Serica Energy, a British independent upstream oil and gas company with operations centred on the UK North Sea and over 85% gas production, today releases a Corporate Update for the year ended 31 December 2021.

Mitch Flegg, Chief Executive of Serica Energy, commented:

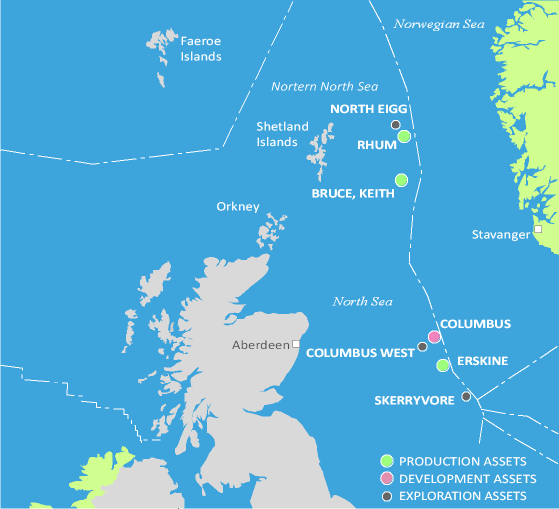

"2021 was a very busy year for Serica, which reinforced the value of our through-cycle investment strategy as our expenditure during the low gas price environment of 2020 on the R3 and Columbus projects bore fruit this year. The importance of our contribution to the provision of vital lower carbon gas to the UK’s energy market was also demonstrated. We will continue to pursue our investment-led strategy this year with a planned well intervention programme on Bruce and Keith in addition to our exploration well at North Eigg. As always, we continue to look for acquisition opportunities that fit our criteria and will add value for our stakeholders.”

Production

- With the introduction of R3 and Columbus, Serica’s production is now 85% gas, a vital part of the UK’s energy mix as we move towards Net Zero. As operator of Bruce, Keith and Rhum, Serica is responsible for over 5% of the UK’s gas production. This production has a significantly lower carbon footprint than imported LNG and helps maintain the UK’s security of supply

- The Rhum R3 well was put into production in late August 2021 and has boosted total Rhum production significantly, adding up to 6,000 boe/d net to Serica

- First production from the Columbus field was achieved in late November 2021. Early production was initially constrained due to temporary unavailability of full capacity in the export system but average rates of 3,270 boe/d net to Serica were achieved in the period up to year-end

Financial

- Gas prices closed 2021 very strongly, contributing to a market average for the year of over 113p/therm (2020: 25p/therm) with oil also higher, averaging over $70/bbl (2020: $45/bbl)

- This allied to growing production volumes drove Serica’s total cash resources to £218.4 million at 31 December 2021 of which £103.0 million was held as cash and deposits (2020: £89.3 million) and a further £115.4 million was lodged as temporary security with gas price hedge counterparties (2020: £1.8 million)

- The BKR net cash flow sharing arrangements came to an end on 31 December 2021. From 1 January 2022, we enter a new phase for the Company where we will be retaining 100% (2021: 60%) of the net cash flow from the BKR fields, benefitting fully from the recent increase in production levels

KeyFacts Energy: Serica Energy UK country profile

KEYFACT Energy

KEYFACT Energy