By Kathryn Porter, Watt-Logic

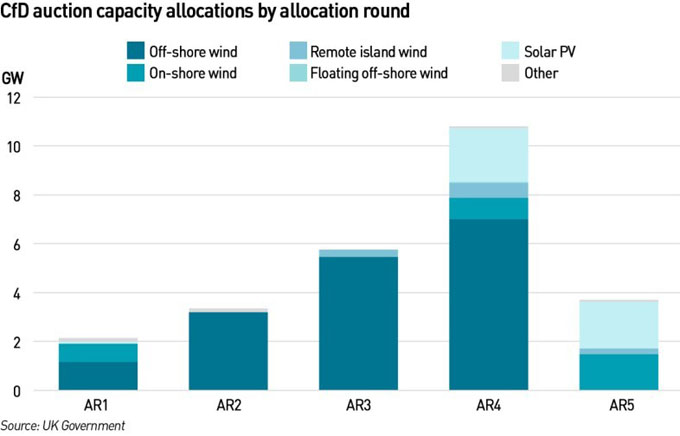

Earlier this month, the UK Government completed its latest subsidy round for renewable electricity generation – the fifth allocation round (“AR5″) for the Contracts for Difference (CfD”) scheme. And it has widely been seen as a failure since no off-shore wind projects bid. At all. Only 3.7 GW of capacity secured contracts, compared with 10.7 GW last year. This follows the disappointment from AR4 when only two of the off-shore wind projects in that auction went on to take FID (final investment decision) and proceed to construction. The remainder have either been cancelled or are trying to secure enhanced economics in the form of tax breaks, to make them viable.

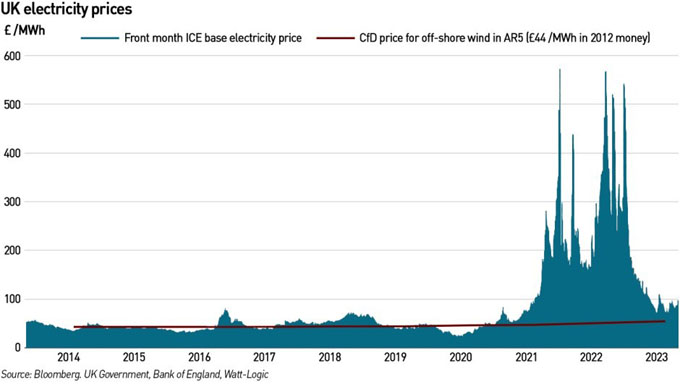

The strike price cap for off-shore wind for AR5 was set at £44 /MWh in 2012 prices, which is equivalent to around £60 /MWh today.

They question is, why has this happened?

The Government continues to see the Contracts for Difference (“CfD”) as a subsidy, introduced to support immature renewable technologies until costs fall and they are able to be built on the same basis as other forms of generation. On this rationale, the support level would decline over time until eventually the subsidy would no longer be required. However, after a quarter of a century of subsidies, this rationale no longer holds water: wind turbines are not an immature technology whose costs can be expected to fall based on some “learning” effects.

The reason that developers continue to require support is not because the technology is uncompetitive due to immaturity, but because no investors are willing to fund merchant power projects in GB, and there is simply no other way to lay off risk in the GB power market. Since developers see the CfD as a hedge and not a subsidy, they do not expect the support level to gradually fall to zero over time. They expect it to rise and fall in line with supply chain costs and inflation (although the CfD is index-linked so some of this cost variability is already factored in).

It is this fundamental difference in expectations that has caused the failure of AR5 as far as off-shore wind (which has traditionally been the largest participant in the auctions) is concerned.

Industry groups have criticised the Government for not increasing the AR5 support levels, but they have mis-understood the reason for each side acting as they have. The have failed to grasp that the Government is acting rationally based on its assumptions about the purpose of the CfD scheme, ie that it is a subsidy that will eventually not be required.

“Assuming that government officials and ministers did at least hear the warnings from industry, it must be concluded that either they simply didn’t believe that cost increases were as bad as the industry claimed, or they were prepared to see the AR5 auction fail rather than go through a delay and revision process. Timing may also have been a factor; with the move to annual CfDs, they might have also felt they could manage any fall in CfD uptake in AR5 through future auction rounds rather than make immediate changes,”

– Grace Millman, Regen

Of course, the Government’s assumptions are incorrect. After a quarter of a century, the penny should have dropped that the CfD is not a conventional subsidy. In the REMA consultation, there is some realisation of this as the question was asked: how can capital costs be recovered if the price of the item being produced (in this case electricity) is close to zero? If we are to assume that renewable generators receive revenues based on the short-term marginal cost of their product, then capital costs will never be recovered through the sale of electricity.

That, however, is a problem for the future, since electricity costs are no-where near zero at the moment. Yet still, developers are unwilling to either build on a merchant basis (ie without a CfD) and take advantage of the currently high market prices, or to build based on the CfD price being offered under AR5 or even AR4 for the most part. They cite rising supply chain costs, and indeed, costs have risen, but this unwillingness indicates either that windfarms are simply not competitive to build despite their technological maturity, or that there is a wider structural problem in the market deterring investment.

When we look at what other projects are being built, we can see that the issue is the latter: no large-scale power projects have been built in GB in recent years without some form of subsidy, whether this is the Renewables Obligation, the CfD, or a Capacity Market contract, with conventional generation receiving the latter. Of course, conventional generation is not immature, but it now requires support since its utilisation levels have fallen to a degree that irrespective of the power price, they do not generate for enough hours to recover their costs without additional income. The small number of large-scale conventional projects that has been launched in recent years indicates that capacity prices have been too low to sufficiently de-risk projects for investors.

Criticism of the Government has been severe. One industry source was quoted in Utility Week as saying the Government “really needs a kicking”, while others characterised the auction as a “major setback”, a “catastrophic outcome,” an “avoidable yet deeply harmful failure” and the “biggest disaster for clean energy in almost a decade.” The Government has been accused of failing to listen to developers who warned that the price was too low, however, another source said that developers have complained about low strike prices before and auctions have still succeeded:

“One of the problems is that the industry has cried wolf a lot and now we’ve just seen a wolf. I think that is an issue. But actually, the whole point of auctions is that they do establish the truth.”

The truth is that the Government needs to understand that the CfDs are a hedge and not a subsidy. And there is no reason to expect the strike price of a hedge to decline over time. However, if wholesale electricity prices fell to zero, then it would be both a hedge and a subsidy since price support would be required, to provide developers with a source of income, since selling electricity will not generate the returns needed to repay capital costs, and to provide certainty over income to ensure that income is sufficient over the life of the contract to provide an acceptable return on investment.

This means that the Government has to let go of its ambition to taper renewable subsidies to zero over time. And it needs to be honest with consumers that they are going to continue to pay these support costs forever, with the value of the support increasing as wholesale prices fall below the strike prices, something the Government expects will happen as renewable generation replaces conventional generation. Unless it faces up to this new power market reality, its plans for renewable generation, and in particular off-shore wind, will continue to stall.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy