WTI (Oct) $86.69 +$1.14, Brent (Nov) $90.04 +$1.04, Diff -$3.35 -10c

USNG (Oct) $2.58 -18c, UKNG (Oct) 82.75p -0.5p, TTF (Oct) €34.0 +€1.01

Oil price

Oil rallied yesterday and again today after Russia by 300/- b/d and the KSA by 1m b/d took their crude off the market but for three months not the one month expected. Comments from Opec said that this was to ‘give visibility’ and is a ‘good signal’ for the market. They added that it should ‘avoid Q1 stock-builds’ and be ‘an easier, simpler and smoother approach to market management’.

Reabold Resources

Last week I was very fortunate to be able to sit down with Steve Williams and Sachin Oza, Joint CEOs of Reabold resources. The meeting had been in the making for at least two months but for various reasons had taken a while to make. The most fortunate aspect of it was that the morning of our meeting saw an announcement from Rathlin Energy which at least added to our conversation on West Newton.

So, I spoke to them about RBD’s key assets across the board. They include a 56% stake in West Newton and the wider West Newton Project area in East Yorkshire, held through a direct licence interest and a stake in Rathlin. Also, of late the move into Italy and a stake in LNEnergy have been the subject of market interest and of course interests in the North Sea, Parta in Romania and Daybreak in the USA.

West Newton has been the subject of much discussion of late, most particularly as shareholders have felt that as operator, Rathlin has not been able to afford to take on what is the key next stage of the development which has shown considerable promise as well as accusations of badly drilled wells and at best poor presentation of future strategy. The recent Rathlin announcement sheds some light on the situation.

As this was going to be my first area for discussion, I think that we were all rather pleased that Rathlin had, by a curious coincidence, issued a regulatory update that very morning which to a large extent answered several of my questions. In the announcement Rathlin say that on 23rd August the Environment Agency issued the variation of the permit for the West Newton A wellsite which was applied for in July 2021. They also added that the permit provides for ‘the production of hydrocarbons’ as well as the drilling of the six additional boreholes and the use of oil-based mud within the Permian age formations at WN A.

This is all good news of course and begs a few questions, not least that the EA permit seems to have taken just over two years to get, no wonder onshore developments are so few and far between if such a time delay is regulation timing. If this is the case then the market should have trusted Rathlin a bit more and not blamed them for not having the cash to go ahead, people I have spoken to though say that the lengthy EA delay was partly contributed to by a variety of reasons. I suspect that the truth of the matter is somewhere in between, the market certainly feels that there has been a marked lack of enthusiasm from the operator.

The other thing to pick up on from the EA report is that the data from West Newton, in particular from the fateful vertical well which to be frank was never expected to flow as it was deemed to be water-damaged, shows that oil-based muds will be needed on the horizontal well. It seems that the analysis by Core Labs, one of the industry’s finest, demonstrated it was a water problem and that it may well have actually flowed with oil-based muds and also other independent agencies say that it is highly commercial with an 86% COS.

The announcement says that the plans for the horizontal well from the West Newton site are underway and well path selection and the engineered well design have been completed, casing has been purchased and drilling rig and other key rig services to determine their availability. Accordingly, ‘commencement of operations are targeted for first half 2024 subject to the approval of the pending EA permit for WN B and rig availability’.

West Newton has exercised investors and partners minds for some time now and there are enough questions on the subject that I am far from convinced that just on the back of one announcement by the operator that all is rosy in the garden means that by next June the drill bit will be spinning. The overriding technical feeling I got from Reabold was that the learning process from the vertical well has been highly encouraging and that immense value is there waiting to be unlocked.

Finally, and by no means least, is the fact that Rathlin as far as I’m aware, is still short of cash and will need to raise significant funds for its share of the drilling programme. My guess is that means a farm-out, and finding an industry partner would be at the top of their list although I would have thought that Reabold and Union Jack are, certainly initially, expecting, maybe hoping to be the last call in this particular placing which may have to include some other, novel structure.

Next stop is Crawberry Hill which when announced by Reabold created a significant amount of, how you say, thought provocation. RBD said that they had a ‘potentially highly significant discovery in Crawberry Hill on the PEDL 183 licence and previously drilled by Rathlin in 2013’. But, the market said, wasn’t that a dry hole when it was announced?

Yes but not now according to Reabold who are claiming this to be in the Zechstein play region, indeed a recent technical review by them suggests play prospectivity in the UK, including the licences acquired through the Simwell transaction and PEDL 183, combining the significant quantity of seismic data, historical wells, core analysis and other proprietary data and analysis assembled by the Company.

Indeed, the Company’s priority now is to develop plans with the aim of making this a drill-ready appraisal opportunity. This could add materially to the already significant resource within PEDL 183 offered from the West Newton trend. The Crawberry Hill-1 well, drilled in 2013, intersected 141m of Kirkham Abbey Formation with good indications of gas shows and porosity. The well was originally drilled to test a deeper target and does not have a full suite of logs over the Kirkham Abbey interval.

So, as RBD sees it, given that ERCE has undertaken a petrophysical analysis of the conventional reservoir of the Kirkham Abbey formation in the Crawberry Hill and Risby-1 wells and interprets average porosities greater than 15% in the top 20m of the Kirkham Abbey formation in Crawberry Hill-1 this is now a real live opportunity. BTW, ERCE also interprets probable gas saturations in the top 6m of the Kirkham Abbey formation in the Crawberry Hill-1 well.

This takes me on to the Risby-1 well which could potentially add to the ‘significant resource’ in PEDL 183, it was drilled in the water leg but ‘good porosity was calculated from the well logs and the potentially very good permeability indicated from well cuttings, which is supported by a drill-stem test in the Kirkham Abbey Formation’.

So, putting all this into context, with all that has been added to the West Newton area, the company has made it absolutely clear that it is going too much to continue with their level of WI in the licence. ‘Given the significant technical analysis that has been completed to date, culminating in the JV partnership agreeing the well path for WN B-2 and the emergence of the Crawberry Hill opportunity, and in line with prudent risk management, Rathlin has decided to reduce its significant working interest position in PEDL 183 with the aim of potentially bringing in an industry partner to participate in drilling on PEDL 183’.

Let’s hope that Rathlin don’t end up needing too much from Reabold in the raise for the well.

Time to think about the investment in LNEnergy which I have been somewhat concerned about since it was announced. Indeed readers will know that I have been highly critical about investing in Italy for many years and with good reason, the pace of progress is almost always between slow and stationary and developments take time and money if they ever happen.

The rest of the market is equally cynical about the deal, it has been provided with very little technical or commercial information about the Colle Santo field which is what LNEnergy has an option to but 90% off. Also it appeared that there hadn’t been enough due diligence, at least the market hadn’t seen any, remember how much trouble Ombrina Mare has caused Rockhopper.

Finally and most importantly this is a low risk development but has not yet been permitted by the authorities in Italy, indeed word was that in a previous life it had been turned down due to local objections. The concerns were valid, there were bound to be significant delays so why not invest when the permit is granted in case of refusal.

The initial questions were fuelled by the shaping of the agreement, an early 3.1% was added to by a multitude of options and cash deals and Reabold upped their stake to 16.2% for an option to buy that interest in the onshore Colle Santo field discovered in 1966.

While still not developed, it is the biggest proven but undeveloped onshore gas development in mainland Western Europe with RPS giving it 65Bcf of gross 2P reserves (RPS estimate, September 2022) and two wells have been drilled with no more drilling being deemed necessary.

RBD say that the project is a low risk, small scale LNG development concept, with first gas targeted for 2025 and what they have already paid to LNEnergy should be enough to bring it to first gas, as and when a permit is granted I imagine. The economics should it go ahead make good reading, apparently Colle Santo has the potential to generate an estimated €11-12m of post-tax free cash flow per annum according to LNEnergy Management estimates, at 9 mmcf/d sales gas and €45/MWh.

The answers to all my questions were relatively straightforward, the subsurface risk is apparently zero and the key to the whole problem is around the European gas market and in particular the Italian Government’s shift in energy policy. Apparently since the war and the reliance on Russian gas they have seen the light and they have made a 180′ turn and with some changes are prepared to back it.

The reason for the original objections were to do with the US oil company Forest Oil who had planned to develop it like a US gas field which was not a runner at the time, apparently this time things are different. The partner nowadays is the local service company Italfluid which is the most important Italian oil service company.

They will lead the process and it will be different from before, they are the biggest local employer and now being an LNG project, a transitional fuel led by a local partner and replacing Russian gas ticks a lot of boxes. This is what makes 2025 a realistic estimate for first gas and why Reabold are convinced that it will get the green light.

Having seen Rathlin make an announcement when I met them, yesterday, as if on cue there was an announcement regarding Colle Santo.

Reabold Resources yesterday provided a further update on developments in the approvals process for the onshore Colle Santo gas field in Abruzzo, Italy.

Following a review with the heads of Environment, Energy, and Mining of the Abruzzo Region, the Abruzzo regional government confirmed its agreement with, and intention to approve, by decree, the Early Production Programme for the Colle Santo gas field, allowing early revenue generation from the Colle Santo project.

The Early Production Programme includes the following:

- Production of gas for a period of 24 months;

- Conversion of gas to power for sale to the electricity grid; and

- Renewal of the Abruzzo Region’s earlier 24-month test approval permit.

It is anticipated that the formal decree from the Abruzzo Region will be provided over the coming months and accordingly, LNEnergy, has entered the operational phase of development at the Colle Santo gas field.

Once on stream, the generation of electricity during the Early Production Programme will be from the use of gas turbines, and the electricity will be tied into a nearby distribution connection point enabling revenue generation. Much of the equipment that is needed for the electricity generation is available locally and can be provided on a rental basis, minimising the capital required.

In addition to providing valuable accelerated cash flow, the Early Production Programme and associated monitoring will facilitate completion of the work required by the VIA Commission for the granting of the full development concession for the Colle Santo gas field.

As announced on 9 May 2023 and 12 June 2023, Reabold acquired a 16.2% equity interest in LNEnergy, whose primary asset is an exclusive option over a 90% interest in the Colle Santo gas field. The Colle Santo gas field is a highly material gas resource with an estimated 65Bcf of 2P reserves[1], with two production wells already drilled and the field is development ready. LNEnergy believes that the field has the potential to generate an estimated €11-12m of post-tax free cash flow per annum.

Stephen Williams, Co-CEO of Reabold, commented:

“We are pleased with the speed and efficiency of the regulatory process in the Abruzzo Region to date and delighted to reach this stage of the Early Production Programme. We can see a clear pathway to generating revenue from gas to power in the near-term, and we believe this news considerably de-risks the granting of the full concession to LNEnergy and the small scale LNG project. Italy needs domestic energy supply to keep prices lower. We look forward to updating shareholders with further progress on the Colle Santo development.”

1 RPS estimate, September 2022

A further announcement will be made as and when appropriate.

So whilst shareholders should be pleased about this and that the Early Production Programme has moved through the Abruzzo Regional Government it still has not yet been approved in its totality although Steve Williams is inordinately confident allowing early revenue generation from the Colle Santo project.

Right now I’m happy to give Reabold the benefit of the doubt which is good of me I know but remember I have been here before. But having sort of solved West Newton and LNEnergy we should have a quick squint at the rest of the portfolio.

And it is a quick squint, there isn’t much to see. Offshore the UK where there are interesting assets in the portfolio they are not for now, the Norther and Central projects don’t fit the bill, at the moment although in a more gentle tax regime they would create value for company and country. The Southern North Sea has P2486 which came with the Simwell acquisition is in the farm-out process and has a drill or drop by July 2024, elsewhereP2396, P2464 and P2493c have been relinquished.

In Romania the Parta licence, 100% owned and where the IMIC-1 well was successfully drilled carries a 20 Bcf contingent resources estimate and whilst the IMIC-2 prospect is live Reabold is still trying to farm it out and is aware of geothermal opportunities in the area. Again, not a geography to stand on one foot waiting for action although management are long term believers in the asset.

Finally in the USA where previous success is now held through a 42% stake in Daybreak Oil % Gas which is OTC traded and creates ‘a value for Reabold’. A modest cash flow producing interest with good if modest growth prospects and is definitely not core.

So, that’s about it, but one should consider the cash situation at Reabold which inevitably means the Shell money which is due in late 2023 unless the FID is earlier and to an extent driven by the Environment Agency and we know what that means.

More realistically I expect Reabold to receive some £5m this year and the rest of the £9.5m on FID, probably next year. RBD have promised £4m of the total as a distribution to shareholders which they will of course honour. They have enough to pay for their share of the West Newton well and whilst the news from Rathlin last week was good they have only just started the ball rolling there.

So, I think that following an interesting few days I certainly have managed to clear my head about the two key assets at Reabold and how they are likely to progress over the next year, say.

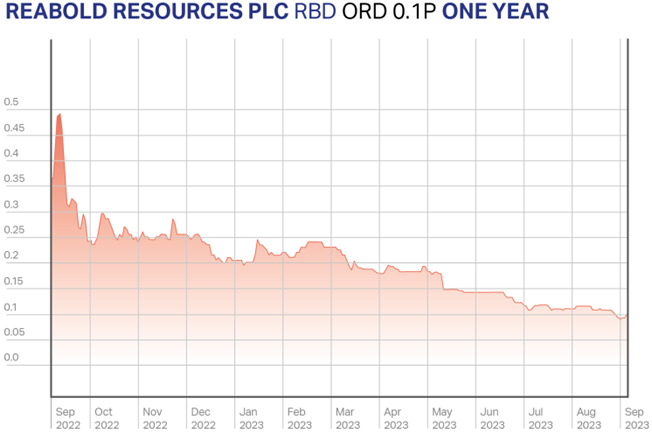

At West Newton the news that Rathlin are finally on the move is very good news, the upside is so huge that getting something done is absolutely vital. I’m still not sure that I would bet that they would either meet the operational deadline set as 1H 2024 or raise the money to pay for it but now the excuses should have virtually expired. If they can’t pay their way I expect either a third party or one or both of the other partners to step in, as I said and in particular for Reabold the chart tells you that they can no longer stand around doing nothing, action is needed.

In Italy whilst the lads were very confident on the prospects and they were highly persuasive that all permits are almost in the bag, they don’t have my historic hang-ups on the country which must be a good thing.

Take a look at the charts and the model is severely stretched, but if you can believe in just a little of the potential from at least one of the stories then the shares really are massively undervalued. Too undervalued to even try to put a Target Price on but if and when the signs are looking backable then there is really big money to be made here, watch this space very carefully indeed.

PS Some market purchases by the board wouldn’t to any harm…

KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy