Highlights:

- Completion of Farm-Out Agreement with RockRose Energy for the divestment of a 60% equity interest in its UK Southern Gas Basin License P2607.

- Submitted Phase I Field Development Plan for the Anning and Somerville gas field developments to the North Sea Transition Authority.

- Completion of the Geophysical Survey covering the Anning and Somerville field developments, all work was successfully completed within budget and without incident.

- Commencement of the pipeline Seabed Geotechnical Survey at the Anning & Somerville Fields, results of the survey will form a critical component of the Environmental Statement and an understanding of the seabed conditions.

- Awarded a contract for a Geotechnical Survey across the Anning and Somerville fields and pipeline locations to Geoquip Marine Operations.

- Announced the issuance of the Invitation to Tender for the Anning and Somerville Southern North Sea gas field production platforms.

- Strong cash position of over $32 million, following $20 million Placement undertaken in the quarter.

PHASE I FIELD DEVELOPMENT – ANNING AND SOMERVILLE GAS FIELDS

Completion of Farm-Out Agreement

In the Reporting Period, Hartshead announced the completion of the Farm-Out Agreement (FOA) with established UK North Sea independent RockRose Energy (RockRose) for a divestment of a 60% equity interest in its UK Southern Gas Basin License P2607 (Farm-out) (Refer ASX Announcement – 5 April 2023).

The Farm-out will provide Hartshead with a total gross consideration of approximately A$196.3 million in value, which includes reimbursement of past costs, a partial carry on HHR’s share of development costs, bonus milestone payments, and $48.4 million of UK government Investment & Capital Allowance.

The completion of the Farm-out is a major milestone for Hartshead, as it materially de-risks the project and provides a clear pathway to the full financing and subsequent development. The transaction implies a significant uplift in value for the project and secures over $536 million of gross project expenditure, which provides both technical and commercial validation of the Company’s gas development.

A Final Investment Decision (FID) for Phase 1, which includes the redevelopment and drilling of the Anning and Somerville fields, is outlined for H2 of 2023. Six production wells are planned and are forecast to come onstream in 2025 at gross peak production rates of 140 mmcfd (net 56 mmcfd to Hartshead, or over 9,000 boepd) (refer ASX announcement 23 June 2022).

Over the quarter the Company advanced discussions with a number of groups relating to further equity divestment or to provide the debt financing to ensure sufficient funding of its remaining share of development costs and the Company has strong confidence in successfully concluding these discussions by year end. The Company is currently working through proposals in order to deliver an optimal solution for shareholders.

Operational Update on UK Southern Gas Basin

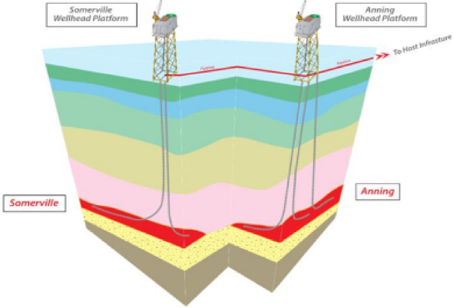

During the Quarter, Hartshead announced that the Company submitted the Field Development Plan (FDP) for the Phase I development of the Anning and Somerville gas fields to the North Sea Transition Authority (NSTA). The Phase 1 development of Anning and Somerville fields will be achieved with a total of 6 production wells. These wells will be produced through two un-manned minimum facilities platforms tied back via a 40km export pipeline to the Shell operated Corvette facility. From there the Anning and Somerville gas production will be transported to the onshore Bacton Gas Terminal via Shell’s Leman system and pipeline.

Other noteworthy operational developments:

- Invitations To Tender (ITTS) for Phase 1 platforms Engineering, Procurement, Installation and Commissioning (EPIC) contracts being finalised for issue.

- The Company has recently issued ITTs for the pipeline route survey for the Phase 1 export pipeline to Corvette.

- Pre qualification process for ITTS for Phase 1 export pipeline EPIC.

- Successful completion of HHR’s first offshore operations – the geophysical and environmental base-line survey of the Anning and Somerville platform locations.

Finally, the Company previously confirmed that it made submission for a number of licences in the UK 33rd Offshore Licensing Round announced by the NSTA in 2022. The results of the licensing round and awards are expected to be announced in H2 of 2023.

Over the period, the Company had a very active period, completing the Farm-out of 60% of the License P2607 to RockRose Energy. In addition the Company completed a major amount of the outstanding work-streams aimed at bringing the project to FID, targeted for Q3 2023. The Phase I development continues to present a highly unique and compelling development opportunity for the Company, with the production of material gas volumes into strong UK gas prices.

Pipeline Seabed Geotechnical Survey Commencement

In the Reporting Period, Hartshead announced that the Company mobilised the Geotechnical Survey across the Anning and Somerville fields and pipeline locations using Geoquip Marine Operations (Geoquip Marine).

The Geoquip Seehorn (Figure 1), an 83 metre Class 2 Dynamic Positioning (DP2) Multi-Disciplined Offshore Survey Vessel, with specialist deep seabed testing and borehole testing capability, will be used for the work program.

The main objectives of the geotechnical survey are to provide the Company with confirmation of the seabed and sub seabed soil conditions to finalize the design and the efficient installation of the offshore facilities and to ensure the safe location of the jack-up drilling rig at the Anning and Somerville locations.

Figure 1: The Geoquip Seehorn DP2 vessel

The survey consisted of the following components:

- One 50m borehole at the jacket centres and one 30m borehole at each jack-up location leg centroid, boreholes will be advanced with a combination of samples and CPTs,

- Onshore / offshore laboratory testing, which shall be performed in accordance with international standards and procedures (i.e. ISO, ASTM, BSI, NS, ISRM, or equivalent).

Field Development Plan Submission During the Quarter, Hartshead announced that the Company has submitted its Phase I FDP for the Anning and Somerville gas field developments to the NSTA, marking a major and material milestone in the Company’s development of its UK Southern Gas Basin assets.

The FDP sets out the development plan, including a detailed description of the subsurface interpretation, planned development wells, production forecasts and facilities, gas transportation route to market, QHSE, and commercial and economic aspects of the development, as the Company progresses towards production.

The development plan consists of six production wells from two wireline capable Normally Unmanned Installation (NUI) platforms at Anning and Somerville. These platforms will then connect subsea to infrastructure for onward transportation and processing for entry into the gas network. The company will now discuss the draft FDP with the NSTA to receive technical feedback and amend for any comments and then commence an audit of the revised project schedules with ERCE before publishing independently audited Phase 1 economics.

Figure 2: Field development schematic

Post receiving technical feedback from the NSTA, the Company will move to finalise project debt funding and take Final Investment Decision for the Phase I development with its joint venture partner RockRose Energy. The development of the Anning and Somerville gas fields will then commence as the Company advances towards First Gas expected in 2025.

Phase I Geotechnical Survey Contract Award

During the Quarter, Hartshead announced that the Company awarded a contract for a Geotechnical Survey across the Anning and Somerville fields and pipeline locations to Geoquip Marine Operations (Geoquip), following a competitive tender for technical and commercial bid evaluation.

The Geoquip Seehorn (Figure 1), an 83 metre Class 2 Dynamic Positioning (DP2) Integrated Geotechnical Survey Vessel, with specialist deep seabed testing as well as borehole drilling, testing and sampling capability, will be used for the work program. The Seehorn was mobilised to the Anning and Somerville field locations in June 2023.

Successful Completion of Hartshead’s First Offshore Operations

In the Reporting Period, Hartshead undertook its first offshore operations via the Geo Ocean III (Figure 1), a 77 metre second generation Dynamic Positioning Multi Disciplined Offshore Survey Vessel, with specialist deep-push Cone Penetration Testing (CPT) and vibrocoring capability.

The main objectives of the geophysical survey were to provide the Company with an interpretation of the seabed geomechanical and engineering conditions at the Anning and Somerville field locations as well as an environmental baseline survey and habitat assessment, as the Company advances towards First Gas.

The survey consisted of the following components:

- A detailed analogue and 2D high resolution survey over a 1,000 metre x 1,000 metre square box centred on the Anning and Somerville jacket locations;

- A 400 metre X 400 metre more detailed analogue survey to inform the exact emplacement of the Anning and Somerville jackets;

- Onshore and offshore laboratory testing of seabed samples taken during the sampling operations. Onshore laboratory testing is still to be completed

The results of the Geophysical Survey will form part of the Environmental Statement which is a key component of the Field Development Plan submission and is also required for the Platform Front-End Engineering Design (FEED) jacket design verification.

Figure 3. The Geo Ocean III with DP2 Dynamic Positioning Capability

Invitation to Tender Issued for Production Platforms

During the Quarter, Hartshead announced the issuance of the Invitation to Tender (ITT) for the Anning and Somerville Southern North Sea gas field production platforms. The ITT has gone out to four major, reputable fabricators with proven track records that pre-qualified through the HHR procurement process and marks a significant step forward in the journey towards first gas from the Company’s UK Southern Gas Basin assets.

The platforms will play a pivotal role in establishing Hartshead as a gas production company, enabling the Company to tap into the establish ed natural gas reserves in the license area and support the UK on its journey towards Net Zero.

The ITT package, containing comprehensive information about the project requirements, technical specifications, bidding procedures and evaluation criteria, requests proposals from the suppliers to provide an Engineering, Procurement, Installation and Commissioning service for the two platforms. The ITT process is expected to take several months prior to award of the contract, when the detailed engineering design of the platforms can begin.

Gabon NKEMBE N°G4-243

Subsequent to the Reporting Period the Company concluded the dispute with the Gabonese State in relation to the Nkembe n°G4-243 Petroleum Exploration & Production Sharing Contract (PSC). The Company confirms that the Nkembe PSC has been terminated and the company is free from any further claim, obligation or payment.

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy