- 46% increase in 2P reserves value per share to USD$1.75 (CAD$2.29) (GBP1.39)

- 2P estimated ultimate recovery now over 108 million barrels

- Strong 1P and 2P reserves replacement ratios of 179% and 418%, respectively

- 24% increase in 2P reserves to 96.7 million barrels

- 21% increase in 1P Reserves to 45.4 million barrels

- Added 7 2P well locations, a 32% increase, extending the 2P reserve life to 22 years

- 2P after tax NPV-10 value increased 48% since year end 2021 to more than $1.5 billion

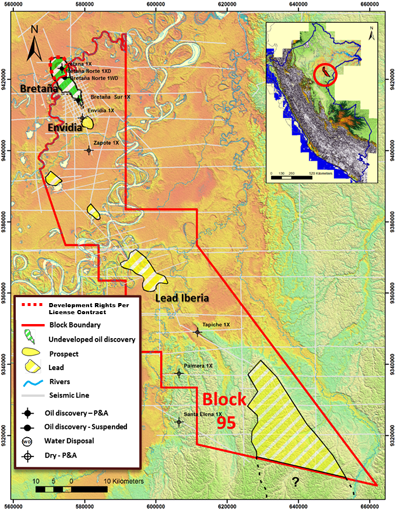

PetroTal has announced the results of its 2022 year-end reserve evaluation ('NSAI Report') by Netherland, Sewell & Associates for the Bretana oil field, operated 100% by PetroTal. All currency amounts are in United States dollars (unless otherwise stated) and comparisons refer to December 31, 2021.

Highlights:

- Increases to Net Present Value (discounted at 10% ('NPV-10')) after tax, per share values to US$0.90/share (CAD$1.23/share), US$1.75/share (CAD$2.29/share), and US$2.86/share (CAD$3.47/share) for 1P, 2P, and 3P categories, respectively;

- Significant increases in all reserve categories:

- Proved ('1P') reserves increased by 21% to 45.4 million barrels. NPV-10, after tax is $0.8 billion ($17.27/bbl);

- Proved plus Probable ('2P') reserves increased by 24% to 96.7 million barrels. NPV-10, after tax is $1.5 billion ($15.60/bbl); and,

- Proved plus Probable plus Possible ('3P') reserves increased by 14% to 168 million barrels. NPV-10, after tax is $2.5 billion ($14.69/bbl).

- Strong results for various key year-end 2022 reserve-based metrics:

- 2022 reserves life index for 1P and 2P reserves, are approximately 10 and 22 years, respectively, using a much higher assumed production run rate of 12,200 barrels of oil per day ('bopd') compared to approximately 7,300 bopd in the prior year;

- Robust 2021 production reserves replacement ratios of 179% and 418% for 1P and 2P reserves, respectively;

- Original Oil in Place ("OOIP"): Increases of 33%, 14%, and 2% to 329, 445, and 632 million barrels, respectively, for the 1P, 2P and 3P cases;

- Increased 1P, 2P and 3P total booked well counts in 2022 by 4, 7, and 7 wells to 21, 29, and 36 wells, respectively; and,

- 2P recovery factor continued to increase in 2022 to 24% (from 22% at year-end 2021) even after the 2P OOIP increased by 14%.

- 2022 Proved Developed Producing ('PDP') reserves increased 49% to 24.1 million barrels, representing 53% of 1P reserves, reflecting an attractive ratio of base production to low risk drilling proved undeveloped ('PUD') targets; and,

- 2P Future Development Capital ('FDC') increased 40% to $404 million from year-end 2021 reflecting an additional 7 wells booked at year-end 2022 and associated water disposal capacity and facilities needed to accommodate higher anticipated flush and run rate production volumes.

Manuel Pablo Zuniga-Pflucker, President and Chief Executive Officer, commented:

"Bretana's reserves have grown tremendously since 2017. Our drilling success combined with the field's strong natural aquifer support that allow for recovery factors beyond 30% has underpinned a world class oil operation that is expected to deliver immense free cash flow for the next 20 years. The field's initial 2017 2P estimated ultimate recovery was 37.5 million barrels which we have now almost tripled to 108.2 million barrels. The PetroTal team is committed to increasing value for all stakeholders from the oil field's ultimate oil recovery enhancement. Noteworthy that our PDP after tax NPV-10 valuation is similar to our current market capitalization. We see significant upside with respect to PUD, Probable, and Possible reserve values that are not reflected in our current market valuation."

KeyFacts Energy: PetroTal Peru country profile

KEYFACT Energy

KEYFACT Energy