Europa Oil & Gas has announced its interim results for the six-month period ending 31 January 2022.

Financial performance

- Strongest interim financial performance since H1 2014 with significant revenue and profit as a result of asset performance and a strengthening oil price

- Revenue £2.2 million (H1 2021: £0.5 million)

- Pre-tax profit of £0.7 million (H1 2021: pre-tax loss £0.7 million)

- Net cash from operating activities £0.9 million (H1 2021: net cash used in operating activities £0.2 million)

- Unrestricted cash balance at 31 January 2022: £0.6 million (31 July 2021: £0.6 million)

Operational Highlights

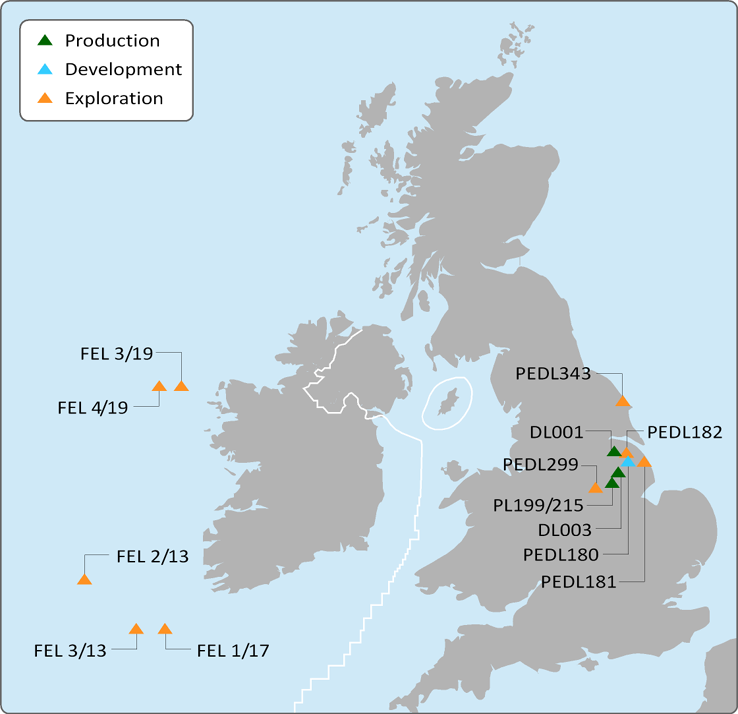

Onshore UK - Wressle oilfield moving from strength to strength and new possibilities for West Firsby

Wressle Oil Field

- Wressle exceeded initial gross projections of 500 barrels of oil per day ("bopd") in August, which increased to instantaneous flow rates in excess of 884 bopd and 480,000 cubic feet ("Mcf") of gas by September following successful proppant squeeze and coiled tubing operations. This more than doubled Europa's total net oil production to 208 bopd during H1 and provided a major boost to revenues against a backdrop of rising oil prices.

- ERCE Equipoise Ltd ("ERCE"), an independent energy consulting group, concluded from analysis of downhole pressure data that higher rates of up to 1,543 bopd can be realised if the facilities constraints on gas production can be alleviated.

- Further resources in the Wingfield Flags and Penistone Flags reservoirs are being reviewed for development and have the potential to increase net reserves.

West Firsby Oil Field

- CausewayGT and geothermal project partner Baker Hughes identified Europa's West Firsby oil field in the Midlands as a suitable candidate for developing a closed-loop geothermal system.

- Future potential for West Firsby to continue delivering revenue and for additional well stock to be repurposed to generate emission-free geothermal energy is in line with the Company's ESG strategy.

Offshore Morocco - high-impact exploration opportunity

- The farm out initiative of the Inzegane Offshore permit located in the Agadir Basin was formally launched in August. Europa has a 75% interest in Inzegane and operatorship of the License covering an area of 11,228 sq. km

- Inzegane represents a high-impact exploration opportunity in a highly underexplored area of the world - complementing Europa's strategy of building a balanced portfolio of assets.

- Recent evaluation identified a significant volume of unrisked recoverable resources, in excess of 1 billion barrels (oil equivalent), in the top five ranked prospects alone.

- Morocco offers a highly attractive investment opportunity with excellent fiscal terms. Several major and mid-cap companies already hold acreage there, including ENI, Hunt, Genel and ConocoPhillips.

Offshore Ireland - Low risk / high reward infrastructure-led exploration in the proven Slyne Basin gas play

- Farmout initiative is continuing on Licence FEL 4/19 which holds the flagship 1.5 tcf Inishkea prospect adjacent to existing infrastructure at the producing Corrib gas field.

Post period

- Exercise of rights by DNO North Sea (UK) Limited to terminate the Sale and Purchase Agreement for acquisition by Europa of Irish exploration licence FEL 3/19.

- Successfully raised gross proceeds of £7.02m, approved by shareholders at the General Meeting on 25 March.

- Proposed acquisition of a 25% interest in the Serenity discovery in the North Sea as part of the Company's strategy to build a balanced portfolio of assets.

Simon Oddie, CEO said:

"We are delighted to bring you our outstanding financial results for the first half, which saw revenue quadruple to £2.2 million and a swing back to profitability from recent years.

Europa's positive H1 performance was driven by excellent production result at our Wressle oil field in North Lincolnshire, which saw our average daily production more than double compared to H1 2021 and coupled with elevated oil prices, which are now exceeding US$100 a barrel.

With the raising of £7.02 million and the proposed acquisition of a 25% interest in the Serenity discovery in the UK North Sea post reporting period, we have now also put in place the third leg of the business, the acquisition of a near-term appraisal and development opportunity. The year is shaping up to be transformational for both our diversified energy portfolio and our financial position."

Europa Oil & Gas company/country profiles: UK l Ireland l Morocco

From small private operators through to multi-national companies, KeyFacts Energy's database includes over 600 ‘first-pass’ preliminary review profiles, available on request.

KEYFACT Energy

KEYFACT Energy