Countries around the world have set ambitious targets around Wind energy production for 2030. But with Wind booming and Oil & Gas back in a big way – does the industry have the Offshore wind vessels required to keep pace with demand?

Soaring global demand for carbon-free energy

While at first glance the slowdown in final investment decisions (FID) for Renewables projects in 2022 suggests the market is stagnating or perhaps even slowing, the reality could not be further from the truth. Offshore wind is currently experiencing significant growth in new markets around the world due to soaring global demand for carbon-free energy that supports climate commitments while also providing energy independence and security. The result is a dramatic uptake in new Offshore wind projects.

The reduction in FIDs is, in fact, most likely due to interest rates, hyperinflation and COVID-related delays. Investors have delayed signing on the dotted line either because they weren’t happy with the rate of return on those projects (due to inflation) or because things were just running slow (due to COVID). The combination of the global pandemic and international financial uncertainty has meant many projects have been pushed to the right, resulting in work that would otherwise have already been started being moved into the back half of the decade.

Offshore wind is going global

Several new countries are making large commitments to building out Offshore wind farms, including the US, Taiwan, Poland, France, South Korea and Japan to name just a few. Offshore wind is truly going global with numerous nations now releasing auctions for new Offshore wind projects, but challenges are beginning to emerge, and we are already starting to see gaps in the market when it comes to the supply of the necessary Offshore wind logistics vessels. While this may be great news for ship owners and yards, any lack of supply chain is of course less welcome for developers, causing prices to rise and difficulties in securing favourable terms and conditions for their projects.

While Offshore wind development is gathering pace on the global stage and new markets are starting to move forward, the bulk of the supply chain and vessel owners in the market are still based in Europe, specifically Norway, Denmark, the Netherlands and the United Kingdom. Furthermore, we should not forget the material impact on the global supply chain when Asian or US players contract European vessels at increasing day rates and cost to complete/execute their projects.

Rapid growth of the installed base and the next generation of Offshore wind vessels

Calculations from Clarksons’ Renewables advisory team show that 30,000 turbines and foundations are expected to be installed by 2030 – this excludes China and floating wind. The Wind Turbine Generator (WTG) installation rate per year is set to double: previously running at 700 - 1,000 WTG/year, from 2025 onwards this should increase to more than 2,000 WTG/year. It is interesting to note also that while +/-10MW turbines are currently the norm, Clarksons believes we will see WTG size mostly around the 15 - 18MW size up to 2030 (although opinions differ on this), with the next generation of Offshore wind vessels needing to be designed for +20MW turbines.

The Offshore vessels required across the lifecycle of an Offshore Wind farm project

Recent analysis by Clarksons found that 50 vessels were involved in the construction of just one UK wind farm over a two-year period. When you extrapolate these figures to account for the huge number of upcoming projects on a global scale, it is clear to see both the massive challenges faced by the Renewables industry as well as the equally significant opportunities presented for those willing to be bold in their decision-making.

The coming decade is likely to bring unprecedented demand for vessels to service Offshore wind projects. With continued dramatic growth of the installed base forecast, every new wind farm project will require a whole new group of vessels to look after it over the course of its lifetime. As such, there will be a huge surge in demand for new maintenance vessels, Service Operation Vessels (SOVs), Construction Support Offshore Vessels (CSOVs), Crew Transfer Vessels (CTVs) and Jack Up Vessels (JUVs) on an ongoing basis to maintain these wind farms over the course of their 20- to 30-year lifespan.

It is also worth noting at this point that the recent resurgence of Oil & Gas is drawing vessels away from Offshore wind projects: vessel owners who decided to utilise their tonnage in Wind following the Oil & Gas price crash in 2014 are now once again using these vessels for their original purpose.

Can Offshore wind vessel supply keep up with demand?

To put it bluntly – no! Even if some projects are not developed as planned, thereby reducing demand a little, we are still predicting gaps in vessel supply. These gaps will inevitably have major consequences, including delayed projects and high day rates. Significant investment in new tonnage is the only solution, but there is still uncertainty in some corners over whether larger vessels have a long and viable life. We do believe however there are opportunities to address this hesitancy, for example:

- Developers need to take a new and more proactive approach to help the supply chain meet the challenges presented by larger turbines and foundations. Long-term contracts to support construction of new vessels and even direct investments in suppliers will be critical if the supply chain is to match the ambitions of turbine producers and developers. Furthermore, collaborative business models could unlock financing that otherwise would be unavailable for many suppliers by lowering the cost of capital, reducing equity needs and providing confidence to investors.

- Governments could step in and support investments in vessels. We have seen this approach taken in the US with MARAD offering financing specifically designed to stimulate the growth and modernization of the US Merchant Marine and US shipyards. This includes offering up to 87.5% financing, repayment periods up to 25 years, fixed or floating rates, and interest rates comparable to US Treasury rate for comparable-term securities.

- Green funding schemes could create more favourable finance terms to assist owners with lending by lowering the equity required in relation to the amount they need to borrow.

The bottom line is that numerous countries have set ambitious targets for wind production by 2030 and in order to facilitate this level of growth, the sector needs to develop manageable ways to bring this amount of supply online and identify any bottlenecks in the supply chain. However, if a combination of longer-term contracts, government-secured finance, and better lending terms were adopted globally for Offshore wind, we could see potential vessel bottlenecks quickly disappear.

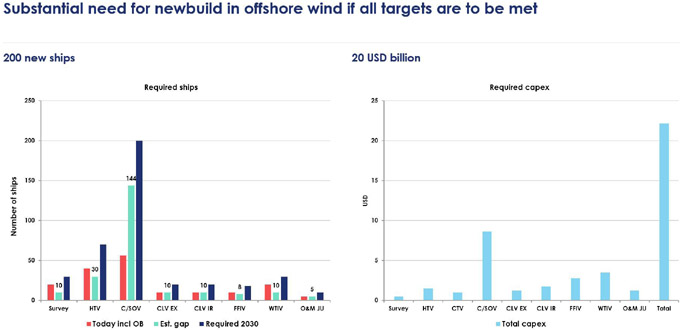

US$20bn of investment required to build 200 new ships by 2030

At present, all Offshore wind vessel segments look to be undersupplied for the remainder of the decade, meaning significant and prompt investment in vessel newbuilding is needed if the industry stands a chance of keeping pace. In fact, estimates from Clarksons suggest that US$20bn of investment is required globally to build 200 new ships if the Renewables industry is able to meet its 2030 targets for Offshore wind production.

Key Offshore wind vessels that are undersupplied include Cable Lay Vessels (CLV), CSOV, Foundation and WTG installation vessels. While there may be some hesitation about proceeding with vessel newbuilding projects due to increased build costs, this must be put into context:

- CSOV: these vessels are now 40% more expensive to build than two years ago but crucially, day rates have also been on the rise. The resurgence of Oil & Gas means these vessels are being taken out of Wind, leading to higher day rates, longer-term contracts and better T&Cs for owners. Over the last six months, we have seen day rates double suggesting there is still a very good business case for building new ships. Plus, CSOVs are being chartered and sold out quicker and earlier each year, leaving wind farms with limited options.

- CLV: this complicated and specialised vessel type has a limited group of potential owners globally. Inter array and export cable vessels are down 10 vessels each based on forecasted demand. As a result, day rates in 2026 are expected to be x2.5 of those seen today, with 2025 predicted to be a very difficult year with undersupply.

- WTIV: while there are lots of capable vessels for 15MW WTG, sites could limit the vessel, requiring larger vessels with longer legs, larger overturning moment, and higher hook heights. Despite new vessels arriving in 2025, some are already booked for the remainder of the decade and undersupply remains a reality. Owners are being selective about which deals they accept based on site conditions, client pipelines and T&Cs. As a result, day rates are predicted to increase north of $250k for Tier-1 WTIVs and could go higher.

Across all vessel types, the reality is stark: unless we get more vessels, we will not be able to build out 2030 targets. Projects will be delayed or come to a grinding halt. In the simplest of terms - failure to invest now in bringing those vessels to market means that 2030 targets will not be achieved.

Frederik C. Andersen, Managing Director of Renewables at Clarksons, commented:

"It is clear that we are at a pivotal moment in time for vessel development for Offshore wind projects. Right now is the sweet spot for Offshore wind vessel development; we’re at a point where there are opportunities for ship owners and investors, the likes of which have rarely been seen before"

“Here at Clarksons, we’ve been successful at getting involved in the financing and building of new vessels to serve these projects. Last year alone we were involved in new vessel build sales for Jack Ups, SOVs and CSOVs, and the industry is only growing. Our specialist team is in place with the skills and knowledge to help clients capitalise on this and help deliver what the world is looking for.

“We have the insight, contacts and skills to give clients the confidence they need to know they are making well-informed decisions that will reap rewards for years to come. Thanks to our extensive experience and ability to leverage the combined strength of the wider Clarksons Group, we are able to support clients with every aspect of Renewables projects. Whether that’s assisting developers with chartering vessels for their new project or helping vessel owners looking for support with design, negotiating prices, setting up finance, and finding contracts for these vessels.”

KeyFacts Renewable Energy Directory: Clarksons Offshore & Renewables

KEYFACT Energy

KEYFACT Energy