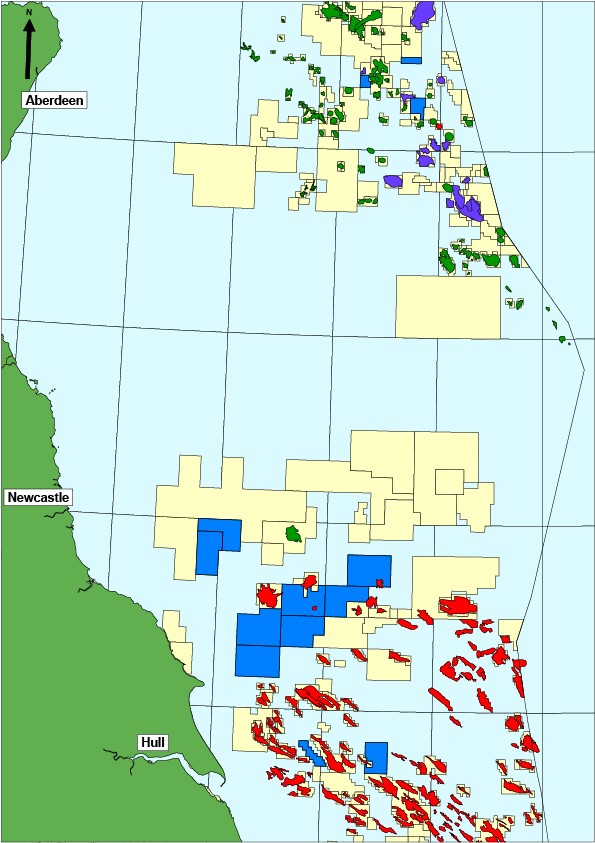

Deltic Energy Plc, the AIM-quoted natural resources investing company with a high impact exploration and appraisal portfolio focused on the Southern and Central North Sea, today announced its interim results for the six months ended 30 June 2022.

Highlights

- Potentially transformational Pensacola exploration well with Shell due to commence drilling in October, targeting an estimated 309 BCF (P50 Prospective Resources) of natural gas.

- Recently committed to a second potentially company-making exploration well with the Selene prospect which contains an estimated 318 BCF (P50 Prospective Resources) of natural gas.

- In the current environment of high energy prices and with ongoing security of supply issues these two prospects will be enormously valuable if successful.

- The Deltic-Capricorn Joint Venture ("JV") is making significant progress across five Southern North Sea licences including taking delivery of new 3D seismic data across licence P2428.

- Deltic's technical team have successfully completed the initial phase of geological work on the Syros prospect in the Central North Sea, and a farm-out process has now commenced as a result.

- Confirmation of new licensing round to be launched in autumn. Preparatory work in anticipation of the UK's 33rd Offshore Licensing Round has commenced with Deltic looking to further strengthen and diversify its portfolio.

- Following significant investment across the portfolio, including preparatory works for the Pensacola well, the Company has maintained a strong balance sheet with cash of £7.6m as at 30 June 2022 (30 June 2021: £11.1m) and remains fully funded for the Pensacola well.

- Loss for the period of £1,031,280 (six months to 30 June 2021: £691,754).

- Cash out flow for the period of £2,464,362 (six months to 30 June 2021: £873,064).

Graham Swindells, CEO, commented:

"I am extremely proud of what we have achieved in the year so far and very excited about the outlook for our company. We have seen considerable progress made across our business, with key developments involving our Pensacola and Selene Prospects, which contain over 600 BCF (P50 Prospective Resources) of natural gas, as well as progressing the licences which formed part of our transformational farmout and partnership with Capricorn Energy. As we stand on the verge of drilling our first well on Pensacola with our partner Shell, and with Selene now to follow, we are further demonstrating the success of our business model which is focussed on identification of early stage opportunities and taking them from licensing through to drilling whilst introducing partners of the highest calibre."

Operating Review

It has been another positive period with the Company announcing a number of key milestones, including the signing of the rig contract for the Pensacola well, which is due to spud in October, and the announcement that the Shell-Deltic JV had reached a positive well investment decision on the Selene prospect. This means Deltic and its shareholders are now participating in two firm wells, operated by their partner Shell, which Deltic estimates are targeting combined gross P50 prospective resources of 627 BCF with 252 BCF (50 mmboe) net to Deltic.

The benefits of Deltic's portfolio of licences, which contain a diverse range of prospects in different geological plays, is becoming apparent as Capricorn continues to invest significant time and resources in maturing the prospect inventory across the five Southern North Sea licences which were farmed out to Capricorn in 2021. It is anticipated that this work could result in a number of further exploration wells in the coming years.

The initial geotechnical evaluation of the Syros prospect, located on Licence P2542 in the Central North Sea close to existing infrastructure on the Montrose-Arbroath high, has been completed with the revised prospect estimated to contain P50 prospective resources of 24.5 mmboe. On the back of this re-evaluation, work is now commencing on attracting partners to take this opportunity through to drilling.

Additionally, the Deltic technical team has been planning for the upcoming 33rd Licensing Round which the North Sea Transition Authority ("NSTA") has indicated will commence before the end of this year with licence awards expected mid-2023.

Southern North Sea Assets

P2252 - Pensacola (30% Deltic, Shell 70% (Operator))

During the period, the partnership has been focused on the preparatory works required for the drilling of the Pensacola exploration well. It was announced on 29 June that the rig contract had been signed by Shell and that the Maersk Resilient would be drilling the Pensacola well once it has completed operations on a Shell operated development well in the Dutch sector. Preparation of the seabed at the well location, in anticipation of arrival of the drilling rig, has been completed and the well is scheduled to be spudded in October.

A drilling the well on paper ("DWOP") exercise was recently carried out with Shell, Deltic, Maersk and other key service companies in The Netherlands to refine the well design and operations in general. A further separate session was held focussing specifically on data acquisition, wireline logging, coring and well testing plans.

Pensacola is a Zechstein Reef prospect located to the north-west of the Breagh gas field in the Southern North Sea. Deltic estimates the prospect to contain gross P50 prospective resources of 309 BCF, with a 55% geological chance of success, which will rank Pensacola as one of the highest impact exploration targets to be drilled in the gas basin in recent years.

Under the terms of the farm out to Shell, Deltic was carried through the initial work programme including the acquisition of new 3D seismic across the Pensacola prospect. Costs for the Pensacola well are shared in-line with the licence working interests, and Deltic remains funded for the costs of the Pensacola well.

P2437 - Selene (50% Deltic, 50% Shell (Operator))

On 26 July, Deltic was delighted to announce that the JV has made a positive well investment decision in relation to the Selene prospect. The NSTA have been informed of the partnership's intention to move to Phase C of the licence, and, as a result of the positive well investment decision, the process of appointing Shell as the licence and well operator has commenced. Well timing is yet to be confirmed, although, based on previous timelines, Deltic expects the well will be spudded within the next 18 months. Meanwhile, efforts will focus on refining the well location and data acquisition programmes to support site survey work, well engineering, and permitting work during the summer of 2023.

Deltic remains convinced that the Selene Prospect is one of the largest unappraised structures in the Leman Sandstone fairway of the Southern Gas Basin and estimates that it contains gross P50 Prospective Resources of 318 BCF of gas (with a P90 to P10 range of 132 to 581 BCF) with a geological chance of success of 70%.

Under the terms of the farm out with Shell, Deltic holds a 50% working interest in the licence, but will be carried for 75% of the costs of drilling and testing the well on the Selene prospect, up to a gross aggregate of USD$25 million.

P2428 - Cupertino Area (Deltic 40%, Capricorn 60% (Operator))

The final processed version of the new 3D seismic data over Licence P2428 was delivered at the beginning of May with further additional products to aid interpretation developed by Capricorn during June and July. The new 3D data is generally of good quality and vastly superior to the legacy 2D data that had been available prior to the 3D seismic being acquired. Naturally, the Plymouth prospect was the initial focus, given the potential read-across from the Pensacola well to be drilled later this year. However, the new 3D data does not support the earlier interpretation made on the legacy 2D seismic and the prospect has been downgraded in relation to the other prospects and leads which exist on the licence. Interpretation of the new data is ongoing, with Capricorn now directing its attention towards maturing the other prospects and leads in the Carboniferous, Leman Sandstone, and the Triassic Bunter Sandstone, including the Cupertino and Richmond prospects which were the original focus of the licence application.

In addition to the seismic interpretation, Capricorn is completing and integrating a number of other geological workflows into local and regional models, including petrophysical analysis, sedimentological studies, basin modelling and structural analysis to support the maturation of the various prospects and leads identified on the block.

P2567 - Cadence (Deltic 40%, Capricorn 60% (Operator))

During the period, Capricorn has been focused on acquiring and integrating the available legacy seismic data, various geotechnical datasets, and the results of new petrophysical analysis into its regional model. Significant effort has been expended on understanding the legacy VE08 3D seismic survey that covers the entire licence area to determine the best technical way forward for reprocessing, and improving the data quality of that survey, using the most up-to-date seismic reprocessing workflows. This enhanced dataset is expected to be delivered before the end of the year and will allow for a robust assessment of the Triassic and Carboniferous prospectivity identified across the licence area.

P2560, P2561 and P2562 - South Breagh Area (Deltic 40%, Capricorn 60% (Operator))

Similar to Licence P2567, Capricorn has been focused on acquiring and integrating the available legacy seismic and geotechnical datasets into its regional model. This has included the purchase of a number of seismic datasets and commencement of seismic reprocessing of the Lochran 3D seismic survey which covers much of Licence P2560 and the northern part of P2562. It is expected that the reprocessed seismic dataset will be available in early 2023.

P2435 - Blackadder (Deltic 25%, Parkmead 75% (Operator))

Deltic has been informed by the Operator, The Parkmead Group, that a farm out partner could not be found to assist in the maturation of the Blackadder prospect, and that a positive well investment decision could not be taken within the current licence timelines. There are a number of technical challenges with the Blackadder prospect, including inadequate seismic image quality associated with the legacy datasets and a structurally complex setting. The Operator has recommended that the licence be relinquished and the NSTA has been informed that the partnership intends to relinquish the licence at the end of the current licence term on 30 September.

Central North Sea Assets

P2542 - Syros (Deltic 100%)

During the period, the Deltic technical team has been focused on maturing the Syros oil prospect based on a newly reprocessed seismic dataset that was delivered in Q1 2022. The Syros prospect has been recognised by previous operators, however the new seismic dataset with significantly enhanced image quality has allowed for a significant reinterpretation, resulting in a simpler and more robust prospect. The Syros prospect is now considered to be a simple rotated fault block, with the Fulmar reservoir very similar to the adjacent Godwin and Caley fields which produced first hydrocarbons in 2014 and 2017, respectively.

The prospect is estimated to contain P50 prospective resources of 24.5 mmboe with P90-P10 range of 12.4 to 33.3 mmboe and a GCOS of 58%. There are multiple offtake options locally with the Arbroath-Carnoustie infrastructure located only 6.5km to the east, and multiple other offtake options including Cayley, Arbroath, Shaw and Gannet within 13km of the licence.

Initial feedback from operators in the area has been positive and a farm out process is commencing with the aim of receiving offers before the end of the year.

P2352 - Dewar (Deltic 100%)

Despite extensive efforts and a significant amount of interest from the industry, a farm out partner could not be found to participate in the drilling of the Dewar prospect within the current licence timelines. Consequently, the intention is to relinquish the licence at the end of its current term on 30 September 2022 and the NSTA has been informed of our intention. The Company will, however, consider re-applying for the Dewar licence as part of its applications for new licences in the 33rd Licensing Round.

33rd Offshore Licensing Round

As part of the new UK Energy Security Strategy, the UK Government announced that the 33rd Offshore Licensing Round would commence before the end of 2022. The exact dates, process and areas to be included in the licensing round have yet to be clarified by the NSTA, but Deltic expects the round to be opened in Q4 2022 with potential licence awards in Q2 or Q3 2023.

Work has begun in-house to identify areas and prospects of interest, as well as potential partnerships on certain opportunities. Given recent changes to the UK tax regime, high resource prices and general industry sentiment, especially towards natural gas opportunities, we are expecting this upcoming round to generate significant interest.

KeyFacts Energy: Deltic Energy UK country profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy