Highlights:

- Energy sector specialist, LAB Energy Advisors, have been appointed by Hartshead to advise the Company on the investment process for industry partnering on its Phase I development of the Anning and Somerville gas fields.

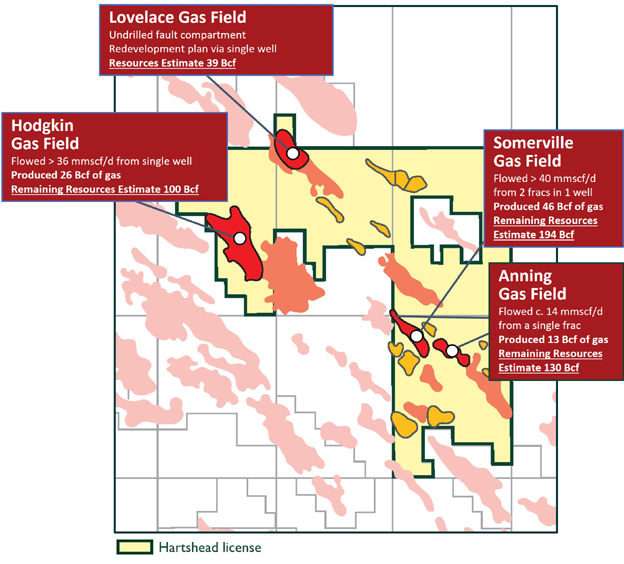

- The appointment of LAB Energy Advisors follows growing interest from several industry players in Hartshead’s P2607 license area of the UK Southern Gas Basin.

- The process commencement is aimed at selecting an industry partner for the Phase I field development.

Hartshead Resources today announced the appointment of LAB Energy Advisors Limited (LAB Energy), a UK based specialist energy sector advisory company with extensive upstream corporate M&A and asset A&D experience, to advise the Company on industry partnering for its Phase I development of the Anning and Somerville gas fields.

CEO of Hartshead, Chris Lewis, commented:

“The level of interest in Hartshead’s P2607 license from potentially suitable industry partners affirms our confidence in the value of the asset. With the increased interest in investment into UK gas developments and high gas prices, now is an opportune time to engage with suitable industry partners. I am delighted to be working with the highly experienced LAB Energy team, and I am confident this will deliver a successful outcome and value for shareholders.”

Converting ~300 bcf of contingent resources into 2P reserves

- ERCE have completed a Technical and Commercial Audit of Harthead’s Phase I development of the Anning and Somerville gas fields.

- ERCE have estimated that Hartshead hold 180 bcf of 1P reserves, 302 bcf of 2P reserves and ~458 of 3P reserves in the Anning and Somerville gas fields located in the UK Southern Gas Basin

- This represents a conversion of almost all the technically recoverable 324 bcf 2C into economically recoverable 2P reserves. It also represents a significant increase in the 380 bcf of 3C contingent resources into 3P reserves. A very large proportion of the 255 bcf 1C contingent resources was also converted into 1P reserves.

- Hartshead is in active discussions with several infrastructure owners with regards to gas transportation and export routes.

- We view this announcement as a very positive and important step in the progress of the project. The certification as reserves of such a high proportion of 2C resources showcases the quality of the project.

- Hartshead continues to be a high value gas development story. We reiterate our target price of A$0.20 per share. We have increased our chance of development from 70% to 75% but have also assumed higher tariffs and some initial costs to compensate for third party gas backout.

Timing and sales

FID is expected to be taken in 2Q23 withfirst gas for the Phase I development estimated in late 2024. The gas production forecasts have been adjusted for the backout of third party gas volumes and shrinkage with peak sales gas of 140 mmcf/d. A Gas Sales Agreement will be entered into at the point of FID with well established offtakers of natural gas in the UK market, such as BP, Shell and Engie.

Valuation

A key next step is the securing of an industry partner for the development phase of the Anning and Somerville gas fields. The booking of ~300 bcf of 2P reserves should facilitate this process. It will also likely enhance access to offtake prepayment and debt financing facilities. The read through valuation of the farm-out transaction between IOG and CalEnergy in 2019 suggests that the industry could pay A$0.20-0.30/sh for Hartshead assets. Core NAV for Hartshead assuming a US$100 mm farm-out and 75% chance of development now stands at A$0.14/sh. Adding phase II leads to a ReNAV of A$0.20/sh. Phase III would add further value.

KeyFacts Energy: Hartshead UK country profile

If you would like a complimentary 7-day trial to our Energy Country Review resource, free access to our daily news alert service, details of marketing opportunities or if you would like to contribute to KeyFacts Energy, click here. We can provide access, sign you up, send full details or set up a quick online meeting to review our services in more detail.

KEYFACT Energy

KEYFACT Energy