Wentworth, the independent, Tanzania-focused natural gas producer today announced its audited financial results for the year ended 31 December 2021 along with its proposed final dividend declaration for the full year 2021. All values are expressed in US dollars unless stated otherwise.

HIGHLIGHTS

Financial

- Another year of exceptional operational and financial performance with record production in Q1 2022

- Declaring a final dividend of 1.16 pence per share ($2.7 million); a total dividend distribution in respect of 2021 of 1.73 pence per share ($4.0 million) representing a yield of approximately 8.0% (calculated on an annualised basis), an increase from 2020 total distributions of $3.8 million

- Share buyback programme to support capital return philosophy initiated in December 2021 and c. $2.6 million returned to date

- Revenues increased by 26% to $23.8 million (2020: $18.9 million), underpinned by long-term fixed gas price contracts and strong production

- Adjusted EBITDAX increased by 40% to $13.6 million (2020: $9.6 million)

- Net profit increased by 79% to $6.1 million (2020: $3.4 million)

- Increasingly robust balance sheet, remaining debt free with a cash balance of $22.8 million (2020: $17.8 million)

Operational

- 5 years without a Lost Time Incident (LTI) and no operational disruption due to COVID-19

- Average gross daily gas production of 81.6 MMscf/d (2020: 65.5 MMscf/d) exceeded guidance which was revised upwards in June 2021

- Low operational cost of production of $0.54/Mscf

- Wentworth gross 2P Reserves estimated to be 135.2 Bcf with an after-tax NPV10 of US$108.1 million, as at 31 December 2021

Corporate

- Expanded commitment to established capital return policy with implementation of share buyback programme

- Tanzania-focused growth continues to be a key focus to capitalise on existing operational track record

- Increased strength and diversity of the Board and management with appointment of Independent Non-Executive Director and Chief Operating Operator

Sustainability

- Wentworth’s domestic natural gas continues to play a critical role in increasing energy access to communities across Tanzania and remains a key partner for the Government of Tanzania to deliver on its ambition to provide universal energy access in Tanzania by 2030 in line with the UN Sustainable Development Goals

- Continued commitment to our local communities through our corporate social responsibility efforts and dedicated foundation programmes

- Publication of Sustainability Report 2021 including disclosure in accordance with the Sustainability Accounting Standards Board

- First year of independent assurance of our greenhouse gas emissions disclosed in line with the Greenhouse Gas Protocol; Wentworth’s carbon intensity per boe of 0.29 kg CO2 e/boe is one of the lowest reported in the London E&P sector

- Partnership established with Vitol to develop SDG aligned community-focused carbon credit programmes in Tanzania to offset all our Mnazi Bay Scope 1 and Scope 2 emissions and partially offset Scope 3 emissions from 2022

- Membership of the United Nations (UN) Global Compact, underlining Wentworth’s commitment to operating responsibly

Dividend

The Directors propose that a final dividend of 1.16 pence per ordinary share be paid, subject to shareholder approval at the Company’s Annual General Meeting, to the holders of the ordinary shares who are on the register of members of the Company at 6.00 p.m. on 1 July 2022. The proposed final dividend will bring distributions to shareholders with regard to the financial year ended 31 December 2021 to $4 million, in line with the Company’s stated commitment to a sustainable and progressive dividend policy.

2022 Outlook

- Production guidance for 2022 has been set at 75 – 85 MMscf/d, raising the guidance band by 5 MMScf/d across the board compared to 2021

- The contracted price for gas produced at Mnazi Bay production has increased from $3.35/MMbtu to $3.44/MMbtu; effective from 1 January 2022

- Operational costs of production remain low at $0.54/Mscf

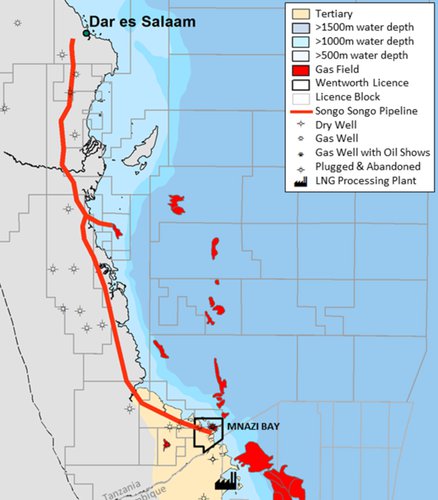

- The Company continues to explore and evaluate growth opportunities both within the Mnazi Bay licence and the greater geographical region to support increasing in-country demand for natural gas

Q1 2022 Operations Update

- The Mnazi Bay Gas field produced 29.8 Bcf during 2021, an increase of 25% over 2020 production

- Mnazi Bay has an estimated 423.3 Bcf of remaining economically recoverable gross 2P sales

- The Mnazi Bay Gas field achieved a new quarterly average daily production record of 98.5 MMcf/d in Q1 2022, surpassing the previous record of 91.5 MMcf/d set during Q4 2021

- As of 1 April 2022, the Mnazi Bay facility has safely operated for 2,060 days (5.6 years) without a Lost Time Incident

- Mnazi Bay Gas facility is expected to be shut-down for up to 10 days in Q2 2022 to allow for scheduled maintenance on the gas gathering system

Katherine Roe, CEO, commented:

“2021 was an excellent year across the board for Wentworth during which we demonstrated our commitment to responsible growth whilst increasing considerable shareholder returns. We are delighted that through our progressive dividend policy and active share buyback programme we saw a record $6 million returned to shareholders in 2021. Our ability to deliver on this is underpinned by our robust financial position, no debt and ongoing cash generation.

“We are also very pleased to have seen record production for the year with a 25% increase in average daily production compared to 2020. This underscores the quality of our asset as well as highlighting the improvements in industrial demand in Tanzania enabling us to further increase our production guidance for 2022. We are also very proud of our exceptional health and safety record. 2021 marked five years without an LTI and it remains an absolute priority to sustain this performance year in, year out.

“We believe in the value opportunity from aligning business and society interests. As such, we are committed to playing a significant role in supporting Tanzania’s commitment to deliver universal energy access by 2030, aligning with the UN’s ambitions. We continue to be well-positioned alongside our JV Partners, Maurel et Prom and TPDC, to deliver on this and be a key part of the solution to supply growing demand.

“We would like to thank our shareholders and stakeholders for their continued support as we look to continue to deliver on our strategy of responsible, sustainable growth through delivering reliable, domestic energy supply to communities across Tanzania.”

KeyFacts Energy: Wentworth Tanzania country profile

KEYFACT Energy

KEYFACT Energy