From our selection of 144 Energy Country Profiles, KeyFacts Energy continue a series of snapshot reports with selected information taken from our 'Energy Country Review' database.

History

Prior to the 1600s, Taiwan was self-governing, although there was no central ruling authority. It was a colony of the Netherlands for about 40 years in the early to mid-17th century and was subsequently independent again for about two decades. China gained control there in the late 17th century and ruled Taiwan for some two centuries. Japan acquired Taiwan in 1895 following the first Sino-Japanese War, and it became a colony.

Taiwan was returned to Nationalist Chinese control in 1945 following Japan’s defeat in World War II. However, in 1949 Chinese communist armies defeated Nationalist forces on the mainland and established the People’s Republic of China there. The Nationalist government and armies fled to Taiwan, again resulting in the separation of Taiwan from China. In the ensuing years the ROC claimed jurisdiction over the Chinese mainland as well as Taiwan, although in the early 1990s Taiwan’s government dropped this claim to China. The Chinese government in Beijing has maintained that it has jurisdiction over Taiwan and has continued to propound a one-China policy—a position that few countries in the world dispute. There has been no agreement, however, on how or when, if ever, the two entities will be reunified.

Country Key Facts

- Capital: Taipei

- Population: 23,8 million (2021)

- Area: 36,188 sq km (13,972 sq miles)

- Languages: Mandarin Chinese (official), Min Nan Chinese (Taiwanese), Hakka

- Major religions: Taoism, Buddhism, Christianity

- Currency: New Taiwan dollar

Wind power in Taiwan

The wind power sector in Taiwan has seen a significant capacity addition in the past decade, almost doubling from 375GW in 2009 to around 700GW in 2018.

A number of factors have been responsible for this - the country has a strong potential for offshore wind with powerful winds and a shallow coastline.

Government policies have also been supportive of offshore wind capacity addition, with attractive feed-in-tariffs, and a conducive business environment.

Government role

The Green Energy Technology Industry Innovation and Promotion Action Plan implemented by the Taiwan Government has set a renewable energy target at 20% of the energy mix by 2025, backed by feed-in-tariffs and regulatory framework.

Presently, the country aims to add 20GW of solar photovoltaic (PV) installations, 5.5GW of offshore wind and 1.2GW of onshore wind capacity by 2025 to meet its target.

In order to attain the renewable energy target set by the government for 2025, the country is going through a green energy revolution.

The government is expecting around $59bn of foreign investment for the development of its renewable energy.

Outlook

A good number of world’s biggest international players are attracted by the island’s strong winds, a stable regulatory framework and the offer of 20-year power purchase agreements with a feed-in-tariff.

The Taiwanese government is focusing more on the offshore segment of the wind power market, as there is limited land area available, along with large potential offshore resources.

If the plans materialise, Taiwan would be among the top ten countries in terms of offshore wind capacity by 2030.

Regulatory framework

The legal basis for the development of and environmental attributes from renewable energy projects is primarily found in the Electricity Act, the Renewable Energy Development Act and the Implementation Regulation Governing Voluntary Renewable Energy Certificates, along with other related rules and regulations.

To promote the development of renewable energy, the Renewable Energy Development Act and related regulations all encourage the establishment of enterprises engaging in renewable energy-based power generation and sales enterprises through a variety of incentives. After the amendment of the Electricity Act in 2017, renewable energy power may be directly sold to end users, detailed rules of which are regulated by the new Regulations on Renewable Energy-Based Power Generation Enterprises Applying for Direct Supply, covering matters such as qualifications and principles of review. For power to be wheeled out through TPC’s grid, the Regulations for Favourable Power Dispatching and Wheeling Expenses cover how wheeling fees are to be calculated.

In addition, TPC, as the sole entity authorised to operate the electricity grid, is obliged to apply feed-in tariffs to all electricity generated from eligible renewable energy-based generator facilities.

For environmental attributes, the National Renewable Energy Certification Centre was established in 2017 to formulate and implement regulations in relation to the Taiwan Renewable Energy Certificate (T-REC) mechanism, verification standards and tracking system. After the renewable energy generation equipment and production amount have been verified, the T-REC is the proof for renewable energy usage and environmental benefits. See question 5 for more details.

E&P

Taiwan has limited indigenous energy resources; therefore, it depends on import for most of its fossil fuel needs. As a result, CPC has cooperated with the government’s “furthering energy supply security mechanism and forging international energy cooperation” policy. CPC is dedicated to improvement of its performance of new energy development, expansion of upstream operations and increase of oversea production to stabilize the supply of crude oil and natural gas of the domestic market and alleviate the impact brought by oil price fluctuation.

In order to improve overall strategic planning, on the basis of active expansion and focus, CPC has adopted exploration and production strategies which aim for expanding foreign operations and exploiting domestic operation, simultaneous undertaking of merger/acquisition and exploration/production and the training of talent for new breakthroughs, in hope of gradually increasing the ratio of self-owned energy reserves within its full sourcing range.

Taiwan has limited indigenous energy resources; therefore, it depends on import for most of its fossil fuel needs. As a result, CPC has cooperated with the government’s “furthering energy supply security mechanism and forging international energy cooperation” policy. CPC is dedicated to improvement of its performance of new energy development, expansion of upstream operations and increase of oversea production to stabilize the supply of crude oil and natural gas of the domestic market and alleviate the impact brought by oil price fluctuation.

In order to improve overall strategic planning, on the basis of active expansion and focus, CPC has adopted exploration and production strategies which aim for expanding foreign operations and exploiting domestic operation, simultaneous undertaking of merger/acquisition and exploration/production and the training of talent for new breakthroughs, in hope of gradually increasing the ratio of self-owned energy reserves within its full sourcing range.

Exploration of onshore oil and gas resources and capacity of geothermal energy

Currently, the company’s 28 onshore producing oil and gas wells are located in and around Mt. Tiezhen, Qingcao Lake, Jinshui, Chuhuangkeng and Guantian. In 2020, they yielded 105 million cubic meters of natural gas and 2,170 kiloliters of condensate. In 2020, CPC carried on domestic onshore oil and gas resources exploration projects and completed a 115.86 km 2D seismic survey of geological structures on Pingtung Plain and 83-square-kilometer geologic surveys including a surface geology survey running from Chiayi to west of the Pingxi Fault in Tainan and a geothermal geology survey of the Mt. Datun area. In order to support national energy policy and actively participate in development of the green energy industry, CPC has also successfully completed the drilling of Tuchang No. 14 and No.15 geothermal wells and is now evaluating their potential of geothermal power generation.

Cooperation for deep-water exploration and self-reliant exploration and production

CPC, Total E&P Chine (TOTAL), and China National Offshore Oil Corporation (CNOOC) signed the Petroleum Contract of Taiyang Block on May 3, 2017. TOTAL, as the Operator, has conducted over 8,000 km 2D seismic survey data acquisition and completed the data processing as of 2020. The interpretation work will continue in 2021.

CPC has also worked with Husky Energy International Corporation to search for oil and gas in deep-water areas within the Block Deep Water 1 (DW-1) in the Tainan basin and completed joint research on the source rock in 2020. Refinement of seismic interpretation of collaborated source rock study and assessment for resource scale of prospects are ongoing in 2021.

In order to increase the percentage of domestically produced energy and gas and oil resources, CPC is evaluating the upside hydrocarbon potential of Tainan and Taihsi Basins Taiwan as the reference for the further exploration on those areas. It has utilized multiple latest technologies, including broadband seismic survey, pre-stack depth migration and a new model for interpretation of seismic survey results for re-processing of available seismic survey information and subsequent consolidation of interpretation and assessment. CPC has also reviewed several sites with exploration potential and planned related operations like boring with the aim to discover resources in national sea areas as soon as possible.

CPC’s upstream operations were launched in 1959. Today, it comprises exploration and production in both onshore and offshore oil and gas fields in Taiwan, the Taiwan Strait and overseas. To date, CPC has yielded the value of over NT$200 billion. Looking to the future, CPC actively enhances the asset value of production sites and plans M&A activities that is centered on exploration and raising its level of ownership over core oil and gas reserves. CPC will endeavor to acquire assets with high upside production potential, above all those with low risk by industry standards. In parallel with this, CPC will develop diversity in the company’s scope of business and to be a player in the green energy industries, aiming to be a very valuable international oil and gas exploration production business.

Renewable energy key players

EGCO Group

In April 2020, EGCO Group completed the acquisition of a 25% ownership interest in Yunlin Holding GmbH which owns the 640MW Yunlin offshore wind farm project in Taiwan.

Yunlin is a holding company which owns 100% of Yunneng Wind Power Co., Ltd. of Taiwan (the “Project Company”). The Project Company is constructing a 640MW offshore wind farm which will be situated in the Taiwan Strait approximately 8 km west of the coast of Yunlin County in Taiwan and covers an overall area of approximately 90 square kilometers. Commissioning of the Project will occur in phases, with phase 1 comprising 352MW scheduled for completion in the 4th quarter of 2020, and phase 2 comprising 288MW scheduled for completion in the 3rd quarter of 2021.

EGCO Group, the first Independent Power Producer in Thailand, is a holding company which has focused on power business investment both in Thailand and overseas and seen investment opportunities in other related power business. The Company’s power plants presently generate electricity using several fuel sources such as natural gas, coal, biomass, hydro, solar, wind, and geothermal which partly enhance power security.

Northland Power

In February 2019, Northland Power's subsidiary executed a Power Purchase Agreement (“PPA”) with Taiwan Power Company (“Taipower”) for its Hai Long 2A offshore wind project, based on its 300 MW Feed-in-Tariff (“FIT”) allocation. Northland and its partner Yushan Energy own 60% and 40% of Hai Long 2A, respectively. Hai Long 2A is the first of the three Hai Long projects (1,044 MW total capacity) to receive its PPA.

Hai Long 2A has entered into a 20-year power PPA with Taipower at the 2019 FIT rate of NTD 6.2795/kWh and NTD 4.1422/kWh for the first and second 10-year periods, respectively. In 2015, the Taiwan government implemented the FIT program to provide long-term contracts designed to inaugurate its offshore wind sector.

Northland Power is a power producer dedicated to developing, building, owning and operating clean and green power infrastructure assets in Canada, Europe and other selected global jurisdictions.

Ørsted

In July 2020, Ørsted and Taiwan-based TSMC signed a corporate power purchase agreement (CPPA). TSMC will offtake the full production from Ørsted’s 920MW Greater Changhua 2b & 4 offshore wind farm, making it the largest-ever contract of its kind within renewable energy. The 20-year fixed-price contract period starts once Greater Changhua 2b & 4 reaches commercial operations in 2025/2026, subject to grid availability and Ørsted’s final investment decision.

Under the agreement with TSMC, the Greater Changhua 2b & 4 offshore wind farm will receive a price for power including T-RECs (Taiwan renewable energy certificate) during the 20-year contract period that is higher than the feed-in-tariff which was originally secured via the outcome of Taiwan’s first offshore windauction in June 2018. This improves the project’s financial viability and helps Ørsted mature Greater Changhua 2b & 4 towards a final investment decision.

In December 2020, Ørsted signed agreements with a consortium comprising global institutional investor Caisse de dépôt et placement du Québec (CDPQ), and Taiwanese private equity fund Cathay PE, who will be acquiring a total of 50 % ownership share of Ørsted’s 605 MW Greater Changhua 1 Offshore Wind Farm. CDPQ will be the majority owner among the two new partners.

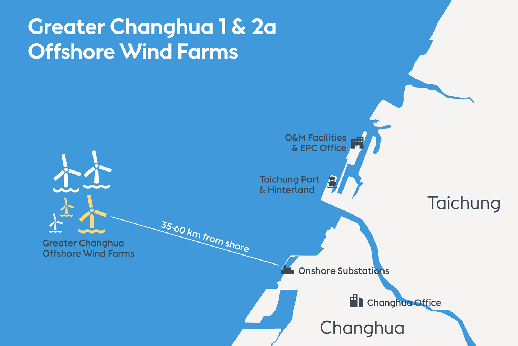

As part of the agreement, Ørsted will construct the Greater Changhua 1 Offshore Wind Farm under a full-scope EPC contract. Ørsted will also provide long-term operations and maintenance (O&M) services from its O&M base at the Port of Taichung.

In March 2021, with all the permits and EIA approvals in place, Ørsted moved ahead with full-scale offshore construction activities of the 900 MW Greater Changhua 1 & 2a Offshore Wind Farms. Ørsted will begin laying export and array cables and installing the offshore substations and foundations in 2021 and will proceed with wind turbine installation in 2022.

Ørsted develops, constructs and operates offshore and onshore wind farms, bioenergy plants and innovative waste-to-energy solutions and provides smart energy products to its customers. Headquartered in Denmark, Ørsted employs 6,080 people.

RWE

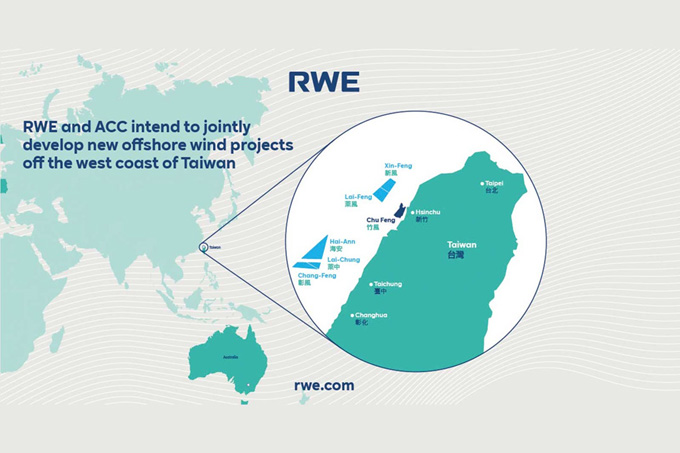

Offshore wind is gaining momentum in Taiwan, where nine gigawatts (GW) of offshore wind capacity is due to be auctioned over the next three years. Against this backdrop RWE and Asia Cement Corporation (ACC) intend to expand their existing strategic partnership to jointly drive the growth of offshore wind in Taiwan and the country’s transition from imported fossils fuels to home grown renewables.

The partners intend to jointly develop new offshore wind projects off the west coast of Taiwan - in the county waters of Hsinchu, Taichung and Changhua. Some of the sites are in water depths that are suitable for floating offshore wind, allowing RWE to apply its international experiences gained from three full-size floating demonstrator projects. This perfectly complements the local expertise and market know-how of ACC. RWE, which opened its office in Taiwan in 2018, and ACC is already collaborating successfully in the development of the Chu Feng offshore wind project, that has a planned installed capacity of up to 448 megawatts.

wpd

With several contracts, wpd is strengthening its presence and activities in Taiwan and intensifying its focus on this emerging energy market.

Early in 2020, ahead of future tender rounds, wpd signed an agreement with Taiwan Green Power Co, Ltd. (TGP), an offshore wind developer belonging to the Taiwanese LeaLea Group. The partners will jointly develop the offshore wind farm site No. 28, which is expected to be part of the third tender round in Taiwan. The project with a planned installed capacity of up to 600 MW is located off the coast of Changhua in an area with excellent wind conditions. Through its development LeaLea has already received the EIA approval and built up a lot of local support for the project. The joint venture with wpd is expected to be the perfect fit as wpd is known as frontrunner for the involvement of local companies in Taiwan and is overperforming with regards to the localization rules.

A further milestone was reached in the Yunlin project, when Thai Electricity Generating Public Company Limited (EGCO Group) acquired a 25% stake in Yunlin Holding GmbH, owner of the 640 MW Yunlin offshore wind farm, from wpd. As the transaction has now been closed, wpd has again been able to win another solvent and reliable partner for the project in addition to the Japanese Sojitz Group (27%), while wpd remains the largest shareholder in the project. The Yunlin project as one of the largest offshore projects in Asia is located in the Taiwan Strait, about 8 km west of the coast of the Yunlin district. The project will be constructed and commissioned in two phases, phase 1 with the first half to be completed end of 2020 and phase 2 with the second half in the third quarter of 2021. A total of 80 Siemens Gamesa SG 8.0 turbines will produce green electricity there.

KeyFacts Energy: Taiwan country profile

If you would like to sign up to KeyFacts Energy's free daily news-alert service click here to join our growing list of subscribers.

KEYFACT Energy

KEYFACT Energy