Oil & Gas History

In the late 1950s, very few people believed that the Norwegian continental shelf (NCS) might conceal rich oil and gas deposits. However, the discovery of gas at Groningen in the Netherlands in 1959 caused people to revise their thinking on the petroleum potential of the North Sea.

The Groningen discovery led to enthusiasm in a part of the world where energy consumption to a large extent was based on coal and imported oil. In the eagerness to find more, attention was drawn to the North Sea. Norway’s geological expertise was negative to oil and gas deposits, but this could not stop the enthusiasm after the gas discovery in the Netherlands.

In October 1962, Phillips Petroleum sent an application to the Norwegian authorities, for exploration in the North Sea. The company wanted a licence for the parts of the North Sea that were on Norwegian territory, and that would possibly be included in the Norwegian shelf. The offer was 160,000 dollars per month. The offer was seen as an attempt to get exclusive rights, and for the authorities it was out of the question to hand over the whole shelf to one company. If the areas were to be opened for exploration, more companies had to participate.

In May 1963, Einar Gerhardsen’s government proclaimed sovereignty over the NCS. New regulation determined that the State owns any natural resources on the NCS, and that only the King (government) is authorized to award licences for exploration and production. The same year, companies got the possibility to carry out preparatory exploration. The licenses included rights to perform seismic surveys, but not drilling.

Even though Norway had proclaimed sovereignty of large offshore areas, some important clarifications remained on how to divide the continental shelf, primarily with Denmark and Great Britain. Agreements on dividing the continental shelf in accordance with the median line principle were reached in March 1965. First licensing round was announced on 13 April 1965. 22 production licences for a total of 78 blocks were awarded to oil companies or groups of companies. The production licences gave exclusive rights for exploring, drilling, and production in the licence area. The first well was drilled in the summer of 1966, but it was dry.

With the Ekofisk discovery in 1969, the Norwegian oil adventure really began. Production from the field started on 15 June 1971, and in the following years a number of major discoveries were made. Exploration in the 1970s was confined to the area south of the 62nd parallel. The shelf was gradually opened, and only a restricted number of blocks were awarded in each licensing round. Foreign companies dominated exploration off Norway in the initial phase, and were responsible for developing the country's first oil and gas fields. Statoil was created in 1972, and the principle of 50 percent state participation in each production licence was established. This rule was later changed so that the Storting (the Norwegian parliament) can evaluate whether the level of state participation should be lower or higher, depending on circumstances.

From 1 January 1985, the State's participation in petroleum operations was reorganised. The State's participation was split in two, one linked to the company and the other becoming part of the State's Direct Financial Interest (SDFI) in petroleum operations. SDFI is an arrangement in which the State owns interests in a number of oil and gas fields, pipelines and onshore facilities. Each government take is decided when production licences are awarded and the size varies from field to field. As one of several owners, the State pays its share of investments and costs, and receives a corresponding share of the income from the production licence. The Storting resolved in the spring of 2001 that 21.5 percent of the SDFI's assets could be sold. 15 percent was sold to Statoil and 6.5 percent was sold to other licensees. The sale of SDFI shares to Statoil was seen as an important element on the way to a successful listing and privatisation of Statoil. Statoil was listed in June the same year, and now operates on the same terms as every other player on the NCS. Petoro was established in May 2001 as a state-owned limited company to manage the SDFI on behalf of the State.

Petroleum activities have contributed significantly to economic growth in Norway, and to the financing of the Norwegian welfare state.

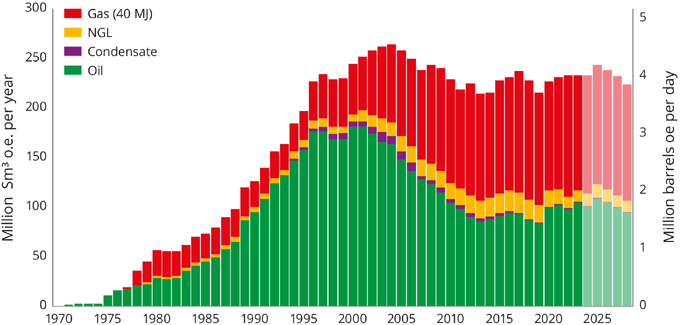

The Norwegian Petroleum Directorate’s forecasts indicate that the production increase will continue toward 2023 – perhaps even reaching the level of the record year 2004. Back then, oil accounted for most of the production. In 2023, gas will account for about one-half of the production.

| Oil production | 2022 thousand bpd |

| Proved oil reserves (year-end) | 7.64 thousand million barrels |

| Natural Gas production | 116.6 billion cubic metres |

| Natural Gas proved reserves (year-end) | 1.98 trillion cubic metres |

Norway Country Key Facts

| Official name: | Kongeriket Norge |

| Capital: | Oslo |

| Population: | 5,587,703 (2024) |

| Area: | 323,758 sq km square miles |

| Form of government: | Constitutional Monarchy |

| Language: | Norwegian |

| Religions: | Evangelical Lutheran |

| Currency: | Norwegian krone |

| Calling code: | +47 |

Key Oil & Gas Players

Aker BP

Aker BP explores for and produces oil and gas on the Norwegian continental shelf and, based on production, are one of the largest independent listed oil companies in Europe.

The Company operate six assets: Alvheim, Ivar Aasen, Skarv, Edvard Grieg, Ula and Valhall, and are a partner in Johan Sverdrup.

In the second quarter of 2024, oil and gas production averaged 444 thousand barrels of oil equivalent per day (mboepd).

Concedo

Concedo is a Norwegian oil company focusing on exploration on the Norwegian Continental Shelf. The vast majority of their staff are geologists or geophysicists, all with many years’ experience from both the Norwegian and international oil industry.

Concedo is privately held and takes the role as partner in its licences. There are no plans to change to a role as operator, to list the company or to seek opportunities internationally.

The company’s business model has been to divest discoveries prior to field development. From 2024 and onwards the focus will still be on organic growth via exploration, but the company may also participate in field development and acquisition of production.

ConocoPhillips

ConocoPhillips is one of the world’s leading exploration and production companies based on both production and reserves, with a globally diversified asset portfolio.

The Company has maintained an active presence in Norway since the early 1960s and holds exploration licenses in the North Sea, Norwegian Sea and Barents Sea with an exploration acreage position covering 586,000 net acres.

ConocoPhillips holds a 28.3 - 35.1% in the Greater Ekofisk Area and non-operated interests in Heidrun, Aasta Hansteen, Troll, Visund, and Alvheim.

Net production for ConocoPhillips in Norway during 2023 was 115 mboed.

DNO

Founded in 1971 and listed on the Oslo Stock Exchange, DNO holds stakes in onshore and offshore licenses at various stages of exploration, development and production in the Kurdistan region of Iraq, Norway, the United Kingdom, Côte d’Ivoire, Netherlands and Yemen.

In 2023, DNO had diversified production across 12 fields in the North Sea of which 10 were in Norway and two in the UK. During 2023, the Norwegian Fenja field came onstream, contributing to a North Sea net production average of 14,203 boepd (13,314 boepd in 2022). Of the total, 13,926 boepd were attributable to Norway and 277 to the UK (13,035 boepd and 279 boepd, respectively, in 2022).

Equinor

Equinor is the premier oil and gas operator in Norway, one of the world’s largest offshore operators, and a growing force in renewables and low carbon solutions.

After more than 50 years of operation, Equinor’s equity production from the NCS remains high, at around 1,374 mboe per day generated from 46 fields operated by Equinor and 7 fields operated by partners. E&P Norway’s net operating income exceeded USD 29 billion in 2023.

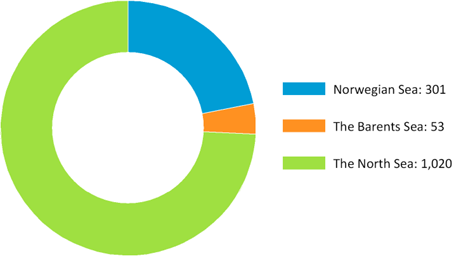

Average production by location in 2023 (mboe/day)

E&P Norway has a project pipeline of over 20 sanctioned projects where the largest projects are:

- Johan Castberg (Equinor 50%, operator), a subsea field development connected to the Johan Castberg FPSO currently under construction, with scheduled start-up in the fourth quarter of 2024.

- Irpa (Equinor 51%, operator), a tie-in project to Asta Hansteen with planned start-up in 2026.

- Halten East (Equinor 57.7%, operator), a tie-in project to Åsgard with scheduled start-up in 2025.

- Snøhvit Future project (Equinor 36.79%, operator), which cuts emissions and extends the life of the Snøhvit field. Scope covering onshore gas compression has scheduled start-up in 2028.

Harbour Energy

As a result of its acquisition of the Wintershall Dea asset portfolio in 2024, Harbour Energy is one of the largest oil and gas producers on the Norwegian Continental Shelf. Norway accounts for over a third of the Company's daily production, making it the largest producing country in their portfolio.

During 2023, Harbour drilled one exploration well targeting the JDE prospect on Equinor’s operated PL 1058. The well was unsuccessful and was plugged and abandoned. Post year end, in January 2024, we drilled the Harbour-operated Ametyst exploration well which encountered gas in the secondary target.

The acquisition of the Wintershall Dea asset portfolio will transform Harbour’s position in Norway, adding a large-scale, gas-weighted, producing portfolio with low operating costs and GHG emissions.

INPEX Idemitsu Norge

INPEX Idemitsu Norge (IIN) is part of INPEX Corporation, Japan’s leading energy enterprise. The company entered the Norwegian Continental Shelf (NCS) in 1989 by acquiring a stake in the Snorre field.

IIN are currently a partner in 34 production licences and five unit areas on the Norwegian Continental Shelf and have 10 producing fields.

In August 2024, IIN (30 %) and OMV (Norge) (Operator; 40 %), and Vår Energi AS (30 %) made gas discoveries in well 6605/6-1 S “Haydn/Monn”, south-west of the Aasta Hansteen field in the Norwegian Sea.

Kistos

Kistos Plc Is an independent energy company focused on low-carbon, low-impact development and production opportunities across mature natural gas basins and energy generation projects. The company’s assets include interests in the Dutch and UK North Sea, onshore Netherlands and Norway.

In April 2023, Kistos reached an agreement to acquire all of the outstanding shares of Norway’s Mime Petroleum, thereby marking the entrance into the Norwegian Continental Shelf.

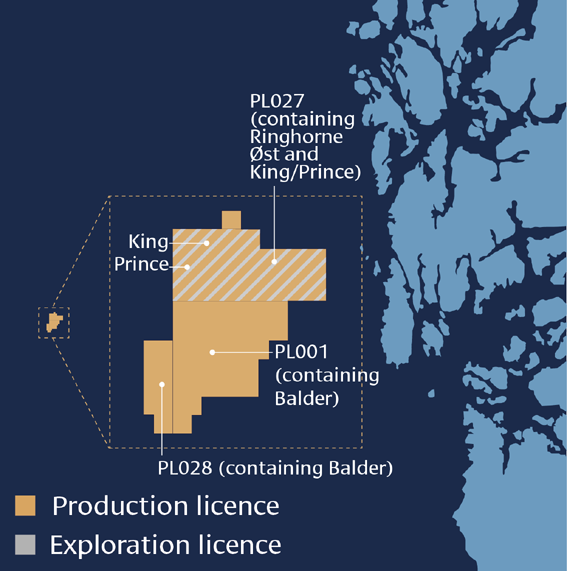

Kistos now has working interests of between 7.4% and 10% in the Ringhorne Øst and Balder fields, including a 10% working interest in the Balder Future project. The licences are operated by Vår Energi ASA (Vår).

The acquisition adds 24 MMboe of 2P reserves (operator estimate) plus 30 MMboe of 2C resources, increasing total Group reserves plus resources to approximately 80 MMboe. The acquisition also adds over 2,000 boe/d of production immediately, helping to boost Group output to in excess of 15,000 boe/d in 2025 once the Jotun FPSO is on production.

Lime Petroleum

Lime Petroleum is a small and fast growing exploration company established in 2012. The Company was pre-qualified in February 2013 and has since then grown a portfolio of exploration licences in all provinces of the Norwegian Continental Shelf.

The Company have built a strong portfolio of licenses comprising interests in the Brage and Yme producing fields, and in exploration and development assets focusing on infrastructure led-exploration, with both high impact prospects and high value prospects.

Lime Petroleum AS currently has interests in 15 licences in the Norwegian Continental Shelf, including 33.8434% in the producing Brage Field and 10% in the producing Yme Field.

Lotos

The LOTOS Group is a vertically integrated oil company, whose business encompasses exploration for and production of crude oil, processing of crude oil, as well as wholesale and retail sale of high-quality petroleum products.

Lotos Exploration & Production Norge was established in Stavanger in September 2007 and pre-qualified as Operator in 2008. The Company merged with PGNiG Upstream Norway in 2023.

M Vest Energy

M Vest Energy (MVE) was founded in 2015 and in March 2016 acquired the assets of Atlantic Petroleum Norway.

In August 2023, MVE announced the acquisition of a 4.4424% working interest (WI) in PL740, the Brasse license, from OKEA. Prior to the transaction, OKEA held a 50% WI in Brasse, with DNO holding the remaining 50%. The partners in the Brasse license have agreed on a fast-track development concept for the oil and gas discovery in the license, paving the way for detailed design studies to link up with the Brage field located 13 kilometres north of the Brasse field. The field is estimated to contain 24 million barrels of oil equivalents in recoverable reserves and will be developed as a tie-back to the Brage field.

OKEA

OKEA is a leading mid- to-late-life operator on the Norwegian continental shelf (NCS).

OKEA is a leading mid- to late-life operator on the Norwegian continental shelf (NCS). The company has a strong asset portfolio including the Draugen and Brage fields, which are operated by OKEA, as well as partner shares in the Gjøa, Ivar Aasen, Nova, Yme and Statfjord fields. In 2023, the portfolio produced 35,385 boepd including 10,799 boepd from the Statfjord area which was acquired from Equinor in 2023. In addition to the inorganic growth focus, OKEA also has activities in projects under development, including Draugen power from shore and drilling of new infill targets. In addition, discoveries, including Hamlet, Calypso and Brasse are under evaluation for development, and the company’s portfolio further includes exploration licences with planned and possible wells in the future.

OKEA is head quartered in Trondheim, with major operations centres in Kristiansund and Bergen, and offices in Stavanger and Oslo.

OMV

OMV is transitioning to become an integrated sustainable chemicals, fuels and energy company with a focus on circular economy solutions. By gradually switching over to low-carbon businesses, OMV is striving to achieve net zero by latest 2050.

OMV has been active in Norway since 2006 and was awarded the first license on the Norwegian Continental Shelf (NCS) in 2007. Today, OMV (Norge) AS is a license holder in many production licenses (PL), several as operator. The licenses are in the Norwegian part of the North Sea, Norwegian Sea and in the Barents Sea. In 2011 and 2012, OMV acquired shares in several field developments: 15% in the Aasta Hansteen gas field development and 20% share in the Edvard Grieg field development.

In 2013, OMV became a major offshore oil and gas producer in Norway after the acquisition of the producing Gullfaks field and the Gudrun development with a 19% and 24% share respectively. The Gudrun field started production in 2014, and the Edvard Grieg field started production in 2015. OMV has also participated in the yearly licensing rounds and ongoing exploration activities on the NCS.

Pandion Energy

Pandion Energy was established in November 2016 on the basis of the operational platform and six licences acquired from Tullow Oil Norge AS in a management buy-out, backed by Kerogen Capital. Today, Pandion Energy is a full-cycle oil and gas company, participating in the discovery, appraisal, development and production of oil and gas resources on the Norwegian continental shelf (NCS).

Pandion Energy has made six discoveries out of seven drilling campaigns, representing a success rate exceeding 85 per cent. The company’s core focus remains in the mature areas close to existing infrastructure in the greater Valhall and Gjøa areas of the North Sea, and the Haltenbanken area of the Norwegian Sea.

In 2023, average net production for Pandion Energy was 8,304 barrels of oil equivalent per day (boepd), an increase of 46 per cent from the average of 5,697 boepd in 2022.

Petoro

The Norwegian state has substantial holdings in production licences on the Norwegian continental shelf (NCS) through the State’s Direct Financial Interest (SDFI). These assets are managed by Petoro AS. The company’s most important job is to help ensure the highest possible value creation from the SDFI to the benefit of the whole of Norway.

Petoro takes care of the Government's direct financial involvement and is the holder of rights to approximately one third of the oil and gas reserves with shares in 43 producing fields on the Norwegian continental shelf.

Petoro delivered a cash flow of NOK 277 billion to the state in 2023. This is the second-highest cash flow ever recorded in the company's history. Since Petoro was established in 2001, the company has delivered more than NOK 3000 billion to the state from the SDFI.

Petrolia NOCO

Petrolia NOCO AS is an independent exploration and production company with a strategic focus on exploring areas near existing infrastructure for swift tie-backs while challenging traditional perspectives to revitalize legacy assets or discover new plays. The company also takes a proactive approach towards reducing emissions through participation in carbon capture and storage and is also supporting all lower emission initiatives on Brage and other assets.

In October 2023, PNO signed an agreement with Vår Energi ASA to acquire its 12.26% interest in the Brage Field.

In January 2024, the company was awarded interest in two licenses in the Norwegian Awards in Predefined Areas (APA 2023). License PL 1221 will be operated by Petrolia NOCO with a 40% working interest. License partner is Equinor with 60% working interest. License PL 1210 will be operated by Harbour Energy (40% working interest) with PNO and Equinor as license partners, both with 30% working interest.

PGNiG Upstream Norway

PGNiG Upstream Norway AS is an oil and gas company with the head office located in Stavanger, Norway. The sole owner is ORLEN SA, which is the largest energy multi-utility in Central and Eastern Europe.

PGNiG Upstream Norway is a non-operating partner in several producing fields: Ormen Lange, Skarv, Gina Krog, Tommeliten Alpha, Duva, Kvitebjørn, Marulk, Alve, Ærfugl Nord, Vale, Skogul, Vilje, Sleipner Vest and Sleipner Øst, Yme, Vale, Utgard, Gungne, Tambar Øst, Valemon and Morvin. The company also holds interests in seven discoveries in the development phase: Fenris, Ørn, Alve Nord, Tyrving, Andvare, Verdande and Yggdrasil.

November 2023 saw a strategic transaction executed in the upstream segment as PGNiG Upstream Norway of the ORLEN Group assumed control of the entire operations of the hydrocarbon producer KUFPEC Norway. Following the transaction, the ORLEN Group’s natural gas output in Norway increased by one-third, reaching over 4 bcm annually, and daily hydrocarbon output exceeding 100,000 boe 2024.

Repsol

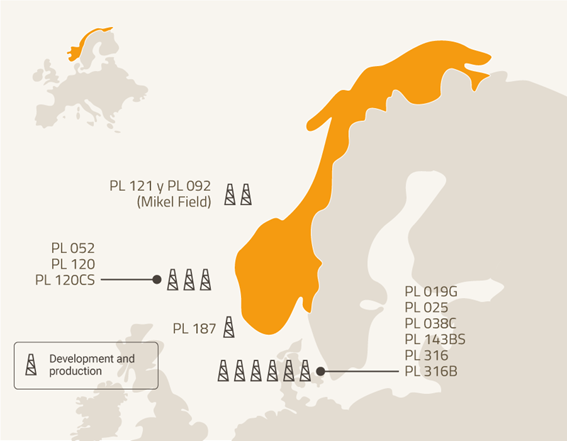

Repsol has been operating in Norway through its wholly owned subsidiary Repsol Norge AS since 2003. The company produces about 30,000 barrels of oil equivalents per day from fields in the Norwegian shelf.

Repsol operates the Blane, Gyda, Rev and Yme fields. We also hold interests in a number of non-operated fields with associated production facilities and intrafield pipelines including Gudrun, Veslefrikk, Visund, Mikkel, Huldra and Tambar East.

Rex International

Rex’s subsidiary Lime Petroleum ("LPA"), was established in 2012 with offices in Oslo, Norway. LPA has since built a portfolio of licences focusing on mature areas close to existing oil and gas infrastructure. LPA was pre-qualified in February 2013 as a partner company and in March 2023, as an operator on the Norwegian Continental Shelf.

LPA uses high-quality seismic data and the Group's Rex Virtual Drilling technology, together with conventional seismic attributes and analysis of the petroleum systems in its exploration efforts.

Shell

Shell’s history in Norway began long before oil was discovered on the Norwegian continental shelf (NCS), with Norsk-Engelsk Mineralolie Aktieselskab (Nemak) established as a subsidiary of Royal Dutch/Shell as early as 1912.

This company acquired a tank farm at Nesodden outside Oslo, launching what was to become A/S Norske Shell. It expanded with coastal depots and service stations along the whole coast.

Norske Shell has experienced huge progress, from delivering lamp oil by horse and cart to today’s high-tech production of gas from waters almost 1 000 metres deep.

Source Energy

Founded in 2017, Source Energy AS is an independent E&P company focused on gas exploration and production on the Norwegian Continental Shelf.

Source Energy has participated in 5 exploration wells and four of these have been reported by Norwegian Offshore Directorate (NOD) as discoveries – the Atlantis discovery (PL878), the Oswig East discovery (PL1100), the Eirik discovery (PL817) and the Norma discovery (PL984). Source’s successful exploration drilling has yielded a material development portfolio with favorable ESG characteristics. The majority of the discoveries are gas/condensate discoveries located close to existing infrastructure for production and export.

The first production from Source’s portfolio is expected in 2030 at which point the cashflow can then be recycled into new exploration activities and developments.

Sval Energi

Sval Energi, previously known as Solveig Gas, has worked with natural gas since 2011. From the very beginning their main business was to transport gas from the North Sea to Europe. Today the company also participate in the exploration and development of oil & gas fields. Going forward, Sval's ambition is to provide energy from oil and gas and new energy sources.

Sval is an exploration and production (E&P) company with a diverse portfolio of production, development and exploration assets on the Norwegian Continental Shelf. Now Sval is in the top ten list of the largest oil and gas producers on the Norwegian continental shelf. In 2022, Sval acquired Spirit Energy’s and Suncor’s Norwegian businesses. Later in 2022, Sval acquired Equinor’s participating interest the Greater Ekofisk area and 19% in the Martin Linge field.

In August 2023, Sval was awarded operatorship for the Trudvang CO2 storage licence in the North Sea. The licence has the potential to store nine million tons of CO2 annually. This corresponds to approximately 20 percent of Norway’s annual CO2 emissions. Sval has a 40 percent ownership stake, while Storegga and Vår Energi each own 30 percent.

At year-end 2023, the Company’s E&P portfolio consists of several exploration licenses and six fields under development. Also, the Company was operator for two producing fields during 2023, Oda and Vale (which had last day of production in September 2023), and at-year end 2023 partner in 14 additional producing fields.

TotalEnergies

TotalEnergies has been present in Norway for over fifty years and has played a major role in the development of a number of large fields on the Norwegian Continental Shelf with operated and non-operated interests in key assets that include:

Ekofisk (39.9%), Eldfisk (39.9%), Embla (39.9%), Tor (48.2%) and Flyndre (6.26%). In 2021, the redevelopment of Tor was finalized while

the development of the Tommeliten Alpha field (20.14%), a satellite of the Ekofisk field, was approved. The production of Tommeliten Alpha started in October 2023.

Johann Sverdrup (8.44%), where production of Phase 1 started in October 2019 and phase 2 came on stream in December 2022. Production facilities in this field are powered from shore resulting in very low GHG emissions, of only 0.67 kg of CO2e/boe.

Oseberg (14.7%), whose facilities also treat, among other fields, the production from Tune (10%). Electrification of the Oseberg installations with power supply from shore was approved by the authorities in 2022.

Islay (5.51%) located in the boundary with the UK sectort in the northern North Sea and operated by TotalEnergies in the UK.

Troll (3.69%), one of the largest oil producing fields on the Norwegian Continental Shelf and with very large quantities of gas, and Kvitebjørn (5%).

Åsgard (7.81%), Tyrihans (23.15%) and Kristin (6%) located in the Haltenbanken region.

Skirne (40%) and Atla (40%) fields, operated by TotalEnergies. On these mature fields, abandonment of wells and decommissioning of flowlines to the Heimdal (16.76%) platform operated by Equinor, are expected to be completed by the end of 2028.

Vår Energi

Vår Energi’s heritage is built on over 50 years of operations on the Norwegian Continental Shelf (NCS), including the very first license issued in 1965 (PL001). Vår Energi AS was established in 2018 through the merger of Eni Norge AS and Point Resources AS. Eni Norge AS was founded in 1965, while Point Resources was created through the merger of the HitecVision portfolio companies in 2016, which then acquired the Norwegian operated business of ExxonMobil in 2017. In 2019, the Company further proved its ability to execute complex transactions, with the acquisition of substantially all of ExxonMobil’s partner-operated assets on the NCS. In 2023, Vår Energi announced the acquisition of Neptune Energy Norge AS. The transaction added a portfolio of complimentary assets and new capabilities

to the Vår Energi team.

Vår Energi has equity stakes in 47 producing fields and produced net 213 kboepd of oil and gas in 2023.

Wellesley

Wellesley is an oil and gas exploration and development company, based in Norway and backed by Blue Water Energy LLP, a leading private equity investor in the energy transition.

Since 2016, Wellesley has been one of the most active and successful explorers in Norway, which has led to the rapid growth of their development portfolio.

Wellesley’s successful exploration drilling has yielded a material, high quality development portfolio with favourable ESG characteristics. Wellesley’s developments are split between their two exploration themes of “Gas to Europe” and “Power From Shore Oil”.

NORWEGIAN SHELF ACTIVITY IN 2023

2023 was an active year on the Norwegian shelf. 92 fields were in operation at year-end, 27 projects were under development and many exploration wells were drilled.

Production was somewhat lower in 2023 than was expected a year ago. This is largely due to unplanned and extended maintenance shutdowns at multiple onshore facilities and fields.

The consequences for gas production were greatest during the summer months, when demand was lower. Production resumed full force starting from early autumn, with November and December being particularly good months for gas export.

Preliminary figures for December indicate a new export record for a single month, with just under 12 billion standard cubic metres gas.

The high activity level seen in 2023 will continue through 2024.

The Norwegian shelf will continue to play an extremely important role for energy security in Europe for many years to come.

Many investment decisions were made in 2022 for projects that were approved by the authorities last year. 27 projects are currently under development, contributing to robust activity in the supplier industry.

This shows that the temporary tax regime change adopted in 2020 has had a very positive effect for the Norwegian supplier industry.

As a consequence of high development activity, oil and gas production is expected to remain stable for the next few years. Over the short term, the new fields coming on stream will offset lower production from ageing fields.

Compared with forecasts presented in The Shelf last year, we see a relatively large increase in investments for 2023 and 2024.

This is a result of factors such as high activity levels in the industry, a weaker Norwegian currency and cost growth. Certain projects have accelerated investments and several fields have gained extended lifetimes and must therefore invest in upgrades.

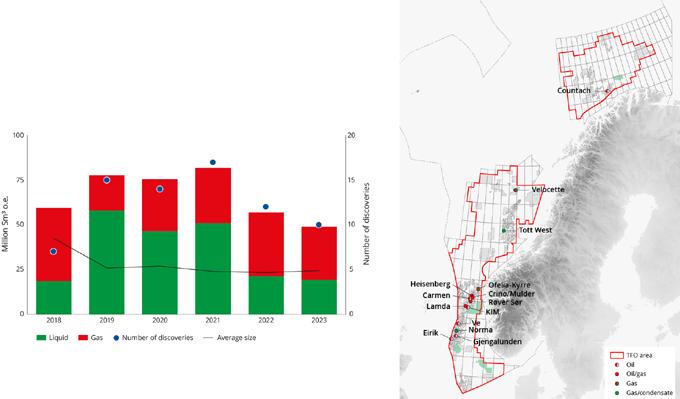

34 exploration wells were spudded in 2023. 23 of these were wildcat wells, where 14 discoveries were made.

It’s important that exploration be conducted around existing infrastructure so discoveries can be tied back and create value while the fields are still in operation.

Nevertheless, the Norwegian Offshore Directorate would like to see companies exploring actively in more frontier areas. In order to realise more of the resource potential, companies must to a greater degree commit to testing new ideas in frontier areas.

There is still significant interest in the annual awards in predefined areas (APA). 25 companies applied for new acreage in APA 2023.

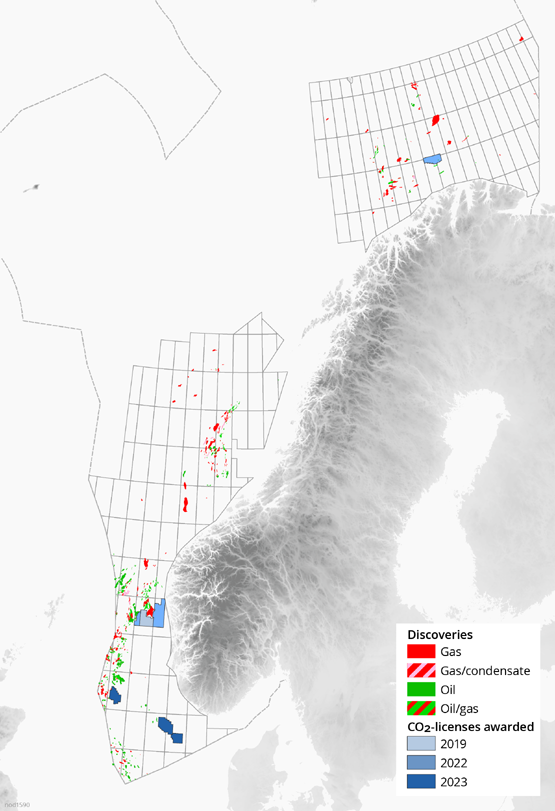

Interest in storing CO2 on the Norwegian shelf continues to increase. Based on its own work, the Directorate has previously demonstrated a considerable potential for safe storage of CO2 on the Norwegian continental shelf.

Six exploration licences have been awarded since 2020. These will now be explored and several companies are now looking at projects aimed at establishing value chains for capturing CO2, transport from Europe and storage on the Norwegian shelf.

It will be important for the Norwegian Offshore Directorate to facilitate the award of more exploration licences where CO2 can be stored, in sound coexistence with petroleum activities and other offshore industries.

On 9 January, the Storting (Norwegian parliament) endorsed the Government’s proposal to open parts of the Norwegian continental shelf for mineral activity. A final resolution will be made in the form of a Royal Decree.

This means that commercial players can now contribute to clarify the existence of commercially attractive mineral resources, and whether such resources can be recovered in a sustainable manner.

A process will now be initiated to announce and award licences pursuant to the Seabed Minerals Act.

At the same time, it will be important to continue the Norwegian state’s work to map resources and the environment.

FACTS AND FIGURES

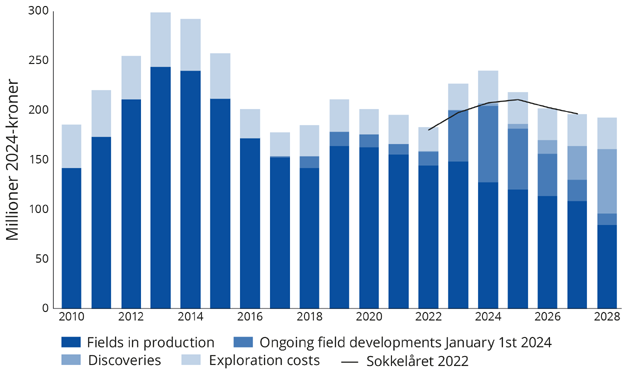

Investments

Significant activity in the industry, a weakened Norwegian currency and growth in costs have resulted in higher projected costs and investments for 2023 and 2024 in particular, compared with what was presented in The Shelf in 2022. Projected investments have also changed for ongoing developments. Several fields report extended lifetimes, which will require increased investments to maintain the facilities' technical integrity. An expectation of increased exploration activity moving forward contributes to growth in exploration investments from 2024.

New investment decisions will be necessary to maintain activity leading up to 2030.

Exploration

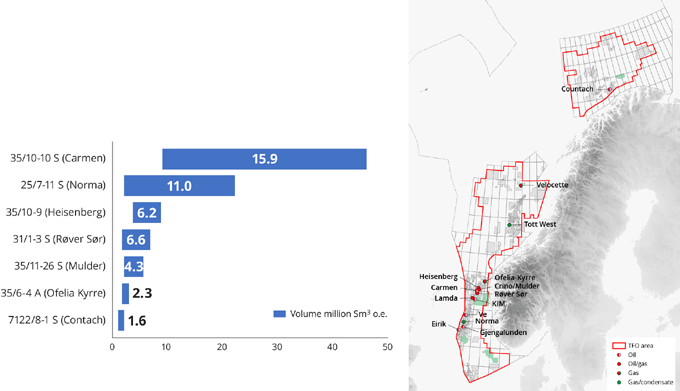

34 exploration wells were spudded in 2023, which is on par with recent years. 14 discoveries were made; 11 in the North Sea, two in the Norwegian Sea and one in the Barents Sea. The largest discovery is 35/10-10 S (Carmen) in production licence 1148. This discovery may contain between 9 and 46 million standard cubic metres (Sm3) of oil. The resource growth from discoveries made in 2023 is about 50 million standard cubic metres of oil equivalent (Sm3 o.e.).

Exploration results

Discovery rate

Awards in pre-defined areas (APA)

In January 2023, 25 companies were offered ownership interests in a total of 47 production licences in pre-defined areas (APA) 2022.

When the application deadline for APA 2023 expired on 23 August 2023, the authorities had received applications from 25 companies. Offers of ownership interests in new production licences are expected to be made early this year.

Geophysical and scientific surveys

99 commercial geophysical surveys were conducted on the Norwegian shelf in 2023. Eight reported surveys were cancelled.

Six geophysical surveys were conducted in the Barents Sea, three of which were drilling site surveys, two subsurface surveys and one ordinary seismic survey.

19 geophysical surveys were conducted in the Norwegian Sea, 13 of which were drilling site surveys, two subsurface surveys and four ordinary seismic surveys.

74 geophysical surveys were conducted in the North Sea. 68 of these took place under the petroleum regulations, while six took place under the CCS regulations. 38 were drilling site surveys, 15 were subsurface surveys, 16 were seabed seismic surveys and five were ordinary seismic surveys.

33 scientific survey licences were issued, 16 of which to Norwegian institutions.

At year-end 2023-2024, there were 92 fields in operation on the Norwegian shelf. Atla, Flyndre, Heimdal, Skirne and Vale shut down over the course of last year, while Bauge, Breidablikk, Fenja and Tommeliten A came on stream.

Production remains at a high level and will peak in 2025. Johan Castberg is expected to come on stream toward the end of 2024, which will yield significant production growth for 2025.

Oil and gas production is expected to remain stable over the next few years as a result of robust development activity on the shelf. Without new fields or major investments in existing fields, production from the Norwegian shelf will decline. Over the short term, the new fields that come on stream will offset lower production from ageing fields.

A total of approx. 233 million Sm³ of o.e. was produced in 2023 – the equivalent of about four million barrels of o.e. per day, which is around the same level as in 2022 .

Gas pro duction in 2023 came to a somewhat lower level than we expected one year ago. This is primarily caused by unplanned and extended maintenance shutdowns at several onshore facilities and fields. Another part of the explanation is delayed well deliveries and multiple wells not yielding the anticipated production.

The Norwegian Offshore Directorate publishes preliminary production figures on a monthly basis.

The new Regulations relating to fiscal measurement in the petroleum activities (Measurement Regulations) entered into force in May 2023. It replaces Regulation No. 1234 of 1 November 2001 relating to measurement of petroleum for fiscal purposes and for calculation of CO2 tax.

Consent to commencement and continuation

Consent to commencement and continuation for facilities is governed by Section 30a of the Petroleum Regulations. The consent system was delegated to the Norwegian Petroleum Directorate by the Ministry of Petroleum and Energy (now the Norwegian Offshore Directorate and the Ministry of Energy) via a letter of 27 November 2006.

Projects/developments

15/5-2 Eirin was the only plan for development and operation (PDO) submitted in 2023 following the wave of PDOs in 2022. 15/5-2 Eirin is a subsea development in the central part of the North Sea. Resources in 15/5-2 Eirin are estimated at 4.5 million Sm3 of o.e.

The authorities received two applications for PDO exemptions in 2023, for the Brage Cook project on the Brage field and Solan and Ludvig on the Gullfaks Sør field. Both are slated to be developed with wells from existing infrastructure, and both are located in the northern part of the North Sea. Resources in the two projects are estimated at 0.1 and 0.3 million Sm3 of o.e., respectively.

In 2022, the authorities received plans for 13 new developments (PDOs) as well as several plans for projects to improve recovery near existing fields or to secure extended lifetimes. Major investment decisions were also made on existing fields. These plans were approved in 2023.

Carbon capture and storage (CCS)

Three licences were issued in 2023 pursuant to the Regulations relating to exploitation of subsea reservoirs on the continental shelf for storage of CO2 and relating to transportation of CO2 on the continental shelf. A total of seven licences have been awarded; one exploitation licence and six exploration licences.

Twelve companies are licensees in these licences, nine of which also carry out petroleum activities.

Seabed minerals

The Seabed Minerals Act entered into force on 1 July 2019. This law facilitates exploration for and extraction of mineral deposits on the Norwegian shelf.

The Storting (parliament) is scheduled to make a decision on opening for mineral activities on the Norwegian shelf in early January 2024.

The administrative responsibility for seabed minerals on the Norwegian shelf is assigned to the Ministry of Energy (MoE). The Norwegian Offshore Directorate has assisted the Ministry in conducting the impact assessment and coordinating the academic study efforts.

The Norwegian Petroleum Directorate, now the Norwegian Offshore Directorate, has prepared a resource assessment for the seabed minerals on the Norwegian shelf. The report, which was submitted in January 2023, concludes that there are substantial resources in place.

The Norwegian Petroleum Directorate has been gathering data in deepwater areas in the Norwegian Sea and Greenland Sea along with the University of Bergen and University of Tromsø since 2011. We have also organised several of our own expeditions since 2018.

In 2023, we carried out one expedition on our own, where we mapped areas along the southern part of the Knipovich Ridge in the northern part of the Norwegian Sea with an autonomous underwater vehicle (AUV). We also participated in a joint expedition with the University of Bergen, where we mapped parts of the same area with a remotely operated vehicle (ROV).

In addition, we participated in a joint expedition with the University of Tromsø, where multiple seismic lines were collected over a sulphide deposit on the Knipovich Ridge.

The Storting's potential resolution to open areas for seabed minerals will mean that the licensing authorities will initiate a process to announce and award permits pursuant to the Seabed Minerals Act.

At the same time, we expect the mapping of seabed minerals to continue, which will take place in parallel with potential commercial players. The authorities want a stepwise development and a cautionary approach to the activity, and additional knowledge will be acquired as regards natural and environmental factors.

Offshore wind

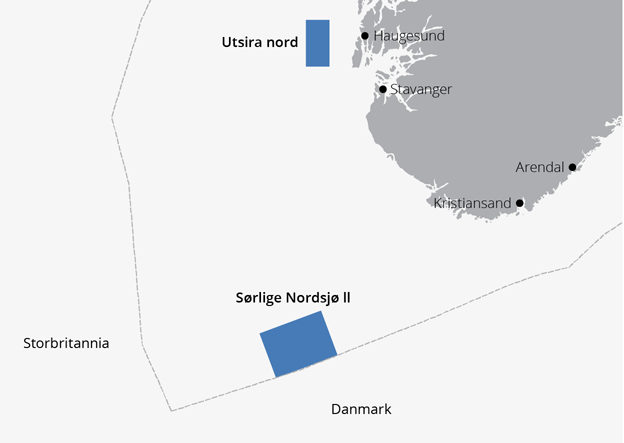

In 2022, the Norwegian Petroleum Directorate was tasked with conducting subsurface surveys in the Utsira Nord and Sørlige Nordsjø II areas, which have been opened for applications for renewable energy generation. The objective is to find the most suitable locations for placing wind turbines.

Seven different measurements are carried out: MBES (multibeam echo sounders) provides key datasets for bathymetry, acoustic backscatter and water column data. We also collect 2D high resolution seismic, sub-bottom profiler (SBP), side scan sonar (SSS), as well as magnetometer data.

The subsurface surveys are set to continue in 2024.

The Norwegian Offshore Directorate has started a process to make this data available to the industry.

NOD have conducted subsurface surveys in the areas of Utsira Nord and Sørlige Nordsjø II.

In 2023, a broadly composed group established by the Directorate identified 20 areas on the Norwegian shelf that could be technically suitable for further development of offshore wind, and where the activity is expected to be suitable for coexistence with other industries.

The NPD has provided technical contributions in this process, which has been spearheaded by the Norwegian Water Resources and Energy Directorate (NVE).

KeyFacts Energy Industry Directory: Norwegian Offshore Directorate l Norway News

KEYFACT Energy

KEYFACT Energy