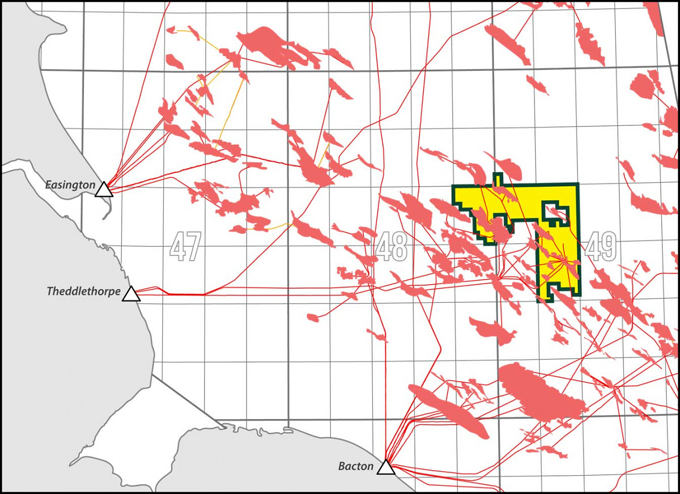

- Re-processed seismic over P2607 licence provides significantly improved imaging of subsurface, including Anning and Somerville fields and other discovered fields and exploration opportunities.

- Revised interpretation of Anning and Somerville confirms previous work and indicates a small increase in Gas Initially In Place (GIIP).

- Hi-grading of additional opportunities within the licence continues to ensure gas recovery is maximised.

- Work programme continues, developing a new subsurface model to allow detailed planning of well locations to maximise gas recovery from each well, while minimising drilling risk.

- UK NBP gas prices (~93p/therm) and futures have strengthened throughout the summer after the lower prices in early spring even with European gas storage levels at 90% of capacity.

- Viaro Energy has reached an agreement with Shell and ExxonMobil to acquire a 100% working interest in the associated gas infrastructure which has been identified as one possible offtake route for Hartshead’s Phase I development

- Hartshead awaiting further clarity on UK Government Energy Profits Levy

In the last quarter of 2023, Hartshead received the reprocessed volume of seismic data purchased from specialist seismic contractor PGS. The reprocessing involved performing pre-stack depth migration processing on the existing seismic data to provide better imaging of the subsurface in at the Anning and Somerville fields, as well as some of the other opportunities in licence P2607.

Interpretation of the reprocessed data has now largely been completed with very positive results. Delineation of the Anning and Somerville fields has predominantly shown only small differences between the two seismic versions giving improved robustness to the estimate volumes of GIIP. Where there is a difference, near the flank of the fields, structures have been lifted up, increasing the volume within the fields.

Imaging of the exploration prospects within the area of the reprocessed seismic has also been enhanced, allowing a more rigorous review of the opportunities. The review will identify the key opportunities to progress in conjunction with the Anning and Somerville development, ensuring development synergies with the aim of maintaining gas production as high as possible for longer.

Subsurface Modelling

The improved seismic data has been used to enhance the subsurface model for the Anning and Somerville fields, allowing a single model to be built covering both fields. Combined with updated reservoir properties, the new model will facilitate detailed responses to questions previously asked by the North Sea Transition Authority (NSTA) as part of the Field Development Plan (FDP) approval process.

Prior to detailed well planning commencing, the well paths will be derived within the subsurface model to optimise the well trajectories ensuring maximum gas recovery from the most cost effective drilling operations.

Oil & Gas UK Government Energy Profits Levy (EPL)

A policy paper published by the government has advised of changes to the UK EPL. Many of these changes were previously detailed as part of the Labour Manifesto including a 3% increase in the EPL rate to 38% from 1 November 2024, an extension to the EPL expiry to 31 March 2030 (currently 31 March 2029) and the removal of the 29% investment allowance from 1 November 2024. The Government will also reduce the extent to which capital allowance claims can be considered in calculating levy profits; however, the extent of the reduction will only be announced in the October budget following engagement with stakeholders.

South North Sea Gas Infrastructure

Viaro Energy has reached an agreement with Shell and ExxonMobil to acquire a 100% working interest in the Shell-operated UK Southern North Sea (SNS) assets. The acquisition includes the Corvette and Leman fields (and the associated infrastructure), which has been identified as one possible offtake route for Hartshead’s Phase I development.

Gas Price

Despite the European Commission announcing that gas storage levels were greater than 90% on 21/08/2024, NBP spot gas price has remained over 90p/therm, with winter future contracts above £1/therm. This indicates that there has been strong gas demand through the summer months, which is forecast by the market to extend into the winter season.

Chris Lewis, Hartshead CEO, commented:

“The recent sub-surface work undertaken by the team serves to increase our confidence in the volumes of gas remaining to be recovered at Anning and Somerville, as well as assisting with future detailed well planning to maximise recovery and minimise risk. All of this work ensures that the field development execution will be successful in delivering gas to the UK grid.

We see strong gas prices in Europe leading out of summer, demonstrating the continued robustness of the European gas market which unpins future gas prices in the UK.”

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy