Highlights

- Good progress has been made with testing at JKT-01Z, with initial production rates of 344 boepd (comprising 241 bopd and 17,500 m3 of gas per day)

- Rapid monetisation of gas and oil production is expected to make Block's monthly cashflow positive

- Nearly $500,000 additional cash revenue per month, based on current production rates and sales prices

- No LTIs, with time and cost to drill beating forecast by 20% and 10% respectively

- Over 30 per cent higher gas price achieved in Georgia, effective from 1 January 2022

- Success at JKT-01Z significantly de-risks and enhances optimisation of future drilling

- Twelve further sidetracks, analogous to the JKT-01Z, being assessed, including re-completion of the WR-B1 well

JKT-01Z Well Testing

Block Energy plc, the exploration and production company focused on Georgia, is pleased to announce testing on well JKT-01Z has commenced, with current average production rates of 344 boepd, comprising 241 bopd and 17,500 m3 (103 boe) of gas per day. Build-up analysis showed no pressure depletion after the clean-up and well testing flows. This indicates the well is likely to be in good communication with the wider reservoir and will provide sustained production like KRT-39.

Rapid monetisation of the gas production from JKT-01Z will be achieved, with the well due to be tied into the recently installed gas infrastructure at KRT-39 within one week. At the current production rate, crude oil price and gas sales price, JKT-01Z is forecast to deliver nearly $500,000 additional monthly cashflow to the Company. Excluding capital expenditure, this additional revenue will make the Company cashflow positive, marking a significant milestone for the Company.

Well JKT-01Z reached total depth at 2,565 metres MD as planned in early January 2022, with no LTIs experienced. Since then, the well has been completed and the well test programme is underway. Except for deliberate shut-in periods to monitor pressure build-up, the well has flowed naturally since 16 January 2022. At larger choke sizes, the well has flowed at higher gas rates than that stated above. Currently, production rates are being constrained to stay within the safe operating limits of the existing gas infrastructure.

To maximise operational efficiency and minimise costs, JKT-01Z was drilled as a sidetrack from a vertical well drilled in 2011 by a previous operator. The well was drilled and completed 20 per cent ahead of forecast time and 10 per cent under budgeted cost, owing to efficiencies achieved across drilling operations and procurement.

JKT-01Z is producing from an in-place volume estimated to be approximately 8 MMbbls. The well was drilled with its trajectory orientated along a productive open fracture network identified from analysis of the Company's 3D seismic survey acquired in 2019. The oil and gas shows observed during drilling correlate with the seismic fracture attribute indicators and lithology changes. Block's reservoir (material balance) modelling of the nearby KRT-39 well, which has been a sustained producer of oil and gas for over 20 years, also indicates the presence of a large, connected pore system and strong aquifer support in the Krtsanisi area of the West Rustavi Middle Eocene Reservoir.

JKT-01Z was drilled along 597 metres of horizontal reservoir section. The top of the reservoir was encountered shallower than prognosed, resulting in a significant increase in estimated reservoir volume, which is expected to enhance resource and reserves volumes.

Gas Sales Agreements

We are pleased to announce the gas sales agreements for the sale of gas from each of West Rustavi and Block XIB have been renegotiated with effect from 1 January 2022, and have provided benefit to the Company from rising gas prices generally.

During 2021, gas was sold at a fixed discount to the price of the last tender completed by the Georgian Oil and Gas Corporation for the sale of its gas. Now, gas is sold at a fixed discount to the price achieved by the largest supplier to the domestic gas market, and this discount is subject to potential reductions in the future based on the Company achieving operational milestones. As a result of the improved agreement terms and the improved market, Block will achieve a price for its gas in Q1 2022 that is over 30 per cent higher than the price achieved by the Company in the second half of 2021.

Future Plans

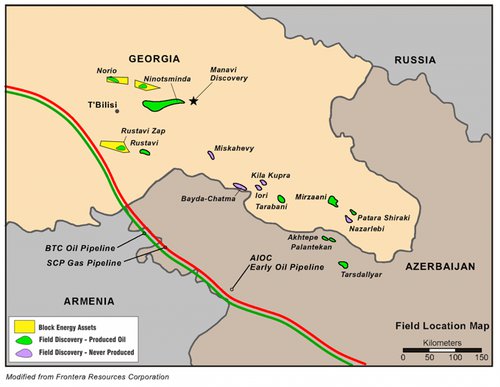

The success at JKT-01Z enhances the Company's confidence in its ability to further optimise drilling within the field through a combination of high-resolution reservoir imaging, reservoir production modelling and horizontal directional drilling technologies. Besides positively impacting the West Rustavi/Krtsanisi field development, this approach should also improve the Company's ability to convert contingent resources to reserves, and reserves to production, across its portfolio.

Using the upgraded sub-surface model, the team are ranking the twelve immediate sidetrack opportunities, analogous to the JKT-01Z well, including a recompletion of the WR-B1 well.

KeyFacts Energy: Block Energy Georgia country profile

KEYFACT Energy

KEYFACT Energy