CATALYST

The United Kingdom’s future gas security a key value driver for Hartshead Resources

Recent developments in Eastern Europe and the tragedy that is occurring in the Ukraine has heightened the risk that gas supplies from Russia to Europe and thus the UK may be impacted. Given that, the UK is experiencing abnormally high gas prices (spot £3.11 per therm), but more importantly for HHR the forward curve is now indicating average gas prices in CY2026 of £0.72/therm, that are 50% higher than the historic ten-year average to June 2021 of £0.47/therm.

IOG’s (a listed comparable company to HHR) share price up >150% in last 12 months

At the end of 2017, IOG was trading at an enterprise value (EV)/(2P+2C) of less than US$1/barrel oil equivalent (boe) on its reported 2P reserves plus 2C contingent resources of ~52 million boe (mmboe). As IOG has developed the Saturn Banks Project (SBP) with forecast first gas from the project in the 1Q 2022, IOG shareholders have seen a steady increase in the EV/(2P+2C) multiple the stock is trading at to its current multiple of >US$8.00/boe. Applying that value multiple on 50% of HHR’s current 2C contingent resource for its Phase 1 proposal of 37.4 mmboe (assumes a 50% farmout to fund Phase 1 development) implies a value on the gas retained of ~ A$200m at first gas in 2H CY2024, compared with HHR’s current trading EV of A$40m.

Phase 1 gas initially in place up 18% to 587 Bcf

Geological reservoir modelling by the Xodus Group for HHR has resulted in an 18% lift in Phase 1 gas initially in place to 587 Bcf, primarily reflecting the inclusion of a previously unmapped extension of the Somerville field.

Phase 2 subsurface work nearing completion

The subsurface work covering the Hodgkin and Lovelace field developments is nearing completion. This will allow revised gas in place volumes, recoverable 2C contingent resources and production profiles to be generated for both fields.

Phase 3 prospective resources lifted to 344 Bcf

An exploration study by Xodus for HHR has generated 14 new prospects and leads with an un‐risked 2U Prospective Resource of 344 Bcf. Twelve new prospects, in addition to the existing Garrod and Ayrton prospects, have been identified on the license area.

Earlier this month Hartshead Resources announced the following operational update with respect to the Company’s exploration portfolio as part of its Phase III field development.

Highlights:

- Xodus Group completes exploration study identifying 12 new exploration prospects

- Phase III exploration inventory now totals 14 prospects

- Phase III 2U Prospective Resources1 total 3442 Bcf (un‐risked)

- Aggregated Phase I, Phase II & Phase III volumetrics across the Hartshead portfolio

- 2C Contingent Resources of 3543 Bcf

- 2U Prospective Resources total 344 Bcf

An exploration study across Hartshead’s License P2607 has been completed by Xodus Group, which has generated a new prospect inventory totalling 14 prospects & leads with un‐risked 2U Prospective Resources of 344 Bcf. Twelve new prospects, in addition to the existing Garrod and Ayrton prospects, have been identified on the license area.

A number of opportunities for further work have been identified by Xodus to potentially further de‐risk the prospects and reduce volumetric uncertainty including seismic reprocessing and geological and geophysical studies. The prospects will be economically evaluated and ranked prior to being short listed for further work. Future work on short listed prospect will also involve initial well planning for the drilling of exploration wells in the final selected prospect or prospects. It may be that the McLaren prospect can be drilled as part of the Somerville development project in 2024 or 2025 and this option is being evaluated. Any other prospects selected to be drilled would likely be drilled as vertical exploration wells, sometime following Phase I first gas which is scheduled for H2 2024.

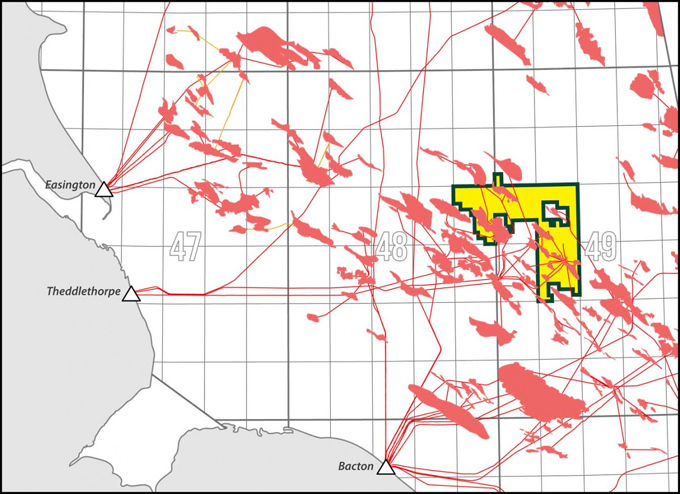

License P2607

The gas fields and prospects are divided into three phases for workstreams and operations:

PHASE I

Comprises the Viking Wx and Victoria Gas Fields. Both fields have historic production, multiple well penetrations, 3D seismic coverage and combined remaining resources of 217 Bcf of gas (audited 2C contingent resources). Hartshead has commenced field development planning work on these two fields and intends to define the development concept and gas export route by 2022, Take Final Investment Decision (FID) on the development in 2023 and achieve first gas in 2024.

PHASE II

Comprises the Audrey NW and Tethys North Gas Fields. Similarly, these field have production, well penetrations and 3D seismic coverage. Seismic imaging requires improvement by reprocessing of the data in order to move these fields into development planning. Hartshead aims to complete seismic reprocessing by the end of 2021, prior to having the contingent resources in Phase II audited and moving these fields forward for development.

PHASE III

Focuses on the exploration portfolio within the blocks. There are two, already mapped and drill ready prospects, adjacent to existing gas fields. However, a full review of the exploration potential of the blocks will be carried out and a complete exploration inventory assembled prior to any decision to drill. It is intended that successful exploration drilling will lead to fields being rapidly tied in to the Phase I infrastructure.

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy