NAMIBIA

Namibia (the Republic of Namibia), borders the Atlantic Ocean on its west coast, Zambia and Angola in the north, Botswana in the east, and South Africa in the south and east.

History

The San, Herero and Nama were overrun by Bantus (Ambos) in the 14th century. The Portuguese arrived in 1485 but did not claim the area. In the 1870s Orlam clans moved into the south, clashing with the Herero. Traders from Germany and Sweden had settled the coast and Germany established a protectorate (German South-West Africa) in 1884, although the British annexed the harbour at Walvis Bay. From 1904 the Germans brutally subjugated local tribes. After German defeat in World War 1 the country was mandated to the UK, through South Africa.

In 1948 South Africa began to apply apartheid, designating areas as homelands and from 1966 The South West Africa People's Organisation (SWAPO) began a guerilla war against them. The UN then assumed responsibility, calling the country Namibia but South Africa maintained its de facto rule. The UN went on to recognise SWAPO and Namibia finally obtained independence from South Africa in 1990 (Walvis Bay in 1994) and Namibia exchanged white minority rule for a stable democracy. Agriculture, tourism and mining now form the basis of its economy.

Namibia is a stable, democratic country, and the Government of the Republic of Namibia is committed to stimulating economic growth and employment through foreign investment.

FOR over a century, Namibia has had a strong mineral foundation, starting with the discovery of diamonds in 1908. In the years thereafter, it has developed into the fourth largest exporter of non-fuel minerals in Africa today.

This is led by its diamond production, which is the sixth largest in the world by value, uranium production, which is the fifth largest in the world, as well as production of gold, lead, zinc, tin, silver and tungsten.

Adding to the known on-shore and offshore resources to which Namibia's economy is largely pinned, is the possibility of oil reserves. For a number of years there has been interest and activity in prospecting for hydrocarbons, both on and offshore, in Namibian territory. The first prospect wells were drilled in the early 1960s and following a number of dry wells, the Kudu gas fields were discovered in 1974, confirming the presence of hydrocarbons in the geological structures off the Namibian coast. The presence of hydrocarbons further motivated companies to explore coal and oil prospects in the country. However, after 36 coal exploration wells produced negative results and several oil exploration wells were found to be dry, interest in Namibia as an oil frontier waned.

| Official name: | Republic of Namibia |

| Capital: | Windhoek |

| Population: | 3,037,441 (2024) |

| Area: | 824,292 Km² (318,261 square miles) |

| Government type: | Republic |

| Languages: | English, Afrikaans,German, indigenous |

| Religion: | Christian, indigenous beliefs |

| Currency: | Namibian dollar, South African rand |

| Calling code: | +264 |

The sedimentary basins offshore Namibia cover an area of approximately 500,000 km², which is comparable in size to the NW Shelf of Australia. By comparison Namibia is underexplored with only 15 exploration wells having been drilled to date resulting in the Kudu gas and condensate discovery in 1974.

The presence of gas at Kudu caused many in the industry to regard the Namibian offshore as being gas-prone and there was not much follow-on exploration activity. Over the last 10 years however, driven by encouraging results from the matching basins on the other side of the Atlantic in Brazil, explorers refocussed on Namibia and during 2012-13 a Brazilian exploration company drilled wells in the Walvis Basin which demonstrated the presence of oil-mature Aptian source rocks. The Wingat-1 well in 2012 encountered thick, mature Aptian oil-prone source rocks and recovered light oil from sandstones within the same interval.

The following year Murombe-1 also penetrated mature, oil-prone Aptian source rocks but, in addition, encountered a 240m-thick turbidite channel sand of Santonian age with a net-to-gross of 15% and an average porosity of 19%. There were no hydrocarbons present in the well which was thought to be due to lack of up-dip seal, however, it did provide calibration for the seismic signature of potential reservoir facies.

Over the same period in the Orange Basin of southern Namibia, the Kabeljou-1 well was drilled to test a structural high to the north of Kudu. This well encountered oil-prone source rocks in the Cenomanian-Turonian but they were immature. The Kabeljou-1 well did not encounter any potential reservoir.

The following year the Moosehead-1 well tested a structural high outboard of Kabeljou-1. The well encountered oil-prone Aptian and Cenomanian-Turonian source rocks. The deeper Aptian sequence was only marginally mature and the primary reservoir target was a carbonate facies which was a non-reservoir where encountered by the well. In combination with the earlier results at Kudu, where the Aptian source was present but more deeply buried into the gas window, there is now a compelling combination of data points which demonstrate the presence of oil-prone source rocks and provide information about the depth of burial required for maturity.

Numerous oil seepages have also been reported offshore Namibia with most occurrences clustered around the Walvis Basin in the north and the Orange Basin in the south.

KEY OIL & GAS PLAYERS IN NAMIBIA

88 Energy

In November 2023, 88 Energy announced the execution of a three stage farm-in agreement with a wholly-owned subsidiary of Monitor Exploration to earn up to a 45% non-operated working interest in onshore Petroleum Exploration Licence 93 (PEL 93), located in the Owambo Basin, Republic of Namibia.

The Farm-In Agreement is between Eighty Eight Energy (Namibia) (Pty) Ltd (88EN), a newly formed, wholly owned subsidiary of 88 Energy and private Namibian company, Monitor Oil and Gas Exploration (Namibia) Pty Ltd (MELN), a wholly owned subsidiary of Monitor. MELN currently holds a 75% working interest in the Licence and acts as Operator of the exploration and development of PEL 93. Private Namibian company, Legend Oil Namibia (Pty) Ltd (Legend) holds a 15% working interest and and Namibian government entity National Petroleum Corporation of Namibia (Pty) Ltd (NAMCOR) holds a 10% working interest in the Licence.

Under the terms of the Farm-In Agreement 88 Energy, together with the current working interest owners, will become party to a new Joint Operating Agreement (JoA) in relation to the Licence and may earn up to a 45% working interest in PEL 93 by funding its share of agreed costs under the 2023-2024 approved work program and budget as defined in the Farm-In Agreement (2024 Work Program), and any future work program budgets yet to be agreed. The maximum total investment costs are anticipated to be US$18.7 million.

PEL 93 covers a vast 18,500 km² acreage position in the north of Namibia, comprising blocks 1717 and 1817 within the Owambo Basin. The region has been identified as one of the last remaining underexplored onshore frontier basins and one of the World’s most prospective new exploration zones.

KeyFacts Energy: 88 Energy Namibia country profile

Africa Oil

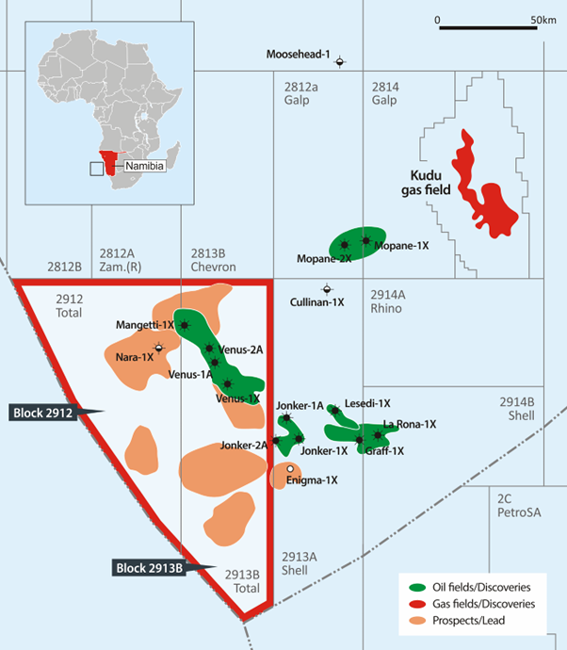

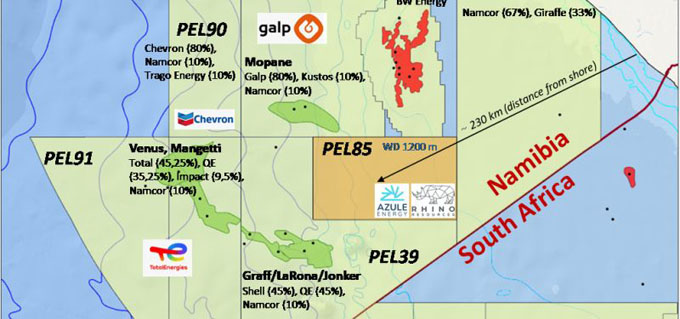

Africa Oil has indirect interests in these blocks through a 31.1% shareholding in its investee company Impact Oil & Gas Limited (“Impact”), which has a 18.9% interest in Block 2912 and a 20.0% interest in Block 2913B. These blocks are operated by TotalEnergies (37.8% in Block 2912 and 40% in Block 2913B). Other partners include QatarEnergy (28.3% in Block 2912 and 30% in Block 2913B) and NAMCOR (15% in Block 2912 and 10% in Block 2913B).

Block 2913B contains the world class Venus light oil and associated gas field that was discovered by the Venus-1X well drilled in 2022, which encountered high-quality light oil-bearing sandstone reservoir of Lower Cretaceous age. Three follow-on appraisal wells have de-risked the field with the results supporting the Venus development case.

On January 10, 2024, the Company announced a strategic farm down agreement between Impact and TotalEnergies, that allows the Company to continue its participation in the world class Venus oil development project, and the follow-on exploration and appraisal campaign on Blocks 2913B and 2912 with no upfront costs. On closing of the farm-out transaction with TotalEnergies, Impact will retain a carried 9.5% WI in each of the two Blocks.

KeyFacts Energy: Africa Oil Namibia country profile

Azule Energy

In May 2024, Azule Energy signed a strategic Farm-In Agreement with Rhino Resources to enter Namibia.

The deal grants Azule a 42.5% interest in Block 2914A (PEL85) located in the offshore Namibian Orange basin. Azule plan to drill two high-impact exploration wells, with the first one expected to spud by the end of 2024.

The current contractor group consists of Rhino (Operator, 85%), Namcor (10%) and local company Korres Investments (Pty) Ltd (5%).

KeyFacts Energy: Azule Energy Namibia country profile

BW Energy

In January 2021, BW Kudu, a wholly owned subsidiary of BW Energy and NAMCOR signed a Farm-In and Carry Agreement. The agreement increases BW Kudu’s working interest in the Kudu license offshore Namibia from 56% to 95% in line with previously disclosed intentions. NAMCOR retains the remaining 5% working interest.

The Kudu gas field is located about 130 km offshore the southern parts of Namibia. It contains an estimated 1.3 TCF of gas (P 50) and was discovered in 1974. The new arrangement will enable gas sales arrangements and increases the likelihood of securing financing for the upstream Kudu development.

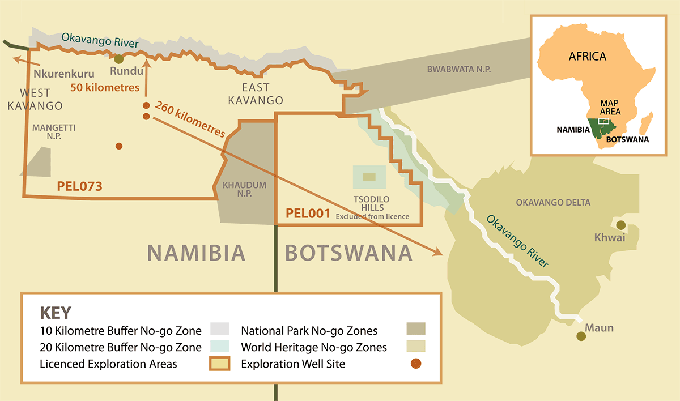

In July 2024, BW Energy signed a Letter Agreement with ReconAfrica to acquire approximately 16.8 million common shares and 16.8 million warrants for a total consideration of USD 16 million in ReconAfrica’s announced equity raise. By participating in the equity raise, BW Energy receives a 20% non-operating interest in the onshore Petroleum Exploration License 73 (“PEL 73”) where ReconAfrica will provide BW Energy with a carry of USD 6.4 million based on the intended initial work program. BW Energy has also committed to certain contingent payments to ReconAfrica based on specific field development milestones.

PEL 73 is located in northeast Namibia, covering an area of approximately 25,341 sq km. Two exploration wells are planned to be drilled in the Damara Fold Belt Basin in the second half of 2024. The wells are targeting a combined un-risked resource potential of 489 million barrels of oil based on the most recent prospective resource report by Netherland, Sewell & Associates Inc. (NSAI).

KeyFacts Energy: BW Energy Namibia country profile

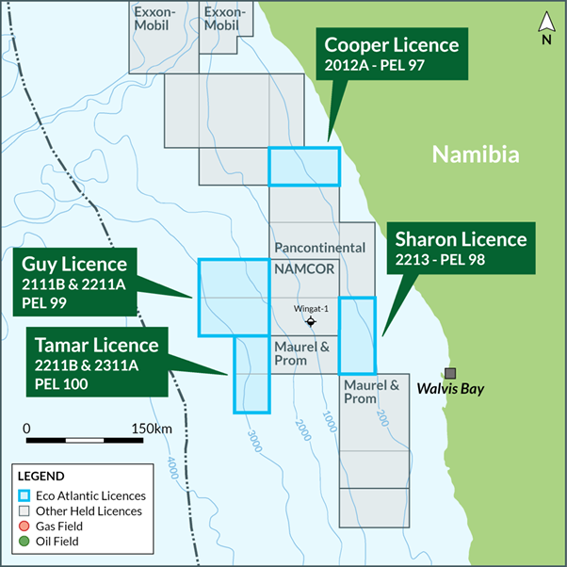

Eco Atlantic

In Namibia, Eco holds Operatorship and an 85% Working Interest in four offshore Petroleum Licences: PELs: 97, 98, 99, and 100, representing a combined area of 28,593 km² in the Walvis Basin.

The Cooper Block (PEL 97) is situated in shallow water (100-500m) within the Walvis Basin offshore Namibia and covers approximately 5,788 km².

Eco Atlantic Oil & Gas is currently focused on further defining the Osprey Lead, an 882 million barrel Aptian/Albian source fed oil target within a sand filled channel system, in the cretaceous sequence, with the mature oil window located in approximately 300 m of water.

The Cooper Block (PEL 97) is situated in shallow water (100-500m) within the Walvis Basin offshore Namibia and covers approximately 5,788 km².

The Sharon Block (PEL 98) is situated in shallow water (100-500 m) within the Walvis Basin offshore Namibia and covers approximately 5,700 km².

The Guy Block (PEL 99) is situated in deep water (1,500-3,000 m) within the Walvis Basin offshore Namibia and covers approximately 11,457 km².

The Tamar Block (PEL 100) is situated in deep water (2,500-3,000 m) within the Walvis Basin offshore Namibia and covers approximately 5,648 km².

Eco Atlantic Oil & Gas holds an 85% working interest in the Tamar Block and is the operator of the licence area. Eco is partnered with NAMCOR (10% working interest) and Moonshade Investment Ltd (5% working interest).

KeyFacts Energy: Eco Atlantic Namibia country profile

ExxonMobil

In April 2019, ExxonMobil increased its exploration acreage in Namibia with the addition of approximately 7 million net acres (28,000 square kilometers) following the signing of an agreement with the government of Namibia and the National Petroleum Corporation of Namibia (NAMCOR) for blocks 1710 and 1810, and farm-in agreements with NAMCOR for blocks 1711 and 1811A.

The blocks extend from the shoreline to about 135 miles (215 kilometers) offshore Namibia in water depths up to 13,000 feet (4,000 meters).

KeyFacts Energy: ExxonMobil Namibia country profile

Fenikso

Fenikso is the new name of the restructured Lekoil Limited.

Fenikso is an African focused oil and gas exploration and production company which currently holds interests offshore Nigeria and offshore Namibia. The Company was founded in 2010 by a group of leading professionals with extensive experience in the international upstream oil and gas industry as well as in global fund management and investment banking.

KeyFacts Energy: Fenikso Namibia country profile

Galp

Galp's position in Namibia consists of two offshore exploration licences, PEL 82 in the Walvis basin and PEL 83 in the Orange basin.

In January 2024, Galp Energia reported a major oil discovery offshore Namibia with its Mopane-1X exploration well.

Galp confirmed that it discovered what it said was a "significant column of light oil in reservoir-bearing sands of high quality."

The confirmation comes after Galp drilled the first exploration well, along with partners Namcor and Custos, in offshore block PEL 83.

In April 2024, Galp, together with its partners NAMCOR and Custos, successfully completed the first phase of the Mopane exploration campaign with the conclusion of the Mopane-1X Well Testing operations.

The Mopane-1X well discovered significant oil columns containing light oil in high-quality reservoir sands at two different levels: AVO-1 and AVO-2. The rig then moved to the Mopane-2X well location, where in March significant light oil columns were discovered in high-quality reservoir sands across exploration and appraisal targets: AVO-3, AVO-1 and a deeper target. In particular, the Mopane-2X well found AVO-1 to be in the same pressure regime as in the Mopane-1X discovery well, around 8 km to the east, confirming its lateral extension.

KeyFacts Energy: Galp Namibia country profile

Global Petroleum

Global holds a 78% participating interest in Petroleum Exploration Licence (PEL) 0094 (Block 2011A) in the Walvis Basin, offshore NW Namibia. This covers 5,798 square kilometres in water depths ranging from 450 metres to 1550 metres. State oil company NAMCOR has a 17% carried interest and private company Aloe Investments Two Hundred and Two (PTY) Ltd has a 5% carried interest.

KeyFacts Energy: Global Petroleum Namibia country profile

Impact Oil & Gas

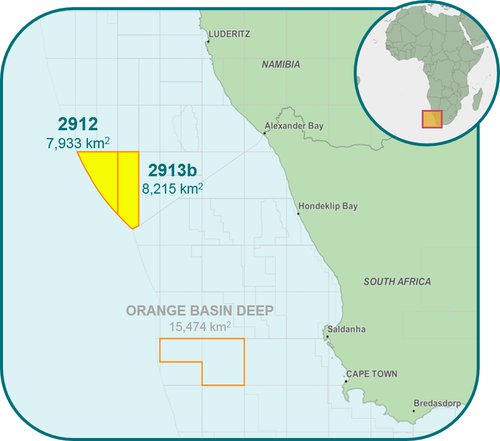

Impact’s Namibia assets cover 16,099km² in a location 300km southern offshore Namibia, immediately adjacent to the South Africa maritime boundary, in 3,000-3,900m of water.

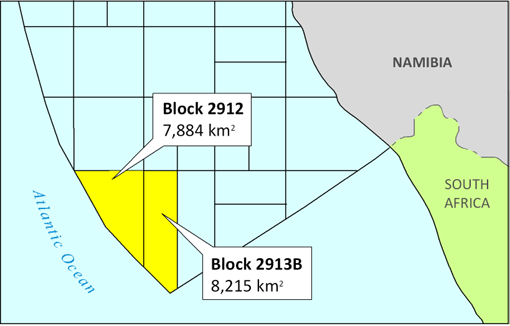

Block 2913B: Petroleum Exploration Licence 56, Block 2913B, is located offshore southern Namibia and covers approximately 8,215km² in water depths up to 3,000m. Impact entered the licence as Operator in 2014, acquiring 2D, then 3D seismic data which defined the Venus prospect. In 2017, Impact and NAMCOR were joined by TotalEnergies, bringing with it significant deep-water drilling expertise to the Joint Venture, and in 2019 QatarEnergy joined the Joint Venture.

Block 2912: Petroleum Exploration Licence 91, Block 2912, is located offshore southern Namibia, adjacent to, but outboard of, PEL 56 and covers approximately 7,884km² in water depths between 3,000 and 3,900m. Impact joined TotalEnergies and NAMCOR on the licence in 2019, as did QatarEnergy.

The acreage lies along the western toe of the Orange River delta, where laterally extensive, large Cretaceous basin-floor fan sands are contained.

Block 2913b is located 150km west of the Kudu Gas field, recent exploration wells along the outer fringes of the Orange Basin and the results from Impacts 2017 acquisition of 1,900sqKm 3D seismic, have demonstrated that there exists a rich, oil prospective zone running through the block. The Company is now exploring the potential extent of this prospective trend extending into block 2912.

In January 2024, Impact, through its wholly owned subsidiary, Impact Oil and Gas Namibia (Pty) Ltd, signed a farmout agreement with TotalEnergies EP Namibia B.V., a wholly-owned subsidiary of TotalEnergies S.E., for the sale of a 9.39% undivided participating interests in Block 2912, Petroleum Exploration Licence 91, and a 10.5% undivided participating interests in Block 2913B, Petroleum Exploration Licence 56. On completion of this transaction, Impact will hold a 9.5% interest in each of Blocks 2912 and 2913B.

Impact will also be reimbursed in cash for its share of the past costs incurred on the Blocks, net to the farmout interests, which is estimated to be approximately USD 99 million.

This Agreement provides Impact with a carry loan for all of Impact’s remaining development, appraisal and exploration costs on the Blocks from January 1st, 2024, until the First Oil Date.

KeyFacts Energy: Impact Namibia country profile

Monitor Exploration

Monitor Exploration (MEL) holds 75% of PEL93, covering an area of 18,500 sqkm over the heart of the Owambo basin in north east Namibia.

MEL has completed passive seismic surveys, remote sensing and gas soil sample analysis which support the interpretation of oil accumulations in several large structures mapped on legacy gravity, seismic and magnetic data.

In November 2023, MEL struck an N$347 million (US$18.7 million) deal to farm-out a key stake in prospective exploration acreage onshore Namibia where a debut wildcat could be drilled in 2025.

KeyFacts Energy: Monitor Exploration Namibia country profile

Nabirm

Nabirm’s petroleum exploration license (PEL 0058), Block 2113A, offshore Erongo Province, Namibia covers 5,750 km², with 3,600 km² located offshore and 2,150 km² located onshore. PEL 0058 is located inboard of the Tullow/Pancontinental‟s PEL 0037 Block and adjacent to the Galp/ExxonMobil Blocks 2212A & B, PEL’s 82 & 83 respectively.

KeyFacts Energy: Nabirm Namibia country profile

NAMCOR

NAMCOR's main business is to ensure the optimum exploitation of Namibia 's petroleum resources and meaningful Namibian participation in resulting business developments in petroleum related exploration activities. The company also acts as advisor to the Ministry of Mines and Energy and assists it in monitoring the exploration activities of licensees.

KeyFacts Energy: NAMCOR Namibia country profile

Pancontinental

Pancontinental has been exploring in Namibia for over a decade and in that time has built up a database of information which indicates the prospectivity of offshore Namibia. Pancontinental’s theories have been validated by the two high profile discoveries made by Shell and TotalEnergies with their Graff1 and Venus-1X wells respectively. Both of these discoveries are on trend to Pancontinental’s PEL 87 Orange Basin area.

Offshore PEL 87: The joint venture consists of Pancontinental with a 75% interest, local company Custos Investments (Pty) Ltd; 15% and the National Petroleum Corporation of Namibia holding 10%.

Pancontinental has granted to Woodside an exclusive option to acquire a 56% participating interest from Pancontinental's interest in PEL 87. Pancontinental has an option to acquire an additional 1% participating interest from Custos Investments.

KeyFacts Energy: Pancontinental Namibia country profile

QatarEnergy

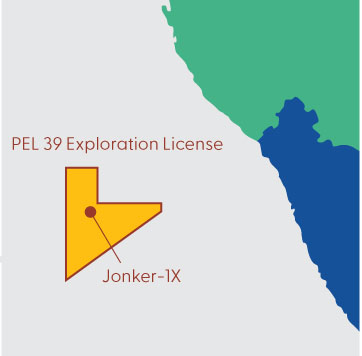

QatarEnergy holds interests in three Exploration Licenses offshore Namibia, PEL-39 (45 percent), PEL-56 (30 percent), and PEL-91 (28.33 percent), covering a total area of over 28,000 square kilometers. (QNA).

In March 2023, QatarEnergy announced a light oil discovery in the Jonker-1X deep-water exploration well drilled in the PEL-39 Exploration License, offshore Namibia.

KeyFacts Energy: QatarEnergy Namibia country profile

ReconAfrica

ReconAfrica holds a 90% interest in a Petroleum Exploration Licence 73 (“PEL 73”) in northeast Namibia which covers the entire Kavango sedimentary basin. The exploration licence covers an area of approximately 25,341.33 sq km (6.3 million acres), and based on commercial success, it entitles ReconAfrica to obtain a 25 year production licence. The Kavango Basin offers both large scale conventional and non-conventional play types. The Licence has an exploration period comprising a number of phases, ending 29 January 2025, or if extensions are requested and granted, ending 29 January 2029.

The fiscal terms of the Petroleum Agreement call for a 5% royalty, and an additional profits tax that applies late in the life of a producing field. ReconAfrica’s Namibian subsidiary is required to pay Namibian corporate income tax of 35%.

In July 2024, ReconAfrica entered into a definitive farm down agreement with BW Energy for the sale of a 20% working interest in PEL 73.

KeyFacts Energy: ReconAfrica Namibia country profile

Rhino Resources

Rhino Resources is a privately-owned exploration company focused on delivering low-cost energy solutions to the African continent.

Rhino has been exploring in Namibia for over a decade, and today holds Operatorship of Block 2914A (PEL 85) with a 85% participating interest.

Located in the shallower portion (~500m to ~1500m water depth) of the very exciting Orange Basin, 2914A is encircled to the outboard by the multiple Namibian discoveries made over the last two years, with the nearest discovery being less than 20km away.

In late 2022, Rhino designed and sole-funded the acquisition of a new 3D seismic survey covering 1700 km², with the aim of reconfirming and expanding the block’s lead inventory.

Early analysis of the new seismic cube, combined with extensive existing datasets, gives confidence in the multiple play types identified and the abundance of drillable prospects.

Rhino and its partners are progressing with the planning and contracting of a 2 well exploration drilling and testing campaign.

KeyFacts Energy: Rhino Resources Namibia country profile

Shell

Shell Namibia Upstream holds a 45% stake in the offshore Petroleum Exploration License 39 (PEL 39) with a 45% interest held by Qatar Petroleum and a 10% held by the National Petroleum Corporation of Namibia (NAMCOR).

In February 2022, NAMCOR and its partners, Shell Namibia Upstream B.V and Qatar Energy, announced that the Graff-1 deep-water exploration well made a discovery of light oil in both primary and secondary targets.

In March 2023, Shell announced a light oil discovery in the Jonker-1X deep-water exploration well drilled in the PEL-39 Exploration License, offshore Namibia.

The Jonker-1X well, located 270 km offshore Namibia, was drilled to a total depth of 6,168 meters in a water depth of 2,210 meters.

In July 2023, Shell concluded drilling Lesedi-1X, its fourth exploration well offshore Namibia and stated that the data gathered so far “confirms the presence of hydrocarbons and further evaluation is required to determine development potential.”

In September 2023, Shell completed drilling of the Cullinan-1X exploration well offshore Namibia, with no discovery made.

In April 2024, Shell concluded drilling Enigma-1X on PEL0039, the company’s sixth exploration well in its campaign offshore Namibia. The company stated that data gathered so far has confirmed the presence of hydrocarbons and that further evaluation is required to determine commercial potential.

KeyFacts Energy: Shell Namibia country profile

Sintana Energy

Sintana holds a carried interest in the PEL 82 (Blocks 2112B/2212A) permit which is located offshore in the Walvis Basin area known as the North West Shelf, one of the most prolific gas provinces in the world.

On March 9th 2022, Sintana completed the acquisition of 49% of Inter Oil resulting in an effective interest to Sintana Energy in PEL 83 of 5% carried interest.

KeyFacts Energy: Sintana Energy Namibia country profile

TotalEnergies

In March 2022, TotalEnergies reported a significant discovery of light oil with associated gas on the Venus prospect, located in block 2913B in the Orange Basin, offshore southern Namibia.

The Venus 1-X well encountered approx. 84 meters of net oil pay in a good quality Lower Cretaceous reservoir.

Block 2913B covers approx. 8,215 sq km in deep offshore Namibia. TotalEnergies is the operator with a 40% working interest, alongside QatarEnergy (30%), Impact Oil and Gas (20%) and NAMCOR (10%).

In January 2024, Impact Oil and Gas signed a farmout agreement with TotalEnergies for the sale of a 9.39% undivided participating interests in Block 2912, Petroleum Exploration Licence 91, and a 10.5% undivided participating interests in Block 2913B, Petroleum Exploration Licence 56.

KeyFacts Energy TotalEnergies Namibia country profile

Tower Resources

Blocks 1910A, 1911 and 1912B cover 23,297 km² of the northern Walvis Basin and Dolphin Graben (offshore Namibia), an under-explored region in which recent drilling results have proven the presence of a working oil-prone petroleum system, along with good quality turbidite and carbonate reservoirs. The new blocks are located directly to the north of licences in which ExxonMobil (‘Exxon’) and Africa Energy Corp (‘Africa Energy’) have acquired interests. In addition, Kosmos Energy have also recently farmed into Shell operated PEL39 in the deep-water Orange Basin.

In August 2024, Tower was notified by the Namibian MME of its agreement to the extension of the Initial Exploration Period of PEL 96 to October 31, 2024 and has invited the Company to apply to enter the First Renewal Period of PEL 96, for a period of 2-3 further years. The MME has also agreed to defer the Company's commitment to acquire 1,000 km² of new 3D seismic data to the First Renewal Period.

KeyFacts Energy: Namibia News Archive

KEYFACT Energy

KEYFACT Energy