- SF7v drilling has completed successfully.

- Cleaning and Testing to take place in March

- 2nd Compressor has now been installed and commissioned with a view of fully running during the course of March

- Richard Herbert to be appointed CEO with full control of day to day operations

- George Lucan to be appointed Executive Chairman with a focus on strategy and stakeholder relations

- Offer received from a group of core shareholders to provide a junior debt facility to cover any drilling programme overruns as well as diligence costs with potential acquisitions, as an alternative to a dilutive placing

Drilling Programme

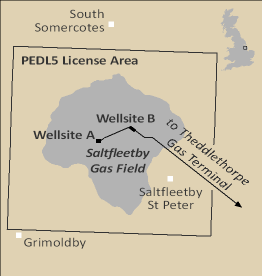

Angus Energy today announced that, in line with the announcement of 10 February 2023, the drilling of the SF7v sidetrack at the Saltfleetby Field has concluded, reaching a total measured depth of 2746 meters in the Westphalian 1D reservoir. The well bore has been secured with 4.5" liner to that depth, slotted across the reservoir. Completion operations will commence later this week after surplus equipment has been demobilised.

Following the setting of the well completion production tubing, well clean-up operations will be conducted in the middle of March once coiled tubing equipment becomes available. Flow testing will follow shortly afterward and, assuming coiled tubing services are available at the scheduled date, the additional flow from this well should be available for export from 1 April. The Company will announce results of the flow test once complete.

The Company is confident from the electric logging, mud logging and gas shows in the reservoir section that the well will be a successful producer. Furthermore, the well is drilled alongside and replicates what was previously the best producing well in the field. Technical detail on the final pathway will be made available on the Company's website and social media pages later today.

Wet commissioning of the second compressor began last week and we expect successful full running in the coming days and are confident that the unit will be available for duty well before 1 April.

Proposed Board Reorganisation

In line with Angus' s vision of becoming a significant player in the aggregation, production and storage of gas, the Board has decided to strengthen its leadership to achieve its goals of delivering growth and returns to shareholders. Accordingly, the Board has resolved to make the following changes, subject to final terms being agreed:

Richard Herbert, a geologist by background, who joined the Board as a Non-Executive Director earlier this year has agreed to assume the role of Chief Executive Officer in charge of day to day management of the Company and responsibility for the ongoing development of the management team. Richard's background at the helm of independent oil and gas companies, such as Frontera Energy, combined with his experience as Head of Exploration at BP, his particular experience in the UK onshore makes him the ideal candidate for strengthening the execution of the Company's strategy.

George Lucan will take up the role of Executive Chairman with particular responsibility for stakeholder and governmental relations and strategic direction. Carlos Fernandes will continue in his role as Finance Director. Andrew Hollis will remain Technical Director of the Company but will be stepping down from his Board responsibilities.

Paddy Clanwilliam will step down as Non-Executive Chairman to become Senior Independent Non-Executive Director, alongside Krzysztof Zielicki, who remains our second Independent Non-Executive Director. Paul Forrest will remain a Non-Executive Director representing the interests of Forum Energy. One further Non-Executive Director is presently under consideration. A further announcement will be made once these changes are finalised.

Offer of Additional Funding

The cost overrun on drilling and the demands of evaluating new projects, including potential gas storage at Saltfleetby, have resulted in a short-term funding need for the Company. The Board after discussions with major shareholders has determined that it was prudent to secure additional funding, and wherever possible, such funding needs should be met with equity dilution only as a last resort.

Accordingly, Angus has entered into a non-binding, conditional Term Sheet with Aleph Commodities for a GBP 3 million junior debt facility intended to convert into a larger and longer-term prepayment facility, whilst production and revenue increase as the SF7v well comes online. The key features are a 6 month bridge finance, priced at SONIA + 15%, 150 million warrants, struck at the previous placement level of 1.65p/share and a repayment option, should the facility not be converted into the prepayment facility, of redemption in either cash or shares (at the option of the Company) at a 25% discount to the 30 day VWAP subject to a floor of 1p per share. Although there can be no guarantee that final documentation will be executed successfully, it is the Company's aim to expedite this process over the coming days.

KeyFacts Energy: Angus Energy UK country profile

KEYFACT Energy

KEYFACT Energy