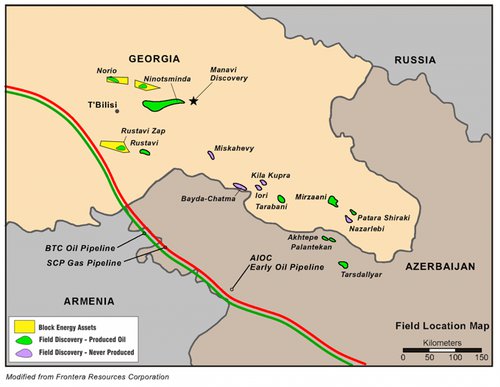

Block Energy Plc, the exploration and production company focused on Georgia, is pleased to announce its operations update for the three months ended 30 September 2022.

Highlights

- Over 102,300 operational man-hours worked in Q3 2022, with no Lost-Time Incidents

- Minimum Work Programme Commitments completed across the entire portfolio

- Deepening of well JSR-01 drilled successfully and below budget, testing programme has now commenced

- Competent Persons Report reaffirms opportunity and investment case for Project I, NPV10 US$57MM (3P Reserves case)

- Q3 production of 37.1 Mboe (Q2: 47.2 Mboe)

- Q3 revenue of $1,833,000 (Q2: $2,228,000)

- As at 30 September 2022 cash balance of$1.1m (30 June 2022: $1.4m) and over 13,000 bbls of oil inventory

During the third quarter of the year the Company continued to deliver on the value opportunity across its asset base. Block again reports robust production, cashflow and cash position. It also continued to demonstrate its technical and operational capability through the successful deepening of well JSR-01 and the independent verification of Project I provided by the Competent Persons Report.

Operations

The Competent Persons Report issued in July independently verified the plan for the initial phase of Project I, with gross field 3P reserves of 3.01 MMbbls with a NPV10 project value of US$57MM, in-line with the Company's internal estimates. The initial phase of Project I comprises five production wells in the West Rustavi / Krtsanisi field.

The scope of the report was deliberately focused on the Krtsanisi Anticline only, with the specific aim of supporting discussions around non-dilutive financing and is not comparable to previous reserve reports. Discussions with a number of parties are ongoing, with strong interest in the region being shown, albeit the Company is well placed to self-fund operations as desired.

Preparations for the deepening of well JSR-01 in the Patardzeuli oilfield were successfully concluded during the period; drilling commenced in late July. Drilling operations were subsequently complete by late September, safely, on plan and below budget.

Testing operations are currently underway, and the Company looks forward to providing a further update to the market once complete. The deepening of the JSR-01 well is designed to evaluate an undrained area of the Middle Eocene reservoir.

The deepening JSR-01 represented the start of Project II and reflected the Company's prudent use of cashflow generated from production to self-fund new wells and rapidly progress the three-project strategy outlined earlier in the year, to accelerate revenues and to evaluate the significant oil & gas opportunities that exists across Blocks XIF and XIB.

As announced in July, during the quarter the State Agency of Oil and Gas ("SAOG") certified that the minimum work programme for Block XIF had been completed, providing the Company security of title, over the licence to 2043. Block has now completed the minimum work programmes across its entire licence portfolio, yet another significant milestone.

Oil and Gas Production

During Q3, gross production (including the state of Georgia's share) was 37.1 Mboe (Q2: 47.2 Mboe), comprising 28.1 Mbbls of oil (Q2: 32.8 Mbbls) and 9.0 Mboe of gas (Q2: 14.4 Mboe). The average gross production rate for Q3 was 404 boepd (Q2: 519 boepd).

Production during the quarter reflected consistent performance from well JKT-01Z and the Company's other producing wells. This followed an extensive intervention programme during the first half of the year, which comprised over 23 workovers. Average Q3 production performance was affected by production volatility from well WR-38Z and greater than average pump maintenance and power supply outages. The production volatility at well WR-38Z is now under control following the implementation of a new production scheme.

Oil Sales

During Q3 2022, the Company sold 17.9 Mbbls of oil (Q2: 21.2 Mbbls) for $1,614,000 (Q2: $1,992,000), with a weighted average price of approximately $92 per barrel (Q2: $94 per barrel), a 2.1% decrease in the realised price in Q3 compared with Q2.

As at 30 September 2022, Block had over 13,000 bbls of unsold oil in inventory.

Gas Sales

During Q3 2022, the Company sold 36.1 MMcf of gas (Q2: 58.4 MMcf) for $192,000 (Q2: $236,000), with a weighted average price of $5.31/Mcf (Q2: $4.04/Mcf). The gas price increase occurred as a result of negotiations with the buyer and an improvement in the reference price on which the contract is based.

Cash Position

As at 30 September 2022, the Company had $1.1million cash at bank (30 June 2021: $1.4 million). The decrease in the cash position reflects the cost of drilling well JSR-01, ordering of LLIs associated with 2 further side tracks, and the workover operations undertaken in the period, offset by continued solid revenue and cashflow generation.

Block Energy plc's Chief Executive Officer, Paul Haywood, said:

"Q3 saw the Company deliver robust production, good cashflows and end the period with cash and oil inventory that will support the ongoing and self-funding development of its three-project strategy. The successful deepening of well JSR-01 saw the progression of this strategy and reflected the Company's technical and operational excellence. Block is better placed than ever to progress and realise the value opportunity that exists across its portfolio, whilst testing JSR-01 DEEP and preparing for drilling the next well in our multi well drilling programme".

KeyFacts Energy: Block Energy Georgia country profile

KEYFACT Energy

KEYFACT Energy