Permian Resources has entered into a definitive agreement with Occidental to purchase ~29,500 net acres, ~9,900 net royalty acres and ~15,000 Boe/d predominantly located directly offset the Company’s existing position in Reeves County, Texas for $817.5 million, subject to customary post-closing adjustments. The effective date of the transaction is July 1, 2024, with closing expected to occur by the end of the third quarter of 2024.

“This acquisition is a natural fit for us given its high-return inventory and proximity to our current operated position,” said Will Hickey, Co-CEO of Permian Resources. “As the Delaware Basin’s low-cost leader, we are highly confident that our team will be able to leverage its operational expertise of the asset to significantly reduce costs and drive meaningful synergies, maximizing value for our shareholders.”

“Our overarching goal is to drive value for our investors, and this acquisition of high-quality assets adjacent to our existing position is a perfect example. Consistent with our strategy of pursuing sound M&A opportunities, this bolt-on acquisition adds core inventory which immediately competes for capital and is accretive to key metrics over both the short and long-term,” said James Walter, Co-CEO of Permian Resources. “Furthermore, the substantial midstream infrastructure and surface acres represent material value and will provide us with significant flexibility going forward.”

Financial Benefits

The transaction is attractively valued at approximately 3.4x 2025E EBITDAX1 and 17% free cash flow yield1, assuming a maintenance production profile and $75 per Bbl / $3.00 per MMBtu flat pricing. The acquisition is expected to be accretive to all key per share metrics, including cash flow, free cash flow and net asset value per share. The Company expects the transaction to deliver accretion to free cash flow per share1 of over 5% per year during the next two, five and ten-year periods. This is consistent with the Company’s disciplined acquisition strategy, pursuing transactions which provide significant accretion to all relevant per share metrics over the long-term.

Acquisition Overview

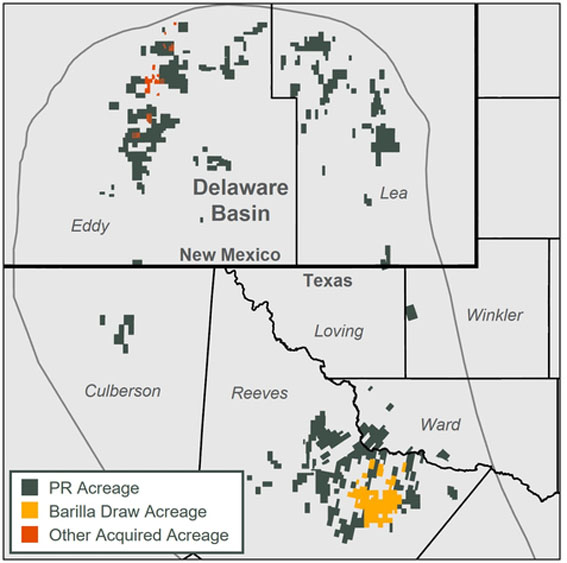

The acquired assets consist of approximately 29,500 net acres and 9,900 net royalty acres primarily located in Reeves County, Texas (27,500 net acres), in addition to Eddy County, New Mexico (2,000 net acres) for a total consideration of $817.5 million. The operated acreage position contains an average working interest of approximately 65% (8/8ths net revenue interest of ~80%) and is contiguous to the Company’s existing positions in both Texas and New Mexico. The acreage has minimal future drilling requirements and is approximately 99% held by production. Additionally, Permian Resources has identified over 200 gross operated, two-mile locations with high NRIs which immediately compete for capital, and Permian Resources expects to begin development on the acquired properties during the fourth quarter of 2024. Total production for the fourth quarter of 2024 is estimated to be approximately 15 MBoe/d (~55% oil).

The acquired assets in Reeves County also include a fully integrated midstream system, supporting superior economics and enhanced flexibility. Infrastructure on the acquired assets includes over 100 miles of operated oil and gas gathering systems and over 10,000 surface acres, in addition to complementary water infrastructure including saltwater disposal wells, a recycling facility, frac ponds and water wells. The midstream gathering infrastructure acquired in the transaction fully accommodates associated volumes, including incremental capacity for future growth or additional third-party volumes. These robust midstream assets and surface acreage provide the Company optionality to either retain to further enhance strong margins or monetize select assets at compelling valuations.

Financing and Liquidity Highlights

The Company intends to fund the acquisition, subject to market conditions and other factors, through proceeds from one or more capital markets transactions. Permian Resources anticipates that the financing of the acquisition will be leverage neutral on a forward looking and pro forma basis, allowing the Company to maintain a strong balance sheet with an expected year-end 2024 pro forma net debt-to-EBITDAX1 ratio of approximately 1x on a last quarter annualized basis, assuming strip prices.

Second Quarter 2024 Update

As of the date of this release, the Company has not finalized its financial and operating results for the second quarter of 2024. Based on preliminary information, Permian Resources estimates its average daily oil production volumes during the second quarter to be between 152.1 and 153.6 MBbls/d and its cash capital expenditures to be between $511 million and $522 million. Additionally, the Company expects its second quarter total controllable cash costs (LOE, GP&T and cash G&A) to be between $7.41 and $7.49 per Boe. The initial estimates of select operational and financial data for the second quarter of 2024 are preliminary estimates and, accordingly, remain subject to change which could be significant.

KeyFacts Energy: Permian Resources United States country profile l KeyFacts Energy: Acquisitions & Mergers news

KEYFACT Energy

KEYFACT Energy