Angus Energy has had at least six bona fide approaches to participate in the FSP and/or other indications of interest in a potential offer for either all of the shares of the Company or the Company's licence interest in the Saltfleetby gas field. In accordance with the Company's announcement of 6 January, the Company considers it inappropriate to identify the Parties but the Company will engage with and evaluate each expression of interest until a firm proposal can be agreed and announced.

Angus is not a large and complicated group and the Company does not envisage an extended period of time will be necessary for the Parties to complete due diligence, other than that involved in familiarising themselves with the documentation details of the £12m Saltfleetby Gas Field Development Loan Facility and associated security arrangements and gas sales hedge.

Consideration of the capital structure of any combination will be of critical importance not just to shareholders, in the instance of a share for share offer, but also to the Loan and Hedge counterparties, each of whom benefit from change of control provisions. Such provisions require the consent of those counterparties to any change of control if the Loan is not to be immediately refinanced and/or the Hedge accelerated.

Additionally, regulatory guidance, newly restated on 13 January 2022 by the Oil and Gas Authority ('OGA'), lays emphasis on evaluation of the financial resources available to the combined group and interested parties, whether for the Company or its Licence interests, are strongly advised to consult the OGA on this point.

George Lucan, CEO, commented:

"We are pleased with the expressed level of interest in the Company or in its principal asset,and will proceed with our formal sales process with due professionalism, expediency and confidentiality to achieve the best possible result for all of Angus' shareholders."

COMPANY PROFILE (November 2020)

KeyFacts Energy holds a global database comprising over 600 Oil & Gas and renewable energy profiles. The following example provides a snap-shot guide to Angus Energy's onshore UK operational activity.

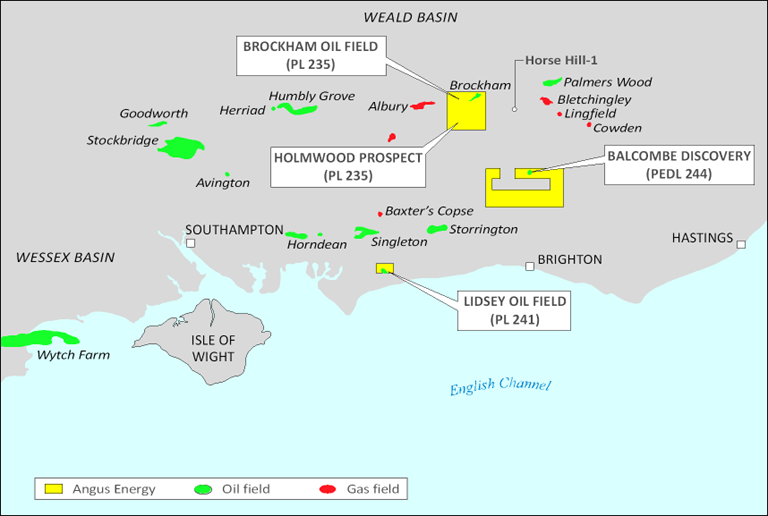

Map source: KeyFacts Energy

Angus Energy majority owns and operates conventional oil production fields at Brockham (PL 235) and Lidsey (PL 241) and has a 25% interest in the Balcombe Licence (PEDL244) and a 12.5% interest in the PEDL143 Licence (A24 Prospect) and a 51% interest in the Saltfleetby Gas Field (PEDL005).

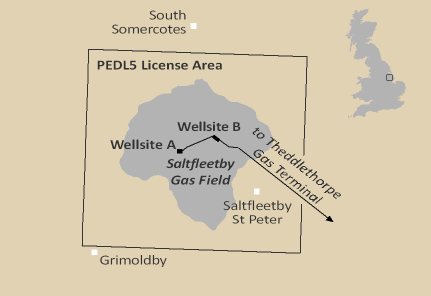

SALTFLEETBY GAS FIELD

- Licence: PEDL005 (Saltfleetby)

- Licence Area: 91.8km²

- Location: Lincolnshire

- Operator: Angus Energy

- Angus Interest: 51%

- Partners: Saltfleetby Energy 49%

- Wells: SF2, SF4, SF5, SF6, SF7, SF8

The Saltfleetby Gas Field is located onshore UK in licence PEDL005, East Lincolnshire. The field was discovered in 1996 and produced gas from both the Westphalian Sandstones and Namurian reservoirs and was, upon discovery, the largest onshore gas field in the UK with a GIIP of 114 BCF. Production began in 1999 at rates exceeding 50 MMScf per day and produced gas, water, and condesnate was piped via a 10” pipeline to the nearby Theddlethorpe Gas Terminal (TGT) where it was processed and sent into the National Grid. Eight wells and several sidetracks have been drilled on the site.

In 2017, TGT was shut down leaving the field stranded with nowhere to process the produced gas and no direct export route. Angus Energy acquired a 51% interest and operatorship in the field in late 2019/early 2020 and intends to continue production from the field following successful reconnection to the National Grid.

The keys parts of the project are to install processing facilities on the existing Saltfleetby site to ensure gas is at the required pressure, temperature, and specification to be sent to the National Grid, and to install a short export pipeline extension of some 750m to connect the field directly to the National Transmission System. Work is underway to complete these projects with the aim to bring the field onstream in early 2021.

In August 2020, Angus Energy entered into an off-take agreement for the entire production from the Saltfleetby Gas Field with Shell Energy Europe.

Geothermal Projects at Saltfleetby

In June 2020, the Company engaged a third party report from Soluzioni Hydrocarburi S.A. on the potential to repurpose two wells at the Saltfleetby Gas Field, SF05 and SF08, for a closed loop system of heat recovery by producing, and reinjecting, water from the Sherwood Sandstone water bearing layer. The report examined preferred flow rates of water necessary to achieve maximum heat recovery, likely pathways, speed and direction of injected water in the formation and the potential for connection or otherwise of the injected water between producer and injector wells and any impact on heat recovery.

The candidate wells’ deviation profiles were drawn to obtain the distance between SF05 and SF08 at mid-aquifer depth which is at a depth of 1,313 m. The wells’ average penetration angle across the Sherwood sandstone was also computed. Note that well distance for a typical well doublet (a two well project) is of the order of 1 km. The result of the study yielded a potential thermal power output for the doublet of between 1.34MW and 6.98 MW which could be used to power a portion of the site for the next decade.

Further Geothermal Project

Away from Saltfleetby, a further potential large scale geothermal project is under study. The proposed scheme, located in an area of high geothermal gradient, would be designed to achieve significant commercial power generation. Current projects in the area have de-risked some aspects of this technology and this project would seek to build on that experience to scale up to a full power generation project.

Current work is evaluating possible locations including preliminary discussions with land owners coupled with technical work on well design, surface facilities and infrastructure including initial contacts with the electricity grid connection provider. At the same time the regulatory and planning framework is being reviewed and initial submissions are in preparation. Deeper geothermal energy will become increasingly important as a stable provider of electricity balancing the output from other green energy sources that are subject to the vagaries of wind and weather. Angus sees a large new market opening for these projects and wishes to be an early entrant to the field.

BALCOMBE FIELD DISCOVERY

- Licence: PEDL244

- Licence Area: 154km²

- Location: Weald Basin, SE of Crawley

- Operator: Angus Energy

- Angus Interest: 25%

- Partners: Cuadrilla Balcombe Ltd. 56.25%, Lucas Bolney Ltd. 18.75%

- Wells: Balcombe 1, Balcombe 2Z (to be tested)

Angus Energy holds a 25% stake in and is the Operator of, the Balcombe Discovery along with its partners Cuadrilla and Lucas Bolney. The Balcombe site lies approximately 8km south east of Crawley near the village of Balcombe. The conventional oil accumulation lies on the downthrown side of the Borde Hill Fault, with dip closure present both to the east and west at Upper Jurassic level. The field is positioned in a prime central location of the Weald Basin, where buried rock intervals are at their thickest, and oil source rock intervals at their most mature.

The Balcombe Discovery is considered to be in the ‘sweet spot’ of the Weald Basin given the 568m thickness and highest maturity of the Kimmeridge layers. Regional work by Angus has established that the Kimmeridge micrite layers encountered at Balcombe can be regionally correlated across to both the Brockham oil field and Horse Hill, where in 2016 UK Oil & Gas Investments PLC and their partners announced excellent flow rates from the Upper and Lower Kimmeridge Micritic limestone reservoirs.

Angus Energy tested the Balcombe 2Z well in the Autumn of 2018 and achieved strong oil flow rates to surface. However, the oil production rates were restricted by drilling fluids not totally recovered from the well. The company intends to return to the site in Q4 2020 to recover remaining drilling fluids and carry out an Extended Well Test to prove up the commercial potential of the field.

LIDSEY OIL FIELD

- Licence: PL241 (Production Licence)

- Licence Area: 5.3km²

- Location: Weald Basin, UK, Bognor Regis

- Operator: Angus Energy

- Angus Interest: 80%

- Partners: Terrain Energy 10%, Brockham Capital 10%

- Wells: Lidsey 1, Lidsey X2

The Lidsey oil field is located in the production licence PL241, onshore West Sussex near Bognor Regis, on the southern flank of the Weald Basin. Angus energy is the operator and majority partner of the licence and currently holds a 80% interest in the field.

The field was discovered in 1987 by Carless exploration with the Lidsey 1 discovery well, which encountered oil in the Middle Jurassic Bathonian Great Oolite formation. The formation is sealed by the overlying Oxford Clay (proven to be effective at both Humbly Grove & Horndean) and sourced by the Lias, Kimmeridge Clay & Oxford Clay. The structure is a tilted fault block structure on the southern flank of the Weald Basin, dip closed to the north, east and west, and fault sealed to the south.

In October 2017 Angus completed the drilling of a second well, Lidsey X2, which is a conventional horizontal producer along structure through the Great Oolite formation. In addition to the Great Oolite, the well also penetrated the Kimmeridge and Oxford clay formations allowing Angus to collect vital data for analysis. Analysis on completion of the well indicated a ‘net oil pay’ section of 443m from the Great Oolite limestone reservoir.

The Lidsey X2 well has been producing since completion via artificial lift (sucker rod pumps). Lidsey 1 was brought back into production in March 2018.

BROCKHAM OIL FIELD

- Licence: PL235 (Production Licence)

- Licence Area: 8.9km²

- Location: Weald Basin, UK, Dorking

- Operator: Angus Energy

- Angus Interest: 65%

- Partners: Terrain Energy 10%, Doriemus 10%, Brockham Capital 10% Alba 5%

- Wells: BRX2Y, BRX3, BRX4Z

Angus Energy is the operator and majority partner of production licence PL235 located in the Weald Basin, onshore UK. The company currently holds a 65% interest in the Brockham field.

The Brockham field was first discovered by BP in the late 1980’s and since then has a long history of production from the Portland Sandstone, a conventional sandstone oil reservoir. Production from the Portland Sandstone has continued since discovery in the 1980’s right up to the last few years. The field has undergone a steady and predictable decline in production rate as the asset has matured.

In February 2017 Angus Energy drilled the BRX4Z sidetrack to assess the prospectivity of oil production in the Kimmeridge Clay formation, a formation that had flowed oil from the Angus Energy drilled Horse Hill-1 well only a few miles away. Following drilling and testing it was confirmed that the Kimmeridge would not flow commercial volumes of oil and the well is now suspended.

Currently the site has a water replacement pressure support well (BR3), a Portland Sandstone production well (BRX2Y) and the BRX4Z sidetrack. Angus Energy still see’s significant value in the Brockham field and intends to continue production from the Portland Sandstone via the BRX2Y well, while also injecting produced water in the BR3 well to maintain pressure support in the reservoir and to increase oil production. The company is also evaluating the potential to perforate the BRX4Z sidetrack in the Portland Sandstone and isolate the Kimmeridge section to further increase the recovery of the remaining Portland oil pool. Angus Energy hopes to have all regulatory permissions to produce, inject, and perforate effectively in the near future and maximise recovery from the mature Brockham asset.

A24 PROSPECT

- Licence: PEDL143

- Licence Area: 91.8km²

- Location: Northern Weald Basin outside of AONB

- Operator: UK Oil & Gas

- Angus Interest: 12.5%

- Partners: UK Oil & Gas plc (67.5%), Egdon Resources (18.4%), Angus Energy (12.5%), Atwood Petroleum (1.6%)

Angus Energy holds a 12.5% interest in PEDL 143, which contains the undrilled Holmwood prospect. The licence is operated by UK Oil & Gas plc and lies immediately to the south-west of the Brockham oil field just south of Dorking, Surrey. The Operator is currently evaluating a number of sites outside of the nearby Area of Outstanding Natural Beauty in advance of developing a drilling programme which will target the Portland Sandstone and the Kimmeridge Clay formation.

The conventional Portland Sandstone reservoir has been proven to be productive at the adjacent Brockham oil field, and at the nearby Horse Hill oil discovery. The well will also target the Kimmeridge Micrites which produced record onshore flow rates at the Horse Hill 1 well in PEDL 137, some 8km to the east. All operations addressing the A24 prospect will be performed through conventional production.

All operations at Holmwood will be performed through conventional production. There will be no hydraulic fracturing or “fracking”.

In August 2019, the Oil & Gas Authority granted a two-year extension to the inital term of the PEDL143 Licence. The inital term will now end on 30 September 2022.

Leadership

Patrick Clanwilliam Non-executive Chairman

George Lucan Managing Director

Carlos Fernandes Finance Director

Andrew Hollis Technical Director

Mike Wells Director of UK Operations (Non-Board)

Cameron Buchanan Non-Executive Director

Contact

Angus Energy

Building 3 Chiswick Park, 566 Chiswick High Street, London W4 5YA

Tel: +44 (0) 208 899 6380 l Email: info@angusenergy.co.uk

KeyFacts Energy: Angus Energy UK country profile l For more details about our company profile database, contact us.

KEYFACT Energy

KEYFACT Energy