By Kathryn Porter, Watt-Logic

There appear to be some tentative signs of a US nuclear renaissance against a backdrop of growing grid instability as coal and gas power stations are pushed out of the market in favour of wind and solar. In my previous two blogs on the US electricity markets (here and here) I discussed the impact of the Inflation Reduction Act and the challenges to reaching net zero targets arising from the need to upgrade grid infrastructure. I also discussed the premature retirement of conventional generation, which has been causing electricity shortages and increasing blackout risks each summer as air conditioning demand stresses power grids. Despite these concerns, the Environmental Protection Agency has proposed measures that would accelerate these closures, leading grid operators to push back saying that “hope is not an acceptable strategy”.

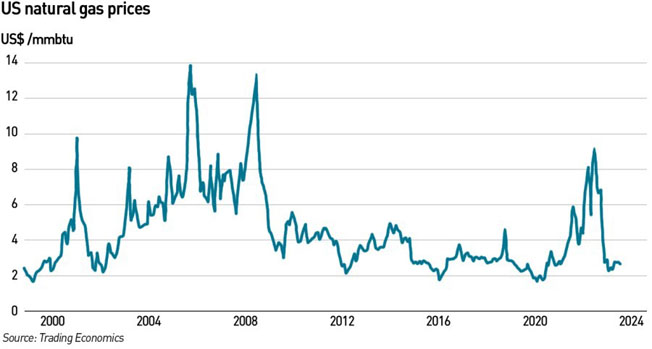

As well as avoiding the obvious pitfalls of closing fossil fuel generation prematurely, the issue of nuclear closures is also on the agenda. In recent years, the mood music in the US has been to close nuclear power stations as part of a wider drive towards clean energy. The economics also pushed in that direction as cheap natural gas made nuclear power relatively more expensive, and the aging fleet was increasingly costly to maintain. But in areas where closures went ahead, carbon emissions have increased (as did unemployment), and with the closure of fossil fuel generation also progressing in response to environmental concerns, electricity grids are increasingly stressed.

This leading to a shift in sentiment, with previously ambivalent policy-makers re-discovering an enthusiasm for nuclear power, something which is reflected in public attitudes, with a recent survey by Pew Research showing that 57% of Americans now favour more nuclear power, up from 43% in 2020. However, with little new-build activity in recent decades, this is a big ask.

Nuclear revival likely to focus on slowing retirements

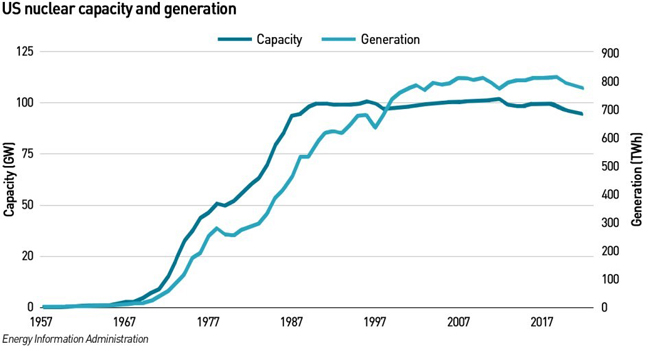

Electricity generation from commercial nuclear reactors in the US began in 1958, peaking at 112 reactors, with just over 100 GW of capacity. By August 2023, there were 93 civil nuclear reactors in operation, with an average age of 42 years. The oldest operating reactor, Nine Mile Point unit 1 in New York, began commercial operations in December 1969, while the newest unit 3 at the Alvin W. Vogtle Electric Generating Plant in Georgia, entered services at the end of July 2023, and is the first reactor to come online since Watts Bar 2 was commissioned in 2016. Twenty-eight states have at least one commercial nuclear reactor. According to the U.S. Nuclear Regulatory Commission, 22 commercial nuclear power reactors at 18 sites are in various stages of de-commissioning.

A dozen US commercial nuclear reactors have closed prematurely in the past decade, ie before their licenses expired, largely due to competition from cheaper natural gas, and major operating losses as a result of low electricity prices and rising costs. These closures have, as in Germany, led to a rise in emissions in those areas, according to the US Department of Energy, and a quarter or more of the fleet is at risk. The owners of seven currently operating reactors have announced plans to retire them between now and 2025 – the fleet is aging and operating costs and the costs of repairs are inevitably rising. Entergy cited low gas prices and increased operating costs as key factors in its decision to close Indian Point last year.

Operators have been assisted in this closure spree by politicians who have tended to position themselves against nuclear as part of wider environmental posturing. However, there are now signs of movement in this standpoint as the risks of an unbalanced transition, as described in my previous post, risks security of supply.

There is also an increased awareness of the environmental impact of nuclear closures. A recent study by researchers at the Massachusetts Institute of Technology (“MIT”) has shown that, were all America’s nuclear power stations to close, air pollution would increase, as coal, gas, and oil would need to increase output to compensate for lost nuclear generation, resulting in an additional 5,200 pollution-related deaths over a single year. More renewable energy would reduce the risk, but not entirely, with increased air pollution still likely in some parts of the country, resulting in 260 more pollution-related deaths over one year. Eastern coastal areas where most nuclear plants are located were particularly affected in the modelling.

“U.S. nuclear power plants contribute more than half of our carbon-free electricity, and President Biden is committed to keeping these plants active to reach our clean energy goals. We’re using every tool available to get this country powered by clean energy by 2035, and that includes prioritising our existing nuclear fleet to allow for continued emissions-free electricity generation and economic stability for the communities leading this important work,”

– Jennifer Granholm, Energy Secretary

The federal government is actively supporting operators in their desire to keep existing plant running. The new Civil Nuclear Credit Program has been created to halt nuclear closures by making US $6 billion in federal money available to help keep then running, describing nuclear energy as “the nation’s largest source of clean energy”. Any owners or operators at risk of closing due to economic factors can apply for funding using sealed bids for an allocation of credits. The scheme is designed not only to promote clean air, but to protect the thousands of jobs that are at risk if more reactors close.

Diablo Canyon is a case in point

The saga of the 2.2 GW Diablo Canyon nuclear power plant in California is an interesting case in point. Four years ago, California regulators approved a proposal to retire the state’s last operating nuclear facility by 2025, when its licences expire (the operating license for the unit 1 expires next year, while for unit 2 it expires in 2025). The plant produces 9% of the state’s electricity.

Then last summer lawmakers scrambled during the final hours of the legislative session to pass Senate Bill 846 to preserve the option to extend the plant’s life to the end of the decade. This reversal, prompted in part by Governor Gavin Newsom, comes amid concerns around grid reliability in California. The bill allows for the reactors lives to be extended through to 31 October 2029 and 31 October 2030 respectively.

“I think the expectation, that a fairly substantial amount of new resources would come online prior to 2024 and 2025, basically does not look like that’s actually in the cards. That’s not to say that progress is not being made on those resources, but certainly [it’s] not being made at a pace that will allow the state to shut the plant down,”

– Jan Smutny-Jones, CEO of the Independent Energy Producers Association

In 2016, Pacific Gas & Electric (“PG&E”), which operates the plant, filed an application to retire its two units in 2024 and 2025. As part of the application, PG&E outlined a plan to replace the plant’s power with three tranches of clean resources, including 2,000 GWh of energy efficiency, 2,000 GWh of carbon-free energy and a 55% renewables commitment. However, the California Public Utilities Commission (“CUPC”) did not approve the plan and the associated US$ 1.3 billion in funding that PG&E had requested, on the basis that it was unclear whether PG&E could actually procure that level of energy efficiency resources.

Instead, the Commission decided to push the question of how to replace Diablo Canyon into its integrated resource planning proceeding. Some experts are sceptical of this approach since Diablo Canyon isn’t the only generating resource that is due to be retired, with 3.7 GW of gas plants set to close. Subsequently, the CPUC approved an 11.5 GW package of clean energy resources to help replace retiring generation, but the delayed generation procurement also meant the transmission expansions necessary were also delayed, and this is stalling delivery. The delivery of renewables also slowed – 4 GW of new renewable generation was expected to come online in the first part of 2022 but only 2.5 GW was actually delivered, in part due to anti-dumping regulations affecting solar panels from Cambodia, Malaysia, Thailand and Vietnam, and the Uyghur Forced Labor Prevention Act, which went into effect at the end of June 2022 which has affected imports from China.

The saga of Diabo Canyon did not end with the signing of Senate Bill 846. Newsom’s decision to support a life extension for the plant shocked environmentalists and anti-nuclear advocates because he had once been a leading voice calling for its closure. Environmental lobby group, Friends of the Earth, sued in the California Superior Court in April, hoping to prevent any change to the closure schedule of the reactors. Their application was denied in late August, on the grounds that the group was asking the court to “impermissibly hinder or interfere” with state regulatory oversight of the plant. Friends of the Earth has said it may appeal the decision.

It isn’t certain that the plant will remain open. It was built in the 1960s, and the costs of the proposed life extensions have not been made public, and may yet be determined to be too expensive. However, blackouts are also expensive so it may come down to how much the state is willing to contribute to the costs.

Lifetime extensions, new reactors and even the prospect of resurrecting mothballed plant

In addition to exploring the obvious route of lifetime extensions, the recent opening of the first new reactor in years, the APR1000 built at Vogtle in Georgia is providing some hope. Yes, the plant has had a troubled story, with various construction problems and cost over-runs, some of which are the inevitable result of the need to rebuild both supply chains and workforce skills after such a long new-build hiatus. A second new unit is due to open at the site in the coming weeks. The original US$ 14 billion cost of Vogtle units 3 and 4 has more than doubled to US$ 30 billion.

Meanwhile Constellation Energy has announced major upgrades to its Braidwood and Byron nuclear power plants, which involve replacing the main turbines at both facilities with state-of-the-art, high efficiency units which will increase the generating capacity of the plants. The work will be carried out in stages during scheduled re-fuelling outages. Constellation expects to see increased output at the plants as early as 2026, with the full uprated output available by 2029. The company cited the Inflation Reduction Act with is 45 year tax credit for carbon-free electricity as making these investments economic.

“These investments in our world class nuclear fleet will allow us to generate more zero-carbon energy with the same amount of fuel and land, and that’s a win for the economy, the environment and Illinois families and businesses who rely on our clean energy. These projects will help create family-sustaining jobs and are a direct result of state and federal policies that recognise the incredible value of nuclear energy in addressing the climate crisis while keeping our grid secure and reliable,”

– Joe Dominguez, President and CEO at Constellation Energy

Both plants are pressurised water reactors (“PWRs”). Byron’s units began commercial operation in 1985 and 1987, and are currently licensed to operate until 2044 and 2046, while Braidwood’s two PWRs entered commercial operation in July and October 1988. Unit 1 is licensed until 2046, and unit 2 until 2047.

Last October, Constellation also announced plans to extend the operating licences of its Clinton and Dresden nuclear plants, also in Illinois, by an additional 20 years. If approved by the US Nuclear Regulatory Commission, this would enable Clinton’s single boiling water reactor (“BWR”) to run until 2047 and Dresden’s two BWRs to operate until 2049 and 2051.

The intriguing prospect of re-opening closed reactors has also recently been floated. In April 2021, the Indian Point Energy Centre shut down unit 3, its last operating reactor – unit 2, having closed a year earlier. The premature closure of the plant removed 2 GW from the New York power grid, roughly 25% of the region’s power supply. As emissions in the state rose and reliability fell, last year three nuclear and environmental experts proposed restoring Indian Point to operational status. In Michigan, Governor Whitmer is supporting Holtec International in seeking a federal grant to re-open the Palisades nuclear plant (this application was later denied but the state has made funds available).

Re-opening mothballed nuclear reactors comes with a host of technical, regulatory, economic, and political challenges. Nuclear reactors are complex machines, and need to keep operating to stay functional. Shutting down not only disrupts this, it also means the loss of the operators, technicians, and engineers experienced in running the plant. Indian Point is decommissioning under a protocol known as “DECON”, which permits rapid progress. Inside the containment domes, dis-assembly work is moving quickly, and would take years to undo. It’s likely reversing the process would be impossible, however re-opening is more feasible for the Palisades plant in Michigan where de-commissioning is progressing more slowly, meaning the plant could conceivably be brought back into service. The recently passed state budget includes US$ 150 million for re-opening Palisades which closed in May 2022.

While it might be technically possible to re-open the plant, the US Nuclear Regulatory Commission (“NRC”) has yet to establish any specific process for re-opening a closed nuclear power station. When a reactor is powered down for the final time, its fuel rods are removed and transferred to a storage pool. At that point, the owner surrenders the operating license and retains what is known as a “possession-only license.” No power company has yet tried to reverse this step, and the lack of NRC guidance on how an operator might pursue license reinstatement is itself a major hurdle to any company contemplating such a move. Complying with NRC requirements when they are clearly specified is expensive and time-consuming, trying to do so when they don’t exist would be a major barrier for any power company to overcome.

An easier prospect for existing nuclear sites would be to host an entirely new power plant. Existing grid connections can be re-used, and local support is likely to be high so that jobs can be preserved. Some experts are also calling for a change in approach to de-commissioning, to discourage rapid dismantling, particularly when plants close before the time stipulated by their licences. Mark Nelson, managing director of the Radiant Energy Fund consulting group suggests that there should be a five-to-ten-year cold-storage policy for nuclear plants, which would preserve them for potential re-opening should economic operating conditions improve. After the 2011 Fukushima disaster, Japan required all its reactors to shut down all for safety assessments, but operators were required to keep them in a restorable condition. Bringing these mothballed reactors back into service has proved challenging, but they are slowly re-opening. A similar approach could be taken elsewhere.

Regulatory reform is essential if nuclear is to contribute fully

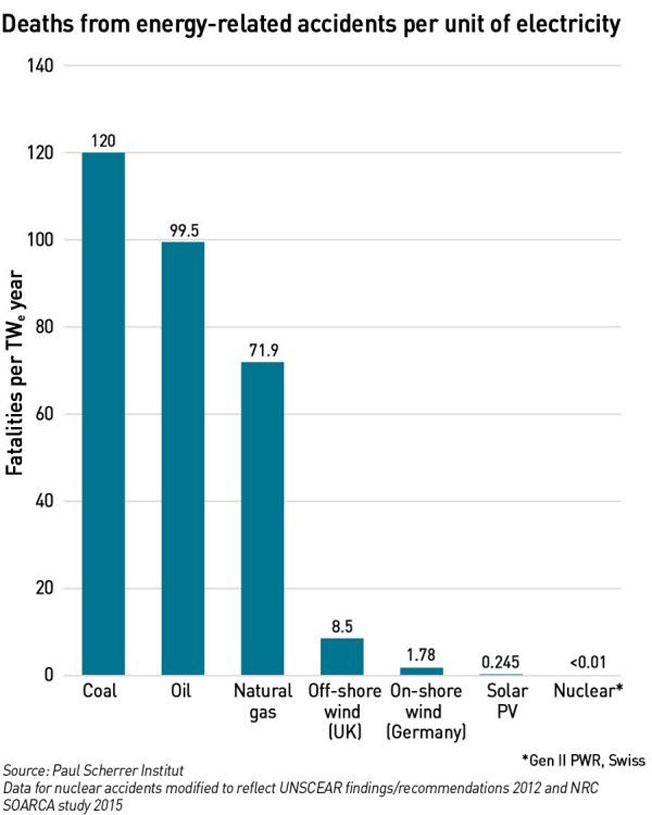

I’m not a huge fan of the APR1000 or its European cousin the EPR, but some of the problems faced by these projects are due to an increased level of conservatism in nuclear regulation in the post-Fukushima era. If nuclear power is to make the desired contribution to de-carbonising energy grids, regulators would do well to re-consider their approach. Nuclear power is one of the safest forms of energy when fatality rates both in terms of construction and operational accidents and local pollution are concerned. The only nuclear accident to result in radiation-related fatalities was Chernobyl, and that was an accident that could have been easily avoided had basic safety protocols been followed. Neither Three Mile Island nor Fukushima saw any deaths that can confidently be attributed to radiation (at Fukushima, the fatalities at the site were a direct result of the earthquake and tsunami ie from falling debris, rather than as a result of radiation).

Of course, nuclear safety is important, but regulations need to be a reasonable and proportionate response to the actual risk factors, and not be based on knee-jerk reactions to events that for the most part were not actually dangerous. On this basis, the closure of Diablo Canyon might actually be sensible since it is located close to a fault line that was not known at the time of its construction. Unfortunately, the US power grid is not unified, and under the current frameworks it is difficult for California to benefit from out-of-state nuclear power.

To give idea of the scale of the regulatory challenge surrounding the licencing of new nuclear technologies, SMR developer NuScale has described the process by which it secured NRC approval saying the process ran from 2008 to 2020, cost half a billion dollars and generated around two million pages of documentation. This is a huge challenge, and it only secures the licence in the United States.

The UK Government recently expressed a desire to collaborate with international nuclear regulators – there is a strong case for the Office for Nuclear Regulation (“ONR”), the UK’s nuclear regulator to leverage the work of trusted country nuclear regulators such as the NRC in order to avoid duplication in the licencing processes. And vice versa. Countries such as Japan, South Korea, the US, France and Britain could easily collaborate on many aspects of nuclear regulation, setting globally acceptable standards and sharing the workload for licencing new technologies. This week nuclear industry leaders delivered exactly this message at the World Nuclear Symposium in London, where they called for “unprecedented collaboration between government, industry leaders and civil society to triple global nuclear capacity to achieve carbon neutrality by 2050”.

It seems that policy-makers and even some environmental lobbyists are experiencing a change of heart around nuclear energy, recognising that without it, reaching net zero goals will be difficult. But there are serious challenges ahead: investment in new nuclear is important, but high capital costs, excessive regulatory barriers, and eroded supply chains and workforces will all make things harder than had nuclear support been more consistent in recent decades. However, it would not be wise to bet against nuclear power, and projects such as Vogtle may well appear prescient in a couple of years when the construction problems are forgotten.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy