Following the completion of the NuTech reservoir characterisation studies, seismic re-mapping and the analysis of the MOU-1 pressures whilst drilling, the Company has identified all the specialist testing equipment and size of perforating guns it requires in-country to commence rigless testing, subject to partner approval, of MOU-1 at the earliest opportunity in 2022, allowing for any potential COVID restrictions that may or may not impact personnel movements. The objective will be to establish commercial gas flow rates and to analyse pressure data to estimate volume of gas connected to the MOU-1 wellbore.

The Company has completed a pilot CNG study. The Company's own project economics indicate that a pilot CNG development in the range 2 to 5 mm cfgpd is economic based on the prices paid for gas in Morocco by the industrial sector.

The Company is of the opinion, subject to partner approval, that a fast-track approach to a CNG pilot development based initially solely on MOU-1 gas volumes would be possible subject to the final results of the MOU-1 testing programme.

Current industrial users of gas in Morocco may urgently require new gas supplies during the early part of 2022. Potential MOU-1 gas would be offered, subject to partner approval, on a first come first served basis to those wanting exclusivity over a new gas supply. There is no other short-term option for access to a new gas supply in Morocco. The Company would not guarantee minimum delivery volumes from MOU-1, in order to eliminate the commercial risk of non-delivery of gas on any particular day. Delivery risk would be shared with the end user. There is no other alternative at present for end users and the proposed commercial model would encourage end users to enter into a joint venture agreement with the Company to help finance and develop incremental CNG gas resources through drilling and completion of additional production wells. The Company is a proven, competent and low cost operator in Morocco with significant "running room" to expand gas sales based on a CNG development concept and a potential gas structure covering 32 km² connected to the MOU-1 gas discovery.

A new Competent Persons Report for the MOU-4 Fan penetrated by MOU-1 is being generated by SLR Consulting (Ireland) Ltd. and will be released at the earliest opportunity at the beginning of 2022.

The Company is fully funded to carry out the extensive MOU-1 testing programme.

End of Year Operations Update

- Extended MOU-1 well testing programme to commence in Morocco

- Fully funded for MOU-1 well testing operations

- Moroccan end users for gas urgently seeking new gas supplies

- Opportunity for early monetisation for Compressed Natural Gas deliveries

- MOU-4 Fan Prospect tested and de-risked by MOU-1 - 32km² confirmed

- MOU-4 Competent Persons Report due to be published early in 2022 pre-MOU-1 testing

- Irish gas demand re-vitalised and requiring the equivalent of the discovery of another Corrib gas field

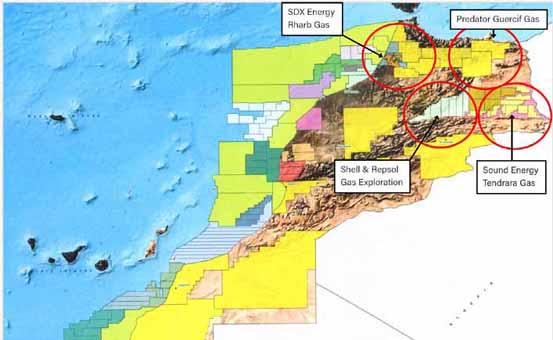

Morocco - The Moulouya Gas Project

As previously reported the MOU-1 well was successfully drilled, logged and completed for rigless testing within budget and without any subsurface operational issues.

The area around the well site has been restored to the highest environmental standards to preserve the pre-drill natural environment.

Post well evaluation studies have now been completed that included state-of-the art log analysis carried out by NuTech in Houston, Texas. This has re-confirmed two zones for perforating and potential gas flow between 1,231 - 1,241 metres TVD KB and 1,276 - 1,300 metres TVD KB. Reservoir characterisation supports the presence of a submarine fan sequence with multiple thin-bedded higher permeability layers.

The reservoir interval is over-pressured. MOU-1 encountered pressures not seen before in the Rharb Basin at the depth of the reservoir in MOU-1. The pressures encountered at this depth were up to 500 psi higher compared to pre-drill prognosis based on the offset well GRF-1 drilled in 1972 and located only 1.25 km to the southeast of MOU-1 but separated from MOU-1 by a basin-defining transfer fault. As a result of the unexpected pressures whilst drilling the mud weight had to be increased to 12.56 pounds per gallon to successfully control the well. A major pre-drill risk was identified as being the potential for stuck drill pipe through the geological interval penetrated by MOU-1, as has been a historical problem in some wells in the Rharb Basin. Despite the unexpected formation pressures the Company's small but highly experienced drilling team and management working in consultation with its service providers and the Star Valley drilling rig team managed to deliver the well without any of the downhole issues previously experienced in the Rharb Basin.

Conventional well logs delivered at the end of the well did not have sufficient resolution to correctly characterise the reservoirs penetrated by MOU-1. Additional logs were not run as the priority was to secure the well for rigless testing rather than risk logging tools getting stuck in areas of poor borehole integrity, which could have created a significant financial lability. Post-well NuTech log analysis identified permeable thin sands. High mud weights with some drilling mud invasion of the permeable zones are forecast to have reduced the calculated gas saturations.

Based on the depth of the primary target encountered in MOU-1, the pre-drill seismic amplitude anomaly is now confirmed to be a 32 km² submarine fan (the "MOU-4 Fan"). Independent third-party, post-well remapping confirms the presence of the MOU-4 Fan, connected and in continuity with the MOU-1 gas discovery.

MOU-1 penetrated only the extreme western edge of the MOU-4 Fan.

Based on the re-mapping of the MOU-4 Fan, the next step-out well location (MOU-4 well) will be approximately 8 kms. east of MOU-1 but within the same common structural closure as MOU-1.

MOU-4 will test the same seismic amplitude anomaly as MOU-1 successfully encountered but in an area where a maximum provisional thickness of gross reservoir interval is interpreted to be 293 metres compared to approximately 70 metres seen in MOU-1. MOU-4 will target a sub-area of the MOU-4 Fan with an independent 4-way dip closure covering 7.3 km² and characterised by a favourable seismic amplitude response, seismic flat spots potentially related to gas-water contacts and a potential "gas cloud" developed at the eastern limit of structural and possibly stratigraphic closure.

Ireland - LNG and Gas Storage

During the year the Company has focussed on the importance of gas in Ireland as a sustainable greener fuel of choice during the Energy Transition and the importance of security and diversity of gas supply.

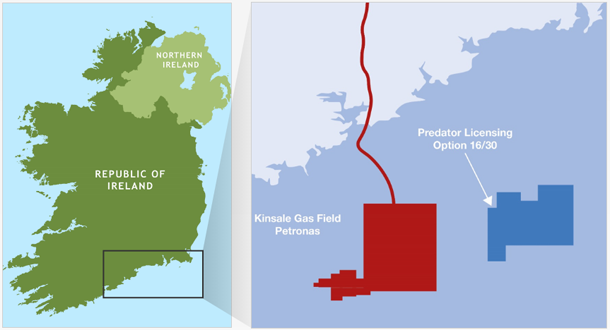

In order to maintain its presence in Ireland, during a difficult time for the fossil fuel industry, the Mag Mell Floating Storage and Regasification Project ("FSRUP") was included in public consultation submissions to the County Cork Development Plan and for the proposed decommissioning of the Kinsale gas pipeline and onshore gas terminal facilities.

Subsequently the Company has generated a "Close Out Report" as requested by the GeoScience Regulation Office of the Department for the Environment, Climate and Communications for its Ram Head Licensing Option, which is the subject of an application for a successor authorisation. In response to Ireland's lack of any operational gas storage facility, the Ram Head technical evaluation included a potential solution to develop a 10 to 15 bcf gas storage facility in an existing gas discovery based on management's 20 years of experience in the Celtic Sea in identifying potential gas storage reservoirs and developing gas storage desktop projects. Such a facility would link in to the FSRUP project to provide summer storage of gas and security of indigenous gas resources during times of peak gas demand and volatility in gas prices.

The Company is currently negotiating a Memorandum of Understanding with a significant entity in the downstream marketing of gas to work together in an exclusive relationship to determine the potential market for FSRU gas and for gas from seasonal storage operations in order to optimise the technical specifications of the FSRU and gas storage facilities for gas send-out to meet periods of high demand and high gas prices.

Towards the end of 2021 it was announced that 2 GW of new gas-fired power generation would be required to be built. Gas supply required for full operation of the power plants would be 300 mm cfgpd, equivalent to discovering another Corrib gas field (in the Company's adjacent Corrib South prospect, which is also the subject of an application for a successor authorisation) or developing the deep discovered gas at Ram Head. The additional power-generating capacity is designed to provide security of energy supply at peak times of demand. This would coincide with peak periods of demand in the European gas market when gas prices are most volatile and gas supplies may be stretched to meet demand. Ireland currently would import the gas required at these peaks times via the interconnector with the UK. Gas price volatility would not be addressed in this manner and electricity prices would continue to come under pressure, having risen 57% in Ireland just this year.

Trinidad

During the first half of the year CO2 EOR operations continued at Inniss-Trinity despite COVID restrictions.

In July 2021 Fram Exploration Trinidad Ltd.'s parent company unilaterally decided to terminate the CO2 EOR operations at very short notice. This was an unforeseen event and the Company continues to evaluate all of its different options to seek redress.

During the latter part of 2021 the Company has been reviewing a number of interesting options with local operators. The Company has presented a commercial model for partnering on CO2 EOR operations to each of these operators based on a sale of Predator Oil & Gas Trinidad Ltd into a new dedicated in-country CO2 EOR services operator. Discussions will continue during the early part of 2022.

The Company's view is that it does not wish to be burdened with operating in Trinidad at the expense of efficiently managing it's potentially valuable assets in Morocco and Ireland where the potential for high-impact returns for shareholders are substantially greater. Maintaining an equity position in a dedicated CO2 EOR services company with a technical advisory role is the Company's preferred business strategy going forward into 2022, particularly as Trinidad is currently suffering a new COVID wave.

Paul Griffiths, CEO of Predator Oil & Gas Holdings Plc commented:

"Despite the COVID pandemic 2021 has been an exceptionally busy year for the Company. The MOU-1 gas discovery has been fully evaluated and the testing programme will now be executed first before any potential additional drilling commences. This is to reflect the commercial opportunity that has crystallised in the last couple of months of 2021 in respect of the situation for current end users of gas in Morocco.

Ireland has been transformed in 12 months. At the beginning of the year gas was side-lined in Ireland. At the end of the year another Corrib gas field is required to supply 9 new gas-fired power stations. Our strategy of hanging in there and providing a technocrat's view of the Energy Transition has served the Company well.

Trinidad has not delivered yet. Not through technical failure, but through an unforeseen and bizarre event that can be put in the context of what others think is an acceptable approach to making a small but positive contribution to addressing Climate Change Concerns.

2022 is set to be an eventful year for the Company in Morocco and we are optimistic about the outcome.

We thank our shareholders for their continued support and patience during yet another difficult year created by the COVID pandemic. Our management strives to deliver success and results based on strict cost control, relevant operational experience and high technical and environmental standards. We are not perfect but we believe trust in management is a valuable asset and should be continually nurtured."

KeyFacts Energy: Predator Oil & Gas Trinidad and Tobago country profile l Morocco country profile l Ireland country profile

KEYFACT Energy

KEYFACT Energy