Denbury today provided results for the third quarter of 2021.

- Progressed installation of the 105-mile extension of the Greencore CO2 Pipeline to the Cedar Creek Anticline (“CCA”) EOR project ahead of plan, with completion expected before the end of November 2021.

- Completed the Oyster Bayou A1 CO2 development expansion with initial production commencing late in the third quarter.

- Reduced total debt by $52 million during the third quarter, exiting the quarter with no outstanding long-term debt and liquidity of $565 million.

- Issued Denbury’s 2021 Corporate Responsibility Report, highlighting the Company’s net negative combined Scope 1 and 2 CO2 emissions for 2019 and 2020 and its target to be fully negative through Scope 3 within this decade.

RECENT CCUS HIGHLIGHTS

- Executed a term sheet with Mitsubishi Corporation for the transport and storage of CO2 captured from Mitsubishi’s proposed ammonia project along the U.S. Gulf Coast. The agreement covers a 20-year period, and Mitsubishi’s project is targeted to produce associated CO2 emissions of approximately 1.8 million metric tons per year (“MMTPA”), beginning in the latter half of the decade.

- Commenced a joint evaluation with Mitsui E&P USA LLC of potential opportunities across the U.S. Gulf Coast to develop carbon-negative oil assets utilizing anthropogenic CO2. As part of the evaluation, the parties seek to jointly pursue CO2 offtake opportunities from Mitsui’s potential projects along the U.S. Gulf Coast.

- Announced joint development of a Texas Gulf Coast sequestration site with Gulf Coast Midstream Partners. Located in close proximity to Denbury’s existing CO2 Green Pipeline, the location has the potential to store up to 400 million metric tons of CO2 at a rate of up to 9 MMTPA. The EPA Class VI permitting process has been initiated and sequestration is estimated to be available by early 2025.

Chris Kendall, the Company’s President and CEO, commented,

“Denbury’s strong operational execution and continued safety focus, combined with support from higher oil prices, delivered exceptional results for the third quarter. We advanced both near and long-term resource development projects, and I am particularly proud that the CCA CO2 development, the largest tertiary project in Denbury’s history, is ahead of schedule with zero recordable safety incidents incurred to date.”

“The third quarter was also a significant period for our CCUS business, as the initial term sheets we executed represent the first steps towards solidifying this substantial growth opportunity for our Company. We have advanced negotiations for additional CO2 transport and storage arrangements, and I remain confident in further announcements by the end of 2021. Our successes in 2021 have set the stage for a very exciting future, as we execute on our strategy to grow the CCUS opportunity while maintaining a strong EOR-focused production business.”

Total revenues and other income in the third quarter of 2021 were $344 million, a 14% increase over second quarter 2021 levels, supported predominantly by higher oil price realizations and also slightly higher oil volumes. Denbury’s third quarter 2021 average pre-hedge realized oil price was $68.88 per barrel (“Bbl”), which was $1.75 per Bbl below NYMEX WTI oil prices, consistent with the Company’s guidance. As compared to the second quarter of 2021, the Company’s average oil differential widened from the $1.32 per Bbl below NYMEX WTI last quarter, primarily as a result of Gulf Coast crudes in comparison to WTI.

Denbury’s oil and natural gas sales volumes averaged 49,682 barrels of oil equivalent per day (“BOE/d”) during the third quarter of 2021. In comparison to the second quarter 2021, third quarter sales volumes were up 1% primarily attributable to the Wind River Basin properties, Oyster Bayou performance, and non-tertiary sales at Conroe Field. Oil represented 97% of the Company’s third quarter 2021 volumes, and approximately 25% of the Company’s oil was attributable to the injection of industrial-sourced CO2 in its EOR operations, resulting in carbon-negative or blue oil.

Lease operating expenses (“LOE”) in the third quarter of 2021 totaled $117 million, or $25.50 per BOE, in line with expectations. On a per BOE basis, LOE expense increased approximately 3% from the second quarter of 2021 due in part to higher power and fuel, contract labor, and workover costs.

CAPITAL EXPENDITURES

Third quarter 2021 development capital expenditures totaled nearly $100 million, bringing year to-date capital expenditures to a total of $174 million. Approximately 60% of the third quarter total was dedicated to the CCA tertiary project, including the Greencore CO2 Pipeline extension, the infield CCA distribution system installation, and field work to begin converting water injection wells to CO2 injection. The Greencore CO2 Pipeline extension project is running ahead of schedule, and completion is now anticipated before the end of November 2021. Initial CO2 injection into CCA is expected in the first quarter of 2022, with production response estimated to commence in the second half of 2023.

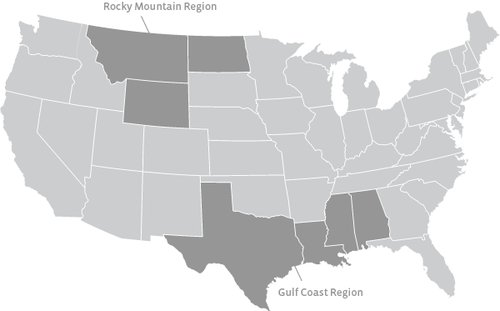

Also during the quarter, the Company completed drilling and injection work at the Oyster Bayou A1 CO2 development expansion in the Gulf Coast. In addition, the Company drilled a horizontal infield development well at Coral Creek in the Cedar Creek Anticline area of the Rocky Mountain region. Production response from these projects commenced late in the third quarter of 2021.

GUIDANCE

Development capital expenditures for the fourth quarter of the year are expected between $75 million and $95 million, with the full year unchanged at a range of $250 million to $270 million. Planned fourth quarter capital expenditures include the completion of the Greencore CO2 Pipeline extension and CCA CO2 infield distribution system, as well as additional field development activities. For the fourth quarter of 2021, LOE per BOE is anticipated to be consistent with the unit rate in the third quarter and sales volumes are anticipated to average nearly 50,000 BOE/d.

KeyFacts Energy: Denbury Resources US country profile

KEYFACT Energy

KEYFACT Energy