WTI (Apr) $81.04 -22c, Brent (May) $85.34 -8c, Diff -$4.30 +23c

USNG (Apr) $1.66 -15c, UKNG (Apr) 69.99p, TTF (Apr) €28.46 +€2.56

Oil price

Oil was up a bit over $3 last week and is up another 70 cents today, the market are calling it ‘Central bank week’ for a good reason, the BOJ, the Fed, the BoE and the Aussie Central Bank all report, none is expected to reduce rates.

In the Ukraine the extra money from the US has meant that more drones have hit refineries in Russia, Reuters estimate that some 7% of capacity is down. Some better economic data from China has helped and on Friday Baker Hughes reported that overall rigs were up 7 units to 629 and in oil were up 6 at 510.

Chariot

Chariot has announced that following detailed discussions with the Board, management, and advisors, it is undertaking a strategic review of Chariot’s Transitional Power division. Transitional Power focuses on providing sustainable power and water solutions in Africa, which includes renewable energy generation projects and electricity trading.

Since 2020, Chariot has built a transitional energy group spanning natural gas, renewables, and green hydrogen. As these divisions have grown, they have increasingly attracted different pools of capital and Transitional Power, which is now focused on the South African energy market, requires funding in the near and medium term to fulfil its potential. Management has been progressing debt and equity financing options at the subsidiary level and has received indications of potential interest from South Africa focused investors to fund the Transitional Power business. Whilst there is no certainty that a funding package will be concluded, management has elected to undertake this review to explore the options available to the Company, which may involve a full or partial sale or demerger of the Transitional Power business or the division remaining part of the Chariot group, with the aim of the strategic review to maximise value for Chariot’s shareholders.

Chariot’s Green Hydrogen division will remain part of the Group and management continues to progress financing options at the subsidiary level.

Whilst there is no guarantee that this strategic review will result in a transaction, management will continue to consider all options and the Company will provide further updates as required.

Adonis Pouroulis, CEO of Chariot:

“I am very proud of our work across our Transitional Power division and wider business over the past three years. In light of the impending funding requirements needed to deliver projects from the portfolio, we believe that launching this strategic review is in the best interests of all stakeholders as we look to realise value from this division whilst enabling it to continue its ongoing growth and development.

This review comes at a time of renewed focus on our near-term natural gas development assets in Morocco with the medium-term ambition of returning capital to shareholders from gas revenues.”

This strategic review of the Transitional Power division is a very smart move indeed by Chariot. As the board explores the potential opportunities such as all or part sale or demerger of this business, they are looking to secure funding to ensure its ongoing growth and development, prevent dilution at the parent listed level, and also importantly renew the Company’s focus on its natural gas development portfolio in Morocco.

Indeed the debt and equity options that are being looked at in the power market operations in South Africa, which itself requires funding in both the near and medium term to fulfil its potential, have been ongoing. But whilst the management has been both progressing internal options and assessing potential funding from third party investors at the subsidiary level they have started to look at different options.

With the way that the Transitional Power Business has grown and showed significant potential into the bargain, financing requirements have naturally developed and are increasingly attracting different sources of capital, with notable mention of interest received from South Africa focused investors. With this in mind, it makes sense to look to explore the options around accessing this funding so, I like this strategic review and it should be a massive positive for the company across the board. It spreads the capital risk but allows significant return from the very substantial portfolio in the gas development business and enables the ongoing growth of the transitional power assets.

Corcel

Corcel, the Angolan focused exploration and production company with battery metal interests, announces the results of its initial exploration activities at the Company's 100%-owned Canegrass lithium project, in Western Australia ("WA").

Corcel Executive Chairman, Antoine Karam, commented:

"Intriguing initial results from the Company's recent work at its 100%-owned Canegrass lithium project in Western Australia indicate broader potential for the project than originally anticipated, reflecting historic interest in the area for both nickel and vanadium."

Lithium Exploration Results:

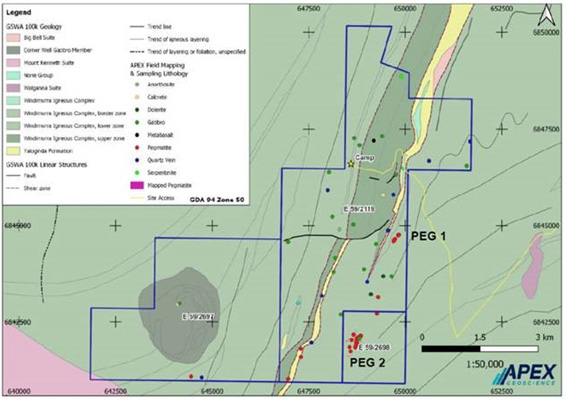

The Company commissioned APEX Geoscience ("APEX") to conduct a rock chip sampling and reconnaissance program at the Company's Canegrass Lithium project in Western Australia. The project consists of three active tenements, E 59/2119, E 59/2697 and E 59/2698, with the Company having lithium rights over all three tenements.

Field work was carried out over a multi-day period in November 2023 and comprised of rock chip sampling of various target lithologies and targeted geological mapping. The goal of the field project was to investigate pegmatite swarms interpreted from satellite imagery and to assess the lithium-bearing pegmatite and magmatic nickel potential of the project.

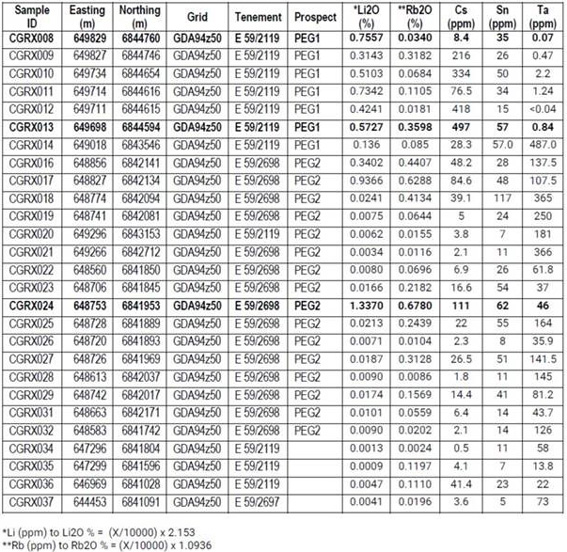

A total of 37 rock chip samples were collected during field work. Sampled lithologies included 26 pegmatite, 5 gabbro-dunite, 5 quartz vein, and 1 calcrete sample. Portable XRF analysis was conducted on the samples using an Olympus Delta, with potassium/rubidium (K/Rb) ratios used to determine the lithium potential of the samples.

The samples were submitted to ALS Global in Perth, WA, and analysed via sodium peroxide fusion digest with ICPMS finish (ALS code ME-MS89L) to return lithium-cesium-tantalum (LCT) pegmatite and mafic-ultramafic intrusion-related elemental suites. The results of the lab assays are provided in Appendix II.

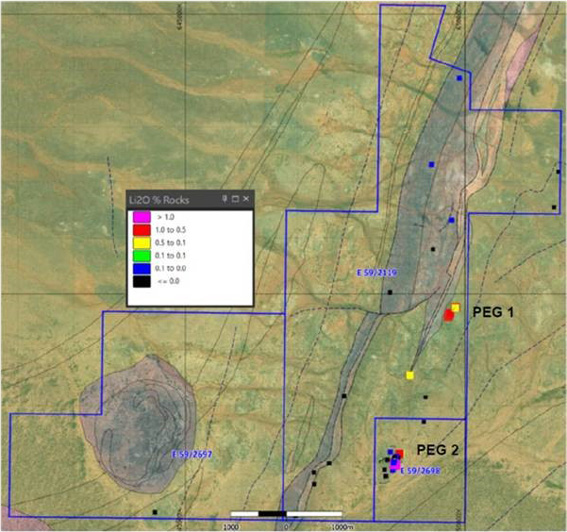

FIGURE II: Pegmatite Sample Locations with LCT Suite Assay Values

During the field program, two separate lithium-bearing mineral pegmatites were observed and sampled in the east-southeast project area, confirming a LCT pegmatite system is present at the project. The two prospects (PEG 1 and PEG 2) share similar mineralogical and structural characteristics, with PEG 2 being larger. Each prospect is positioned ~4.7km and ~2km respectively, north of the Walgoo Monzogranite contact, the likely source granite for the LCT pegmatite system. Lepidolite was the primary lithium-bearing mineral observed with lepidolite abundances varied across the swarms, with the highest sample grading 1.34% Li2O. Visual observations currently suggest no spodumene mineralisation present at the project.

FIGURE III: Li2O % in Rock Chip Samples

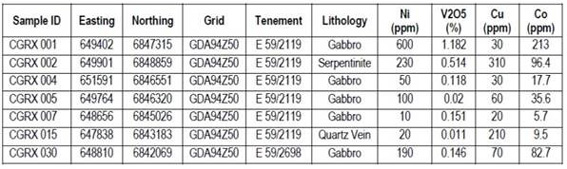

Nickel and Vanadium Potential:

The Shephards Discordant Zone (SDZ), which runs the length of tenement E 59/2119 from north-south, represents a significant break in the igneous stratigraphy of the Windumurra Igneous Complex. This unit, associated with large vanadium deposits (in magnetite-bearing gabbros) at the Atlantic Vanadium Pty Ltd's Windimurra Vanadium Mine to the north, offers very prospective ground for magmatic vanadium and nickel (+/- Cu-Co-PGE) type mineralisation on the Project. Samples CGRX001 and CGRX002 were collected from the upper zone of the Windimurra Igneous Complex in the northern portion of the Project and returned assay values of 600 ppm Ni and 1.18% V2O5 and 230 ppm Ni and 0.51% V2O5, respectively. Notable nickel and vanadium results are presented in Appendix IV.

FIGURE IV: Rock Chip Samples Notable Ni and V2O5 Assay Values

KEYFACT Energy

KEYFACT Energy