commissions, and the relevant approvals from the Block 3B/4B Joint Venture Partners, have now been satisfied and accordingly, Azinam has assigned the Assigned Interest to AOSAC and in return Africa Oil has transferred the Eco Securities (as defined below) which have been cancelled ("Completion").

Eco now holds a fully carried 5.25% interest in Block 3B/4B Offshore South Africa, reduced from 6.25%. Following the cancellation of Africa Oil's previously held in aggregate, 54,941,744 Common Shares (valued at c. $CAD11.5m as at 29 July 2024) and 4,864,865 Warrants (collectively, the "Eco Securities"), the outstanding common share capital of the Company is now reduced to 315,231,936 Common Shares and 48,541,666 warrants.

Board Replacement

As a result of Completion, Africa Oil is no longer a shareholder in the Company and no longer has the right to appoint a director to Eco's Board of Directors. Accordingly, Africa Oil's representative, Oliver Quinn, has stepped down from Eco's Board of Directors (the "Board") with immediate effect.

Consequently, Eco is pleased to announce the appointment of Mrs Emily Ferguson as a Non-Executive Director with immediate effect. Mrs Ferguson brings 22 years of experience in the oil and gas industry, spanning technical, commercial, and senior leadership roles, with a particular focus on exploration assets. Most recently, she spent six years at TotalEnergies, where she served as VP of Exploration for Europe, the Middle East, North Africa, and Asia until August 2024. In this role, she was responsible for overseeing exploration activities across multiple regions. Before this, Emily was the lead negotiator for E&P asset divestments and acquisitions across Europe, South America, and Africa, with a particular emphasis on Southern and Eastern Africa. Prior to her time at TotalEnergies, Emily spent 12 years at Maersk Oil, where she held roles as Head of Kurdistan and Kazakhstan Exploration Assets, as well as Head of Kenya Exploration. She holds a BSc in Geology and Petroleum Geology and an MSc in Petroleum Geology from the University of Aberdeen, Scotland.

KeyFacts Energy: Eco Atlantic South Africa country profile l KeyFacts Energy news: People on the Move

KEYFACT Energy

KEYFACT Energy