Orrön Energy is an independent, publicly listed renewable energy company (Nasdaq Stockholm: “ORRON”) within the Lundin Group of Companies. The Company transformed into a renewable energy Company in July 2022, and has since grown its annual power generation from 300 GWh to 1,000 GWh, and established a 40 GW pipeline of early-stage greenfield projects in the Nordics, the UK, Germany and France. The Company is active in all stages of renewable energy projects, ranging from project initiation, development, operations, maintenance and repowering.

The business strategy is focused on growth across two core areas; building a portfolio of cash-generating assets and developing a large-scale pipeline of projects. The operational portfolio consists of high-quality wind power assets in the Nordics, which the Company seeks to optimise and grow organically to support continuous growth of power generation and revenue streams. The greenfield portfolio is targeting initiation of development projects within proven and low-cost technologies such as onshore wind, solar and batteries in the Nordics, the UK, Germany and France. The Company has an opportunistic approach to realising value from the greenfield portfolio and will seek to monetise projects throughout the value chain, depending on market conditions at the time. For the largest projects, the strategy will be to divest prior to incurring significant development and construction costs.

History

Orrön Energy was born in 2022, but can trace its roots back to Lundin Energy and its predecessor company Lundin Petroleum, formed in the early 2000s. Lundin Energy’s oil and gas business was acquired by Aker BP in 2022, to create the leading exploration and production company for the future.

As part of the transaction with Aker BP, Orrön Energy was created with the renewables assets from Lundin Energy as a base and became the new renewables vehicle within the Lundin Group of Companies. Orrön Energy has retained key members of Lundin Energy’s Board and management team, with knowledge of the renewables asset base and a proven track record of building companies which have delivered significant value for shareholders over many years.

Operational assets

Orrön Energy owns and operates a portfolio of wind power assets in the Nordics, with an estimated annual power generation of between 900 and 1,000 GWh in 2024. The wind power assets are managed by an experienced team in Sweden with a longstanding background from the renewables industry. A range of projects are ongoing to optimise the power generation capacity and organically grow the portfolio, which includes extending the operational lifetime of assets, re-powering and consolidation of ownership shares. The Company is also working with optimising the grid utilisation by adding complementary technology and providing ancillary services.

A large portion of the power generation derives from assets that are newly constructed and equipped with modern technology to ensure low cost and efficient operations. This means that the cost for estimated maintenance is low, with high availability and efficiency during a long-term asset lifetime.

Sweden

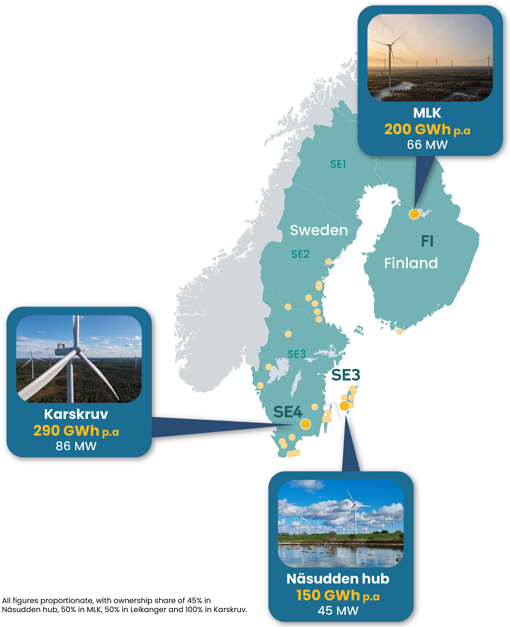

The Swedish portfolio consists of ownership in 200 operational wind turbines in more than 50 sites, which have an estimated long-term proportionate annual power generation of around 800 GWh and a total net installed capacity of around 300 MW. A majority of the assets are situated in the SE3 and SE4 price areas. Availability warranties are in place for a majority of the Company’s assets, which guarantees the availability of the turbines and gives the Company protection against downtime and outages.

The largest producing asset in the Swedish portfolio is the Karskruv wind farm, which was completed and taken over for commercial operations at the end of November 2023. Karskruv has an estimated annual power generation of 290 GWh, which is generated from 20 Vestas turbines with a total installed capacity of 86 MW. The wind farm is situated in the SE4 price area.

Another large production hub for the Company is situated at Näsudden on Gotland, consisting of ownership in five wind farms, with a combined power generation of around 165 GWh in the SE3 price area. This is a pioneering region for wind power in Sweden and Gotland is also where the Company has its operational office.

Finland

The Company owns 50 percent of the Metsälamminkangas (MLK) wind farm and 100 percent of a 9 GWh wind farm located in Hanko in Finland. MLK has an estimated long-term gross annual power generation of around 400 GWh, which is generated from 24 GE turbines with a total installed capacity of 132 MW. The wind farm has an estimated operational life of around 30 years and has been in operation since the end of March 2022.

Development

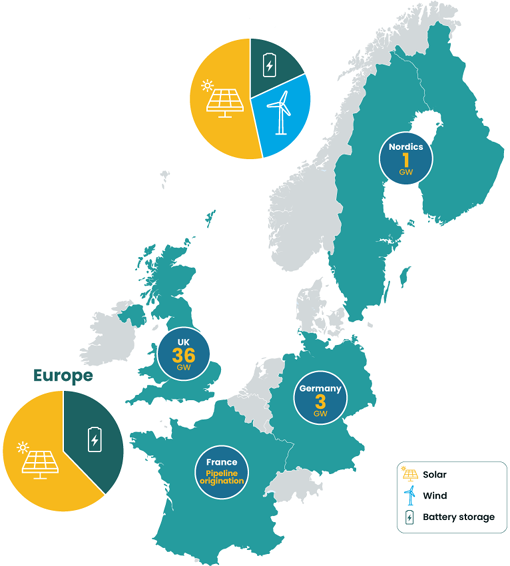

The Company is maturing a 40 GW onshore greenfield portfolio consisting of onshore wind, solar and battery projects in the Nordics, the UK, Germany and France. This is led by experienced development teams, with a proven track-record of greenfield project origination and development in these markets. Final project realisation will be dependent on a number of factors, such as permitting, fulfilment of projects milestones and commercial viability.

The Company has an opportunistic approach to realising value from this portfolio and seek to monetise projects throughout the value chain, depending on market conditions at the time. For the largest projects, the strategy will be to divest prior to incurring significant development and construction costs.

In the UK, the Company has secured a portfolio of grid connections with a capacity of 24 GW for solar projects and 12 GW for co-located battery projects, with expected grid energisation dates between 2030 and 2040. The grid connections are located in favourable areas for development, based on extensive screening of key criteria such as irradiation, grid capacity, land availability and constraint mapping. The UK has a high permitting success rate for projects and, in addition, large-scale projects benefit from increased regulatory support as nationally significant infrastructure projects (NSIP). Having already secured grid connections, the Company has secured multiple land exclusivity agreements in 2024 and is in negotiations to secure land rights for other projects.

In Germany, the Company has initiated land acquisition work in targeted regions which have been chosen based on a range of key criteria, such as irradiation, grid capacity and land availability. The Company has successfully originated a pipeline of around 3 GW of solar and battery projects, and secured multiple exclusivity contracts for land.

In France, the Company has carried out early-stage land availability studies as well as high level grid surveys. The Company has also identified key areas based on irradiation, land availability and grid capacity and is working to secure land for its first projects.

Nordics

In the Nordics, the Company is progressing a range of stand-alone and co-located project opportunities, ranging from early-stage projects in the screening phase, through to projects with construction permits in place moving towards investment decisions. This allows the Company to organically grow its portfolio, optimise power generation and crystalise further value from its operational assets, which includes projects aimed at extending asset lifetimes, re-powering and consolidation of ownership shares.

In Sweden, the Company has established a portfolio of greenfield project opportunities ranging from early-stage to permitted projects, totalling over 500 MW across wind, solar and battery projects.

In Finland, the Company has acquired a greenfield portfolio, consisting of four wind energy and battery projects with an initial estimated installed capacity of up to 180 MW, with land secured for all wind turbine locations. The greenfield projects are at an early-stage, and the Company aims to reach the ready-to-build stage in 2027.

Construction

The Company is working on a range of stand-alone greenfield as well as co-located project opportunities, ranging from early-stage projects in the screening phase, through to projects with construction permits in place moving towards investment decision. Once an investment decision has been made and the development project has the required permits in place, it will progress towards the construction phase prior to entering the operational phase.

Leadership

Daniel Fitzgerald CEO

Grace Reksten Skaugen Chair of the Board

Espen Hennie Chief Financial Officer

Henrika Frykman General Counsel

Carl Sixtensson Technical Director

Robert Eriksson Director, Corporate Affairs and Investor Relations

Contacts

Orrön Energy AB

Hovslagargatan 5

SE – 111 48 Stockholm

Sweden

Tel +46 8 440 54 50

KeyFacts Renewable Energy Directory: Orrön Energy l KeyFacts Energy: Company Profile

KEYFACT Energy

KEYFACT Energy