W&T Offshore today reported operational and financial results for the third quarter of 2024 and declared a fourth quarter 2024 dividend of $0.01 per share.

Key highlights for the third quarter of 2024 and through the date of this press release include:

- Produced 31.0 thousand barrels of oil equivalent per day (“MBoe/d”) (52% liquids) within the Company’s third quarter guidance despite impacts from hurricanes and downtime;

- Incurred lease operating expenses (“LOE”) of $72.4 million, 6% lower than the bottom end of the Company’s third quarter guidance range;

- Generated net cash from operating activities of $14.8 million and Free Cash Flow of $3.9 million in the third quarter of 2024, marking the 27th consecutive quarter of positive Free Cash Flow;

- Reported net loss of $36.9 million, or $(0.25) per diluted share;

- Adjusted Net Loss totaled $25.7 million, or $(0.17) per share, which primarily excludes the net unrealized gain on outstanding derivative contracts, non-ARO plugging and abandonment (“P&A”) costs and related tax effect;

- Posted Adjusted EBITDA of $26.7 million;

- Increased cash and cash equivalents to $126.5 million and lowered Net Debt to $266.0 million at September 30, 2024;

- Maintained a low leverage profile with Net Debt to trailing twelve months (“TTM”) Adjusted EBITDA of 1.6x, which does not include the benefit of the full expected production acquired in 2024;

- Paid fourth consecutive quarterly dividend of $0.01 per common share in August 2024;

- Declared fourth quarter of 2024 dividend of $0.01 per share, which will be payable on November 29, 2024 to stockholders of record on November 21, 2024;

- Reduced 2024 full year capital expenditure budget from $35 to $45 million to $25 to $35 million;

- Continued commitment to sustainability by publishing the 2023 Corporate Environmental, Social and Governance (“ESG”) report; and

- Named as one of five finalists for the Best Proxy Statement in the small cap category at the 18th Annual Corporate Governance Awards hosted by Governance Intelligence (formerly Corporate Secretary) which recognizes outstanding achievements in governance, risk and compliance.

Tracy W. Krohn, W&T’s Board Chair and Chief Executive Officer, commented,

“We remain committed to executing our strategic vision focused on free cash flow generation, maintaining solid production and maximizing margins. This commitment enabled W&T to deliver another quarter of solid results despite production being temporarily impacted by approximately 3.5 MBoe/d of shut-ins associated with hurricanes and other unplanned downtime, but production was still within our guidance range for the quarter. In October, we have seen production levels recover to around 34.0 Mboe/d. We continue to make progress integrating our 2024 acquired assets into W&T with four of the six fields online, but we still have more work to do to return the remaining two fields to production, which provides additional upside. Additionally, we continue to reduce costs and capture synergies associated with our asset acquisitions with LOE 6% below the bottom end of our guidance range. We remain focused on generating Adjusted EBITDA and Free Cash Flow and the third quarter 2024 marked the 27th consecutive quarter of positive Free Cash Flow. Our proven and successful strategy and operational excellence should help us continue to produce strong results both operationally and financially for the remainder of 2024 and into 2025.”

“We continue to demonstrate our commitment to a high quality, comprehensive ESG effort by issuing our 2023 ESG report. This is our fourth sustainability report, and we continue to make strides regarding shareholder rights, board structure and oversight, human rights, labor, health and safety and environmental initiatives. We are constantly seeking to improve our capabilities to better allow us to report on an increasing number of SASB standards and GRI standards for the oil and gas sector. W&T’s culture of success and sustainability is built on environmental stewardship, sound corporate governance, and contributing positively to our employees and the communities where we work and operate. In 2023, we added a new Board member, Dr. Nancy Chang, who is the chair of our Environmental, Safety and Governance committee that oversees our ESG efforts. Dr. Chang has helped to guide W&T in its ongoing commitment to high standards of ESG and corporate governance. We invite you to review this report to learn more about our sustainability program and our plans for improvement in the future. In addition, W&T was named as one of five finalists for the Best Proxy Statement in the small cap category at the 18th Annual Corporate Governance Awards. Our proxy statement clearly demonstrated our ongoing commitment to excellence and high standards of transparency and corporate governance.”

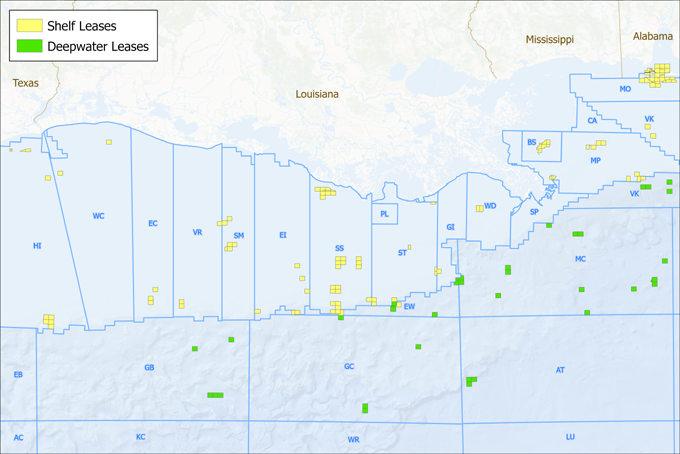

W&T acreage in the Gulf of Mexico

Production, Prices and Revenue: Production for the third quarter of 2024 was 31.0 MBoe/d, within the Company’s third quarter guidance and down compared with 34.9 MBoe/d for the second quarter of 2024 and 35.9 MBoe/d for the corresponding period in 2023. Production in the third quarter of 2024 was temporarily reduced by approximately 3.5 MBoe/d mainly due to hurricanes and third party downtime. The year-over-year decrease was partially offset by increased production from wells acquired in January 2024. Third quarter 2024 production was comprised of 13.2 thousand barrels per day (“MBbl/d”) of oil (43%), 2.8 MBbl/d of natural gas liquids (“NGLs”) (9%), and 90.1 million cubic feet per day (“MMcf/d”) of natural gas (48%). Two of the six fields acquired in early 2024 remain shut-in. W&T continues to work on returning these fields to production, either through existing third-party sales routes or alternative Company-owned sales routes.

W&T’s average realized price per Boe before realized derivative settlements was $41.92 per Boe in the third quarter of 2024, a decrease of 6% from $44.40 per Boe in the second quarter of 2024 and a decrease of 1% from $42.48 per Boe in the third quarter of 2023. Third quarter 2024 oil, NGL and natural gas prices before realized derivative settlements were $75.09 per barrel of oil, $21.51 per barrel of NGL and $2.79 per Mcf of natural gas.

Revenues for the third quarter of 2024 were $121.4 million, which was approximately 15% lower than the second quarter of 2024 revenue of $142.8 million driven by lower realized prices for liquids and lower production volumes. Third quarter 2024 revenue was approximately 15% lower than $142.4 million of revenue in the third quarter of 2023 due to lower average realized prices and lower production volumes.

KeyFacts Energy: W&T Offshore US Gulf of Mexico country profile

KEYFACT Energy

KEYFACT Energy