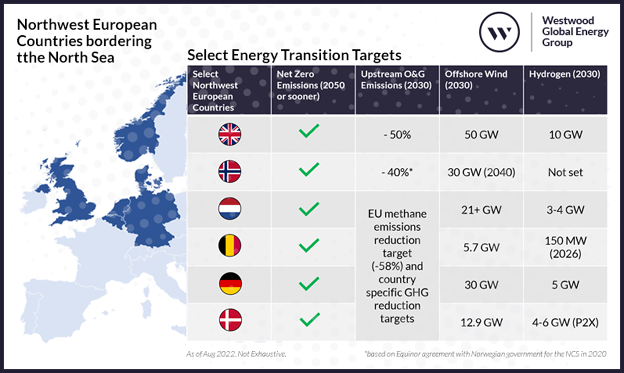

Net Zero targets and emission reduction initiatives in Northwest Europe (NWE) have created huge opportunities in offshore wind, hydrogen and carbon capture and storage (CCS) for those countries bordering the North Sea.

To leverage these, collaboration between stakeholders is going to be essential; creating markets for hydrogen and carbon where there were previously none, while integrating the offshore wind sector to maximise wind as a reliable energy source.

NORTHWEST EUROPE ENERGY TRANSITION TARGETS

SOURCE: WINDLOGIX, WESTWOOD ATLAS, GOVERNMENT ANNOUNCEMENTS, NSTA, EQUINOR

Same but different

While these countries may all be targeting Net Zero by 2050 or sooner, their approach to decarbonisation and thus opportunities will differ, depending on the existing energy supply mix, a country’s economic make-up, and available carbon storage potential.

A high density of emissions-intensive heavy industries has resulted in the UK adopting an industrial decarbonisation cluster approach. By 2030 the UK is targeting 10 GW of hydrogen production from both blue and green sources (up from an initial target of 5 GW) alongside a carbon storage target of 20-30 MTPA. Hydrogen production and fuel switching will support hard to abate sectors, while CCS will ensure heavy industries can continue to thrive in a Net Zero future. Via its CCUS Cluster Sequencing Process, the UK government is targeting deployment of two clusters by the middle of the decade, with the East Coast Cluster and the Hynet Cluster having been selected, and plans for a further two clusters to be online by the end of the decade.

With an electrical grid made up of 95% renewable sources and 50% of large point source emissions from offshore oil and gas (O&G) installations, Norway’s offshore CO₂ storage potential far exceeds its domestic needs. The strategic focus in Norway is on becoming a net importer of CO₂. The Northern Lights CCS project recently agreed the main principles for the world’s first cross-border CO₂ transport and storage contract, where CO₂ will be transported from Yara ammonia and fertiliser plant in Sluiskil, Netherlands, to the storage site in Norway.

When it comes to hydrogen, Norway is looking to capitalise on its large natural gas reserves and is hoping to become a net exporter of hydrogen and other higher energy density carriers, the Barents Blue project being a prime example; an 800 MW blue hydrogen project that will subsequently be converted to ammonia for export. Integration between offshore wind and O&G facilities has already developed, with Equinor’s offshore floating wind farm Hywind Tampen looking to partially electrify the Snorre and Gullfaks platform.

In the Netherlands, an extensive gas grid, large industrial clusters, and nearby offshore wind farms, makes the country well suited to an energy system in which hydrogen plays a significant role. The development of CCS clusters such as the Porthos project located in Rotterdam will enable carbon capture from industries in the region.

Belgium will be a net exporter of CO₂ with recent announcements between Equinor and Fluxys reviewing the potential of running a pipeline from Zeebrugge in Belgium to Norway for permanent storage.

Denmark on the other hand is now targeting green hydrogen production with power-to-x to produce green fuel to power aircraft, ships and trucks. The Danish government said its 4-6 GW target will produce about two million tonnes of green hydrogen per year, positioning Denmark as a future net exporter of green energy. While the recent announcement of a cross-border CO₂ transportation arrangement between Denmark and Belgium paves the way for more efficient international cooperation on CCUS, enabling Denmark to become a net importer of CO₂.

Finally in Germany, heavy industry and large point source emissions will undoubtably require CCS and hydrogen to support Net Zero targets. Equinor and Wintershall Dea recently announced plans to develop the Norwegian-German (NOR-GE) CCS project via a 900 km pipeline from the Wilshelveim CO₂ collection hub in Germany to storage sites on the Norwegian Continental Shelf (). The country is leaning towards green hydrogen as it looks for ways to reduce its reliance on Russian Gas, recently signing an agreement with Canada to import green hydrogen.

In short, each country bordering the North Sea has Net Zero targets but is approaching emissions reduction in a different way, depending on the magnitude, location, and source of emissions.

Clusters enable collaboration

Hydrogen and CCS projects are establishing themselves through clusters that support sectoral decarbonisation in areas of concentrated emissions sources, while also promoting new economic development opportunities in these areas. The development of these clusters will be vital to not only manage the number of stakeholders involved but to ensure collaboration between industries and stakeholders that have not previously worked together.

For example, in the UK’s East Coast Cluster project, there are currently 14 carbon capture projects progressing to the due diligence stage of the Phase-2 Cluster Sequencing process, including blue hydrogen manufacture, refineries, fertiliser plants, and waste-to-energy facilities. With several other carbon capture projects potentially involved in the cluster, the number of stakeholders involved will continue to grow. Given that each project will involve multiple stakeholders progressing on separate timelines with different capacities, technologies and support mechanisms, all the while having pipeline transport networks and intermediate storage being developed in parallel, collaboration will be key to ensure project success.

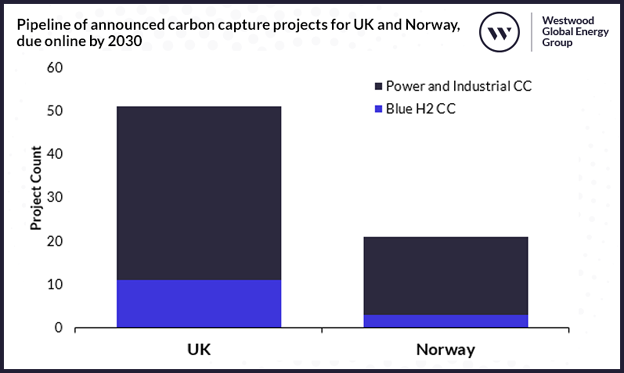

With this complexity in mind, Westwood’s Atlas New Energies market intelligence solution for Northwest Europe’s energy transition, tracks carbon capture (CC) and carbon storage (CS) projects separately, to better understand the nuisances between projects and understand the interdependency between projects.

PIPELINE OF ANNOUNCED CARBON CAPTURE PROJECTS FOR UK AND NORWAY, DUE ONLINE BY 2030, WITH BLUE HYDROGEN PROJECTS IDENTIFIED

SOURCE: ATLAS NEW ENERGIES, WESTWOOD ANALYSIS

Of the 70 plus UK and Norway CC projects that Westwood is currently tracking, 14 are blue hydrogen projects producing over 22 tonnes/year of CO₂, which will require storage. For the Acorn project as part of the Scottish Cluster, currently over 50% of the 5 MTPA of CO₂ to be stored in the initial phase of the project is expected to come from blue hydrogen projects. In the East Coast Cluster, the bpH2Teesside, H2NorthEast and H2H Saltend blue hydrogen projects make up nearly 3 MTPA of the initial supply of CO₂ to be stored.

While every blue hydrogen project will need a sink for its produced CO₂, CS projects may need to diversify the supply of their CO₂ to decouple their dependency on the success of blue hydrogen. The rapid development of CO₂ carriers will help provide access to more sources of CO₂, but it comes at a cost when considering CO₂ shipping payments and the construction of an offloading terminal.

In addition to blue hydrogen and CS, other interlinkages are developing in the New Energies space. Green hydrogen projects are coupling with CC from neighbouring emitters or direct air capture plants to produce synthetic fuels, while electrolysers are being installed directly on offshore wind farms to produce offshore hydrogen.

Although the drive to Net Zero presents multiple opportunities within the sector, collaboration will be key in turning those opportunities into reality.

Stuart Leitch, Senior Analyst – Emissions & New Energies, Westwood Global

sleitch@westwoodenergy.com

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy