- Daniel Gould, the new CEO, is leading the evolution of SDX away from a pure oil & gas business into an integrated, hybrid energy-provider in Morocco - becoming a strategic regional player in the energy transition sector.

- SDX is divesting its Egyptian assets - to focus on growing its Moroccan operations and generate initial funding to support the new strategy.

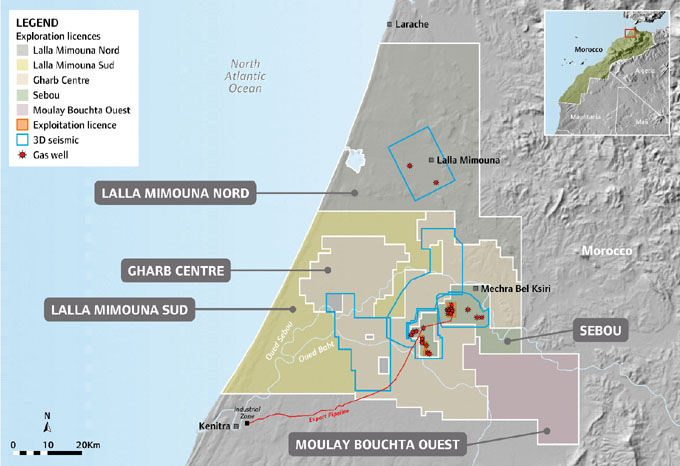

- SDX will maintain its upstream Moroccan gas assets and continue to produce natural gas, selling it to offtakers.

- SDX will operate on the principle of 'doing more with what we have' - with a plan to extend its existing gas transportation infrastructure to enable gas imports from Spain, via the Maghreb-Europe Gas Pipeline - expanding gas supply to Morocco's Kenitra region.

- The Company also intends, in the medium-term, to expand into renewable power generation - leveraging its strong gas offtaker base for a commercially compelling cross-sell of gas and green electricity.

- Delivery of concrete milestones on the Company's strategic roadmap in the coming six months will demonstrate SDX's successful shift into the transition energy sector - creating stable cash-flow, re-rating the Company's valuation and generating value for its shareholders.

Daniel Gould, Chief Executive Officer said:

"Over the last six months, SDX's senior management has been working intensively to reposition the Company, setting the foundation to execute the Company's new strategy. This strategy will help the company to deliver long-term, sustainable value-creation - unlocking new business directions and project opportunities. With the upcoming disposal of Egyptian assets and a series of exciting opportunities in Morocco, SDX has begun repositioning itself corporately and operationally and I am looking forward to steering the Company towards a prosperous future for its shareholders."

SDX's new corporate strategy is to evolve the Company into a vertically-integrated hybrid gas- and renewable-energy producer in Morocco and beyond. The strategy is built on the core principle - 'Doing more with what we have'. The company will look to leverage its 12+ year presence in Morocco, a successful track-record of delivery, a strong gas offtaker client list and a unique gas transportation infrastructure, enabling gas distribution to one of the largest free trade zones in Africa.

SDX's vision for a diversified energy transition business is planned to be realised through a series of complementary and modular projects. These consist of the following 'building blocks':

(A) Expansion of SDX's existing gas transportation infrastructure to connect to the Algeria-Spain gas pipeline ("GME") - once realised this will enable SDX to supply gas from Europe to industrial offtakers in Morocco's Kenitra region;

(B) Generation and cross-selling of renewable energy together with SDX's existing gas offtake contracts; and

(C) Vertical expansion into additional power-generation initiatives, on an opportunistic basis.

These projects may be executed in parallel and independently of each other - taking advantage of the high demand and favourable pricing environment in Morocco for additional gas and green electricity. SDX plans to enter into partnerships with key stakeholders in a number of projects and expects to both expand existing and create new joint ventures.

True to its principle of 'Doing more with what we have', SDX fully intends to continue its upstream activities in Morocco in the immediate future and beyond, planning additional drilling activity in 2024, planned to be funded by way of a prepayment agreement with the Company's largest offtaker.

The strategic plan is designed for the short- and medium-term horizon, covering up to four years - with milestones expected to be reached in the near future.

While the primary focus during this period remains on Morocco, the Company remains open to international expansion as opportunities may arise in the future.

The Company looks forward to sharing further information with stakeholders over a series of webinars and scheduled meetings - details of which will be communicated in due course.

Financing Strategy

The successful execution of the Company's Corporate strategy in the short and medium-term is contingent on the effective divestment of SDX's Egyptian assets and executing on the management's funding strategy. The Board remains confident that it is on track for the Egyptian sale as per the Company's earlier guidance and further announcements will be made once definitive legal documentation has been signed to effect the sale.

KeyFacts Energy: SDX Energy Morocco country profile

KEYFACT Energy

KEYFACT Energy