By Kathryn Porter, Watt-Logic

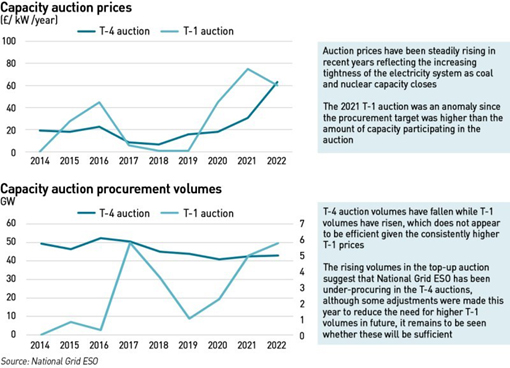

Last week the T-4 capacity auction for delivery in 2026-27 closed at a record price for the long-term auction of £63 /kW /year, an double the previous high in the T-4 auction, and higher than the price in the T-1 auction the previous week. This is the second highest ever price, after last year’s T-1 auction cleared at £75 /kW /year when the procurement target exceeded the amount of capacity participating in the auction.

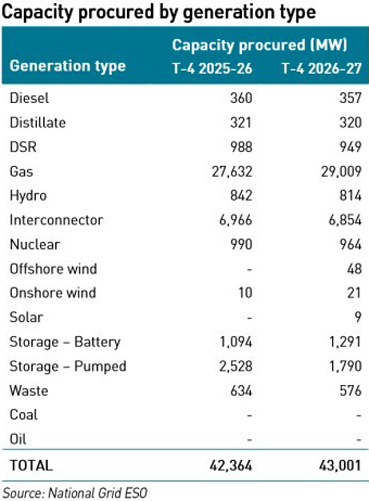

As with the T-1 auction, a small amount (47.6 MW) of off-shore wind secured contracts, alongside 20.7 MW of on-shore wind. Solar projects won 8.6 MW meaning that intermittent renewables accounted for 76.9 MW. While this is a very small amount, it has been growing in the past couple of years, which could turn out to be risky since system stress events are most likely to occur during periods of low wind output, and in winter, the evening peak when demand is at its highest is after sunset.

Most other technologies were broadly flat against the previous T-4 auction apart from gas which saw a 1.4 GW increase, including a brand new CCGT – a 1.6 GW unit that is to be built at Eggborough. Other significant new build included batteries (1.3 GW de-rated), the Viking interconnector (1.0 GW), DSR (0.8 GW) and gas engines (0.5 GW).

New-build gas capacity was expected but is controversial

Since only 39 GW of existing capacity entered the auction against a target of 43.9 GW, it was expected that new-build capacity would participate and set a price that was higher than in previous years, which is largely what happened, although the price exceeded analyst’s expectations with both BNEF and Aurora forecasting that prices would clear around £40-£53 /kW /year. The success of the new Eggborough CCGT is a rare but much needed success for a new-build CCGT in the capacity market, but it has attracted controversy since its 15-year contract will take its operations past the 2035 deadline for the electricity system to reach net zero.

The Government is currently consulting on plans to allow such plant to exit or suspend its capacity contract in order to install abatement measures, and it also intends to tighten emissions rules that would restrict the running hours of unabated gas plant.

There have been some suggestions that the Government might face litigation risks in relation to these contracts if generators see their income fall following the introduction of tighter emissions limits. Whether this is true would depend on the wording of the contracts – if they allow for changes in emissions limits to be applied to plant with an existing capacity contract then the risk of litigation would be limited, but if not, then generators might try to argue that the terms of the contracts have been changed without agreement, triggering a claim for compensation.

I’m not sure if such a claim could succeed since the Government’s intentions are clear, and developers should enter the auctions with this in mind. The developers may well be considering that the high clearing price will secure good economics for the first 9 years of the 15 year agreement and that the chances of the grid actually being net zero by 2035 are not that high, meaning that some of these rules may need to be relaxed to preserve security of supply. Indeed the 2035 target is explicitly subject to security of supply, providing the Government with a get-out-of-jail free card should it be needed.

Are the T-4 capacity auction targets appropriate?

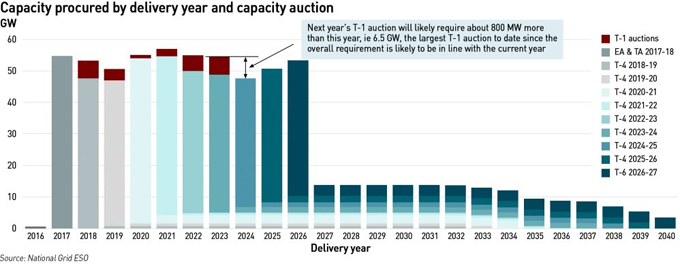

The procurement target for the T-4 auction had been raised by 1.5 GW last month following recommendations from National Grid ESO. The reasons for the increase were a reduction in the estimated amount of operational capacity outside the capacity market of around 350 MW and a 700 MW adjustment to account for a long-running discrepancy between units’ stated connection capacity and their Transmission Entry Capacity. Similar adjustments have been made for all previous T-1 auctions, so NG ESO believes that applying the adjustment to the T-4 auction would avoid the need to make the correction in future top-up auctions.

I can’t help wondering if the target wasn’t still too low. We have seen T-4 procurement falling, but T-1 procurement rising, suggesting that insufficient capacity is being procured in the longer-dated auction. This matters since the top-up auction tends to be more expensive, so getting this balance wrong adds arguably un-necessary costs to consumer bills.

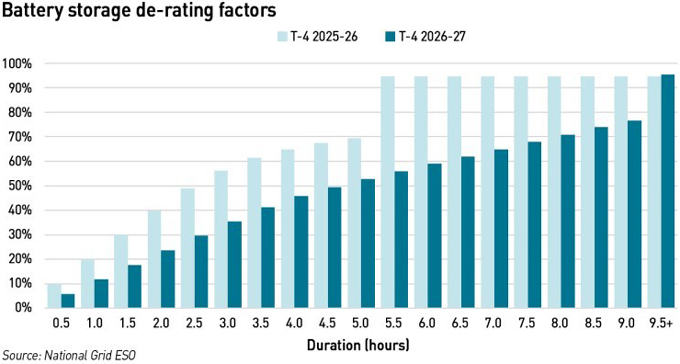

87.4% of the capacity was awarded to existing units, while only 8.0% of the procured capacity (3,451 MW) was for new-build generation projects, compared with 1,919 MW (4.5%) last year. While this is an improvement, concerns around whether the capacity market is securing adequate new capacity to replace conventional generating plant which is closing remain – over the next couple of years more than 4 GW of coal and nuclear capacity will close. To make matters worse, a third of the new-build capacity is made up of battery projects, whose duration is rarely more than 4 hours, and is typically closer to 90 minutes. This means they would be of limited use if a system stress event were to last longer than a couple of hours.

Despite the higher auction price, two new-build CCGTs (Killingholme, 429 MW and Dam Head Creek, 822 MW) and two large OCGTs (Eggborough, 285 MW and Corby, 314 MW) were un-successful. Together they could have added 1,850 MW of reliable, dispatchable generation. According to Timera Energy, capital costs for gas-fired projects are increasing due to a combination of de-carbonisation risks from 2035 as noted above, and investor ESG mandates.

“The big surprise in the auction was how high offer price levels were for new build capacity. Historically there has been a strong overhang of new build gas engine & CCGT projects above 30 £/kW/yr that have acted as strong price resistance. The increase in cost structure of this thermal capacity is playing an important role in pulling up capacity prices,”

– Timera Energy

The absence of nuclear generators reflects the fact that small modular reactors are not expected to be operating much before the end of this decade, still a few years beyond the horizon of this auction, and no large-scale nuclear projects can be built in the 4-year horizon of the market. Even my preferred Advanced Boiling Water Rectors have only been built in 5 years at best.

The contribution from batteries, while higher than in previous years, is lower than it might have been since battery de-rating factors were tightened this year. This meant that 5.0 GW of battery projects only added 1.2 GW of de-rated capacity. However, the higher auction price favoured longer-duration batteries, with 352 MW being secured. 4-hour batteries have less penal de-rating factors at 46% compared with 18% for a 1.5-hour battery.

The reduction in battery de-rating factors seems sensible, particularly reducing the de-rating factors for longer duration batteries down from 95% which carried an implicit assumption that system stress events would be short-lived. As the energy transition progresses and we become more reliant on wind, periods of low wind output will likely lead to system stress events for two reasons: the lower utilisation rates of conventional generation will mean there is less of it around and with many countries following a similar wind-led strategy, imports may not always be available when needed as connected markets may also be experiencing low wind conditions. Since those conditions can persist for days and even weeks, it seems risky to ascribe high availability rates to batteries that last for only fractions of a day. I think the de-rating factors may still be too high when we look forward into the next decade, so I would expect to see them decline, partly because as the assets age they will hold less charge and therefore run out faster, and partly because over time the likely length of stress events may increase.

Making the numbers add up

I continue to be concerned that procurement targets are falling short of what will be needed as we move thorough this decade against the backdrop of coal and nuclear closures, and the severe delays to the delivery of new nuclear. I worry about an over-reliance on interconnectors, whose performance in a system stress event is wholly un-tested.

When I mention these concerns to people at NG ESO, they point out that there has never been a system stress event and that higher levels of procurement would increase costs to consumers. Both of these are true, but that doesn’t mean the targets are correct – the very existence of the capacity market reduces the likelihood of system stress events since it ensures that capacity is operating: new capacity is built and existing capacity remains open. If the targets are set correctly, then you could argue that system stress events would be rare, and limited to times when risks overlap in unexpected ways, for example, low wind output coinciding with an unusually high number of gas or nuclear outages.

But I worry that there is too much focus on ensuring the capacity market does not inhibit net zero ambitions and not enough attention to the new risks that are emerging. That capacity shortages could occur in winter when demand is high is not new, but NG ESO does not currently adjust for the fact that the weather systems that lead to still weather in winter also result in very low temperatures. In other words at the times of highest demand, the contribution of wind is likely to be lower.

In addition to these winter risks, other factors are emerging which change the risk profile at other times of year. We have seen examples of low wind conditions being spread over very wide areas, and lasting for long periods – the heat-wave last summer was an example of this. This reduces the likely contribution of interconnectors since many of our connected markets have high weather correlation with GB and are also planning to rely on wind as a key source of energy in the future.

The weather patterns that create heatwaves don’t just suppress wind output – the heat itself creates problems. Very hot weather reduces the output solar panels which are less efficient when it is hot. Thermal power stations also become less efficient since it becomes more difficult to cool them and more energy is wasted as heat. Hot weather also increases heat losses in the grid itself – overhead power lines can slacken and sag with the heat, which increases their electrical resistance, and transformers produce heat when they operate, becoming less efficient as temperatures rise. If temperatures rise too much they become unsafe and can explode. In our connected markets, hot weather reduces hydro and nuclear output.

Heatwaves typically happen in the summer, which is also when most scheduled power station maintenance takes place. Planning maintenance in winter makes no sense since outright demand is higher, but maintenance has to happen sometime, so periods of low demand are chosen. However, there is a risk that a combination of conventional power station maintenance and low wind output in summer can create shortages – this happened last summer when there were several Capacity Market Notices issued as a result of low wind conditions when 12.5 GW of conventional gas and nuclear plant was offline for planned outages. This might even suggest that the risks of a system stress event are higher in summer because of the impact of maintenance, and this will certainly push up auction prices since generators will need to be compensated for the risk that they are unavailable during a system stress event due to a sensibly-planned maintenance outage.

Electricity market tightness in the shoulder months (spring and autumn) has long been a risk because of the chances that early or over-running maintenance coincides with unexpected or unseasonal weather. It may well be the case that as the grid de-carbonises, the risks of shortages will occur at any time of year rather than summer being a period of low risk, and that will make planning very difficult both for plant and grid operators. Indeed it might be sensible for generators and the system operator to co-ordinate maintenance, and for generators to be exempt from capacity market penalties if they are unavailable due to pre-agreed maintenance. That would allow NG ESO to manage the risks associated with summer maintenance, and reduce the chances of penalties, thereby preventing auction prices from rising to offset this risk.

At the same time as all of this, demand is set to rise due to the electrification of heating and transport. And if recent trends of hot summers continue, we could see growth in air-conditioning demand, particularly in the domestic sector – most heat pumps can provide cooling, so there would be a natural tendency towards demand growth if people install a heating system that can also provide cooling in summer when in the past they would not run their heating.

The past year has seen increased attention being paid to security of supply. This is welcome, but I worry it does not go far enough. Rising auction prices, and rising T-1 procurement both suggest the market is becoming tighter. Getting the targets wrong, or setting de-rating factors too generously will increase the risk of future capacity shortages as we accelerate the replacement of dispatchable generation with intermittent renewables.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy