Oil price

WTI $78.96 +31c, Brent $83.26 -15c, Diff -$4.30 -64c, USNG $5.28 +34c, UKNG 190.5p -2.0p, TTF €87.35 +€8.16

A mixed, low volume day as expected at this time of the year and as traders try to ensure that their books are flat by tomorrow’s close.

This morning the price has fallen, only by around a dollar but it is in reaction to a speech by President Putin in which he has said that Russia will stop selling crude and products to the ‘cap nations’ from February 1st for 6 months with a seperate ban on refined products to come.

Also it’s worth taking a look at CNBC where Brian Sullivan interviews the legend and author of The Prize Daniel Yergin. In the interview Dan says that we are seeing the collapse in the global oil market as we know it, up until now oil from South America and the Middle East around the globe but from now Russian crude flows east and under a restricted price. He thinks that Russia will lose money as a result of the sanctions particularly as whilst they can buy up tankers, insurance through the London market is more difficult.

Challenger Energy Group

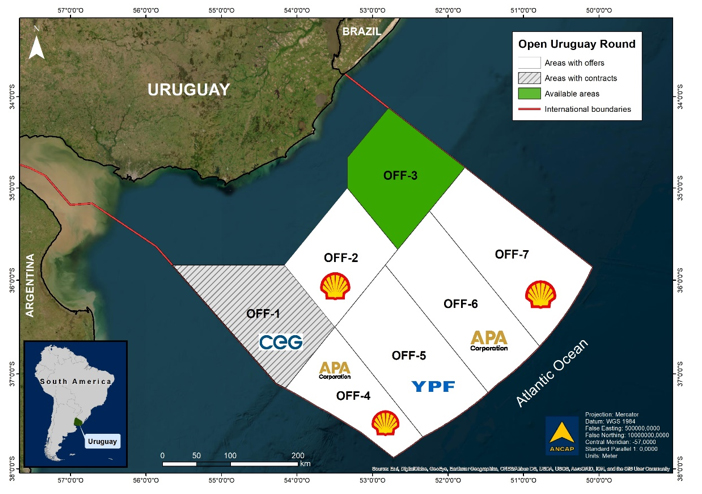

As a result of the Open Uruguay Round process approved by Decree 111/019, three bids for the exploration and production of hydrocarbons for two offshore areas of Uruguay were received in the second instance of 2022 (OFF-4 and OFF-5).

YPF (www.ypf.com) submitted bids for areas OFF-4 and OFF-5. On the other hand, a consortium formed by APA Exploration LDC (APA group company, www.apacorp.com) and BG International Limited (Shell group company, www.shell.com), submitted a bid for the OFF-4 area. This means that there was competition for OFF-4.

After the corresponding analysis, the bids submitted by the APA/Shell Consortium for the OFF-4 block and the bid submitted by YPF for the OFF-5 block were awarded.

The winning bids include the following committed exploratory programs:

As can be seen, the work offered includes the acquisition of new 3D Seismic data in the OFF-4 area. The rest of the activities proposed by the companies involve using the extensive database of existing seismic data, generated in the framework of previous round processes, for the definition of prospects of greater exploratory interest. The nominal investment associated with the work presented amounts to US$ 31 million for both areas, at full cost and risk of the companies.

After these offers are formally approved, ANCAP will request authorization from the Executive Branch to sign the contracts with the awarded companies for each Area, as stipulated in Decree 111/019. It should be noted that such hydrocarbon exploration and production contracts establish that the companies assume all the risks, costs and responsibilities of the activity and such costs will only be reimbursed in the event of commercial production.

Exploration and production projects are subject to national environmental regulations, and ANCAP promotes the adoption of the industry’s best practices and technologies aligned with such regulations and with the objective of carrying out sustainable activities. Uruguay has developed specific regulations and guidelines for these activities, including recent experience in environmental authorizations for marine seismic projects and offshore exploration wells, through the Ministry of Environment as the competent agency.

In conclusion, considering the news mentioned above, the updated offshore oil and gas map of Uruguay is presented below:

For our interest it can be seen that CEG, with its early approach got OFF-1 100%.

Some comments from Eytan Uliel, CEO of Challenger Energy talking to Petroleum Economist:

Uruguay has “all of the technical merits but none of the issues”, says Eytan Uliel, CEO of AIM-listed independent Challenger Energy. The frontier country “has, in a short space of time, become a focal point of the whole business”, Uliel says, adding there is significant potential for “value uplift ” there.

Challenger was the only applicant when it opted to bid for a Uruguayan licence in May 2020, but the block “was very big, off shore and in shallow water”, with historic, 2D seismic data available. “No one had really paid much attention to it” he adds.

It was two years before Uruguay’s president formally approved the licence—which therefore started in August this year—but during that time the Venus and Graff discoveries were made in Namibia by TotalEnergies and Shell respectively. Uruguayan geology is “the direct conjugate margin” of the discoveries in Namibian waters, Uliel says, noting that, as a result, Challenger has seen a significant upswing in interest from potential investors and partners.

Uliel confirms his company is discussing farm-in options, ideally with “one of these much larger companies”, which “will allow us to accelerate to the next phase of work, which would be a 3D seismic acquisition campaign”. And there is already talk among the licensees in Uruguayan waters of collaborating through a “3D multi-client seismic survey”, he adds.

Despite being a frontier country for oil and gas, Uruguay is a “great place to do business with a really transparent, clear licensing regime”, Uliel continues, praising Montevideo’s “functioning bureaucracy” and lack of corruption.

For CEG this is extremely interesting, basically a Shell / APA consortium have secured the licence right next to theirs, with a technical work program including 3D seismic. This is especially interesting as the 3D seismic will abut their licence, and so it makes sense to work out some cooperation at the very least.

The next interesting piece of news here is that YPF has picked up AREA OFF 5, as I predicted when writing about CEG’s early manoeuvres offshore Uruguay earlier this year they have ended up in a sea of majors; all but 1 licence in Uruguay is now gone. This means that the company will need to spend less than $1m and will finish all of its initial 4 year work commitment within the next 6 months; meanwhile the majors will be spending over $230m in the next few years.

Finally, just across the way, YPF has now got Court approval to commence seismic on the CAN-1 block, this is interesting as it is offshore Argentina but more importantly it is immediately proximate to the CEG block as well: https://www.batimes.com.ar/news/argentina/court-approves-offshore-oil-exploration-projects-off-coast-of-buenos-aires-province.phtml

So, as we knew, whilst the world was in the grips of the pandemic, the CEG team had nipped in under the noses of the majors and picked up what might be the prime block in this exciting frontier area. Obviously the optimum route for them would be to farm-out but as we can see, CEO Eytan Uliel is looking at all his options and I can see that most outcomes involve a potentially huge win for the company, something that the market has yet to acknowledge.

KeyFacts Energy Industry Directory: Malcy's Blog

KEYFACT Energy

KEYFACT Energy