Highlights:

- The Field Development Plan (FDP) for Hartshead’s Phase I gas development has been submitted to the NSTA.

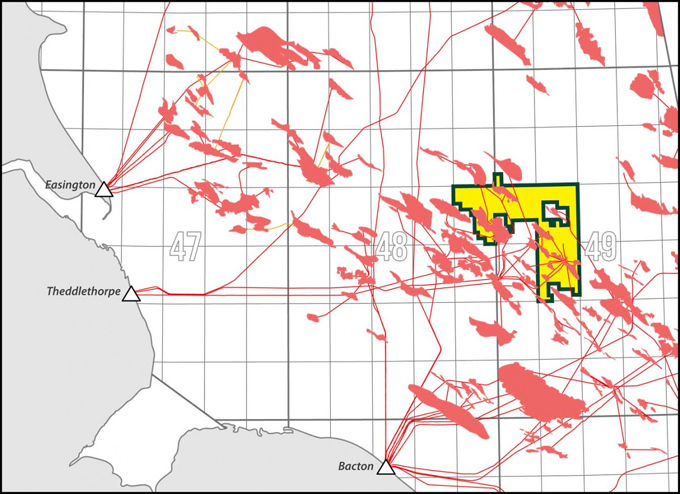

- Major milestone in the phased development of Hartshead’s P2607 license area (RockRose 60%/40% Hartshead) in the UK Southern Gas Basin has been achieved.

- The field development consists of an unmanned dual platform development with gas transportation via a subsea tie-in to the offtake route.

- FDP submission further advances the project towards a clear pathway to project development of the previously producing gas fields.

- A$135.7 million consideration committed by RockRose for purchasing Hartshead’s 60% interest forms part of Hartshead’s equity requirement for the project development costs of Phase I.

- Discussions with parties for the debt funding of Hartshead’s remaining expenditure are well advanced and are expected to be concluded alongside FID in Q3 2023.

Hartshead Resources has submitted its Phase I Field Development Plan (FDP) for the Anning and Somerville gas field developments to the North Sea Transition Authority (NSTA), marking a major and material milestone in the Company’s development of its UK Southern Gas Basin assets.

The FDP sets out the development plan, including a detailed description of the subsurface interpretation, planned development wells, production forecasts and facilities, gas transportation route to market, QHSE, and commercial and economic aspects of the development, as the Company progresses towards production.

The development plan consists ofsix production wellsfrom two wireline capable Normally Unmanned Installation (NUI) platforms at Anning and Somerville. These platforms will then connect subsea to infrastructure for onward transportation and processing for entry into the gas network. The company will now discuss the draft FDP with the NSTA to receive technical feedback and amend for any comments and then commence an audit of the revised project schedules with ERCE before publishing independently audited Phase 1 economics.

Post receiving technical feedback from the NSTA, the Company will move to finalise project debt funding and take Final Investment Decision for the Phase I development with it’s joint venture partner RockRose Energy. The development of the Anning and Somerville gas fields will then commence as the Company advances towards First Gas expected in 2025.

Chris Lewis, CEO, commented:

“This milestone is a significant advancement towards Hartshead becoming a UK gas producer and playing our part in the UK’s energy security and energy transition. Seeing the development project take shape, and having a clear development plan and offtake route identified, is immensely gratifying after all the hard work put in by the team so far. I now look forward to taking FID alongside our project partner RockRose.”

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy