Vermilion is an international energy producer that seeks to create value through the acquisition, exploration, development and optimization of producing properties in North America, Europe and Australia. Their business model emphasizes organic production growth augmented with value-adding acquisitions, along with providing reliable dividends to investors.

The company is targeting growth in production primarily through the exploitation of light oil and liquids-rich natural gas conventional resource plays in Canada and the United States, the exploration and development of high impact natural gas opportunities in the Netherlands and Germany, and through oil drilling and workover programs in France and Australia. In addition, Vermilion holds a 56.5% working interest in the Corrib gas field in Ireland.

History

Vermilion was founded in 1994 as a Canadian oil and gas exploration and production company focused on assets in Alberta, Canada. In 1997, Vermilion took the highly innovative step of expanding internationally through the acquisition of oil-producing assets in France. Since that time, Vermilion has continued to add assets to its portfolio focusing on three core regions: North America, Europe and Australia. Vermilion has successfully leveraged its international diversification to outperform the relevant energy and broad market indices over the long-term.

Production and reserves

Production during the second quarter of 2024 averaged 84,974 boe/d which was at the upper end of the Company's quarterly production guidance range and represents an increase of 2% year-over-year.

Year-end 2023 proved developed producing ("PDP") reserves were 173 mmboe and total proved plus probable ("2P") reserves were 430 mmboe, reflecting a reserve life index of 5.6 years and 14.0 years, respectively.

2025 CapEx

Vermilion's Board of Directors has approved an E&D capital budget of $600 – $625 million for 2025. The budget includes drilling and infrastructure capital allocated to all major business units, including ongoing drilling and debottlenecking on the BC Montney asset and European gas exploration and development in Germany, Netherlands, and Central and Eastern Europe. This level of capital investment is expected to deliver annual average production of 84,000 to 88,000 boe/d, which represents 2% growth at the mid-point compared to the original 2024 production guidance.

North America

In North America, Vermilion plans to invest approximately $380 million of E&D capital, which will be deployed across the liquids-rich gas assets in the BC Montney and Alberta Deep Basin and light and medium crude oil assets in southeast Saskatchewan and the USA. In 2025, the Company plans to drill a total of 36 (32.9 net) wells in North America, including six (6.0 net) Montney wells in BC, fifteen (12.6 net) Deep Basin wells in Alberta, eleven (10.3 net) wells in southeast Saskatchewan, and four (4.0 net) wells in the United States. Vermilion will continue to invest in infrastructure to de-bottleneck its Montney facilities by adding compression to the 8-33 battery, which will increase gas handling capacity by approximately 5,000 boe/d. Future expansion and optimization plans will increase total Montney throughput capacity to 28,000 boe/d within the next few years, facilitating strong free cash flow for two decades from existing Mica Montney drilling inventory.

Vermilion is resuming operated drilling in the United States in 2025, with four (4.0 net) two-mile wells targeting the Turner and Parkman formations. The 2025 United States drilling program follows a year of participating in non-operated drilling across numerous formations, providing valuable insight into the deliverability of these zones on Vermilion's acreage.

International

Vermilion plans to invest approximately $230 million across its international assets, with an emphasis on European natural gas exploration and development. With this capital investment, the Company plans to drill ten (8.2 net) wells, comprised of five (5.0 net) wells in Germany, two (1.2 net) wells in the Netherlands, one (1.0 net) well in Croatia, and two (1.0 net) wells in Slovakia, while also funding maintenance capital requirements in France, Ireland, and Australia.

In Germany, Vermilion will further its deep gas exploration program by completing drilling operations on the Weissenmoor Sud well (1.0 net), which began ahead of schedule in October 2024. Additionally, production from the initial discovery well (1.0 net) at Osterheide is expected to commence during the first half of 2025. We expect to finish drilling operations on the Weissenmoor Sud well in early 2025. Following the positive test results on the second deep gas exploration well (0.64 net) at Wisselshorst in December 2024, the Company will conduct further testing operations and proceed with tie-in operations, expected online in the first half of 2026. The Company also plans to drill one shallow gas well (1.0 net) and three (3.0 net) infill oil wells in 2025.

In Central and Eastern Europe, Vermilion plans to drill one (1.0 net) well on the SA-10 block in Croatia to keep the gas plant fully utilized, while also drilling two (1.0 net) exploration wells in Slovakia. The Company will continue to evaluate the successful discoveries on the SA-7 block in Croatia to determine the ultimate development potential.

In the Netherlands, Vermilion plans to resume drilling with two (1.2 net) wells targeting Rotliegend prospects. In addition, capital will be allocated to a high-return infrastructure optimization project which is expected to drive operating cost savings while reducing production downtime and extending production capacity in the region.

GLOBAL OPERATIONS

CANADA

In Canada, Vermilion is a key player in the highly productive Mannville condensate-rich gas play. In addition, they hold a dominant land position in the West Pembina Cardium resource play, in the Peace River Arch in British Columbia and Alberta and have a high-working interest position in southeast Saskatchewan.

Acquisition

In December 2024, Vermilion Energy entered into an arrangement agreement to acquire Westbrick Energy, a privately held oil and gas company operating in the Deep Basin, for total consideration of $1.075 billion by way of a plan of arrangement, expected to close in Q1 2025.

The Acquisition enhances depth and quality of Vermilion's Deep Basin inventory and complements the Company's high-growth, liquids-rich Montney asset. Vermilion's Canadian liquids-rich gas assets, combined with over 100 mmcf/d of high-netback, low-decline European natural gas production provides the Company with a premium realized natural gas price. Vermilion is committed to strategically growing its international assets both organically, as demonstrated by recent successes in Germany and Croatia, and via acquisitions. In the near term, the Company will focus on operational execution, debt reduction, return of capital, and further high-grading of assets within its portfolio, including non-core asset sales, to enhance long-term shareholder value.

Acquisition Highlights

- Approximately 1.1 million (770,000 net) acres of land and four operated gas plants with total capacity of 102 mmcf/d in the southeast portion of the Deep Basin trend in Alberta. This footprint is contiguous and complementary to Vermilion's legacy Deep Basin assets providing significant operational and financial synergies, including: capital efficiency improvements, infrastructure optimization, gas marketing opportunities, and other corporate synergies. These synergies have not been factored into the economic evaluation but are expected to be realized over time. The Acquisition excludes undeveloped Duvernay rights on approximately 300,000 (290,000 net) acres of land which will be retained by the shareholders of Westbrick.

- Stable annual production of 50,000 boe/d (75% gas and 25% liquids) expected in 2025(2), based on Vermilion's development plans. This production level represents 5% year-over-year growth and is forecast to generate more than $110 million of annual free cash flow ("FCF") based on forward commodity prices. Revenue from the acquired assets will be derived approximately 50% from liquids and 50% from gas. In conjunction with the Acquisition, Vermilion plans to actively and opportunistically hedge gas production to mitigate financial risk.

- 2025E annual net operating income of $275 million based on forward prices translates into an NOI multiple of approximately 3.9x. The multiple compresses to 3.3x in 2026 as net operating income is forecast to increase to $330 million based on forward pricing.

- Significant, high-quality drilling inventory adds over 700 locations in the Ellerslie, Notikewin, Rock Creek, Falher, Cardium, Wilrich and Niton formations, with half-cycle IRRs ranging from 40% to over 100% based on estimates provided by McDaniel & Associates Consultants Ltd ("McDaniel") and using three consultant average October 1, 2024 pricing assumptions(6).

- Proved developed producing ("PDP") and proved plus probable ("2P") reserves estimated at 92 million boe (75% gas) and 256 million boe (74% gas), respectively, based on McDaniel estimates. The acquisition price per boe of PDP reserves is $11.70, which translates to an implied recycle ratio of 1.3 times based on 2025 forecasted operating netbacks and 1.5 times based on 2026 forecasted operating netbacks, as noted above. Approximately 30% of the over 700 identified drilling locations have been included in the reserves estimates.

- Before-tax PDP reserve net present value at a 10% discount rate is estimated at $1.0 billion based on McDaniel estimates(6) and using three consultant average October 1, 2024 pricing assumptions. This value represents over 90% of the purchase price, implying significant upside value associated with probable reserves and unbooked locations.

- Vermilion's significant debt reduction efforts over the past five years, totaling over $1 billion since 2020, created the balance sheet capacity to execute this long-duration, strategic acquisition, yielding a 15% increase in excess free cash flow ("EFCF") per share in 2025. The Company will continue its disciplined efforts on balance sheet management and capital allocation to ensure debt targets are reached in a timely fashion.

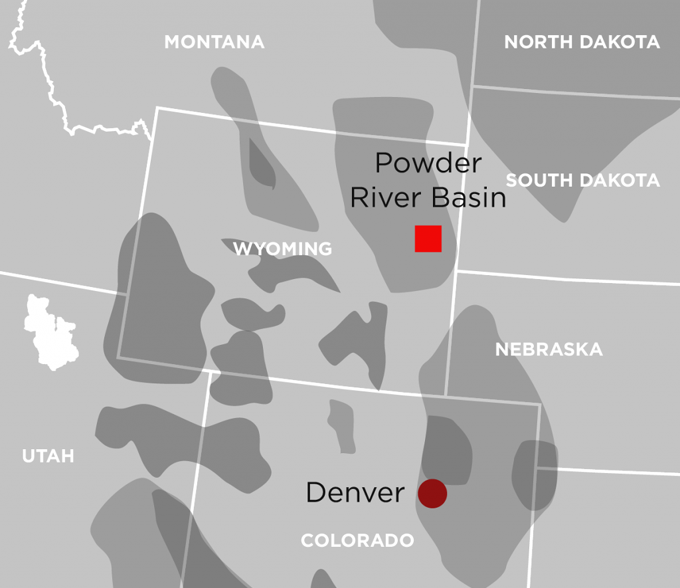

UNITED STATES

In the United States, Vermilion has a significant land position in the promising Turner Sand play in the Powder River Basin. North American assets represent approximately 60% of our total corporate production.

Vermilion entered the U.S. in 2014, acquiring 53,000 net acres of land in the Turner Sand play in the Powder River Basin of northeastern Wyoming.

Encouraging initial results prompted Vermilion to consolidate its working interest in the Turner Sand project area to 100% through the acquisition of the remaining 30% interest in 2015.

Vermilion subsequently acquired additional lands in May 2016 and August 2018, and completed a strategic acquisition in 2021 to further consolidate their land base. The Company now holds approximately 85,000 net acres of land in this promising light oil Play.

FRANCE

France was Vermilion’s first international expansion when they entered the country in 1997.

Today, Vermilion is France’s largest oil producer, constituting approximately two-thirds of the domestic oil production.

Located in the Aquitaine and Paris Basins, Vermilion’s assets are characterized by large original oil in place conventional fields with high working interests and a low base decline rate. Since their initial entry into France, the Company have completed three additional acquisitions, making significant investments in the country.

Vermilion REP SAS

Route de Pontenx

40160 Parentis-en-Born, France

Tel +33 (0)5 58 82 95 00

NETHERLANDS

Vermilion entered the Netherlands in 2004 and are currently the second-largest onshore natural gas producer in the country.

Vermilion has tripled its undeveloped land base in the Netherlands since the beginning of 2012 and now hold approximately 800,000 net acres of undeveloped land within the country.

The Company's producing assets are located in the northwest part of the country, with a regional office in Harlingen and their European headquarters is located in Amsterdam. Vermilion have continued to deliver strong, organic production growth in the Netherlands. Their significant inventory of identified drilling locations combined with favorable European natural gas prices, a reliable fiscal regime and low operating costs means that Vermilion will continue to look to grow their Netherlands business unit in the future.

FFW

Vermilion intends to extract natural gas from a new small gas field in the southwestern part of Friesland. A project procedure has been initiated for this project 'Gasextraction Friesland Follega Woudsend', abbreviated as FFW. The Ministry of Climate and Green Growth (KGG) coordinates this procedure and closely involves (regional) authorities in the implementation. The gas field extends under the territory of the municipalities of Súdwest-Fryslân and De Fryske Marren. Regional authorities, local interest groups and residents have been informed about the intention and proposal for participation in their region.

Vermilion Amsterdam

Radarweg 29 (Millennium Tower, 14th floor)

1043 NX Amsterdam

Tel: 0517 493 333

GERMANY

Germany’s hydrocarbon industry is one of the oldest in the world with an oil well drilled in the Weitzer Oil Field in Lower Saxony commencing production before 1860.

Vermilion entered Germany in February 2014 and currently holds a 25% interest in a four partner consortium. Associated assets include four gas producing fields spanning 11 production licenses as well as an exploration license in surrounding fields. Total license area comprises 204,000 gross acres, of which 85% is in the exploration license.

The Company entered into a farm-in agreement in July 2015 that provides Vermilion with participating interest in 18 onshore exploration licenses in northwest Germany, comprising approximately 850,000 net undeveloped acres of oil and natural gas rights. Vermilion will assume operatorship for 11 of the 18 licenses during the exploration phase.

In 2015, the Company was awarded 110,000 net acres (100% working interest) across two exploration licenses.

In December 2016, Vermilion closed the acquisition of operated and non-operated interests in five oil and three gas producing fields from Engie E&P Deutschland GmbH. Vermilion will assume operatorship of six of the eight producing fields. During 2016, the assets produced approximately 2,000 boe/d (50% oil), representing our first operated producing properties in Germany.

In 2016, the majority of activity was associated with permitting and pre-drill activities for the Burgmoor Z5 well.

During December 2016, Vermilion completed the acquisition of oil and gas producing properties from Engie E&P Deutschland GmbH, their first operated production in the country.

In December 2024, Vermilion successfully tested its second deep gas exploration well (0.64 net), which was drilled during the third quarter of 2024. The well flow tested at a restricted rate of 21 mmcf/d of natural gas with a wellhead pressure of 6,150 psi, which supports the Company's expectation that deliverability would have been higher without testing equipment limitations. The Company plans to conduct further testing operations and will proceed with tie-in operations in order to bring the well online in the first half of 2026. Vermilion's operated working interest in this well increased from 30% to 64%.

This marks the second successful test result from the deep gas exploration program in Germany, representing 38 mmcf/d of combined European gas flow tests to date.

Vermilion Energy Germany GmbH & Co. KG

Baumschulenallee 16

30625 Hannover

Tel +49 (0) 511 / 544 14 50

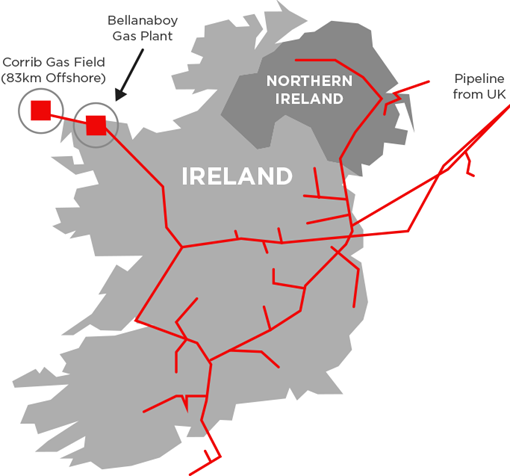

IRELAND

Vermilion holds a 56.5% operated interest in the Corrib gas field, offshore Ireland.

In March 2023, Vermilion Energy closed the acquisition of Equinor Energy Ireland ("EEIL").

The acquisition of EEIL adds an incremental 36.5% interest in the Corrib Natural Gas Project, increasing Vermilion's operated interest to 56.5%. The acquisition makes Vermilion the largest provider of domestic natural gas in Ireland. Vermilion entered into an agreement with Equinor ASA in November 2021 to acquire EEIL with an effective date of January 1, 2022 for total consideration of US$434 million ($556 million), before closing adjustments and contingent payments. The net purchase price after adjusting for the interim free cash flow between the effective date and closing date inclusive of Vermilion's estimates of European windfall taxes based on information released to-date on how it will be implemented in Ireland, the contingent payment and other closing adjustments is approximately $200 million.

The acquisition of EEIL adds approximately 7,000 boe/d of premium-priced, high netback, low emission European natural gas production, further strengthening Vermilion's international portfolio. Vermilion has been operating internationally for over 26 years, which has served as a key differentiating advantage as their diversified asset base provides exposure to global commodities, which reduces volatility and drives industry leading netbacks. The company's international assets target conventional reservoirs, which typically have lower decline rates and better capital efficiencies compared to many North American basins. The combination of high netbacks, low decline rates and strong capital efficiencies drive outsized free cash flow, which supports Vermilion's capital markets model of increasing the return of capital to shareholders as debt levels decrease. The March 31, 2023 closing of the Corrib acquisition is already incorporated in our 2023 guidance provided on March 8, 2023.

Corrib is a world class, low emission, natural gas facility comprised of a conventional gas field located 83 kilometers off the northwest coast of Ireland and a state of the art gas processing plant onshore Ireland. The facility has a gross plant capacity of approximately 350 million cubic feet of natural gas per day and is currently producing 115 million cubic feet of natural gas per day, representing approximately 20% of Ireland's natural gas consumption and 100% of Ireland's domestic gas production. Since taking over operatorship in 2018, Vermilion has reduced costs and increased uptime, while maintaining world class safety and environmental performance.

The Corrib gas field is located approximately 83 km off the northwest coast of Ireland. Gas is transported to the Bellanaboy Bridge gas plant through 90km of pipeline where it is then processed prior to being delivered to the national grid. The Corrib project generates significant free cash flow for Vermilion given low operating costs and minimal ongoing capital expenditures requirements.

Vermilion Exploration & Production Ltd.

Unit 4, Údarás na Gaeltachta

Belmullet, Mayo

F26 R2E9, Ireland

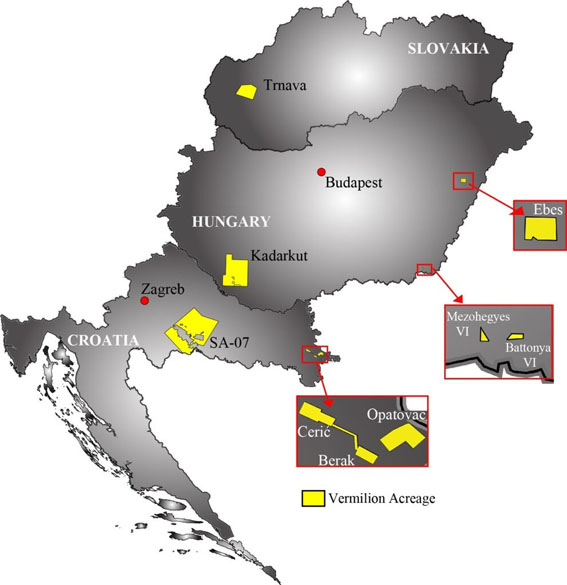

CENTRAL & EASTERN EUROPE

Vermilion's position in Croatia covers approximately 515,000 acres (61% working interest) making Vermilion one of the largest onshore landholders in the country. A significant portion of our acreage is located near producing oil and gas fields.

The Company hold approximately 300,000 acres in Hungary (100% working interest) across the Kadarkut, South Battonya, and Ebes concessions.

In Slovakia, Vermilion have partnered with NAFTA, the country’s dominant E&P in a farm-in arrangement which grants them a 50% working interest to jointly explore approximately 50,000 net acres.

AUSTRALIA

Vermilion entered Australia in 2005 by acquiring a 60% operated interest in the Wandoo field.

In 2007, Vermilion acquired the remaining 40% interest. Production is from two operated off-shore platforms, one of which (Wandoo B) is permanently staffed. Since acquiring the Wandoo asset, Vermilion has conducted a number of drilling campaigns with the long-term goal of managing production volumes to targets while meeting long-term supply requirements of their customers. Many of the wells drilled at Wandoo are extreme long-reach lateral wells. While having true vertical depths of only 600 metres, two recently sidetrack wells have measured depths of nearly 3,000 metres and 3,800 metres, respectively.

LEADERSHIP

Dion Hatcher, President & Chief Executive Officer

Lars Glemser, Vice President & Chief Financial Officer

Tamar Epstein, General Counsel & Corporate Secretary

Terry Hergott, Vice President, Marketing

Yvonne Jeffery, Vice President, Sustainability

Darcy Kerwin, Vice President, International & HSE

Geoff MacDonald, Vice President, Geosciences

Randy McQuaig, Vice President, North America

Kyle Preston, Vice President, Investor Relations

Averyl Schraven, Vice President, People & Culture

Gerard Schut, VP European Operations at Vermilion Energy

Business Unit Management

Ryan Carty, Australia Business Unit

Jeff Davies, Germany Business Unit

Pantxika Etcheverry, France Business Unit

Marius Nowak, Central & Eastern Europe Business Unit

Scott Seatter, U.S. Business Unit

Jarlath Trench, Ireland Business Unit

Sven Tummers, Netherlands Business Unit

HEAD OFFICE

3500, 520 3rd Avenue SW

Calgary, Alberta T2P 0R3

Tel: 1-403-269-4884

KeyFacts Energy: Vermilion Canada country profile

KEYFACT Energy

KEYFACT Energy