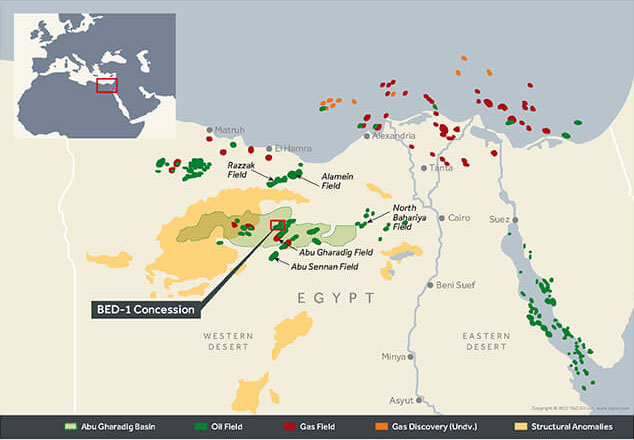

TAG Oil announces the results of its independent resources evaluation of the Abu Roash “F” unconventional formation (“ARF”) in the Badr Oil Field (“BED-1”), Western Desert, Egypt, dated November 21, 2022 (the “BED-1 Report”), prepared by RPS Energy Canada Ltd. (“RPS”) and its previously announced independent reserves report associated with its royalty interests within Petroleum Mining Permit (“PMP”) 38156 (Cheal A/B), PMP 60291 (Cheal E) and PMP 53803 (Sidewinder) (collectively the “Permits”), onshore New Zealand, dated November 7, 2022, prepared by ERC Equipoise Ltd. (“ERCE”).

A) BED-1 REPORT HIGHLIGHTS

- RPS estimates the ARF oil-initially-in-place (“OIIP”) P50 Volumes to be 531.5 million barrels over the BED-1 concession area and Mean Volumes to be 536.6 million barrels. The discovered OIIP in the ARF is imaged by 3D seismic coverage, significant well control with over 30 penetrations, petrophysical analysis of available log and core data and production tests from the ARF.

- TAG Oil’s current Field Development Plan (“FDP”), consisting of drilling 20 horizontal wells to be completed with multi-stage fracture stimulation, is focused on the east central part of the BED-1 concession area and contains OIIP P50 Volumes of 178.3 million barrels and Mean Volumes of 179.0 million barrels.

- FDP Capital investment discounted at 10% is US$104 million for the 2C Development Pending Contingent Resources in the ARF.

- FDP Operating investment discounted at 10% is US$160 million for the 2C Development Pending Contingent Resources in the ARF.

- RPS best estimate for Contingent Resources volumes (2C Development Pending) is 27.0 million barrels gross with 16.5 million barrels net to the Company.

- RPS estimate for Contingent Resources (2C Development Pending) net present value discounted at 10% and assumed RPS Price Forecast of April 1, 2022, per barrel is US$339 million (risked at 80% chance of development) and US$423 million (un-risked).

B) ROYALTY REPORT HIGHLIGHTS

- ERCE estimates the 1P Proven Reserves Volumes to be 14 thousand barrels and 2P Proven plus Probable Reserves Volumes over the Permits to be 53 thousand barrels net to the Company.

- Net present value discounted at 10% is CDN$1.47 million for Proved Reserves and CDN$4.96 million for Proven plus Probable Reserves.

Abby Badwi, Executive Chairman of TAG Oil commented,

“We are pleased that the RPS report supports TAG’s technical assessment of the unconventional development of the ARF and our team’s plans for such large-scale development by utilizing North American proven drilling and completion technologies for the first time in Egypt. To validate these assessments, the first pilot well, a re-entry of an existing well, is scheduled for next month and will be followed by the first horizontal well with multi-stage fracture stimulation completion to be drilled in the first quarter of 2023. In New Zealand the value of the royalty interest is attributable to the Company continuing to receive a gross overriding royalty equal to 2.5% of the gross sales revenue. In the 2022 calendar year, the Company received CDN$947,477 in royalty payments.”

KeyFacts Energy: TAG Oil Egypt country profile

KEYFACT Energy

KEYFACT Energy