A one-off ‘windfall tax’ on the UK’s offshore oil and gas operators would cause irreparable damage to the industry and leave consumers even more exposed to global shortages, the industry’s leading body has warned.

Such a tax has been proposed by some opposition politicians as a response to surging gas prices across Europe. Such rises could add £700 to the average UK domestic annual energy bill (currently £1,250) from April.

OGUK, which represents the UK offshore oil and gas industry, said the increases were a global problem and showed the importance of protecting the UK industry rather than penalising it.

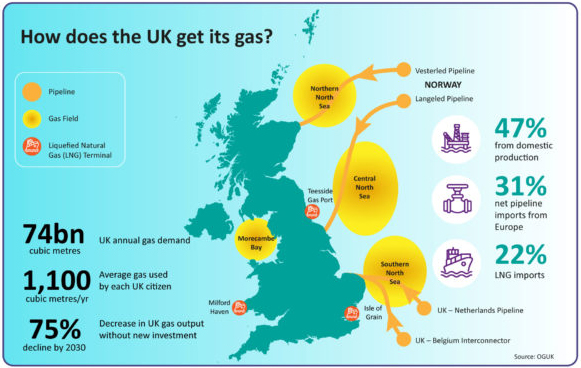

- The industry extracts gas from deep under the UK’s surrounding seas, providing about half the 74 billion cubic metres of gas used by consumers each year – buffering them against global shortages.

- There are about 250 gas and oil installations, with 10-12,000 offshore workers, operating on the UK continental shelf to provide the nation with a secure source of energy.

- The UK relies on oil and gas for about 73% of its total energy.

OGUK argues that energy companies will become increasingly reluctant to make the long-term multi-billion-pound investments needed to extract such resources if they are threatened with new windfall taxes whenever prices go up.

It argues that such taxes would drive investment down – and the UK’s oil and gas production would plummet, forcing it to import far more of its energy.

Jenny Stanning, OGUK External Relations Director, said:

“This idea is offering consumers false hope – and the risk of real long-term damage to UK Plc.

“In the short term the Treasury is already gaining from these price rises. It will get an additional £3.5 billion taxes in the two years from last April – making a total of more than £5 billion. We already pay up to 40% corporation tax – roughly double any other sector.

“In the longer-term a windfall tax would also be the worst thing for consumers because it would damage competitiveness, and discourage energy companies from investing in the UK.

“That would reduce our energy security and make us even more dependent on imports from places like Russia and the middle east.

“Many of the companies that might be affected by a windfall tax are also investing heavily in low-carbon and renewable energy. For them, a windfall tax could reduce the amounts they could invest.”

“The UK gets 73% of its total energy from gas and oil. About 24m homes are heated by gas which also generates 42% of our electricity. So, the Europe-wide gas shortages are a stark reminder of why the UK should safeguard its offshore sector – and financial stability is an essential part of that.”

KeyFacts Energy Industry Directory: Oil & Gas UK

KEYFACT Energy

KEYFACT Energy