2023 was an active year on the Norwegian shelf. 92 fields were in operation at year-end, 27 projects were under development and many exploration wells were drilled.

Production was somewhat lower in 2023 than was expected a year ago. This is largely due to unplanned and extended maintenance shutdowns at multiple onshore facilities and fields.

The consequences for gas production were greatest during the summer months, when demand was lower. Production resumed full force starting from early autumn, with November and December being particularly good months for gas export.

Preliminary figures for December indicate a new export record for a single month, with just under 12 billion standard cubic metres gas.

The high activity level seen in 2023 will continue through 2024.

The Norwegian shelf will continue to play an extremely important role for energy security in Europe for many years to come.

Many investment decisions were made in 2022 for projects that were approved by the authorities last year. 27 projects are currently under development, contributing to robust activity in the supplier industry.

This shows that the temporary tax regime change adopted in 2020 has had a very positive effect for the Norwegian supplier industry.

As a consequence of high development activity, oil and gas production is expected to remain stable for the next few years. Over the short term, the new fields coming on stream will offset lower production from ageing fields.

Compared with forecasts presented in The Shelf last year, we see a relatively large increase in investments for 2023 and 2024.

This is a result of factors such as high activity levels in the industry, a weaker Norwegian currency and cost growth. Certain projects have accelerated investments and several fields have gained extended lifetimes and must therefore invest in upgrades.

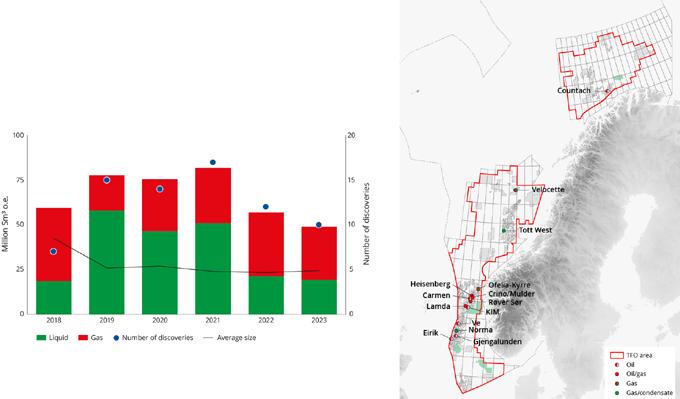

34 exploration wells were spudded in 2023. 23 of these were wildcat wells, where 14 discoveries were made.

It’s important that exploration be conducted around existing infrastructure so discoveries can be tied back and create value while the fields are still in operation.

Nevertheless, the Norwegian Offshore Directorate would like to see companies exploring actively in more frontier areas. In order to realise more of the resource potential, companies must to a greater degree commit to testing new ideas in frontier areas.

There is still significant interest in the annual awards in predefined areas (APA). 25 companies applied for new acreage in APA 2023.

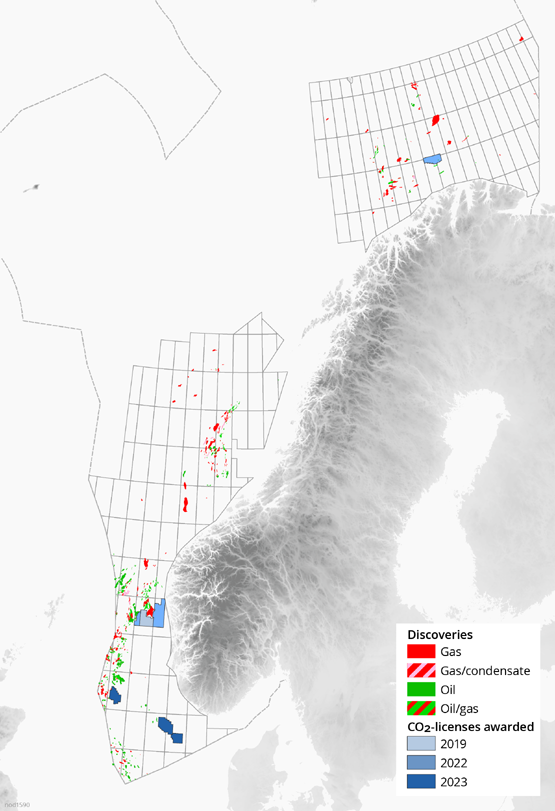

Interest in storing CO2 on the Norwegian shelf continues to increase. Based on its own work, the Directorate has previously demonstrated a considerable potential for safe storage of CO2 on the Norwegian continental shelf.

Six exploration licences have been awarded since 2020. These will now be explored and several companies are now looking at projects aimed at establishing value chains for capturing CO2, transport from Europe and storage on the Norwegian shelf.

It will be important for the Norwegian Offshore Directorate to facilitate the award of more exploration licences where CO2 can be stored, in sound coexistence with petroleum activities and other offshore industries.

On 9 January, the Storting (Norwegian parliament) endorsed the Government’s proposal to open parts of the Norwegian continental shelf for mineral activity. A final resolution will be made in the form of a Royal Decree.

This means that commercial players can now contribute to clarify the existence of commercially attractive mineral resources, and whether such resources can be recovered in a sustainable manner.

A process will now be initiated to announce and award licences pursuant to the Seabed Minerals Act.

At the same time, it will be important to continue the Norwegian state’s work to map resources and the environment.

Facts and figures

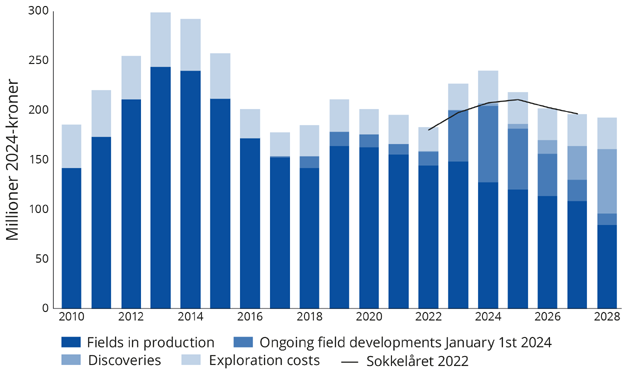

Investments

Significant activity in the industry, a weakened Norwegian currency and growth in costs have resulted in higher projected costs and investments for 2023 and 2024 in particular, compared with what was presented in The Shelf in 2022. Projected investments have also changed for ongoing developments. Several fields report extended lifetimes, which will require increased investments to maintain the facilities' technical integrity. An expectation of increased exploration activity moving forward contributes to growth in exploration investments from 2024.

New investment decisions will be necessary to maintain activity leading up to 2030.

Exploration

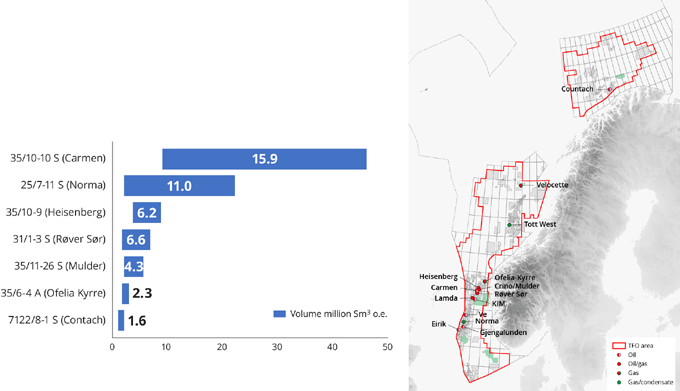

34 exploration wells were spudded in 2023, which is on par with recent years. 14 discoveries were made; 11 in the North Sea, two in the Norwegian Sea and one in the Barents Sea. The largest discovery is 35/10-10 S (Carmen) in production licence 1148. This discovery may contain between 9 and 46 million standard cubic metres (Sm3) of oil. The resource growth from discoveries made in 2023 is about 50 million standard cubic metres of oil equivalent (Sm3 o.e.).

Exploration results

Discovery rate

Awards in pre-defined areas (APA)

In January 2023, 25 companies were offered ownership interests in a total of 47 production licences in pre-defined areas (APA) 2022.

When the application deadline for APA 2023 expired on 23 August 2023, the authorities had received applications from 25 companies. Offers of ownership interests in new production licences are expected to be made early this year.

Geophysical and scientific surveys

99 commercial geophysical surveys were conducted on the Norwegian shelf in 2023. Eight reported surveys were cancelled.

Six geophysical surveys were conducted in the Barents Sea, three of which were drilling site surveys, two subsurface surveys and one ordinary seismic survey.

19 geophysical surveys were conducted in the Norwegian Sea, 13 of which were drilling site surveys, two subsurface surveys and four ordinary seismic surveys.

74 geophysical surveys were conducted in the North Sea. 68 of these took place under the petroleum regulations, while six took place under the CCS regulations. 38 were drilling site surveys, 15 were subsurface surveys, 16 were seabed seismic surveys and five were ordinary seismic surveys.

33 scientific survey licences were issued, 16 of which to Norwegian institutions.

At year-end 2023-2024, there were 92 fields in operation on the Norwegian shelf. Atla, Flyndre, Heimdal, Skirne and Vale shut down over the course of last year, while Bauge, Breidablikk, Fenja and Tommeliten A came on stream.

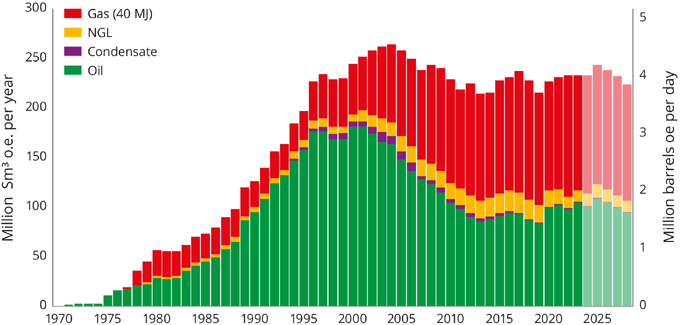

Production remains at a high level and will peak in 2025. Johan Castberg is expected to come on stream toward the end of 2024, which will yield significant production growth for 2025.

Oil and gas production is expected to remain stable over the next few years as a result of robust development activity on the shelf. Without new fields or major investments in existing fields, production from the Norwegian shelf will decline. Over the short term, the new fields that come on stream will offset lower production from ageing fields.

A total of approx. 233 million Sm³ of o.e. was produced in 2023 – the equivalent of about four million barrels of o.e. per day, which is around the same level as in 2022 .

Gas pro duction in 2023 came to a somewhat lower level than we expected one year ago. This is primarily caused by unplanned and extended maintenance shutdowns at several onshore facilities and fields. Another part of the explanation is delayed well deliveries and multiple wells not yielding the anticipated production.

The Norwegian Offshore Directorate publishes preliminary production figures on a monthly basis.

The new Regulations relating to fiscal measurement in the petroleum activities (Measurement Regulations) entered into force in May 2023. It replaces Regulation No. 1234 of 1 November 2001 relating to measurement of petroleum for fiscal purposes and for calculation of CO2 tax.

Consent to commencement and continuation

Consent to commencement and continuation for facilities is governed by Section 30a of the Petroleum Regulations. The consent system was delegated to the Norwegian Petroleum Directorate by the Ministry of Petroleum and Energy (now the Norwegian Offshore Directorate and the Ministry of Energy) via a letter of 27 November 2006.

Projects/developments

15/5-2 Eirin was the only plan for development and operation (PDO) submitted in 2023 following the wave of PDOs in 2022. 15/5-2 Eirin is a subsea development in the central part of the North Sea. Resources in 15/5-2 Eirin are estimated at 4.5 million Sm3 of o.e.

The authorities received two applications for PDO exemptions in 2023, for the Brage Cook project on the Brage field and Solan and Ludvig on the Gullfaks Sør field. Both are slated to be developed with wells from existing infrastructure, and both are located in the northern part of the North Sea. Resources in the two projects are estimated at 0.1 and 0.3 million Sm3 of o.e., respectively.

In 2022, the authorities received plans for 13 new developments (PDOs) as well as several plans for projects to improve recovery near existing fields or to secure extended lifetimes. Major investment decisions were also made on existing fields. These plans were approved in 2023.

Carbon capture and storage (CCS)

Three licences were issued in 2023 pursuant to the Regulations relating to exploitation of subsea reservoirs on the continental shelf for storage of CO2 and relating to transportation of CO2 on the continental shelf. A total of seven licences have been awarded; one exploitation licence and six exploration licences.

Twelve companies are licensees in these licences, nine of which also carry out petroleum activities.

Seabed minerals

The Seabed Minerals Act entered into force on 1 July 2019. This law facilitates exploration for and extraction of mineral deposits on the Norwegian shelf.

The Storting (parliament) is scheduled to make a decision on opening for mineral activities on the Norwegian shelf in early January 2024.

The administrative responsibility for seabed minerals on the Norwegian shelf is assigned to the Ministry of Energy (MoE). The Norwegian Offshore Directorate has assisted the Ministry in conducting the impact assessment and coordinating the academic study efforts.

The Norwegian Petroleum Directorate, now the Norwegian Offshore Directorate, has prepared a resource assessment for the seabed minerals on the Norwegian shelf. The report, which was submitted in January 2023, concludes that there are substantial resources in place.

The Norwegian Petroleum Directorate has been gathering data in deepwater areas in the Norwegian Sea and Greenland Sea along with the University of Bergen and University of Tromsø since 2011. We have also organised several of our own expeditions since 2018.

In 2023, we carried out one expedition on our own, where we mapped areas along the southern part of the Knipovich Ridge in the northern part of the Norwegian Sea with an autonomous underwater vehicle (AUV). We also participated in a joint expedition with the University of Bergen, where we mapped parts of the same area with a remotely operated vehicle (ROV).

In addition, we participated in a joint expedition with the University of Tromsø, where multiple seismic lines were collected over a sulphide deposit on the Knipovich Ridge.

The Storting's potential resolution to open areas for seabed minerals will mean that the licensing authorities will initiate a process to announce and award permits pursuant to the Seabed Minerals Act.

At the same time, we expect the mapping of seabed minerals to continue, which will take place in parallel with potential commercial players. The authorities want a stepwise development and a cautionary approach to the activity, and additional knowledge will be acquired as regards natural and environmental factors.

Offshore wind

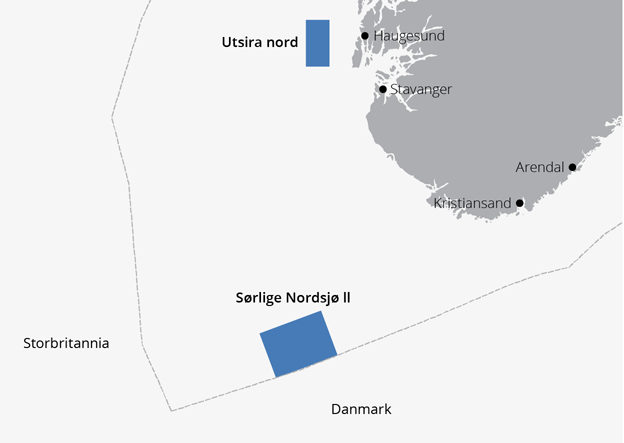

In 2022, the Norwegian Petroleum Directorate was tasked with conducting subsurface surveys in the Utsira Nord and Sørlige Nordsjø II areas, which have been opened for applications for renewable energy generation. The objective is to find the most suitable locations for placing wind turbines.

Seven different measurements are carried out: MBES (multibeam echo sounders) provides key datasets for bathymetry, acoustic backscatter and water column data. We also collect 2D high resolution seismic, sub-bottom profiler (SBP), side scan sonar (SSS), as well as magnetometer data.

The subsurface surveys are set to continue in 2024.

The Norwegian Offshore Directorate has started a process to make this data available to the industry.

We have conducted subsurface surveys in the areas of Utsira Nord and Sørlige Nordsjø II.

In 2023, a broadly composed group established by the Directorate identified 20 areas on the Norwegian shelf that could be technically suitable for further development of offshore wind, and where the activity is expected to be suitable for coexistence with other industries.

The NPD has provided technical contributions in this process, which has been spearheaded by the Norwegian Water Resources and Energy Directorate (NVE).

Data management

The Norwegian Offshore Directorate is responsible for collecting, storing and publishing data from the Norwegian shelf.

In 2023, the consultancy Menon Economics assessed the gains derived from the Norwegian Petroleum Directorate's data sharing activities, and concluded that the data sharing contributes to annual gains in time and resources saved for licensees in the order of NOK 1.5 billion.

Section 85 of the Petroleum Regulations was amended as of 1 January 2023. These Regulations govern the duration of confidentiality for geological, technical reservoir and production/injection aspects in reports or other materials submitted to the public authorities.

The duration of confidentiality for interpreted data has been shortened from 20 to 5 years (this will apply in full as of 2028). Interpreted data from relinquished areas/licences can be released after one year. This change has resulted in about 6000 data sets being released in 2023. The vast majority of this data is available in Diskos.

Diskos 2.0 was launched in April 2023. Diskos is the national data repository for exploration and production-related information from the Norwegian shelf. All seismic, well and production data reported to the Norwegian Petroleum Directorate is uploaded to Diskos.

Diskos is now in the cloud. Several automated processes and API integration allow for new opportunities and ways to use Diskos data.

Technology

Our technology strategy places particular emphasis on technology areas we believe will be crucial for the Norwegian shelf moving forward. It also deals with measures to be implemented.

Our primary focus is on technologies that can contribute to discovering more, producing more and reducing emissions, and that licensees in the production licences make them a high priority. We believe we can see the impact of our initiatives in three distinct areas; electrical subsea systems, a pilot for injecting low salinity water, and we're generally seeing more companies focusing on potentials in tight formations.

This strategy was the basis for the topics at the NPD's 2023 Technology Day, which was primarily aimed at companies engaged in activities associated with oil and gas on the Norwegian shelf. The 2024 Technology Day will be held in June.

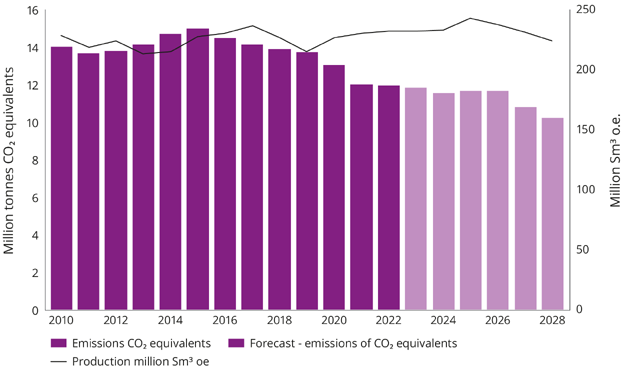

Emissions

Emissions from petroleum activities come from the combustion of natural gas and diesel in turbines, motors and boilers, from safety flaring of natural gas, venting and fugitive emissions of gas, as well as from the storage and loading of crude oil.

Emissions from the sector are expected to decline somewhat per produced unit over the next few years. This is due to the companies' emission-reducing projects, which are mainly transitioning from local power supply to power from shore.

KeyFacts Energy Industry Directory: Norwegian Offshore Directorate

KEYFACT Energy

KEYFACT Energy