By Kathryn Porter, Watt-Logic

The issue of grid connection delays has garnered a lot of attention recently, as developers report large waits to connect to electricity networks, and accuse network operators of holding back net zero plans. Networks are often seen as boring but necessary, and from a regulatory standpoint, Ofgem has not given them the attention they deserve – its network charging and access reforms are dragging on (seven years and counting), with the work largely moved out of the original Significant and Targeted Code Reviews into a new DUoS SCR and TNUoS Taskforce.

Market participants could be forgiven for thinking that this has simply not been a priority for Ofgem, except that now the complaints have got louder, and the press is reporting on multi-year connection delays, the always reactionary regulator has been spurred into talking about it if not actually taking action.

What is the connections problem?

The transmission entry capacity (“TEC”) register contains all sites connected to and awaiting changes in their connection to or use of the transmission system. At the end of June there were 1,028 projects amounting to 326 GW waiting to increase their connection capacity while only three sites with a combined capacity of 1.2 GW wanting to reduce. Every day, more new projects are added to the register, extending the queue.

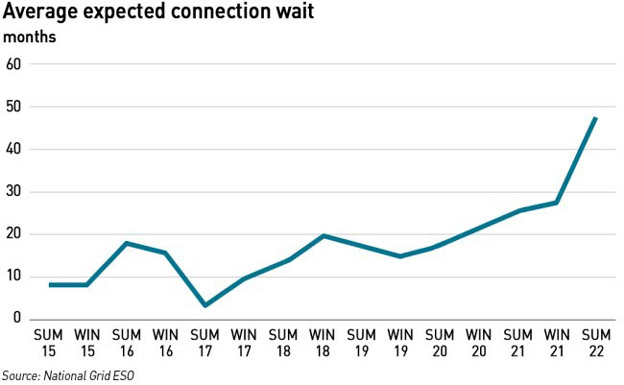

In the last 18 months, the time it takes for developers to connect renewable energy projects to the grid has grown significantly. Where previously projects might have got a connection date in 2025, some are now being pushed back to 2040. Centrica has a database of over 400 sites that will be suitable for renewable projects, but over 90% of them cannot progress because of grid connection issues. In many instances the team has applied to the DNO for a connection only to be told that National Grid ESO has indicated that a supergrid transformer or a grid supply point further up the chain needs to be upgraded first. According to Centrica, approximately 80% of the 300 substations across England and Wales need upgrading – a figure NG ESO would neither confirm nor deny.

“Supergrid transformers are huge bits of kit that weigh several hundred tonnes, and it takes years to install them. We’re talking five to eight years for each one of these. The government is telling all these companies to go green and charging them for their carbon emissions, but the companies can’t actually physically do the thing they need to do to build that out. We’ve been frustrated by an archaic system,”

– Bill Rees, director of Centrica Energy Assets

Harald Overholm, chief executive of Swedish solar company Alight, was reported in the FT saying the problem was due to “a collective failure of public policy”, warning that grid connection delays “could become a systemic problem for the UK unless it is addressed hastily. National Grid needs to invest, change its ways of working and hire enough people to meet the demand for the energy transition.” He also said his might re-consider investments in the UK if the delays are not addressed soon.

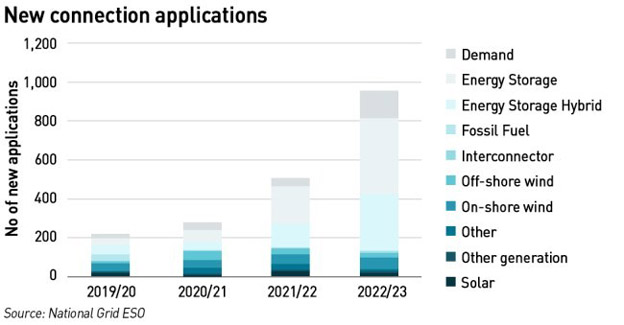

National Grid ESO says historically it received 40-50 applications for connections each year, but this has risen to about 600 per year with the growth in renewable generation. This is in addition to connection requests at the distribution level.

“Over 280 GW of generation projects are currently seeking to connect to the transmission network and an increasing number of those projects have connection dates into the mid to late 2030s. Renewable project developers are waiting too long to connect to the network, and this is hindering our progress to deliver Net Zero… The causes for these delays are clear. We have seen huge increases in the numbers and capacities of projects seeking to connect, yet our data shows that up to 70% of those projects may never be built. Those projects are holding capacity that is significantly delaying the connection of other projects,”

– Julian Leslie, Head of Networks, National Grid Electricity System Operator

David Cole, market director at engineering firm Atkins, has described the grid upgrades required to support the energy transition as “probably the biggest engineering challenge the UK has faced in a very long time.” His team has analysed the generation that will have to be built to meet net zero targets and says it is “a big increase on anything we’ve ever achieved in the past. The most we’ve ever achieved is just over 6 GW per year, and the average need to meet the 2035 net-zero target is 14 GW per annum.”

Other countries are facing similar challenges leading to competition for resources, both for raw materials and skilled labour. Staffing issues are adding to the problem – DNOs are struggling with the volume of work associated with connections requests, but around a quarter of all connection staff are expected to retire in the next two to five years, exacerbating under-staffing.

Why are grid connections being so delayed?

The Connection and Use of System Code (“CUSC”) determines the process by which projects obtain connections to and use the transmission system. The Code requires network operators to manage new applications on a first come, first served basis, and developers face financial penalties for withdrawing from the queue. There are no requirements for projects to have reached a particular stage of development in order to apply to join the TEC register, so developers can use their applications as placeholders – this means that projects that are more remote and even unlikely to be delivered block other projects with greater readiness. Even worse, if those earlier projects use up existing network capacity, the later projects will need to wait for network reinforcements to be carried out before they can get connected.

Ofgem is finally waking up to the issue. In May, CEO Jonathan Brearley gave a speech to the Utility Week Live conference in which he cited an “urgent” need to do three things:

- Better coordinate generation and network investment through more effective system planning;

- Accelerate the build out of networks following those plans; and

- Speed up connections to the grid, maximising use of the existing network to connect as many parties as possible.

He said that the new Future System Operator (“FSO”) due to be launched in 2024 will be instrumental in planning the system at both transmission and distribution levels to anticipate the network capacity needed to meet 2035 and 2050 targets. However, he still referenced the need to do this “at the lowest cost to consumers” which has been a source of tension within the RIIO process – how is “lowest cost” defined, and, importantly, over what timeframe.

Brearley said the first version of the network plan was produced by the ESO last year in the form of the holistic network design, focusing on the government’s target to connect 50 GW of offshore wind by 2030. This year, “as part of developing the scope and function of the FSO, we will be progressing the scope and detail of the Central Strategic Network Plan – a holistic plan to assess our evolving energy needs, and how best to fulfil them.” This rather smacks of back-solving to fit this newly prioritised issue into existing workstreams, although that is perhaps a cynical interpretation.

He added that once the FSO has put the Central Strategic Network Plan in place, it will be important to get the capacity identified within it built as soon as possible…Ofgem has approved all of the projects in the Holistic Network Design and put in place a new streamlined regulatory framework (the Accelerated Strategic Transmission Investment, or ASTI).

“We used that plan to unlock an unprecedented amount of anticipatory investment, totalling about £20 billion of electricity transmission network. Now what in business as usual might have taken Ofgem years to approve, iterating and arguing with each individual network company, on each project, took a matter of months, once we had the confidence that this was already laid out in a holistic assessment of what is needed,”

– Jonathan Brearley, Chief Executive of Ofgem

He added that once the Energy Bill has been passed into law, Ofgem may be able to put such strategic projects out to open competition, so that whoever can build the relevant infrastructure most quickly and cost-effectively could be commissioned, rather than leaving it to the monopoly network company to deliver on these projects. In the meantime, Ofgem is reviewing how it regulates network spending through its price controls in the light of the changes in system planning described above.

“20% of generation capacity in the transmission queue will have to wait for a further 10 years before they reach their offered connection dates. And 40% have been offered connection dates beyond 2030. That pace is simply not compatible with our ambitions on cost, security, or net zero. It is the biggest risk to decarbonising the power system by 2035, and it is clear we need to go further and faster to get renewable sources of power onto the grid as quickly as possible,”

– Jonathan Brearley, Chief Executive of Ofgem

In relation to the issue of long connections times, Brearley said “sometimes it is the role of the regulator to call out difficult things” and that the current state of play is “simply not acceptable”. He described the first come, first served queuing system as being the principal cause of the problem and said that it no longer makes sense, proposing a new approach which would prioritise projects that are ready to connect over those, “potentially zombie projects”, that are delayed and take up space others can use. Although the first come, first served rule was imposed by Ofgem itself when it prevented network companies from discriminating between applicants in the connections queue.

“Ofgem does not allow network companies to discriminate between projects seeking a connection whereby connectees are treated on a first-come, first-served basis, with any required network upgrades only progressed when connections are formally agreed,”

– Energy Networks Association

A queue management process was developed by the Energy Networks Association and published in December 2020, but this has yet to be adopted into the CUSC. NG ESO raised a code modification request (CMP 376) in July 2021, which would introduce this process into the CUSC and allow for queue management. This request has yet to be approved by Ofgem which expects to make its decision by 15 September – so much for needing to urgently address the issue!

NG ESO did try to implement a form of queue management last summer, including queue management milestones in offers for new connections and modification offers for a short period from 1 July 2021. However, it faced a backlash from developers forcing it to offer assurances that the milestones would not be enforced, and removed at the earliest opportunity.

Interaction with network price controls

According to Dieter Helm, professor of economic policy at Oxford University, the failures date back to rules set when the electricity sector was privatised in the 1990s. Regulators rejected strategic planning for the grid allowing developers to request a connection to the network from any site, a system which will not deliver the demands of the energy transition.

“Neither the grid nor the distribution networks were designed to handle any of these demands. On the contrary, they were built on the assumption of ever-larger coal and nuclear power stations in the post-Second World War era, and to take this electricity from these stations, located either close to coal mines or, in the nuclear case, on the coast, to the main sources of demand – notably in the south, and down through the distribution networks. This generation would be driven off baseload power, with the system matching movements in demand from older stations further up the merit order. The assumptions were that electricity could not be stored at scale and that the demand side would be passive. Finally, the location of power generation was coordinated and planned in an integrated way with the grid and distribution networks, with the Central Electricity Generating Board and the Electricity Council ensuring that it all added up,”

– Dieter Helm

Helm says the problems from privatisation extend off-shore where, instead developing an integrated off-shore network, the “mantra was that the grid should be passive, responding to requests to connect, but having no say over where and how these connections occurred”. Ofgem actively promoted off-shore transmission owners (“OFTOs”), essentially a series of binary links to the shore by competitors to National Grid, resulting in network inefficiency and separate transformer sites being developed all along the east coast of the UK.

He criticises the entire approach to network regulation and the idea that networks must be delivered at the lowest cost to consumers. There is an obvious tension around the definition of “cost to consumers” and it is far from clear that a degree of over-building of networks would be a significant detriment – the impact on individual consumers is likely to be marginal. (Incidentally, Helm would like to see Ofgem drastically slimmed down, a position I share.)

“Ofgem effectively starts with “more-for-less” , and the objective of resisting real price increases. Whatever is to be done to get from here to 2035, it must not lead to higher real bills. The politics of this is understandable, but then it is not the politics that should drive a periodic review; rather, it is the statutory duties of Ofgem, and the surrounding legal framework on net zero and the Environment Act statutory targets,”

– Dieter Helm

Against the backdrop of an increased need for grid investment comes a new version of the price control system for networks, RIIO (Revenues = Incentives + Innovation + Outputs) which been tightened in its second phase, RIIO-2, making anticipatory investments even more difficult. Several witnesses in last year’s Ofgem and Net Zero enquiry raised concerns about the uncertainty mechanisms in RIIO-2, which are designed to allow a re-opening of the price control in response to market change.

Market participants worry that Ofgem’s processes may be too slow and / or the evidential hurdles too high for this system to be effective. And where re-openers are allowed, they risk sub-dividing the price control into much shorter periods. (RIIO does not prevent operators from making anticipatory investments, but it restricts their ability to pass the costs through to consumers unless the investment is shown to be necessary, and as network companies are unlikely to make investments without certainty of cost recovery, they avoid such projects.)

The Committee said the price control regime has “the potential to discourage investment at exactly the point when it is needed most”, and that Ofgem needs to ensure price controls allow the appropriate level of investment ahead of need and do not restrict investments that are necessary to enable the transition. It recommended that Ofgem carried out a review of its use of uncertainty mechanisms, their effectiveness, the regulatory burden they have placed on energy networks and their impact on investment in time for any conclusions to be reflected in the next price control period.

In the final RIIO-2 determination for DNOs, Ofgem put in place 37 common and five bespoke uncertainty mechanisms, saying that strategic or anticipatory investment will be considered in the context of smart optimisation and will need to be evidenced using monitoring data and connectivity models, plus local area energy plans and emerging flexible technologies and services.

There are concerns that this will all require additional planning, engagement, evidence gathering and cost-benefit analyses, which may prove difficult to execute within the relatively short five-year price control period (the previous price control lasted for eight years). Stakeholders have questioned whether they will be agile enough to allow for timely investment and to mobilise the necessary resources and supply chains. Much depends on the resourcing and capability of Ofgem in approving budget allocations relating to these uncertainty mechanisms.

The plan, as described by Helm, is that network companies identify investment needs under the uncertainty mechanisms, and then Ofgem will “sit in judgement” on each and every application, essentially turning into the investment committee of these companies, taking over the proper functions of their boards. Even worse, he says, is that Ofgem thinks it knows what the likely investment categories are, as if network systems can be unbundled into precisely these categories. Is this really the job of the regulator?

NG ESO has adopted tactical measures to address the issue while it consults on permanent reforms

NG ESO is taking a number of tactical steps to mitigate the connections problem while it waits for CMP 376 to be approved. It has also put in place a five-point plan to address some of the near-term challenges, which includes:

- TEC (Transmission Entry Capacity) amnesty – this allowed customers to leave the connections queue without incurring penalties. The amnesty closed in April 2023 and received over 8 GW of interest. ESO is currently reviewing the costs with Ofgem and expects to notify customers whether their application to terminate or amend their TEC has been accepted by the end of this month.

- Background modelling assumptions – ESO is updating how it calculates project connection dates and is working with the transmission system owners to review and update existing contracts with these new Construction Planning Assumptions.

- Storage – Batteries and other energy storage technologies both draw energy from and release energy to the grid. As this technology has a dual purpose, ESO has changed how it calculates its impact on the system.

- Contract terms – ESO is developing new contractual terms for connection contracts to manage the queue more efficiently, so those projects that are progressing can connect and those that are not can leave the queue.

- Interim offer for BESS (Battery Energy Storage Systems) – ESO is enabling energy storage projects to connect to the grid more quickly to speed up connections for up to 95 GW of energy storage projects in the pipeline. To ensure system security, they may be instructed to reduce their output at times, although this is expected only on very rare occasions.

The new methodologies applying to the Construction Planning Assumptions for battery projects have been agreed by all three transmission system owners and will be used for both existing contracted projects and new connection applications, ensuring consistency across the country. However, to implement these changes, a complete review of the GB Transmission Reinforcement Works (“TRW”) for all contracted offers with a connection date after 1 January 2026 is necessary. This review will rationalise the TRW required for the contracted parties and identify any options for battery projects to connect earlier but with interim restrictions. NG ESO anticipates that after the review has been completed, some parties within the transmission system queue could see their connections dates moved forward.

It has also introduced a two-stage process for connections, allowing it to revise assumptions on the amount of grid capacity realistically required to connect new projects, given a large percentage of existing projects in the queue is likely to fall away. Ofgem thinks this could shorten connection times by 2- 10 years for many projects.

The two-step process is an interim measure applying to connections within England and Wales which will allow National Grid Electricity Transmission to carry on issuing light touch connection offers while carrying out the Transmission Reinforcement Works review. The measure will run for 12 months from 1 March 2023 while the review is being carried out. It is anticipated that running the review and the two-step offer process concurrently should result in improved completion dates (reflecting a reduced requirement for reinforcement works).

In step one, customers are provided with standard offer, reflecting the requested connection point and an indicative completion date, based on the current TEC amnesty queue and the existing Transmission Reinforcement Works requirement reflecting the general scale of works to enable connection for projects applying now against the current contracted background. However, it will not include the detailed works or indicative costs and charges that would usually be included in a connections offer, and securities will be set at £0. If this offer is accepted, it will be updated to identify the transmission works, programme, charges, connection site/point, and any updated terms as per step two.

In step two, a follow-up offer is issued a maximum of nine months after acceptance of the step one offer. This offer will include the complete populated suite of appendices for the agreement, including securities and programme of work, based on the identified TRW. These offers will be progressed in regional batches, so that they can be processed as efficiently as possible.

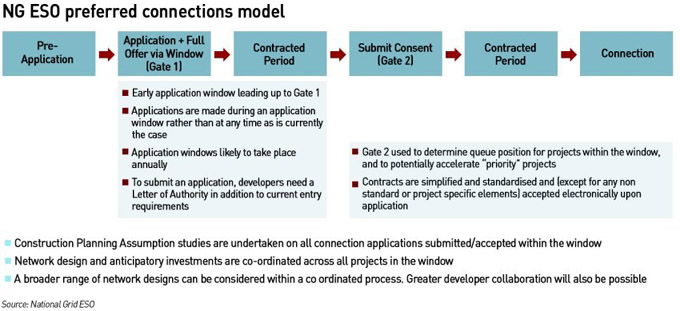

Finally, ESO is considering the future direction of connections under its Connections Reform project. It is currently consulting on a number of different connections approaches – the deadline for responses is 28 July, and ESO expects to make its final recommendations by November. Based on standard practices for changing industry codes and licences, the implementation of these reforms would be mid-to-late 2025. It is therefore actively exploring alternative implementation approaches with both Ofgem and the Government in order to expedite delivery, either by accelerating existing code governance processes, or through legislation.

Without a major change in the regulatory approach connection delays will continue

The current approach to grid connections is clearly inadequate in a world which has moved from a small number of large generators to a large number of small generators. The challenges of grid reinforcement are not just administrative, they also relate to the size and nature of the infrastructure requirements. Not really mentioned in any of this is the impact of intermittency on the grid, one of the other key changes resulting from the energy transition. But the connections process is largely indifferent to this – while it of course measures the negative impact projects may have on the grid and the need for reinforcement, any positive impacts are ignored. There is scope for this to change, for example incentivising developers to co-locate different technologies in order to provide additional grid services such as inertia and reactive power. A connections process that incentivises developers to minimise the negative impact their project has on the grid, or even strengthens it would be beneficial.

The other significant issue with the status quo is the difficulty in changing the status quo. Despite his combative rhetoric, Jonathan Brearley ignores the fact that it is Ofgem itself which is perpetuating the current issues. CMP 376 is literally holding back NG ESO’s ability to implement queue management, something Ofgem apparently wants, but is yet to approve. This modification was raised two years ago, and now just needs Ofgem to give it the green light to go ahead – why has this not yet been done? And if Ofgem cannot prioritise an important code modification it has publicly stated is necessary, how confident can we really be that Ofgem will process uncertainty mechanisms in a timely fashion?

Not very, I would suggest, particularly when we remember that the network charging reforms which were initially launched seven years ago are still incomplete. The work on both the DUoS SCR and TNUoS reforms was paused in November in light of the energy crisis and resumed in February when meetings of the TNUoS Taskforce re-started, and the DUoS SCR was due to continue, with timelines and further details on Ofgem’s planned engagement with industry promised by early summer 2023, but as far as I can tell, not yet delivered.

Ofgem has placed itself at the centre of the networks:

- It is developing strategic network planning roles for the Future System Operator for the electricity transmission sector (and expects to have a similar role in gas transmission) and is consulting on giving the FSO an active role in electricity distribution (and potentially also gas distribution);

- It is determining the principles by which future supply and demand will be modelled by the FSO, as part of its role in developing the Centralised System Network Plan;

- It is developing the funding model for the FSO;

- It is considering a new price control for networks;

- It expects to approve individual network investment decisions under the RIIO-2 uncertainty mechanisms;

- It is continuing to review the way in which networks are paid for by users.

In addition, Ofgem must approve most changes to industry codes, so existing industry processes cannot by updated in any meaningful way without Ofgem’s prior agreement, with each change being subject to time-consuming consultations.

It is worth asking whether all of this should fall within the remit of an economic regulator, or whether Ofgem is drifting too far into operational matters. It is far from clear that Ofgem has either the expertise or bandwidth to deliver everything from deciding the principles that will underpin high level network planning through to approving individual investment decisions on a very granular level.

It would make more sense for DESNZ to take the lead on defining the role of the FSO and how it is paid for, and for Ofgem to stick to setting price controls, with some oversight of network charging. Telling the system operator how it should go about modelling future supply and demand, or trying to approve individual network investments feels like a level of operational involvement that is not justified. Getting involved at such a granular level generates questions about how Ofgem’s work is overseen, and what happens if its processes fail, either because they are too slow or because errors are made. By taking on such a wide range of work, Ofgem is almost certain to become a bottleneck in the system, and the very problems it is trying to solve will be exacerbated and not alleviated.

The Government needs to go back to the drawing board and reconsider the scope of Ofgem’s remit, or whether it should be broken up into separate regulators for networks and supply (or whether, as I would prefer, retail market regulation is simply transferred to the Financial Conduct Authority). As it is, Ofgem is drifting too far into network planning rather than simple economic regulation, and that is unlikely to be a good thing.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy