New laws imposing £5 billion of new taxes on the UK’s offshore oil and gas operators risk driving away investors and undermining the nation’s future energy supplies, the industry’s leading trade body has warned.

The Energy Profits Levy Bill, which has passed its final stages in the House of Lords, risks starving crucial North Sea projects of tens of billions of pounds of investment, said Offshore Energies UK, which represents 400 organisations involved in the sector.

Deirdre Michie, OEUK’s chief executive, said that she was disappointed that the levy had become law and urged ministers to work with the industry to minimise the damage done to it.

The UK’s oil and gas operators were already paying a 40% tax rate on profits from oil and gas production on the UK Continental Shelf. (UKCS). Under the new law, the UK’s offshore oil and gas operators must pay an additional 25% tax on UK oil and gas profits.

This means the combined rate of tax is now 65% – by far the highest tax rate faced by any business sector.

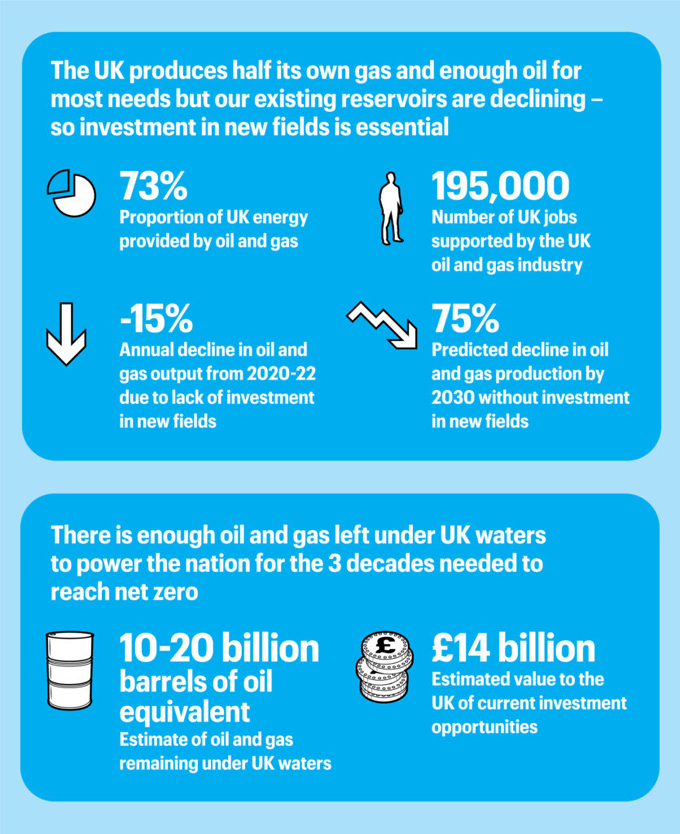

The UK’s offshore oil and gas industry produced the equivalent of 38% of the nation’s gas and 82% of its oil in 2021. It also supports about 200,000 jobs across the UK, from Shetland to Southampton with concentrations in East Anglia, Merseyside, Yorkshire and northeast England, the northeast of Scotland, Tayside and the Highlands and in Scotland’s Central Belt.

Source: OEUK

Deirdre Michie, said she recognised that surging energy bills meant an exceptionally tough year for consumers, so help was vital – but funding that help through sudden new taxes risked long-term damage to the UK’s businesses and its energy security.

She said:

“Exploring for oil and gas and then bringing it to shore is inherently a risky and expensive business so our members need the UK’s fiscal rules and other regulations to be stable and predictable before they consider investing the hundreds of millions of pounds needed for such projects.

“We are actually very proud to pay our taxes and support the UK government and consumers, but we are already the UK’s most highly taxed industry, so when new taxes are introduced suddenly, like this one, it makes the UK look like a riskier place to invest.

“That raises the cost of borrowing and so discourages investment in new energy sources just when global events suggest the UK should be doing all it can to maximise its own energy sources.

“I would urge the government and our eventual new prime minister to work with us to do everything possible to reassure investors and minimise the impact of this enormous tax increase.”

What taxes are paid on North Sea oil and gas?

Companies operating in the North Sea are liable for three separate profit-related taxes on oil and gas production:

- Ring fenced corporation tax (Currently set at 30% of profits)

- Supplementary charge (Currently set at 10% of profits)

- Petroleum revenue tax (PRT). (Currently set at 0%)

- Total receipts from these taxes were £3.1 billion in 2021/22.

The Energy Profits Levy is an additional 25% tax on UK oil and gas profits on top of the existing 40% headline rate of tax. This means the combined rate of tax on profits is now 65% – the highest rate for any UK commercial sector.

- The Levy takes effect from 26 May 2022.

- HM Treasury estimates that it will raise an extra- £5 billion in its first 12 months – in addition to the £7.8 billion tax ‘take’ predicted for 2022-23 by the UK government’s Office for Budget Responsibility.

- Following an announcement by the Leader of the House on 30 June that the Bill would be ‘fast tracked’, the Bill completed all of its stages in the House of Commons on Monday 11 July.

- It completed its final stages, in the House of Lords, on Wednesday July 18 and will now become law.

KeyFacts Energy Industry Directory: Offshore Energies UK

KEYFACT Energy

KEYFACT Energy