From our selection of 144 Energy Country Profiles, KeyFacts Energy continue a series of snapshot reports with selected information taken from our 'Energy Country Review' database.

MOZAMBIQUE

With more than 150 trillion cubic feet (tcf) of proven natural gas reserves, Mozambique has been touted as the next great LNG player and is making full use of its potential as it looks at rivaling top African LNG producers like Nigeria and Algeria.

5 major IOCs are already investing in exploration, and proceeding with the construction of platforms for drilling and storing natural gas.

Excellent relations with its neighbours

Moreover, Mozambique has excellent relations with its neighbours, signing Governmental MoUs with African countries and major consumer nations, including China, and signing a technical services agreement with Trinidad & Tobago.

The race in the Rovuma basin started in 2017 and the contracts signed are already worth more than $20 billion within 2 years. Several liquefied natural gas trains are planned for the Rovuma Basin concessions, with a combined annual capacity of over 15 million tonnes, with LNG production starting in the next four years.

History of Petroleum Exploration in Mozambique

Exploration for hydrocarbons in Mozambique goes back to 1904 when the early explorers discovered thick sedimentary basins onshore Mozambique. Poor technology and lack of funds halted those early exploration attempts.

From 1948 onwards international oil companies moved into Mozambique and carried out extensive exploration, mainly onshore with limited activity offshore. As a result the Pande Gas Field was discovered in 1961 by Gulf Oil followed by the gas discoveries of Búzi (1962) and Temane (1967).

Exploration activity declined in the early 1970’s due to political unrest.

New activity was established in the early 1980’s with the enactment of law 3/81 and creation of ENH. In the following years extensive work was carried out to map and appraise the Pande Field.

A breakthrough was made in 1993 when it became clear that the Pande Field could be mapped using direct hydrocarbon indicators (DHI) from seismic data and it turned out that there was a giant bright spot at the top of the reservoir. The method was later also used to map the Temane field with good result.

From 1970 to 1980 there have only been drilled 6 wildcat wells in Mozambique – 3 of them offshore.

An extensive drilling campaign conducted by Sasol in 2003 which included exploration and production wells in the Pande/Temane Block allowed the expansion of gas reserves and the discovery of Inhassoro Gas Field, making total of 5.504 trillion cubic feet (TCF).

Country Key Facts

- Official name: Republic of Mozambique

- Capital: Maputo

- Population: 32,181,798 (2021)

- Area: 799.380 km² (305,000 sq mi)

- Form of government: Republic

- Languages: Portuguese

- Religion: Christian, Muslim

- Currency: Metical

- Calling code: +258

6th Licensing Round

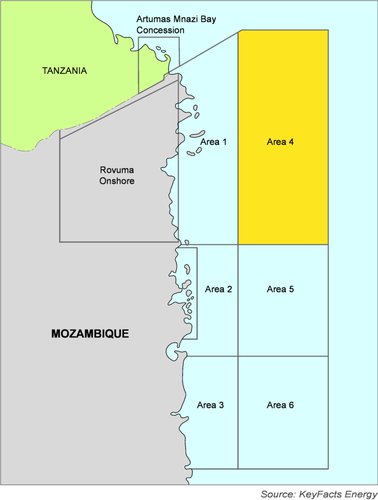

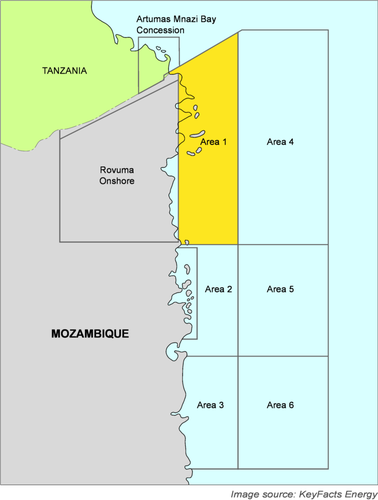

In November 2021, The National Petroleum Institute (INP), representing the Ministry of Mineral Resources and Energy launched the Mozambique 6th Licensing Round for newly defined blocks, offshore Mozambique. For this Licence Round, 16 new blocks have been defined for exploration and production, spread over 4 distinct areas, all offshore, comprising more than 92,000 km sq.

Current activity

Mozambique’s current natural gas production is operated by Sasol (South Africa) in the Inhambane Province, which holds proven reserves of 2.6 trillion cubic feet (tcf). The natural gas is produced and processed at a central facility in Temane and then transported via an 865 km pipeline to South Africa, with a link to southern Mozambique for domestic use.

In May 2016, Sasol initiated drilling of the first well for its Production Sharing Agreement (PSA) license. The PSA development is an integrated oil, liquefied petroleum gas project adjacent to Sasol’s existing petroleum facility. The first phase of the project includes 13 wells and an LPG production facility for an estimated cost of USD1.4 billion.

Due to the discovery of over 180 tcf of natural gas reserves in the Rovuma basin by Texas-based Anadarko and ENI (Italy), Mozambique is expected to become a major exporter in 2023. Anadarko will build an LNG plant to process the gas they discovered in Area 1, off the northern coast of Mozambique near the border with Tanzania. They selected a joint venture of developers including Chicago Bridge & Iron (CB&I), Saipem (Italy) and Chiyoda (Japan) to construct the Afungi LNG Park valued at USD25-30 billion. In January 2017, Anadarko submitted the LNG Plan of Development (POD) to the government of Mozambique and it hopes to make a Final Investment Decision (FID) this year.

ENI has commissioned a floating LNG (FLNG) facility for its Coral South Project, due for completing in 2022. The Engineering Procurement and Construction (EPC) contract was officially awarded to a consortium composed of Technip, JGC and Samsung Heavy Industries. Additionally, ExxonMobil agreed to acquire from ENI a 25% indirect interest in the Area 4 block. ENI leads the Coral South FLNG project and all upstream operations, and ExxonMobil will lead the construction and operation of liquefaction facilities onshore. TOTAL concluded its PSA and is expected to initiate exploration activities in the second half of 2017 in Areas 3 and 6.

In 2015, ExxonMobil was awarded a concession for exploration and production of four offshore blocks in the Angoche and Zambezi areas along with Sasol, ENI and Delonex (U.K.). However, none of the operators have started exploration or production activities as negotiation agreements with the government are not finalized, although ExxonMobil will likely begin exploration in 2017.

Empresa Nacional de Hidrocarbonetos (ENH), the state-owned hydrocarbon company, represents the Mozambican Government in petroleum operations. It is stipulated by law that ENH participates as a stakeholder in petroleum operations and production as well as exploration projects.

ENH is also engaged with other national flagship projects such as the port expansion of the oil and gas terminal in the Port of Pemba, and the General Urbanization Plan for the district of Palma, where the natural gas business activities will be concentrated. In partnership with the Korean gas company Kogas, ENH is also operating a gas distribution network to provide households and industry with piped gas in the south of Mozambique.

The government of Mozambique determined that a portion of the gas should be used locally to address the domestic market and the Ministry of Mineral Resources and Energy launched a tender to identify companies interested in developing industrial projects to use the gas. Norway’s Yara International was granted an allocation of 80-90 mcf/d of gas to produce 1.2-1.3m t/yr of fertilizers. Additionally, Royal Dutch Shell’s Gas to Liquid (GTL) project will produce 38m b/d of liquid fuels such as diesel, naphtha, and kerosene.

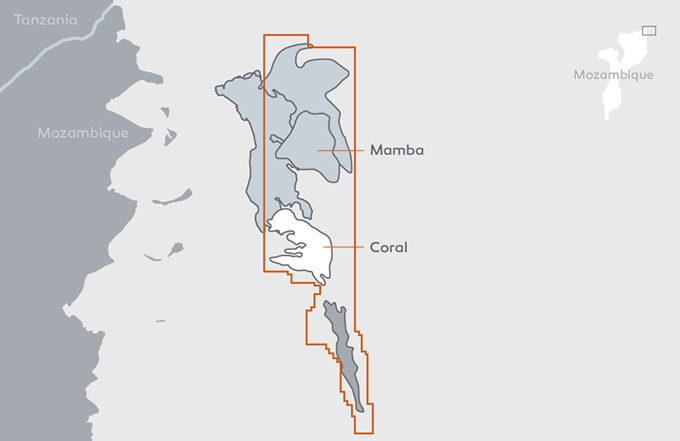

Development concept of Area 4

Map source: Galp

Coral offshore

The Coral South project consists of the construction of a floating liquefied natural gas (FLNG) unit with a capacity of more than 3.4 million tons per year (mtpa) of LNG, which will be connected to six wells.

The FLNG will be allocated to the southern part of the Coral discovery, which is located exclusively in Area 4, containing about 16 tcf of natural gas.

At the end of 2016, Galp's Board of Directors approved the investment in the Coral South area, with a Final Investment Decision (FID) having been taken by the consortium during 2017. The consortium awarded the Engineering, Procurement, Construction, Installation and Commissioning (EPCIC) contract for the FLNG unit to the TJS consortium (Technip, JGC, Samsung).

Total development capex for upstream and midstream is estimated at c.$7 billion and first gas is expected during 2022. The Area 4 consortium also signed a c.$5 bn project financing package with a syndicate of leading ECAs and international financial institutions.

In October 2016, the consortium signed an agreement with BP for the offtake of the volumes produced through the Coral South FLNG, for a period of 20 years.

During 2019, the consortium started the drilling campaign of the Coral area, which includes plans for the drilling of six wells, and is progressing according to the project timeline.

Rovuma LNG

The Mamba discovery stands out for the size and quality of its resources, which allow for a high-scale project and reduced unit operating costs. Allied to the area’s geographical location, this should ensure a high competitiveness compared to other LNG projects.

Since the reservoirs extend between Area 4 and the adjacent Area 1, it will require the approval of unitisation agreement, which has already been submitted, by the Government of Mozambique.

The Area 4 consortium is preparing the first phase of the discovery’s development, with potential for subsequent phases. In 2018, Galp and its partners submitted the Development Plan for Rovuma LNG project, considering two LNG trains of 7.6 mtpa each.

In May 2019, the Government of Mozambique approved the Development Plan for Phase I of the Rovuma LNG project and also approved the LNG sales and purchase agreements for the project. The Joint Venture that is developing Area 4 has awarded the midstream EPC contract for Phase I of the Rovuma LNG onshore facilities to the JFT consortium, which is made up of JGC, Fluor and TechnipFMC.

Currently, the partners are working on the remaining milestones for the project’s final investment decision, namely securing the project financing package. LNG production is estimated to start in the second half of this decade.

Mozambique LNG

Mozambique LNG is the country’s first onshore LNG development. The project includes the development of the Golfinho and Atum fields located within Offshore Area 1 and the construction of a two-trains liquefaction plant with a capacity of 12.9 million tonnes per year (Mt/y). The Area 1 contains more than 60 Tcf of gas resources, of which 18 Tcf will be developed with the first two trains. The Final Investment Decision (FID) on Mozambique LNG was announced on June 18, 2019, and the project is expected to come into production by 2024.

The Mozambique LNG project is largely derisked since almost 90% of the production is already sold through long-term contracts with key LNG buyers in Asia and in Europe. Additionally, the project is expected to have a domestic gas component for in-country consumption to help fuel future economic development.

Total operates Mozambique LNG with a 26.5% participating interest alongside ENH Rovuma Área Um, S.A. (15%), Mitsui E&P Mozambique Area1 Ltd. (20%), ONGC Videsh Ltd. (10%), Beas Rovuma Energy Mozambique Limited (10%), BPRL Ventures Mozambique B.V. (10%), and PTTEP Mozambique Area 1 Limited (8.5%).

Mozambique LNG represents a total post-FID investment of 20 B$. The project financing amounts to 14.9 B$, the biggest ever in Africa, and includes direct and covered loans from 8 Export Credit Agencies (ECAs), 19 commercial bank facilities, and a loan from the African Development Bank.

Key Oil & Gas Players

China National Petroleum Corporation (CNPC)

In May 2016, CNPC and Empresa Nacional de Hidrocarbonetos E.P. (ENH), signed a cooperation framework agreement between CNPC and ENH.

Under the agreement, the two sides will reinforce cooperation in oil and gas exploration and production, and natural gas processing and marketing. Specifically, CNPC will actively participate in Mozambique’s exploration and production (E&P) projects, promote cooperation in gas field services, and cultivate technicians and managerial talents for Mozambique’s oil industry.

CNPC has been participating in offshore gas E&P projects in Mozambique since 2013.

Block 4 is CNPC’s first ultra-deep subsea natural gas and liquefied natural gas (LNG) project in East Africa, and the largest individual project of Chinese enterprises in the country.

Also, CNPC is actively involved in oilfield services and engineering construction projects in Mozambique, such as geophysical prospecting, pipeline construction, project contracting, and equipment supply.

Energi Mega Persada Tbk. (EMP)

In October 2013, EMP acquired 75% stake in BUZI EPCC block. Currently, the gas block has 2P reserves of 283 billion cubic feet and prospective resource of 13.4 trillion cubic feet (on 100% basis). The remaining 25% of the stake in BUZI EPCC is owned by Empressa Nacional de Hidrocarbonetos.

ENH

In August 2018, the government of Mozambique approved concession contracts granting energy companies exclusive rights on a block in the Northern Zambezi basin. Eni, ExxonMobil, Delonex Energy, Sasol and ENH are now allowed to start exploration activities in the Block. The companies were awarded exploitation licenses of Block 5 in 2015 but there was a three year delay for the approval of the contracts.

Eni

Eni has been present in Mozambique since 2006, following the acquisition of a participation in the Petroleum Contract of Area 4, in the offshore Rovuma basin, in the north of the country.

Following an intense exploration campaign that spanned just 3 years, between 2011 and 2014 the supergiant gas fields of Coral, Mamba and Agulha were discovered, boasting estimated 2,407 billion cubic meters of gas in place.

Coral initial development program includes the construction of a floating plant (FLNG), to treat, liquefy, store and offload LNG. The plant will have a liquefaction capacity of approximately 3.4 million tons per year. Construction has started in June 2017 production is expected to start in 2022.

The Mamba Complex development program includes the construction of an onshore plant composed by 2 trains for gas treatment and liquefaction, with a liquefaction capacity of 15.2 million tons per year. Production is expected to start in 2024.

Eni is additionally Eni is the operator of Block A5-A Consortium, with partners ExxonMobil, Delonex Energy, Sasol and ENH.

The block was awarded to Eni following the 5th competitive Licensing Round launched by the Republic of Mozambique. It extends over an area of 5,133 square km, at water depths between 300 and 1,800 m, in a completely unexplored zone in front of the town of Angoche.

ExxonMobil

In December 2017, ExxonMobil Development Africa B.V. completed the acquisition of a 25 percent indirect interest in Mozambique’s gas-rich Area 4 block from Eni and assumed responsibility for midstream operations.

ExxonMobil will lead the construction and operation of all future natural gas liquefaction and related facilities, while Eni will continue to lead the Coral floating LNG project and all upstream operations. The operating model will enable the use of best practices and skills with each company focusing on distinct and clearly defined scopes while preserving the benefits of an integrated project.

ExxonMobil now owns a 35.7 percent interest in Eni East Africa S.p.A. (to be renamed Mozambique Rovuma Venture S.p.A.), which holds a 70 percent interest in Area 4, and is co-owned with Eni (35.7 percent) and CNPC (28.6 percent).

In July 2018, Mozambique Rovuma Venture submitted the development plan to the government for the first phase of the Rovuma LNG project, which will produce, liquefy and market natural gas from the Mamba fields located in the Area 4 block offshore Mozambique.

The plan details the proposed design and construction of two liquefied natural gas trains which will each produce 7.6 million tons of LNG per year.

ExxonMobil additionally holds an interest in Block 5 in the Northern Zambezi basin.

Galp

Galp has been present in Mozambique in the Upstream business since 2007. The entry into the country was marked by the signing of the farm-in contract with Eni and the Empresa Nacional de Hidrocarbonetos (ENH) for the exploration of Area 4, located in waters ranging from shallow to ultra-deep waters of the Rovuma basin.

Kogas

Kogas owns a 10 percent stake in the Area 4.

Mitsui Oil Exploration (MOECO)

In Offshore Area 1, the Company continues to reprocess 3D seismic data covering the Orca, Tubarão, and Tubarão Tigre discovery areas, in accordance with the appraisal program submitted to the Government of Mozambique in the first quarter of 2015.

In March 2018, official approval from the Government of Mozambique for the Golfinho/Atum Field Development Plan was received. The Development Plan outlines the integrated onshore project from the reservoir to the LNG market and is a culmination of the substantial progress made to date on the technical and commercial aspects of the LNG development.

The Mozambique LNG project will be Mozambique's first onshore LNG development, initially consisting of two LNG trains with total nameplate capacity of 12.88 MTPA to support the development of the Golfinho/Atum fields located entirely within Offshore Area 1. This foundational project paves the way for significant future expansion of up to 50 MTPA from Offshore Area 1. The Golfinho/Atum Project will also supply initial volumes of approximately 100 million cubic feet of natural gas per day (MMcf/d) (50 MMcf/d per train) for domestic use in Mozambique.

Oil India Limited (OIL)

In March 2021, OIL announced that Mozambique Rovuma Offshore Area-1 Project has satisfied all the conditions precedent for the first debt drawdown of the project financing, which was finalized by the Project in July 2020. The senior debt financing of USD 14.9 Billion comprises of Export Credit Agencies (the “ECA”) Direct Loans, ECA Covered Facilities, Commercial Bank Facilities and a Loan Facility with the African Development Bank. The first drawdown from project financing is expected in April 2021.

OIL is a Sponsor in Area 1 Block, through its 40% shareholding in BREML, which holds a 10% Participa development, initially consisting of two LNG trains with total nameplate capacity of 13.12 million tons per annum (MMTPA) for which Final Investment Decision (FID) at consortium level was announced on 18th June 2019.

The Project is operated by Total E&P Mozambique Area 1 Limitada, a wholly owned subsidiary of Total SE, with 26.5 percent working interest. Co-venturers include ENH Rovuma Área Um, S.A. (15 percent), Mitsui E&P Mozambique Area1 Limited (20 percent), ONGC Videsh Rovuma Limited (10 percent), Beas Rovuma Energy Mozambique Limited (10 percent), BPRL Ventures Mozambique B.V. (10 percent), and PTTEP Mozambique Area 1 Limited (8.5 percent).

ONGC Videsh

ONGC Videsh holds 16% interest in the Mozambique Rovuma Area-1 Offshore Project out of which 10% PI is held directly by ONGC Videsh and another 6% interest is held through its 60% shareholding in ‘Beas Rovuma Energy Mozambique Limited’ (“BREML”) while the remaining 40% shares in BREML are held by Oil India Limited (“OIL”).

PTTEP

In February 2018, PTTEP announced Mozambique LNG1 Company Pte. Ltd., the jointly owned sales entity of PTTEP and other partners of Mozambique Rovuma Offshore Area 1 project, entered into a long-term LNG Sale and Purchase Agreement (SPA) with Électricité de France, S.A. (EDF), an integrated electricity company headquarter in France. The off-take agreement calls for the supply of 1.2 million tonnes per annum (MTPA) for a term of 15 years.

Qatar Petroleum

In December 2018, Qatar Petroleum entered into an agreement with an ExxonMobil affiliate to acquire a 10% participating interest in three offshore exploration blocks in the Angoche and Zambezi basins in the Republic of Mozambique.

In March 2019, Qatar Petroleum entered into an agreement with Eni to acquire a 25.5% participating interest in block A5A

Rosneft

In late 2015, RN-Exploration (a subsidiary of Rosneft Oil Company) and a subsidiary of ExxonMobil were declared winners for three blocks in the fifth license round organized by INP. Rosneft and ExxonMobil were awarded three license areas: A5-B in the Angoche Basin, and Z5-C and Z5-D in the Zambezi Delta. In October 2018, the consortium where Rosneft holds 20% signed concession agreements for the exploration and production of hydrocarbons on the three areas with the Government of Mozambique, and the companies started exploration works.

Sasol

Since they pioneered the monetisation of the Pande and Temane gas fields which had been stranded for over 30 years, Mozambique has been a heartland of Sasol’s oil and gas strategy. For a decade the company have processed gas from the Pande and Temane fields in a Central Processing Facility (CPF) and transported it via an 8.5-km pipeline to gas markets in South Africa and Mozambique. This was made possible through Sasol's partnership with the Companhia Moçambicana de Hidrocarbonetos (CMH) and International Finance Corporate (IFC).

During 2019, Sasol signed exploration and production concession contracts on two new blocks in Mozambique; PT5-C which is adjacent to our existing producing licence and A5-A which is an offshore concession located centrally in the country.

In exploring new avenues to import gas into South Africa, Sasol established a dedicated team to engage parties involved in the development of the substantial natural gas fields of the offshore Rovuma Basin.

Mozambique remains at the core of Sasol's strategy and the company aim to maximise shared value with the government of Mozambique.

TotalEnergies

In September 2019, TotalEnergies closed the acquisition of Anadarko’s 26.5% operated interest in the Mozambique LNG project for a purchase price of $ 3.9 billion.

Mozambique LNG is the country’s first onshore LNG development. The project includes the development of the Golfinho and Atum fields located within Offshore Area 1 and the construction of a two-trains liquefaction plant with a capacity of 12.9 million tonnes per year (Mt/y). The Area 1 contains more than 60 Tcf of gas resources, of which 18 Tcf will be developed with the first two trains. The Final Investment Decision (FID) on Mozambique LNG was announced on June 18, 2019, and the project is expected to come into production by 2024.

The Mozambique LNG project is largely derisked since almost 90% of the production is already sold through long-term contracts with key LNG buyers in Asia and in Europe. Additionally, the project is expected to have a domestic gas component for in-country consumption to help fuel future economic development.

Total operates Mozambique LNG with a 26.5% participating interest alongside ENH Rovuma Área Um, S.A. (15%), Mitsui E&P Mozambique Area1 Ltd. (20%), ONGC Videsh Ltd. (10%), Beas Rovuma Energy Mozambique Limited (10%), BPRL Ventures Mozambique B.V. (10%), and PTTEP Mozambique Area 1 Limited (8.5%).

Mozambique LNG represents a total post-FID investment of 20 B$. The project financing amounts to 14.9 B$, the biggest ever in Africa, and includes direct and covered loans from 8 Export Credit Agencies (ECAs), 19 commercial bank facilities, and a loan from the African Development Bank.

KeyFacts Energy provide bespoke reports covering selected country and energy company 'at-a-glance' reviews, allowing users to access valuable 'first-pass' information ahead of more detailed analysis. Contact us for further information.

KeyFacts Energy: Country Profile

KEYFACT Energy

KEYFACT Energy