Baron Oil, the AIM-quoted oil and gas exploration company with projects in SE Asia and the UK, announces that at the Annual General Meeting of the Company to be held later today, the Company's Non- Executive Chairman, John Wakefield, will make the following statement:

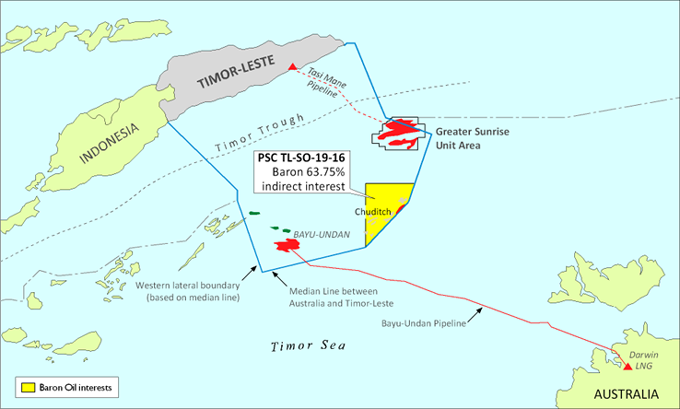

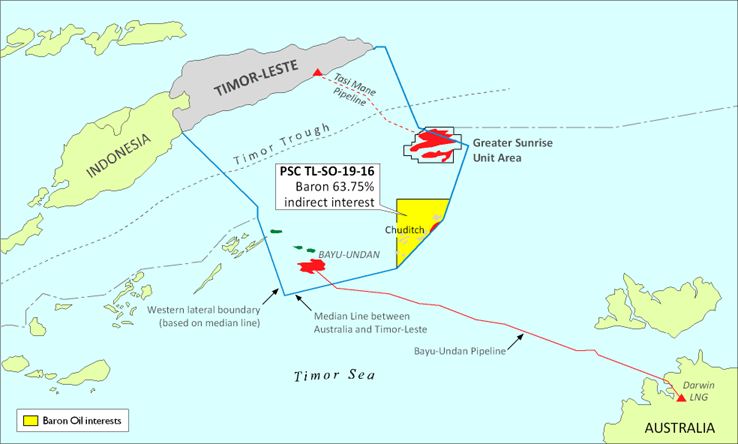

SE Asia: Timor-Leste, offshore TL-SO-19-16 PSC ("Chuditch") - Baron 75%; Timor Gap 25%

The significant progress made since the beginning of the year in relation to Chuditch has largely been in the technical sphere. The main element of the work programme has been the reprocessing of the 3D seismic covering the Chuditch discovery and adjacent analogous prospects and lead. The work by the seismic processing contractor, TGS-NOPEC Geophysical Company ASA ("TGS"), carried out under our close supervision, is to a high standard and uses the most modern and demanding techniques. TGS has recently been delivering the new, high-fidelity image of the reservoir structure to our geoscience team and the interpretation of the data has begun.

In addition, we have now received a report from Elite Offshore Timor Lda on 'Chuditch Field Facilities Definition Concepts', which was commissioned to identify, assess, and compare field development concepts. The study evaluated the layout and costs of the necessary infield facilities, the various pipeline and standalone options for gas export, and the treatment and storage of carbon dioxide.

We continue to engage with multiple potential farm-in partners by hosting a continuously updated dataroom, not only with 'traditional' exploration and production industry players, but also with companies seeking security of gas supply and infrastructure providers. As previously announced, we have begun a programme of showcasing the Chuditch asset at the most relevant international industry forums to promote and publicise its value.

Alongside this, the office in Dili (Timor-Leste), is now fully staffed and operational, thereby reinforcing our already strong and constructive relationships with in-country authorities, partners and industry peers.

Based on the success of our first live investor presentation in late January 2022, which was attended by more than 100 participants, we anticipate holding a second similar Chuditch focused event at an appropriate juncture later in 2022.

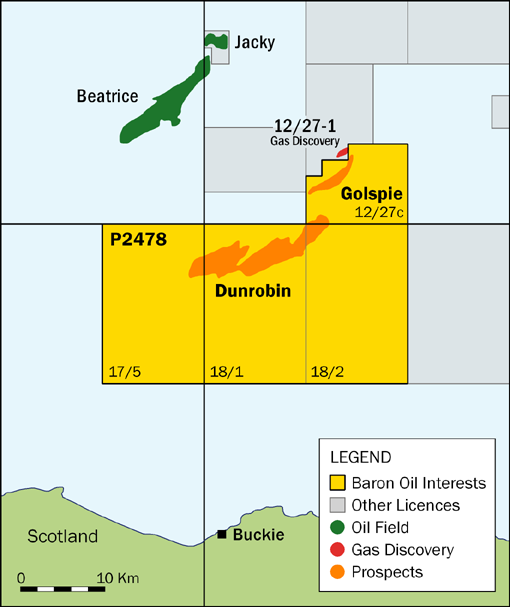

United Kingdom Offshore Licence P2478 - Corallian 36%; Upland Resources 32%; Baron 32%

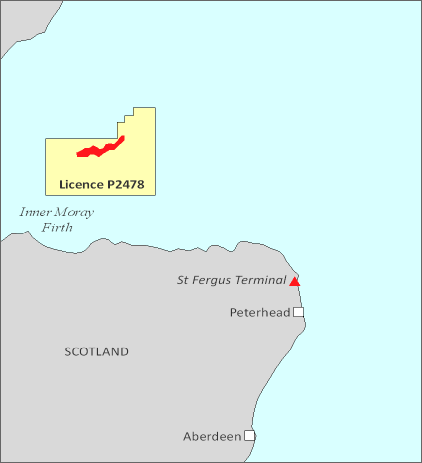

We continue to be directly involved in the technical work which will complete the outstanding Phase A work commitments on this licence situated in the Inner Moray Firth part of the North Sea. The primary aim is to mature our subsurface understanding of the potentially large Dunrobin prospect. The key components, that of 3D and 2D seismic reprocessing plus geochemical studies, are being delivered with interpretation on schedule to begin in July 2022. We believe we have achieved a significant uplift in data quality. An updated evaluation of Dunrobin is anticipated to be available during Q4 2022, which will provide sufficient time for us to consider our strategy with our partners, potentially including engaging with prospective drilling and funding partners, ahead of the July 2023 'drill or drop' decision.

We are encouraged by the UK Government's recent updated policy paper (British Energy Security Strategy, 7 April 2022) which has the potential to revive the business and regulatory hydrocarbon exploration environment in the UK North Sea. In addition, an initial understanding of the UK Government's proposed "windfall" tax (the Energy Profits Levy) is that it may lead to producing oil and gas companies re-engaging in exploration drilling. Both aspects could have a positive impact on the chances of the Dunrobin prospect, with its relatively large size and ease of drilling, being tested.

Conclusions

The oil and gas industry tailwinds remain highly favourable and seem likely to be sustained across the medium term. Chuditch, where we have a 75% interest in a significant discovery, is potentially a low risk, low cost, shallow water development of significant volumes of gas. Currently, we are targeting a decision in Q4 2022 on whether to enter an appraisal and step-out drilling phase in 2023.

In parallel with Chuditch, the outlook for the Dunrobin prospect in UK Licence P2478 has been transformed by rising oil prices and the publication of the UK government's revised energy security strategy. An updated evaluation of Dunrobin is anticipated to be available during Q4 2022. Combined, we see considerable potential to generate significant shareholder value from these key assets which the Company is focussed on delivering.

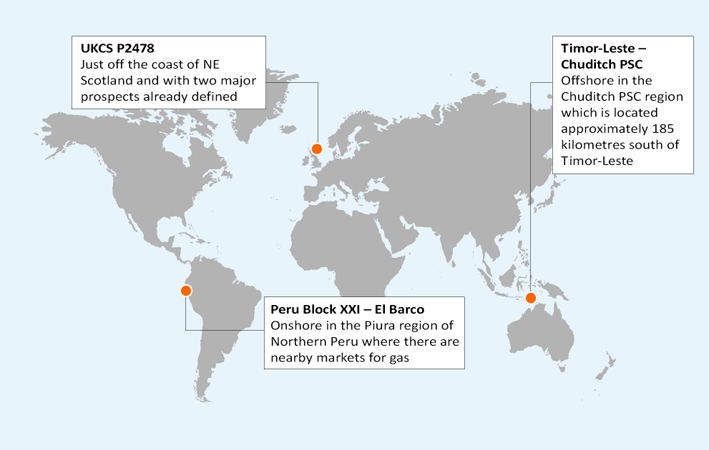

COMPANY PROFILE

Baron Oil is an independent oil and gas exploration company headquartered in London. The Company currently holds interests in exploration acreage in SE Asia (Timor-Leste), Latin America (Peru) and the UK.

Shares in the company are quoted in the UK on the AIM market of the London Stock Exchange.

OPERATIONS

UKCS P2478 – Inner Moray Firth

In September 2019, Baron was awarded a 15% interest in P2478 (Blocks 12/27c, 17/5, 18/1 and 18/2) under the 31st Round of Offshore Licensing.

Situated in the Inner Moray Firth, the P2478 licence contains the Dunrobin prospect which consists of large shallow rotated fault blocks which are mapped mostly on 3D seismic data including candidate direct hydrocarbon indicators. The prospect is believed to be one of the few remaining undrilled UK North Sea targets having Pmean prospective resources of the order of 100 MMBOE.

The licence’s current modest work commitment is to undertake reprocessing of legacy 2D and 3D seismic data and other subsurface studies in order to reduce risk and refine volumetric estimates ahead of making a “drill or drop” decision before the end of Phase A of the licence period in July 2023. The prospect lies at shallow depth (c. 660 metres subsea) in shallow waters (c. 75 metres).

The regional study work, carried out by a large European E&P Company, which included the area over Licence P2478, confirmed and enhanced the Company's geological understanding and corroborated their view of Dunrobin as a potentially attractive and substantial target. The results are being incorporated into the ongoing work programme which includes preparations for the seismic reprocessing in order to reduce further the pre-drill risk on the prospect.

The relative size and ease of drilling make the Dunrobin prospect a potential good fit for Baron’s corporate strategy. There are signs of industry interest returning to the UK North Sea which could lead to a decision to pursue the licence into the drilling phase in 2023.

In August 2021, Baron Oil reached an agreement to increase its interest in UK Offshore Licence P2478 from 15% to 32%, conditional on approval from the UK Oil and Gas Authority ("OGA").

Innovate Licence P2478 was awarded to Corallian Energy (Operator, 45%); Upland Resources (40%); and Baron (15%). The Licence's current phase modest work commitment is to undertake reprocessing of legacy 2D and 3D seismic data and perform other studies in order to reduce risk and refine volumetric estimates ahead of making a "drill or drop" decision before the end of Phase A of the licence in July 2023.

Covering blocks 12/27c, 17/5, 18/1 and 18/2 in the Inner Moray Firth area of the North Sea, the Licence contains the prospective Dunrobin area which consists of large shallow rotated fault blocks which are mapped mostly on 3D seismic data including candidate direct hydrocarbon indicators. Well costs are expected to be modest at c. £7 million gross as the prospect lies in shallow water of less than 100 metres and the total drilling depth of the well is prognosed to be approximately 660 metres.

Dunrobin is evaluated by Baron to be one of the few remaining targets yet to be drilled in the UK North Sea with estimated gross mean prospective resources of the order of 100 MMbbl (a non-SPE PRMS compliant estimate).

In Q1 2021, the joint venture partners received the results of technical studies from a large European E&P company under a work sharing agreement, which enhanced the partners' understanding of the petroleum geology and corroborated their view of Dunrobin as a potentially attractive and substantial target.

Farm In Agreement

In order to build on work already undertaken on the Licence and to accelerate progress, existing partners Corallian and Upland have signed an agreement whereby Baron will increase its interest in the Licence from 15% to 32% in exchange for paying 100% of the costs of the remaining Phase A work commitments up to a cap of £160,000. Under the terms of the Agreement all other costs, including, inter alia, licence and OGA fees and the Operator's administrative expenses, will be borne by all of the partners proportionate to their revised interests. Corallian will remain the Licence's Operator with Baron assuming the role of technical overseer of the remaining Phase A work commitments. No consideration is payable to Corallian or Upland under the Agreement.

On completion of the Agreement, the revised interests held in the Licence will be as follows:

- Corallian 36%;

- Upland 32%; and

- Baron 32%

UK: Dunrobin prospect (Baron 15%)

• prospective resources 174mmboe (Operator Corallian in-house Pmean prospective resources estimate)

• low-cost option: shallow water, shallow target

• proven reservoir, updip from minor discovery

• major European E&P sponsored regional study

• outstanding obligation: 3D seismic reprocessing

• “drill or drop” decision by July 2023

Timor-Leste – TL-SO-19-16 PSC (75% Interest)

SundaGas Timor-Leste (Sahul) Pte. Ltd. (“TLS”), a fully owned subsidiary of Baron, is the parent company of the Timor-Leste subsidiary SundaGas Banda Unipessoal Lda. (“Banda”), which is the Operator of and 75% interest holder in the offshore Timor-Leste TL-SO-19-16 PSC (the “Chuditch PSC”). The remaining 25% interest is held by a subsidiary of the Timor-Leste state oil company Timor Gap, E.P., whose interest is carried by Banda to development. Banda has entered into an agreement with Spectrum Geo Australia Pty Ltd., a wholly owned subsidiary of TGS-NOPEC Geophysical Company ASA, for the licensing and reprocessing of the 3D seismic data.

Chuditch PSC – The Baron Plan

• Licence extension granted in February 2021 expected to

− allow SundaGas Banda to complete PSC commitment technical work programme; and

− assess viability of drilling of an appraisal well and potentially further exploration wells in timely manner

• Earn In has increased Baron’s indirect PSC interest from 25% to 63.75%

• Baron to fund 100% of costs* until end of Firm Commitment Period (“FCP”)

• Baron carries residual SundaGas Pte Ltd effective 11.25% interest until FCP ends

• $1mm Bank Guarantee (“BG”) remains in place

• No change in Operator due to Earn In, remains as SundaGas Banda Slide 6

* Includes Timor-Gap E.P. (Timor-Leste’s National Oil Company) which is carried to development and has a 25% direct interest in the Chuditch PSC

The Chuditch PSC is located approximately 185km south of Timor-Leste, 100km east of the producing Bayu-Undan field, and 50km south of the planned Greater Sunrise development. It covers an area of approximately 3,571 km², in water depths of 50-100m, and contains the Chuditch-1 gas discovery drilled by Shell in 1998. The well was drilled in 26 days at a cost of US$8 million and encountered a 25m gas column in the Jurassic Plover formation on the flank of a large faulted structure. Shell’s mapping of the then available 2D seismic data suggested that the greater Chuditch area may contain significant quantities of recoverable gas.

The work programme for the current phase of the Chuditch PSC includes an obligation to reprocess a minimum of 800km² of 3D and 2,000km of 2D seismic data. Subject to encouraging results from the reprocessing, the subsequent commitment is to drill a minimum of one well in the third and final year of the Initial Period of the PSC, effectively a ‘drill or drop’ decision to be made by November 2022.

Through an earlier Share Exchange, SGPL became a significant shareholder in Baron (9.99%) and SGPL’s team, which is currently under contract to TLS and operating the Chuditch PSC, remains in place. Under the terms of an Amended Services Agreement between SGPL and TLS, SGPL will continue to be paid fees for management and administrative services. This Agreement has been extended to the end of December 2022.

In order to successfully monetise this potentially significant asset, a key objective for the Chuditch PSC in 2022 will be to attract drill funding for which there are multiple options and alternatives. By retaining, aligning and incentivising the existing SGPL team the Directors believe that the prospects of achieving this goal are enhanced. The Board believes that Baron’s net share of estimated SPE PRMS Mean compliant prospective resources of 2,525 BCF and 23 MMbbl of condensate, equivalent to a total of 444 MMBOE is more than sufficient to attract attention from the major regional gas players and other potential partners.

SGPL’s team members have extensive operating experience in South-East Asia, including with Hess, Conoco, Murphy, Kerr McGee and Sun before founding Mitra Energy (now Jadestone) in 2005 and then SGPL in 2016. The team has a significant record of achieving successful farmouts which span multiple countries and includes transactions with super major oil and gas companies, large and smaller regional players and private equity.

In January 2021, Baron announced a significant upgrade in the gross estimated Mean Prospective Resources to 3,527 BCF. The prospective resource base within the Chuditch PSC licence area consists of the Chuditch-1 discovery, three adjacent prospects (Chuditch West, Chuditch South West and Chuditch North), and a previously unrecognised, significantly sized lead (Chuditch North East). There is technical evidence which may indicate that the mapped limits of the prospects and lead coincide with the gas water contact interpreted in the Chuditch-1 discovery, such that there is the potential for a single, large accumulation within the licence area. The seismic reprocessing work programme is aimed at confirming the structural configuration of the Chuditch discovery and adjacent prospects and lead prior to any drilling.

The other known significant gas accumulations in offshore Timor-Leste, Bayu-Undan and Greater Sunrise, both contain condensate in addition to gas. Baron believes that there is the, as yet unevaluated potential, for condensate in the Chuditch PSC licence.

In February 2021, Baron announced that SundaGas Banda had been granted a 12-month extension to Contract Year 1 of the Chuditch PSC, to 8 November 2021, thereby extending the current initial 2 year phase of the PSC to November 2022. The extension will allow Banda to complete the commitment technical work programme and so assess the viability of drilling an appraisal well and, potentially, further exploration wells in a timely manner.

In July 2021, Baron announced an Independent Resource Update, validated to SPE PRMS 2018 industry standards, which indicates gross Mean Prospective Resources of 3,368 Bscf of gas and 30 MMbbl of condensate, equivalent to a total of 592 MMBOE. The High Estimate of gross Prospective Resources equivalent to 1,156 MMBOE may reflect potential for a single, large accumulation.

The Company expect that the 3D seismic reprocessing work will deliver data seven to twelve months from commencement. Seismic data interpretation, geological and other studies will occur in parallel during this period. The results of the studies may have the potential to reclassify the resources in the Chuditch-1 discovery from Prospective to Contingent, as defined by the Society of Petroleum Engineers’ (“SPE”) Petroleum Resources Management System (“PRMS”).

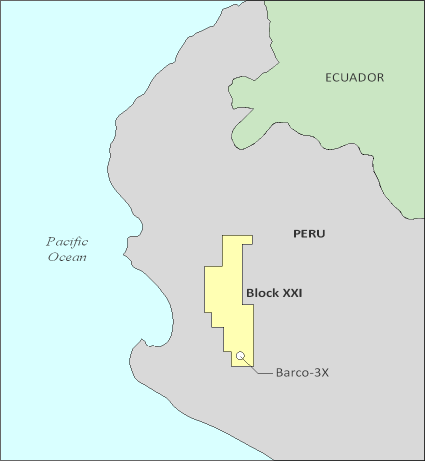

Peru Block XXI – El Barco (100% Interest)

Peru: El Barco-3X well option (Baron 100%)

• dual objectives

- c. 14bcf* gas at c.1,400m

- c. 8.5mmbbl* oil at c.1,700m

• early production options for oil & gas

• licence currently in Force Majeure

• Intention to make decision on future drilling strategy later in 2021

• El Barco prospect defined on Baron 2016 2D seismic data

*Baron in-house P50 prospective resources estimates

Despite the ongoing COVID-19 restrictions in Peru, Baron Oil continue to pursue efforts to drill the proposed 1,850 metre El Barco-3X well to test for low-risk gas in the Mancora Sands and higher-risk oil and gas in fractured basement.

There appears to be some movement around the Company's application for a three-year extension option to the licence, a prerequisite for attracting a drilling partner during the current licence phase. Baron Oil understand that Perupetro, the Peru state regulatory authority, has initiated the prescribed Government approval process which requires sign off from the Ministry of Energy and Mines and Ministry of Economy before going to the Central Bank and Presidential Palace for signature. The Board understands that this process typically takes between three to six months. If successful, this would help open up a way forward for the project.

In the meanwhile, the Company maintain a preference for bringing in a drilling partner with operator capabilities as they believe this represents the best way to develop and monetise any discovery. However, it remains unclear how quickly oil and gas exploration activity might recover once COVID restrictions have been lifted. For the moment, the licence remains in Force Majeure.

Whilst there are issues around the most recent national presidential elections, in the Piura area where the proposed well would be situated, a regional president and council are in place. This will be of assistance in due course as Baron Oil have a requirement to undertake workshops in the local communities of Belisario and El Barco ahead of any drilling authorisation.

LEADERSHIP / CONTACT

John Wakefield Independent non-executive Chairman

Andrew Yeo Chief Executive Officer

Jon Ford Technical Director

Executive office:

PO Box 404, Hastings, TN34 9LF

+44 (0) 20 7117 2849

Registered office:

Finsgate, 5-7 Cranwood Street, London, EC1V 9EE

+44 (0) 20 7117 2849

PERU

Calle General Julian Arias Araguez N° 250

Urbanización San Antonio, Distrito de Miraflores, Lima

+51 (1) 444 2900

KeyFacts Energy: Baron Oil Timor Leste country profile l UK country profile l Peru country profile

KEYFACT Energy

KEYFACT Energy