Acquired by Energy Investments Global Ltd in 2014, Heritage holds a portfolio of quality assets managed by a highly experienced team with excellent technical, commercial and financial skills.

Typically focused on regions which may have been overlooked and where it can participate as an early entrant, their asset portfolio provides both geographical and operational diversification. Heritage have a producing asset in Nigeria and exploration assets in Ghana and Papua New Guinea.

Producing

Material corporate transactions undertaken in 2012 provided a balance to the portfolio with assets that include significant production and reserves. The joint venture company Shoreline Natural Resources, created in partnership with Nigerian company Shoreline Power, has established an indigenous company which will provide a platform for further growth within the country. Through Shoreline, Heritage acquired an interest in OML 30, a world-class asset. OML 30 lies onshore the Niger Delta in one of the most prolific oil provinces in the world and includes eight producing fields with oil and gas contained in numerous stacked reservoirs.

Exploration

Activity on the exploration portfolio is focused on Ghana and Papua New Guinea.

With its partners, Heritage has a 39.6% working interest in the Offshore South West Tano (OSWT) and 38.7% interest in the offshore ultra-deep water East Keta licence blocks in Ghana, in 1,300 and between 2,500 and 3,500m of water.

Heritage with its partner Kina holds attractive acreage in Papua New Guinea, a gas/condensate system close to existing and planned gas evacuation infrastructure. The proposed construction of a new LNG facility in the area increases the attractiveness of the holding.

OVERVIEW OF OPERATIONS

Ghana

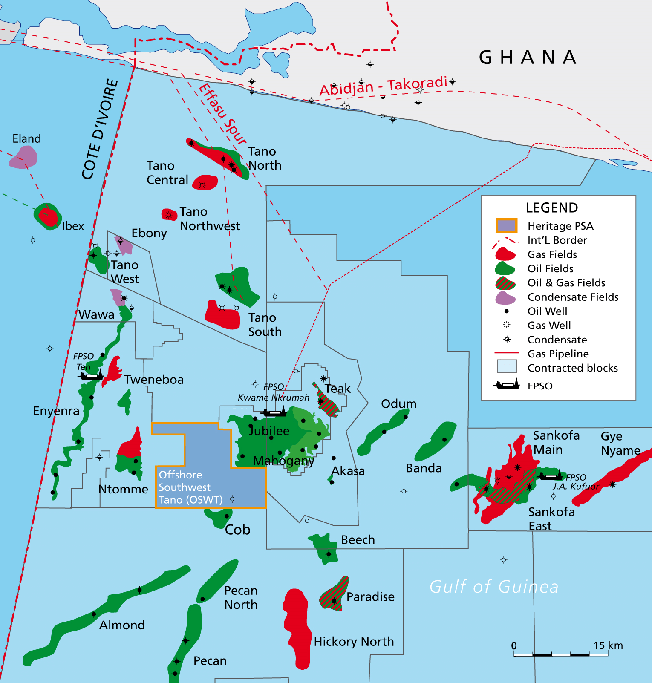

Offshore South West Tano (“OSWT”) Block

Heritage has a 39.6% working interest in the Offshore South West Tano (“OSWT”) Block, which covers an area of approximately 175 square kilometres, in water depths of 1,300m. The block is operated by OSWT & EK Operating Company.

The block lies within a prolific, world-class petroleum system adjacent to the giant TEN and Jubilee fields. Development of the asset could be possible through standalone development or tie-back to nearby third-party infrastructure providing an option for rapid monetisation.

Multiple Upper Cretaceous turbidite systems traverse the block. A number of prospects have been mapped on modern 3D seismic, part of the same petroleum and reservoir system as Jubilee and TEN. Prospects identified include Edinam, a high-impact, multi-target exploration opportunity, and Mansonia, a low-risk appraisal of an extension of the Jubilee field with a secondary play-opening deeper target.

OSWT Highlights

Licence

- 175km² licence area in water depths ranging from 1,300 to 1,900m.

- Licence was awarded in 2014 with the Initial Exploration Period extended to July 2023, with a single well commitment.

- OSWT is operated by the OSWT & EK Operating Company, comprised of Heritage 39.6%, Blue Star 39.6%, GNPC Explorco 8.8% and GNPC 12% partnership.

Proven Petroleum System

- Proven petroleum system with multiple producing fields in close proximity. Two plays identified on block: Turonian play as proven at Jubilee/TEN; and the Cenomanian play proven at Sankofa/Afina and Paradise/Hickory North.

- Prolific Turonian/Cenomanian source rock with OSWT overlying the main source kitchen.

- Reservoirs are stacked Upper Cretaceous channel and fan systems which can be clearly mapped on 3D seismic.

Prospectivity

- Two key prospects have been identified and mapped on high quality PSTM and PSDM seismic data.

- Edinam – targeting three reservoir intervals in the Turonian and Cenomanian plus a potential extension to the TEN system.

- Mansonia – low-risk appraisal opportunity targeting the down-dip extension of Jubilee’s Lower Mahogany Unit with a secondary exploration target in the deeper Mahogany Ultra Deep (MUD) formation.

- Essia – follow-on prospectivity in upper Turonian channel sands, representing an attractive third drilling location.

Infrastructure

The Block lies between infrastructure at the Jubilee and TEN fields and is in close proximity to other evacuation facilities. OSWT lies ~60km from the Takoradi shore base.

Preliminary operations are ongoing with drilling scheduled for 2023.

East Keta Block

Heritage has a 38.7% interest in the offshore ultra-deep water East Keta Block, which covers an area of approximately 2,239 square kilometres.

The East Keta Block is a frontier exploration licence located approximately 100 kilometres from the coast of Ghana with water depths ranging from c. 2,500 to 3,500 metres.

Initial mapping has identified several large prospective Cretaceous and Miocene aged fans and channels. 3D seismic acquisition is planned.

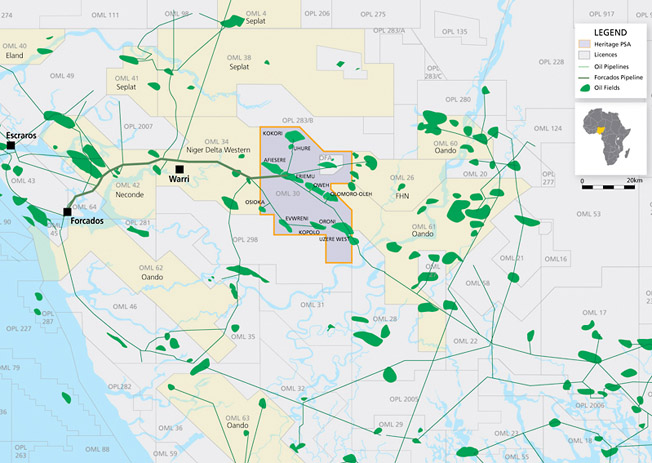

Nigeria

OML 30

OML 30 is a world-class asset in the Niger Delta. It includes eight producing fields each with oil and gas contained in up to 40 stacked reservoirs.

OML 30 lies onshore within the Niger Delta in one of the most prolific oil and gas provinces in the world. The licence covers 1,097 square kilometres and includes eight producing fields with oil and gas contained in numerous stacked reservoirs. The fields are deltaic shallow marine shelf sands at intermediate depth. The fields each contain up to 40 stacked reservoirs and the reservoirs are underlain by substantial aquifers that provide very strong pressure support. The oil is good quality 22-38° API and typically sells at over a 2% premium to Brent.

Since 1961 over 200 wells have been drilled on the licence and the strong aquifer support has enabled the majority of these to be producers. There is the potential to both stabilise and increase production in the near term through rigless workovers in existing wells and drilling of additional producers.

The licence benefits from infrastructure being in place with nine flow stations (eight currently operating). The facilities benefit from a standard design so equipment can easily be replaced or upgraded if required.

The OML 30 acquisition included a segment of the TFP which transports liquids from OML 30 to the Forcados Terminal. The 87 kilometre long pipeline is 28 inches in diameter and has a current capacity of about 600,000 bpd. The TFP is used by several other operators and provides additional revenue for OML 30 through the tariffs charged.

Heritage Energy Operational Services Ltd (HEOSL) took over operatorship of OML 30 in 2017. Since then, Heritage has embarked on aggressive rehabilitation and upgrade of facility equipment, resulting in additional wells being opened and optimised for production.

Most of the current production increase is as a result of production optimisation activities and additional investments in facilities equipment to improve capacity and uptime. Some well intervention activities and flowline repairs have also contributed to the current production. The production growth was also supported by improved security and robust community relations programmes.

Papua New Guinea

PPL437 is a highly prospective exploration licence within a proven hydrocarbon fairway in the fly platform. One drillable prospect and five leads have been identified.

Heritage has earned a 42.5% working interest in PPL437 by funding and acquiring ~105km 2D seismic and a contribution to back costs. The licence is operated by Kina Petroleum who hold the remaining licence equity.

PPL437 is located within the Fly Platform in the Western Papuan Basin, onshore PNG. The licence is located within a proven hydrocarbon fairway between the Stanley and Juha fields and north of the Elevala/Tingu and Ketu discoveries.

It also benefits from proximity to the PNG LNG gas pipeline which extends from the fold belt gas fields to the LNG plant in Port Moresby. In addition, a new pipeline has been proposed to traverse the block as part of the upcoming development of the Elevala/Ketu and Stanley Fields. Any discovery within PPL437 could be developed as part of an aggregation project with the neighbouring fields which together form a significant resource potential.

Evaluation of the dataset, which includes regional gravity/magnetic data, surface geological mapping, and c.950 kilometres 2D seismic identifies one drill-ready prospect (Malisa) and five leads. Prospectivity lies within clastic Jurassic and Cretaceous reservoirs in simple structural basement drape traps.

Greater than 1tcf of upside potential lies within the remaining leads.

Contact

Heritage Exploration & Production Ghana Limited

59 Senchi Road, GA-083-6113, Airport Residential Area, Accra, Ghana

E: info@heritageoilltd.com

Heritage Energy Operational Services Limited

Heritage Place, 21 Lugard Avenue, Ikoyi, Lagos, Nigeria

Heritage Oil (UK) Limited

27 Knightsbridge, London, United Kingdom, SW1X 7LY

Management

- Scott Lewis Chief Financial Officer

- Philip Laing General Counsel & Company Secretary

- Keith Walters VP Technical

- Nick Baker Country Manager Ghana

Board

- Michele Faissola Heritage Board Member

- Guido Michelotti Heritage Board Member

- Ado Oseragbaje Chief Executive Officer

- Jeremy Cape Heritage Board Member

- Nasir Pasha Heritage Board Member

KEYFACT Energy

KEYFACT Energy