i3 Energy, an independent oil and gas company with assets and operations in the UK and Canada, today announced the following Q1 2022 operational and financial update.

Highlights:

- Q1 2022 average production of approximately 18,095 barrels of oil equivalent per day ("boepd"), representing a 100% increase over Q1 2021

- Canadian Capital budget to increase by up to $50 million above the previously announced $47 million 2022 programme (together, the "Enlarged Capital Budget"), focused on continued low-risk, high-return development drilling of i3's core Glauconite and Cardium fairways, with expanded Montney and Clearwater programmes

- Full-year 2022 net operating income ("NOI" = revenue minus royalties, opex, transportation and processing) is now forecast to be $241million for 2022 assuming the full implementation of the Company's Enlarged Capital Budget

- Strong drilling results from the Company's operated and non-operated development programmes

- Increased the Company's Clearwater position by ~20% through the acquisition of 15 net sections (38.5 km2) of proximal, strategic acreage

- Monthly dividend payments of £1.1827 million commenced in March with year-to-date distributions totalling £3.55 million; a dividend increase is expected to be announced in due course

Majid Shafiq, CEO of i3 Energy plc, commented:

"We are very pleased with the continued strong performance of our Canadian production base, and the resulting cash flow generation in the first quarter of 2022. We exited Q1 above 20,000 boepd, in part due to the contribution from wells drilled as part of our maiden operated drilling programme. Results from wells drilled to date have met or exceeded management's pre-drill geological and production capacity expectations and have been drilled within budget. This, allied with the performance of our base production assets, increased NOI projections and strong commodity price forecasts has led us to plan for an expanded drilling programme for the second half of the year. An increase in dividend pay-out for 2022 is also expected to be announced in due course."

Q1 Production and 2022 Update

Production in Q1 2022 averaged 18,095 boepd, comprised of field estimate sales equalling 53.5 million standard cubic feet of gas per day ("mmcf/d"), 6,006 barrels per day ("bbl/d") of natural gas liquids, 2,789 bbl/d of oil and 376 boepd of gross overriding royalty interest production. The strong quarterly production represents a 100% increase over Q1 2021 and is a direct result of the continued outperformance of i3's low-decline base production, which is forecasted at 11.5%, and strong operational results across the Canadian portfolio. The Company exited Q1 2022 with record production of 20,312 boepd with April field sales estimates averaging 20,256 boepd.

2022 Guidance Update

i3's Board of Directors has approved a 2022 capital budget increase of up to an additional $50 million, internally funded through existing operations, over the previously announced Canadian capital budget of $47 million. The increased capital budget is a direct result of the Company's robust operational performance and forecasted strength in commodity prices. The Enlarged Capital Budget of up to $97 million will allow for the expansion and acceleration of i3's key Canadian development opportunities.

The Enlarged Capital Budget is fully-funded through existing Company resources (cash on hand and near-term forecasted cash flow), and is expected to materially enhance 2022 production and NOI while preserving the Company's strong balance sheet. The programme is designed to maximize near-term production and cash flow through further development of the Company's large inventory of predictable and highly-economic Glauconite locations in Central Alberta, while continuing to advance i3's high-impact Simonette Montney position and recently expanded Clearwater holdings (as described below). The revised capital budget is forecast to provide peak production above 24,000 boepd. As a material percentage of the budget will be deployed in Q4 2022, the full impact and benefit of the expanded capital budget will occur in 2023 and beyond.

Based on full deployment of i3's Enlarged Capital Budget, 2022 NOI is now forecasted to be $241 million, with the Company expecting a material working capital surplus that will be available for additional development drilling, opportunistic acquisitions, and distributions to shareholders.

Operational Results

During Q1 2022 the Company participated in 11 gross (5.2 net) wells across its drilling portfolio, including 3 gross (3.0 net) operated wells and 8 gross (2.2 net) non-operated wells. The results across the entire programme, both operated and non-operated initiatives, continue to achieve or exceed management's type curve expectations. The wells were all drilled within budgetary estimates.

i3 continues to systematically expand upon and advance the development of its large inventory of highly profitable booked and un-booked locations, as the Company remains focused on delivering total shareholder returns. Based on current strip pricing, the Company has an identified inventory of 870 gross (465 net) locations, of which approximately 40% are currently booked in GLJ's 2021 Year-end Reserves Report for i3 Energy Canada Ltd. Of the Company's total inventory, approximately 570 gross (340 net) locations are capable of delivering payback periods of less than one year and provide average estimated rates of return of approximately 240%. The Company is actively advancing this inventory to bring forward a multi-year development strategy, capitalizing on robust near-term commodity prices and the Company's extensive infrastructure network.

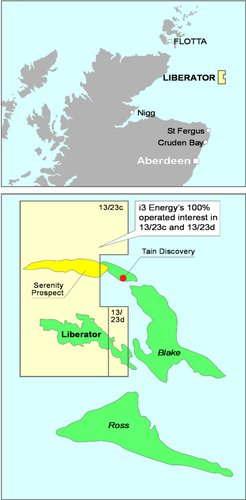

Serenity Appraisal Farm-out

As announced on 21 April 2022, i3 has executed a Farm-in Agreement ("FIA") with Europa Oil & Gas Limited ("Europa").

Under the terms of the FIA, Europa will acquire a 25% non-operated working interest ("WI") in a sub-area of UKCS Licence P.2358 Block 13/23c containing the Serenity discovery by funding a 46.25% paying interest for one appraisal well on the field, whereafter i3 will retain a 75% operated WI in the New Serenity Block. The gross well cost is estimated to be circa £14mm and is expected to spud in late Q3 2022.

KeyFacts Energy: i3 Energy UK country profile

KEYFACT Energy

KEYFACT Energy