Image source: Calima Energy

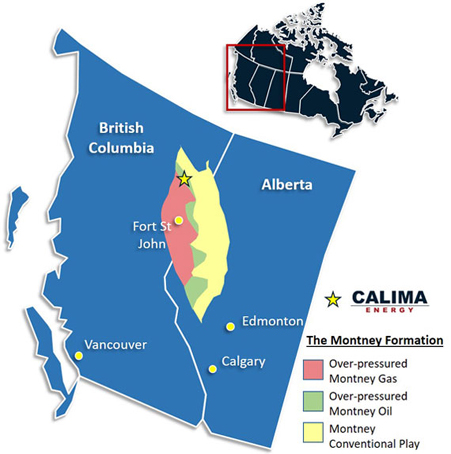

Australian investors could benefit from developments in faraway Canada, where the Montney Formation in British Columbia is turning into one of the most attractive oil and gas plays in North America.

The direct link to the region – ASXlisted junior oil explorer called Calima Energy – this month emerged as the 100 per cent owner of 72,000 acres of drilling rights in the highly prospective Montney.

Calima completed two simultaneous transactions to take over its joint venture partners TSV Montney and TMK Montney, underlining its strong belief in the potential for its acreage, where drilling is set to commence by the year’s end.

‘‘The Montney basin is very prolific and production has increased so significantly that it has overwhelmed the pipeline capacity,’’ says Calima’s managing director Alan Stein, an industry veteran who has previously steered successful public businesses such as Fusion Oil & Gas and Ophir Energy.

‘‘It delivers economic performance comparable to the best of the US resource plays such as the Marcellus and Eagle Ford.’’

Calima’s promoters got into the basin early, after a new geoscience technique developed in Perth helped predict the high potential for liquids in the region.

The investment group Havoc Partners, of which Stein is a part, invested in the play back in 2014, then decided to increase the investment in 2017 through the ASX-listed Calima. Based on an independent geological report by consultancy McDaniel & Associates, Calima’s drilling rights holds prospective resource of 2.1 trillion cubic feet of gas and 115 million barrels of liquids. The major play is the high-value condensate – used as a diluent to help transportation of heavy oil from the oil sands at nearby Alberta – but the huge volume of gas will also provide significant additional revenue for the venture. Calima has outlined a drilling campaign from December to March 2019 that will involve one vertical well and two horizontal wells. It plans to return after a few months and drill another three horizontal wells. All the horizontal wells are likely to be brought on production by 2020, resulting in cashflow from the sales of gas and condensate. Calima’s belief in the potential of the Montney is underscored by the quality of its neighbours, which include ConocoPhillips and Petronas, as well as local Canadian producers, who are mainly targeting the region’s liquids-rich hydrocarbon reserves for LNG export. Its optimism is also based on the results of immediate neighbour, Saguaro Resources, which has jumped into the top quartile of Montney producers after drilling more than 60 wells, all of which are successful.

‘‘Their acreage is analogous to the acreage we are drilling. So we look to the result that Saguaro has been able to achieve and we hope to deliver similar results,’’ Stein says.

Current gas prices in the area have been depressed, trading at nearly 60 per cent discount to US benchmark prices, due to non-availability of pipeline transport capacity.

But this situation is expected to turn over the next few years, with nearly $US70 billion worth of pipeline and LNG investments planned in the region.

Shell recently indicated it would take a Final-Investment-Decision on its planned $C40 billion LNG project by October, which could be quite significant for the basin.

Stein compares the Montney’s current situation to how things panned out in Queensland, when plans for a number of major LNG investments were outlined nearly a decade ago.

The announcement of LNG projects in the state had resulted in a significant increase in asset prices and share price valuations because of the expected increase in demand for gas.

Similarly, increasing interest in the Montney is reflected in the trends of rising prices for land transactions in the area. In some of the most recent transactions, ConocoPhillips is reported to have paid $C4453 per acre, nearly double the average of $C2500 prevailing last year.

By comparison, Calima’s total acreage,at the company’s current market value, is only valued at $C750 an acre. The vast upside potential will be of significance to Calima’s investors, given the company’s stated aim of transacting on its acreage.

‘‘If we can drill up this project and demonstrate that it is, in fact, similar to the acreage next door, then we would like to transact in a way that will deliver value to our shareholders,’’ Stein says.

The reason, he says, is that developing the entire project would take several billion dollars, and Calima does not have the balance sheet to fully exploit that opportunity.

The company last raised $3.5 million for working capital in April and is looking at several options to fund its drilling program.

‘‘There are various groups that have offered to provide funding in exchange of drilling royalties,’’ Stein says.

‘‘There have also been some discussions about joint ventures with other operators.

‘‘Or we could do an equity capital raising to fund our drilling.’’

The Montney basin is very prolific and production has increased so significantly that it has overwhelmed the pipeline capacity.

KEYFACT Energy

KEYFACT Energy