Bowleven, the Africa focused oil and gas exploration group traded on AIM, today announced its Full Year Results for the year ended 30 June 2021. The key highlights are as follows:

Operational

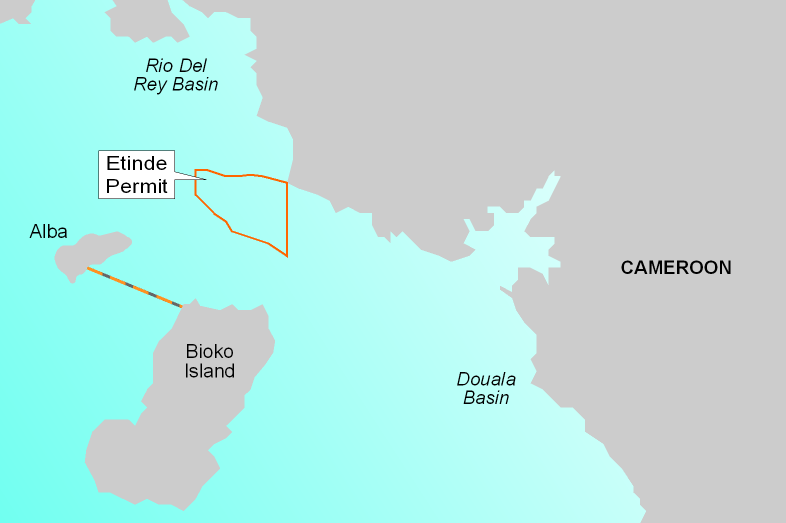

Etinde, offshore Cameroon

- The Front End Engineering Design (FEED) project completed in December 2020 with follow-up evaluation completed during Q1 2021.

- FEED highlighted that an IM field only development based on domestic gas sales only, with reinjection and recycling of surplus gas would not deliver sufficient return on investment for the JV partners under current market conditions. The Board of Bowleven believes that the addition of IE reserves and higher domestic and/or export gas production is critical for the Limbe facility based development option.

- Processing Etinde wet gas production at the Marathon Oil-operated Bioko Island facilities in Equatorial Guinea has become a potential alternative and Société Nationale des Hydrocarbures (SNH) has given the JV partners approval to investigate this option.

- Work is progressing on re-evaluation of the IE reservoirs with the aim of adding this option to the Field Development Plan.

- The economic investment case for Etinde remains strong, with the Company’s interest in the Etinde project continuing to hold an estimated value of $150 million, well above the Group’s current market capitalisation.

- Financial

- The loss for the financial year was $2 million.

- Bowleven closed the year with $4.1 million of cash and a financial investment of $2.5 million giving a total value of funds of $6.6 million. Cash balances at 30 October 2021 were $3.0 million.

- There are commercial and regulatory issues which have yet to be resolved in conjunction with the uncertainty regarding the optimum development concept. Resolving these issues to permit FID to be reached in 2022 will be a challenge for the JV partners and any delays in reaching final resolutions will create a high financial risk for Bowleven.

- The timing of resolving these issues impacts the Directors considerations relating to their assessment of the going concern status of the group. It was therefore considered appropriate that a number of different scenarios were considered by the Directors. In addition to these scenarios, a number of further sensitivities were modelled which considered the impact of increases in opex and capex and changes in FID timing. Each of the scenarios and sensitivities demonstrated positive cash balances twelve months from the date of approval of the financial statements and the Directors are therefore satisfied that the Group has adequate resources to continue in operational existence for 12 months from the date of the approval of the financial statements. However, timing of progress towards FID is not within the control of the Group. Should these commercial and regulatory issues not be resolved as anticipated, it is likely that Bowleven would be required to raise additional short-term funding to bridge expenditure to FID and the receipt of $25 million due from the JV partners at that milestone.

Corporate

- The Etinde JV partners are in continued discussion with SNH and various other commercial parties in respect of the domestic sale of gas, Liquefied Petroleum Gas (LPG) and condensate.

- The Group has entered initial discussions with Marathon Oil regarding using the Bioko Island facilities subject to approval from SNH.

- Appointment of Jack Arnoff as NED and Chairman.

Outlook

The Company’s key objective is to deliver on a revised strategy in FY2022 which includes:

- Working with JV partners on Commercial and Finance matters in respect of the Etinde development options with the aim of reaching an Etinde project FID in 2022.

- The JV partners propose to renew the Etinde Exclusive Exploitation Agreement (EEEA) licence as part of the regulatory process associated with FID in 2022. The risk of the Etinde licence potentially being removed following its expiry in January 2021is considered low at the current time.

- Maintaining disciplined capital management to secure progress towards FID whilst maintaining financial resources, the Company thereafter exploring funding options regarding development capital.

Eli Chahin, Chief Executive Officer of Bowleven plc, said:

“We continue to focus on maximising the economic return to our shareholders. Throughout the course of 2021, we have seen global gas prices return to high levels and trend towards higher long term prices. With the expected timing of our first gas condensate production, we uphold a strong economic case for our asset with capital returns anticipated by the Board to be favourable.

Our focus for 2022 is to reach an agreement within the JV partnership and our wider stakeholders on the optimum development concept for Etinde and reach FID during the year. The Board and the executive team are continually discussing ways to mitigate project and financing risk and will continue to seek ways to deliver significant long-term value to investors whilst securing the sustainability of the Company.”

KeyFacts Energy: Bowleven Cameroon country profile

If you would like to sign up to KeyFacts Energy's free daily news-alert service click here to join our growing list of subscribers.

KEYFACT Energy

KEYFACT Energy