By Kathryn Porter, Watt-Logic

Politicians have been telling conventional energy business for years that they intend for their business models to become obsolete in the transition to net zero. Now they seem completely taken aback by the fact that these private businesses, which exist primarily to deliver returns to their investors, are behaving in short-term, profit-maximising ways. It makes perfect sense for these businesses to sweat their assets and seek to leverage any beneficial market trends when they expect a shortening of their expected economic lives.

This is entirely rational…businesses exist primarily to deliver returns to their investors – this is the purpose of capitalism: governments expect private enterprise to invest in, say, electricity generation, and in return the investors in those businesses expect to earn a level of profits that is at least commensurate, on a risk-adjusted basis, with what they could earn from alternative investments. This serves a wider purpose than the enrichment of individuals since these investors are often things like pension funds…if they do not perform well then pensioners receive less income. Obviously, there are arguments for and against capitalism, but in a capitalist society, governments should not expect private businesses to prioritise “social good” however that may be defined…if you move the goalposts, as governments have done with de-carbonisation policies, then you must expect businesses to respond to make the best of it that they can.

The reason I’m writing about this is that we’re seeing this play out in various different ways in energy markets around the world, and policymakers seem not only caught off-guard but also offended by these developments.

Biden tells the oil industry he wants to put it out of business, and is shocked when they cut investment

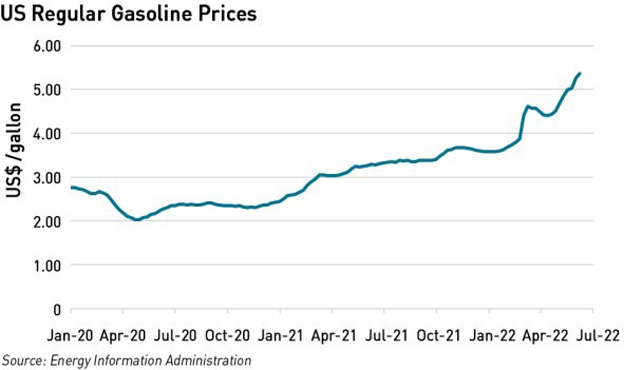

First of all we have US President Joe Biden, who has not only signalled very clearly his desire to do away with fossil fuels, he has imposed significant new regulatory burdens on the industry since taking office. Now he is threatening to use emergency powers if these same companies don’t increase supply in response to high prices. He is particularly exercised about the current high price of petrol, telling oil companies:

“You need to work with my Administration to bring forward concrete, near-term solutions that address the crisis and respect the critical equities of energy workers and fence-line communities….in advance of that, I request that you provide the Secretary with an explanation of any reduction in your refining capacity since 2020…”

– Joe Biden, President of the United States of America

I confess to not knowing what the “critical equities of energy workers and fence-line communities” actually are, but my question is, why should oil companies do this? Why should they justify reductions in capacity…reductions that are entirely consistent with Biden’s stated desire to see a reduction in fossil fuel use?

According to Bob McNally, head of consultancy Rapidan Energy, Biden had expected shale drilling to increase rapidly in response to higher prices…this isn’t realistic at the best of times but not only has the industry and its investors reacted to de-carbonisation policies by raising the bar for new projects, the industry is also facing supply chain challenges and rising labour costs.

Biden has singled out Exxon-Mobil and is accusing oil companies of failing to increase production in order to benefit from higher prices. He is complaining that the are not drilling, not making new investments, and making share buy-backs. But what exactly did he expect when he made it abundantly clear that he wants to make these businesses obsolete?

Large parts of the US at risk of blackouts

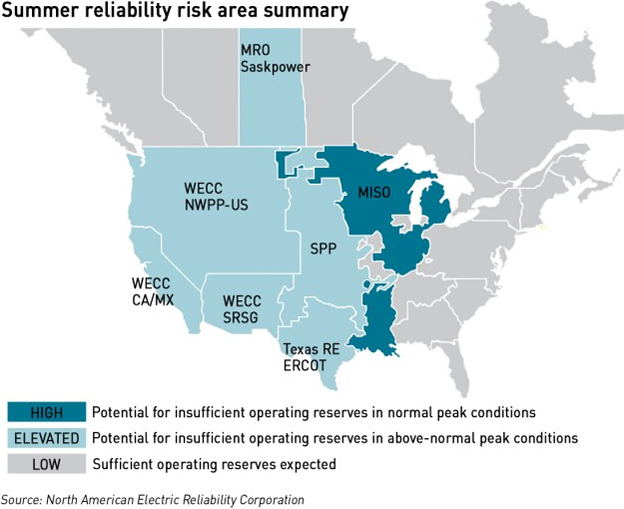

This comes after warnings of power shortages across large parts of the United States. Last month I wrote about possible power shortages in California, and now regulators in Michigan and Texas have issued similar warnings. The Midcontinent Independent System Operator (“MISO”) is expecting a summer peak forecast of 124 GW while there is typically only around 119 GW of generating capacity available, while The Electric Reliability Council of Texas (“ERCOT”) has asked customers to conserve energy after several power plants closed unexpectedly. California expects peak demand could exceed available supply by as much as 3.5 GW.

“Regulators in several regions of the United States are predicting record heat and drought this summer that could cause rotating blackouts. MISO, ERCOT, and the California Independent operator are a few that are already warning their residents that problems may occur where they would need to conserve energy. States are pushing solar and wind generation to become carbon free, but those technologies are intermittent, operating only when the wind blows and the sun shines so they cannot be relied on 24/7 to supply power.

Some states, particularly California, are adding expensive battery storage capacity to hold excess power to be released when needed. The cost of battery storage capacity is not factored in when states and manufacturers tell the public that wind and solar are cost competitive with natural gas and coal generated power. These renewable technologies have helped increase electricity costs to consumers because of their intermittency, and electricity prices continue to rise. In fact, the Energy Information Administration estimates that electricity prices will rise by a national average of 3.9 percent from last summer,”

– Institute for Energy Research

Some of the problems are linked to summer droughts which affect hydro-power output and the availability of cooling water for nuclear and coal plant, but lack of regulatory coherence over de-carbonisation polices is also playing a part, where the necessary storage and transmission investments to ensure a stable energy transition have been lacking. The speed with which conventional generation is being replaced with intermittent renewables, without these balancing technologies being in place, is creating issues with stability and contributing to the prospect of shortages in the summer, when cooling demand peaks. Conventional generation is leaving the market faster than the expected – 2% of the generation capacity in MISO has closed in the past year.

The National Electricity Market of Australia suspended indefinitely

Then we have the situation in Australia where the National Electricity Market (the “NEM”) has been suspended for the first time in history, and households have been urged to reduce energy use to avoid blackouts. The reasons are as follows: gas and coal prices have been rising, pushing up the cost of fossil fuel generation to a point where market rules required a price cap to be applied. The generators responded by withdrawing capacity from the market, not wanting to sell at a loss or use up scarce coal stocks (this post on the Watt-Clarity blog describes some of the generator bidding activity during this period).

The situation has been exacerbated by a combination of planned and unplanned maintenance outages in the thermal fleet and periods of low wind and solar output, as well as unseasonably low temperatures which have unexpectedly boosted demand. The suspension means that instead of running 5-minute actions, AEMO, the market operator will make central dispatch decisions based on generator availability with prices being set at the average of the previous 28 days for the relevant hour of the day. If generation costs are higher, generators will be able to apply for additional compensation which will be recovered from consumers later on.

The price cap mechanism was designed at the inception of the NEM in 1998 to manage short term disruptions such as summer heat waves – longer-term global energy shortages were not anticipated in the market design. In addition, the cap level has not been updated in over 20 years, and was set in relation to gas prices.

While coal is still cheaper than gas, it is becoming difficult for power stations to procure coal – as global prices have risen, domestic buyers are competing with export markets, so coal operators adjust their bidding strategies to price themselves out of the market when demand is lower.

However, once the cap is triggered, this coal rationing approach cannot be used because under the market rules, a generator that has bid in to the market must be fully utilised before the market operator can direct other generators to run. This discourages generators with low coal reserves from bidding in at all. A similar dynamic applies to other time-limited generation such as hydro, where water stocks need to be managed.

“It’s never been done before so the details have never been tested…If directed to lose money the obvious question is at what level,”

– Tony Wood, energy program director at the Grattan Institute

The idea now appears to be that AEMO will work with the generators to manage the situation and agree which plant should be directed to run, although it’s unclear how generators will be paid, if they will be directed to run at a loss, and whether consumers will be hit with higher charges as AEMO seeks to recover costs. This is prompting calls for market reform, with suggestions that the Western Australian model of a ringfenced, government-owned electricity sector backed by a domestic gas reserve should be under consideration.

Britain staggers into an electricity supply crisis this winter, placing its hopes on coal..

As I have written before, the GB market is going to be short this winter, with 2 GW of nuclear and 4 GW of coal capacity scheduled to close this year, and outages in the French nuclear fleet raising the prospect we will be exporting to rather than importing from France. EDF has already declined to keep Hinkley Point B open – the plant was closing for safety reasons and had had extended outages while its condition was evaluated. Given the problems in EDF’s domestic fleet, further life extensions for aging British reactors must be a low priority for the company.

However, the Government has just entered into a bespoke bilateral agreement with EDF to allow West Burton A coal fired power station to remain open this winter. The plant had been set to close in September, and the Government will now have to pay enough to make it economic for the plant to remain open and also to purchase the necessary coal. This is not straightforward…EDF had understandably run down its coal stocks ahead of closure, but since it used to buy from Russia it now needs to create a whole new supply chain for this winter. This won’t be cheap, and the price of the contract will reflect that. Similar deals are in the works to keep coal units at Drax and Radcliffe open.

However, the specifics of the EDF deal are interesting. West Burton A consists of four, 500 MW units, but this deal only covers 400 MW of capacity, with EDF agreeing to keep two of these units open, one to provide this capacity and one as a backup. These units will now close in March next year. The question is why is this deal only for 400 MW? We need all of the remaining coal capacity to remain online, so why not the full 2 GW? I reached out to EDF’s press office – I don’t normally look for comments since I’m not a journalist – and they were kind enough to take the time to respond.

The answer is that two of the units already began de-commissioning last October and cannot now be returned to service. The other two can but due to their age and reliability concerns, EDF was only comfortable offering 400 MW in the expectation that at any time one of the units would be needing maintenance. West Burton A opened in 1957, a year after the historic opening of Calder Hall which closed way back in 2003 – another 5 years and it would have been able to hold Platinum Jubilee parties of its own! So it’s hardly surprising that EDF is cautious about the amount of capacity it is willing to commit to, and this is a much larger concern than access to coal. Safety assessments have been run, and while the plant will not operate on a normal commercial basis, it will be available to act as the station of last resort providing emergency back-up power to National Grid ESO.

The other coal plant that is due to close this year are one of four 500 MW units at Ratcliffe (opened 1963) and two units at the relatively youthful Drax which first opened in 1974. Even if all of these stay open, the impact of the nuclear closures and the prospect of exporting to France instead of importing will certainly wipe out the spare capacity margin which last winter was just 3.9 GW on a de-rated basis. This will make lower the resilience of the grid and lead to real risks of shortages during periods of low wind output, with rationing likely for industrial users.

While technical problems with the French reactors are not things the Government could reasonably be expected to predict, the closure of aging conventional capacity should not have come as a surprise. That the Government is now scrambling to keep the oldest coal plant in the market, despite all its net zero ambitions, is a sign of the seriousness of the current problem. But this is entirely self-inflicted – ever since I started my blog I have been warning about falling capacity margins, and if I could see it coming, why couldn’t they?

…while Germany is also firing up old coal plant

Germany has announced that it will be re-starting coal power stations in a bid to reduce gas demand this winter over fears of gas shortages – the German government has said it will pass emergency legislation to re-open mothballed coal plant for electricity generation. Germans are also being urged to reduce electricity use to conserve supplies. Yet the Government seems determined to press ahead with the closure of its three remaining nuclear power stations with a combined capacity of 4 GW, but the end of this year, claiming that the technical and safety hurdles for remaining open are too high (apparently their fuel rods need replacing and the lead time for this is 12-18 months).

Germany has spent billions of euros on its failed Energiewende and its energy prices are the highest in the world, but like many of its peers, the country has failed to make the necessary investments in storage and transmission to deliver on the policy’s objectives, and the country relies heavily on imports, including nuclear power from France and gas from Russia. Now the availability of both is under threat the country has no choice other than to turn back to coal.

Cakism in energy is beginning to bite

The Cambridge English Dictionary defines “cakism” as “the wish to have or do two good things at the same time when this is impossible”. Energy policy is full of it – the desire to replace dispatchable generation with intermittent generation while maintaining security of supply; the desire to end the use of fossil fuels while expecting energy companies to continue to invest and increase production at the drop of a hat; the desire to maintain a nuclear capability without making the necessary investments; the desire to transform the energy system without it costing anything (or at least without consumers noticing that it will cost anything).

But the effects of covid and the war in Ukraine have exposed the many flaws in the policies of the energy transition across the developed world, and policy-makers appear to have no answers. This is why we are seeing governments committed to net zero turning back to coal in order to keep the lights on, the prospects of blackouts, and the complete breakdown of market mechanisms.

It’s time for policy-makers to take an honest look at their net-zero ambitions and strip out the wishful thinking. The energy transition is possible, but it won’t be cheap, and can’t necessarily be achieved by 2050. And based on currently-available technologies, countries without access to sufficient hydro-power or geothermal energy will not be able to reach net zero without nuclear. Accepting these realities is the first step to correcting past mistakes and planning for a transition that actually works.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy