As part of our 'at-a-glance' guide to company global operational activity, we feature Azule Energy.

In March 2022, bp and Eni signed an agreement to form a new 50/50 independent company, Azule Energy through the combination of the two companies’ Angolan businesses.

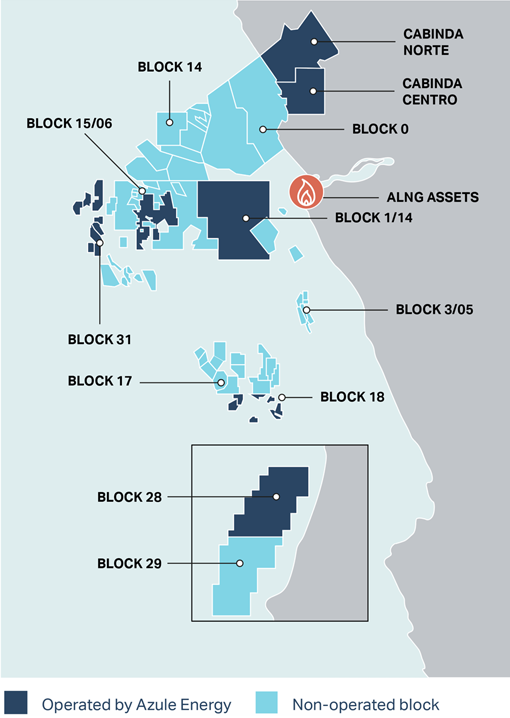

The main assets now transferred to Azule Energy are:

- From bp: operated Blocks 18 and 31 offshore Angola, and non-operated stakes in blocks 15, 17, 18/15, 29 and NGC, and a participation in Angola LNG JV.

- From Eni: operated Blocks 15/06, Cabinda North, Cabinda Centro, 1/14, 28 and soon NGC. In addition, stakes in non-operated blocks 0 (Cabinda), 3/05, 3/05A, 14, 14 K/A-IMI, 15 and participations in Angola LNG and, prospectively, Solenova JVs.

Azule Energy will invest in new infrastructures and new technologies to drive the Angolan energy industry forward, while doing so in a way that is environmentally responsible and socially just.

Azule Energy aims to become a pioneering exemplar of integrated international energy company. As well as producing #oil and generating energy from #solarpower, the company will target Angola’s natural #gas reservoirs – a first for the nation - and enhance the nation’s capacity as a global exporter of gas.

Azule Energy is designed to become a leading lowcost, lowcarbon energy operator. An African success story steeped in the heritage and expertise of its founder partners, bp and Eni.

In 2021 bp’s total production in Angola was approximately 100,000 boe/d. Eni’s total production in Angola was approximately 100,000 boe/d. Both bp’s and Eni’s equity share of Azule Energy’s production is expected to be approximately 100,000 boe/d.

ANGOLA OPERATIONS

Azule's portfolio of assets includes 16 licenses, 6 of which are operated by Azule. They include oil and gas production and the New Gas Consortium, Angola’s first non-associated gas project. The company also holds a participation in Angola LNG JV and Solenova, a solar JV with Sonangol developing Caraculo’s photovoltaic project.

Oil

Angola’s offshore and onshore oil producing and exploration locations are segregated into defined areas or licensed ‘blocks’. Operations are located in 16 blocks, both offshore and onshore. Azule directly operates 8 of these blocks.

In 2022 oil and condensates will account for about 85% of total hydrocarbon production, or approximately 200 mbbl/d growing to about 250,000 barrels equivalent a day (boe/d) of equity oil and gas production over the next 5 years.

Expected Net Production in the 2022-2026 period: 1,236 mboe/d (yearly average of 247 mboe/d)

Assets

- Floating production, storage, and offloading (FPSO) units

- Azule's wells can reach depths of up to 2,000 metres, with oil produced from 4 floating production storage and offloading vessels (FPSO). Each has the capacity to produce 1.75 million barrel of oil equivalent per day (boepd).

An FPSO is home to up to 160 people, has a helideck, control room, galley/catering facilities, gym, lounge and cinema. It is held in position for its 25-year life by a spread of 12 mooring lines connected to anchor piles on the seabed 1,300 metres below.

The KBR-designed topsides accommodate all processing facilities for oil, gas and produced water, as well as seawater treatment for water injection. A subsea production system provides intelligent well technology, and water and gas injection wells. Manifolds, flow-lines and risers connect the wells to the FPSO for export to trading tankers via a remote offloading system.

Gas

In 2022 gas will account for about 15% of Azule’s equity hydrocarbon production. Produced in association with liquids, gas is separated from oil and then channelled via pipeline to Angola LNG, where it is liquefied and shipped overseas, and supports domestic demand for power as well. A bridge fuel for the energy transition and a major driver for Angola’s economic diversification, over the medium term natural gas will grow in importance in Azule’s production mix.

New Gas Consortium (NGC)

A first for Angola. Historically, gas has been captured as a by-product of oil extraction (associated gas). The NGC is different in that it specifically targets to develop and produce non-associated gas located in the offshore gas fields to supply Angola LNG, thereby enhancing the nation’s gas export capability.

The NGC will be operated by Azule Energy and is an unincorporated joint venture with Sonangol P&P, Chevron and Total. The non-associated gas of the Phase 1 of the project will come from the Quiluma and Maboqueiro shallow waters field with additional potential related to gas from Blocks 2, 3 and 15/14 areas.

The first gas is expected in the second half of 2026 and the project is projecting to produce more than 300 mmscfd at plateau.

Angola LNG

A first for Angola. Historically, gas has been captured as a by-product of oil extraction. The NGC is different in that it specifically targets and develops offshore gasfields to supply Angola LNG, thereby enhancing the nation’s gas export capability.

The ALNG project was built to create value from offshore associated gas resources and is one of the largest ever single investments in the Angolan oil and gas industry. With a 27.2% share, Azule Energy is one of the four shareholders in this incorporated joint venture, alongside Sonagas, Total and Chevron, the operator.

The onshore gas liquefaction plant for the treatment and marketing of gas associated with the production of crude oil is located near Soyo in the Zaire province in north Angola. The installed plant capacity is 5.2 MTPA (million tonnes per annum).

Solar

Azule’s first renewable energy business project is Caraculo’s photovoltaic plant, being developed by Solenova, a 50-50% joint venture between Azule Energy and Sonangol created specifically for the promotion of renewable energy projects in Angola.

Located in the province of Namibe, the project consists of the phased installation of a 50 Megawatt (MW) photovoltaic plant; the first 25 MW phase is currently under construction and is scheduled to be operational in 2023.

Caraculo’s photovoltaic plant will contribute to the reduction of diesel consumption for the generation of electricity and will support the diversification of the energy matrix in Angola, particularly by feeding electricity to the southern territory’s grid.

The project also falls within the national government’s “Angola Energy 2025” long-term plan to provide access to basic energy services to the population.

Quiluma and Maboqueiro (Q&M) fields

In July 2022, Eni and its Partners in the New Gas Consortium (NGC), Chevron’s affiliate in Angola Cabinda Gulf Oil Company (CABGOC), Sonangol P&P, bp and TotalEnergies, together with Angola’s National Agency for Oil, Gas and Biofuels ANPG, announced that the Final Investment Decision (FID) for the development of the Quiluma and Maboqueiro (Q&M) fields has now been taken by the Consortium. This is Angola’s first non-associated gas development project.

The project includes two offshore wellhead platforms, an onshore gas processing plant and a connection to Angola LNG plant for the marketing of condensates and gas via LNG cargoes. Project execution activities will start in 2022 with a first gas planned in 2026 and an expected production of 330 mmscf/day at plateau (approximately 4 billion cubic meters/year).

The sanctioning of the Q&M Project is an important milestone towards unlocking new undeveloped sources of energy, sustaining a reliable supply of gas to the Angola LNG plant, and fostering the continued economic and social development of Angola.

The New Gas Consortium partners encompass Eni (25.6%, operator), Chevron affiliate CABGOC (31%), Sonangol P&P (19.8%), bp (11.8%) and TotalEnergies (11.8%).

Eni holds a 13.6% interest in Angola LNG, together with Chevron affiliate CABGOC (36.4%), Sonangol (22.8%), bp (13.6%) and TotalEnergies (13.6%). The plant is located in Soyo, Province of Zaire and has a treatment capacity of approximately 353 bcf a year of feed gas and a liquefaction capacity of 5.2 mmtonnes a year of LNG.

In March 2022, Eni signed an agreement with bp to form a joint venture company called Azule Energy, combining both companies' businesses in Angola. The Operatorship of the Q&M Project is now guaranteed by Azule Energy following completion of the transaction.

LEADERSHIP

- Adriano Mongini CEO

- Riccardo Boris Business Development Director

- Hiten Mehta Chief Financial Officer

- Giuseppe Vitobello Chief Information Officer

- Peter Harriman Chief Operating Officer

- Girogio Moscatelli Development Projects Director

- Jaime Luzolo Energy Transition & Decarbonization Director

- Giovanni Aquilina Exploration Director

- Helder Silva Government Affairs & External Relations Director

- Chris Hawkes Health, Safety & Environment Director

- Ana Ferreira Human Resources Director

- Lisa Morrison Internal Audit & Integrated Risk Management Director

- Francisco Simao Legal & Corporate Affairs Director Procurement Director

- Filipe Lima Transition Director

- Daniele Casati Procurement Director

CONTACT

Azule Energy

Av. 4 de Fevereiro,197

Torres Atlantico

Luanda, Angola

Tel: +244 222 637 440

Archive news

Azule Energy begins Angola operations 02/08/2022

Eni completes negotiations to start up New Gas Consortium in Angola 28/07/2022

Eni-Sonangol JV, lays the first stone of Angola's first photovoltaic project 22/05/2022

Eni achieves start-up from Ndungu EP development project, deep offshore Angola 28/03/2022

Eni and bp to create new independent joint venture in Angola 11/03/2022

KeyFacts Energy: Azule Energy Angola country profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

From small private operators through to multi-national companies, KeyFacts Energy's database includes over 600 ‘first-pass’ preliminary review profiles, available on request.

KEYFACT Energy

KEYFACT Energy