Robert Chambers

In this article focusing on Indonesia, Robert Chambers takes a look at the upstream company landscape, starting with a quick review of the M&A deals in 2023 and then going through the companies that are currently involved, with the focus being on the international investors.

23 M&A summary

The early-part of the year saw little in terms of M&A, with the first deal only coming in June. We then was the two "big" deals announced at July's IPA conference. The table below summarizes the M&A deals announced in Indonesia in 2023.

Indonesia - Announced M&A deals - 2023

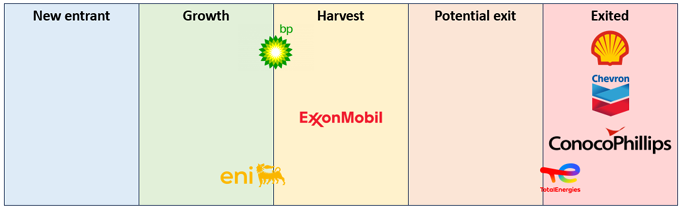

International companies - The majors

We saw some significant upstream exits from the majors this year, with both Shell and Chevron divesting their remaining upstream assets. However, I believe we have now reached a point where we are unlikely to see further upstream exits from the majors, with the remaining players having both anchor projects and a willingness to continue to invest.

Those remaining (and likely to remain) are:

- BP: have a clear reason to remain in Indonesia as operator of the Tangguh LNG project where the third train was brought onstream this year (after a number of delays). The approval and progress towards FID of further upstream and CCS developments at the asset continue to show good momentum. On the growth side, they have a stake in the Andaman II PSC as well as picking up the Agung I and Agung II exploration blocks.

- ExxonMobil: they had been looking risky given that their only upstream asset is the Cepu PSC. However, this is a great asset and there has been a lot of positive news this year regarding their investment in Indonesia, even if the current focus looks to be CCUS and downstream.

- Eni: are very focussed on the Kutei basin and have (finally) added the Rapak and Ganal PSCs this year, as well as exploration success in the basin with the Geng North well. I expect to see continued investment in the basin with a focus on maintaining production through Jangkrik and developing Geng North. However, I'm not sure they will look at other basins.

The recent exits from the upstream space in Indonesia are ConocoPhillips (exit in 2021), Shell (2023), and Chevron (2023). In addition, TotalEnergies (2017/2018) are as good as gone (they just have a lingering 13.5% interest in the Sebuku PSC). I see it as very unlikely that any of the companies would re-enter.

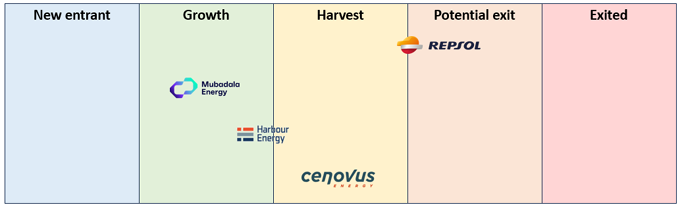

International companies - Mid-caps

The lack of mid-caps seems to be a global issues for the upstream industry, with the industry polarized, leaving our traditional explorers with a limited buyer pool. This trend applies to Indonesia too and, whilst there are mid-caps present, they seem to have a limited view to growth.

- Repsol: have divested from the rest of Southeast Asia but have held onto Indonesia. This year saw them relinquish their interest in the Andaman III PSC after the Rencong-1 well came up dry in 2022. There major interests are now the producing Corridor PSC and the potential development of the Kaliberau Dalam field in the Sakakemang PSC, targeted to be onstream by 2028. December saw the approval of the Corridor PSC being switched from gross split terms to cost recovery, which should improve the value and now might be the right time to exit. MedcoEnergi are still the obvious buyer.

- Mubadala Energy: a company that seems to have had a second wind in Indonesia. They have very limited remaining production (Ruby field / Sebuku PSC) but they have a major stake in three Andaman PSCs (Andaman I / Andaman II / South Andaman). The two big exploration successes in these blocks gives them a big reason to stay, although they may look to farm-down their interest in the two PSCs in which they hold 80% once they have firmed-up the resource.

- Harbour Energy: they have had a busy end to 2023, with the acquisition of Wintershall DEA (no assets in Southeast Asia). This brings with it a global portfolio which may change their view on Indonesia but I expect any rationalization to come later. For Indonesia, legacy production comes from the Natuna Sea Block A PSC but the portfolio now looks nicely balanced with the Tuna PSC awaiting development and the Andaman PSCs starting to prove-up nicely. Hopefully we will see Zarubezhneft divest their interest in the Tuna PSC, so Harbour can move towards FID.

- Cenovus (Husky): following the merger of Husky and Cenovus, I was expecting Indonesia to be considered for divestment. However, they continue to progress developments at their Madura Strait PSC, with an FLNG development now being proposed. They last took new exploration acreage in the 1st 2021 bid round with the Liman PSC.

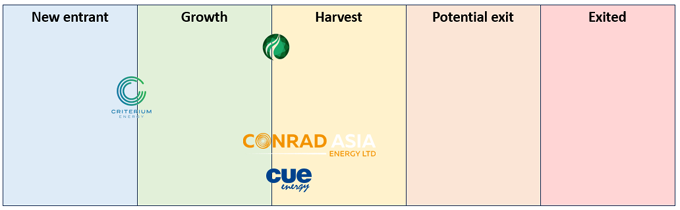

International companies - Smaller players

There have been many smaller international investors in Indonesia. However, I will put my focus on those with a more international investor base.

- Jadestone Energy: are progressing nicely with the development of their Akatara gas field in the Lemang PSC, with first gas expected in April 2024. This will bring some much needed cashflow and, together with no further issues with their Montara field in Australia could see them set for a strong 2024. If funding allows, they could look at further acquisitions in Indonesia.

- Criterium Energy: were a new entrant to Indonesia in 2022, and have continued to invest in Indonesia this year with the acquisition of Mont D'Or, where there could be decent upside potential. In addition, they recently turned a nice profit on their 2022 acquisition of the Bulu PSC (Lengo). They and seem to have an appetite for further investments and I would imagine Indonesia is high up their list.

- Conrad Asia Energy: after a big 2022, this year has proved more challenging for Conrad. They had been hoping to take FID on their Mako gas field developments but this seems to have hit some hurdles around the GSA and third-party pipeline access. I hope things turn around for them in 2024.

- Cue Energy (NZOG subsidiary): legacy production from the Sampang PSC has been added to through bringing the PB oil field onstream in the Mahato PSC. Indonesia now contributes over 50% of their production and revenue, so they could look to expand here. It might seem strange to say it, but it could easily be argued that Indonesia provides the most investor friendly environment for upstream growth within their current portfolio, given their other countries of operation are New Zealand & Australia.

There are many more smaller companies that I am keeping an eye on, particularly those that could pick up undeveloped discoveries and bring them across the line and will be very interested to see who has agreed to acquire Criterium's Bulu stake.

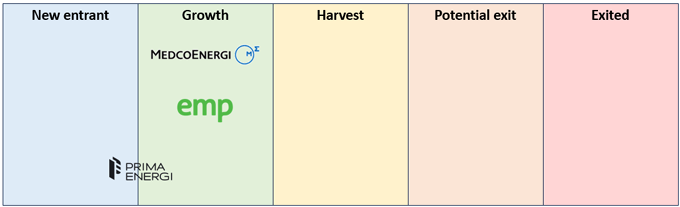

Domestic companies

There is a very long list of domestic companies. I will just mention the two largest here, together with a new entrant that could also be labelled a small international company.

- MedcoEnergi: the last few years has seen plenty of ambition and a healthy appetite for acquisitions. More recently, it has been a bit quieter, with a couple of divestments (Thailand / Vietnam) and no acquisitions. However, I still see them as an active buyer and they may well end up picking up one (or both) portions of SapuraOMV in Malaysia. I see them continuing to grow and will be linked with asset sales, both at home and in the region.

- EMP: are the other larger Indonesian company that have picked up a number of PSCs. I could see them taking more trimmings from Pertamina's domestic portfolio.

- Prima Energi: have quietly appeared, with the initial award of the Bawean PSC in 2022. This year saw them acquire 100% interest in the Northwest Natuna PSC that contains the undeveloped Ande Ande Lumut heavy oil field. The field has some development challenges but, with some tweaks to the fiscal terms and development plans, there should be a way to make it economic, given the 80 MMboe resource size.

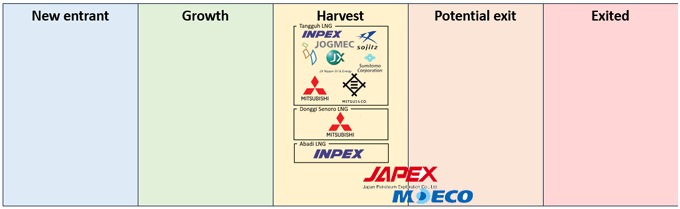

Japanese companies

Japan has a long history with oil and gas in Indonesia but this has significantly shrunk over the last decade. The majority of the remaining interest is in the LNG export projects but some smaller holdings are also maintained.

The LNG projects with Japanese company interest in the projects are:

- Tangguh LNG: a number of Japanese companies have an interest across the three unitised PSCS including: JOGMEC, JX Nippon, Mitsui, Mitsubishi, INPEX, Sojitz, and Sumitomo. I don't see any changes likely here.

- Donggi Senoro LNG: Japanese interest here is held by Mitsubishi, with an interest in both the LNG plant and the Senoro-Toili JOA. I don't see any changes likely here.

- Bontang LNG: there is no direct interest in the project since INPEX lost the Mahakam Offshore PSC. However, INPEX still hold a small stake in the Sebuku PSC (Ruby field) that provides some limited feedstock but I doubt we will see any change prior to the expiry of the PSC in 2027.

- Abadi LNG: INPEX hold a 65% operated stake. With the project finally progressing, they could consider a farm-down of minor stakes to Japanese off-takers. Alternatively, could we see a larger stake sold to a new project partner?

On the farm-in side, Japanese companies may show an interest in the Andaman PSCs if the volumes lead to an LNG export development.

Outside of the LNG projects, we generally see shrinking interest. This year, we saw Mitsui exit from the Northwest Natuna PSC (AAL), adding to their 2022 exit from the Bulu PSC (Lengo). The limited remaining interest in non-LNG assets are:

- JAPEX: hold a 25% stake in the Kangean PSC.

- MOECO: hold a 10% stake in the Sakakemang PSC (KBD).

Both of these could be targeted for divestment.

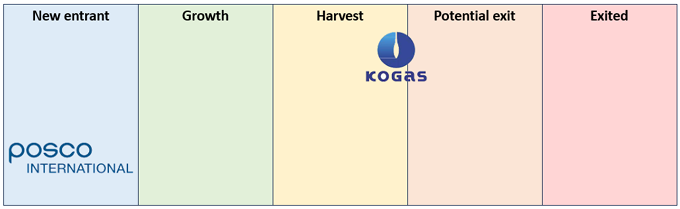

Korean companies

Korean companies have a shorter history within Indonesia but, again, the gas-to-LNG projects are the focus due to their offtake agreements.

There is only one gas-to-LNG project with a direct Korean company interest.

- Donggi Senoro LNG: Korean interest here is held by KOGAS, with an interest in both the LNG plant and the Senoro-Toili JOA. KOGAS is also an off-taker, with a contract for 0.7 mtpa of LNG. However, we have seen a price dispute surrounding the mid-term contract price paid by KOGAS which did not go in their favour. As a result, they have stated they will cut their exposure to the project, although it is not clear exactly what is meant by this (it could just be the offtake contract).

The only other Korean presence in Indonesia's upstream came from the 2nd bid round of 2022.

- POSCO International: signed the Bunga PSC in July 2023 (offered in 2022).

The regional NOCs

Southeast Asia has seen the regional NOCs take an increasingly important regional role outside of their home countries.

For Indonesia, PETRONAS is the main regional NOC with a significant stake holding, whilst PTTEP is stuck waiting on the sidelines.

- PETRONAS: have shown a big commitment in taking a 15% stake in Abadi which adds to a number of PSCs they already have an interesting in. They have continued to invest and are progressing their Hidayah discovery, in the North Madura II PSC, towards FID.

- PTTEP: they have held an interest in the Natuna Sea Block “A” PSC since 2013 but would like to grow in Indonesia. However, there are continuing legal issues relating to the 2009 oil spill at the Montara field (in Australia, but impacted Indonesia). They will be unable to invest further until these issues are fully resolved.

Questions and feedback

I have created this article through my own research. If you have any questions or feedback on the article then please drop me a DM.

KEYFACT Energy

KEYFACT Energy