Image source: Imperial Oil

- Nearly $900 million of cash generated from operations; more than $1 billion returned to shareholders

- Renewed share purchase program; returned $1.6 billion to shareholders under prior 12-month program

- Major upstream and downstream planned maintenance completed; positioned for strong second half

Estimated net income in the second quarter of 2018 was $196 million, an increase of $273 million compared to the net loss of $77 million in the same period of 2017.

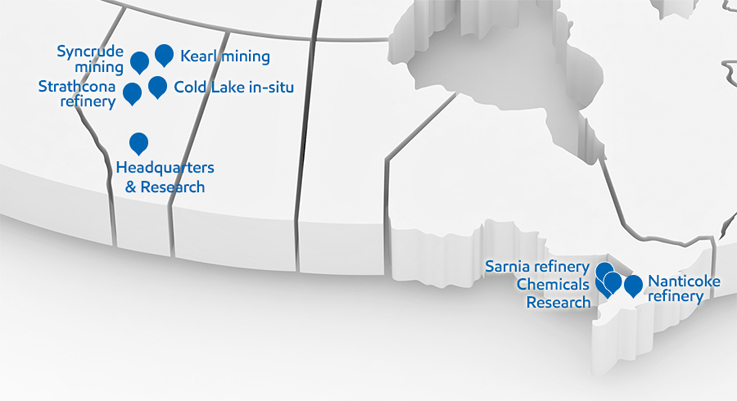

The quarter was characterized by significant planned maintenance at Imperial’s major upstream and downstream assets. These activities affected operational results and were aligned with the company’s commitment to maintain safe and reliable operations. Planned turnarounds occurred at one of Kearl’s two plants, Cold Lake’s second largest plant, Syncrude’s largest coker, and at Strathcona, the company’s largest refinery.

“Completion of the heavy maintenance schedule in the second quarter positions the company for strong operational performance in the second half of 2018,” said Rich Kruger, chairman, president and chief executive officer.

Refinery throughput averaged 363,000 barrels per day and petroleum product sales averaged 510,000 barrels per day. Despite the Strathcona refinery turnaround, Imperial achieved its highest quarterly sales volumes in nearly 30 years, demonstrating the company’s commitment to grow sales and reliably supply customers. To maximize value, Imperial continued to leverage its logistics and processing capabilities to take advantage of discounted Canadian heavy crude prices.

Upstream gross oil-equivalent production was 336,000 barrels per day, reflecting the impact of planned turnaround activities. Recovery from the June 20 power outage at Syncrude is ongoing with partial production restored in July and return to full rates anticipated in September. The company continued to progress activities to enhance future operations, including construction to add supplemental crushing capacity at Kearl and scaled application of new solvent technology at Cold Lake.

In the quarter, Imperial renewed its share purchase program, allowing the company to buy approximately 40 million shares over the 12-months ending June 26, 2019. Under the prior program that ended June 26, 2018, Imperial purchased 41 million shares for $1.6 billion. In the first half of 2018, Imperial returned $1.4 billion to shareholders through share purchases and dividends. Imperial’s approach to capital allocation focuses on maintaining a strong balance sheet, paying a reliable and growing dividend, investing in attractive growth opportunities and returning surplus cash to shareholders through share buybacks.

“Our business model offers distinct competitive advantages that are difficult for others to replicate,” added Kruger. “We are focused on capitalizing on these advantages to maximize near-term business results and long-term shareholder value.”

Second quarter highlights

- Net income of $196 million or $0.24 per share on a diluted basis, an increase of $273 million compared to a net loss of $77 million or $0.09 per share in the second quarter of 2017.

- Cash generated from operating activities was $859 million, an increase of $367 million from the second quarter of 2017.

- Capital and exploration expenditures totalled $284 million, an increase of $141 million from the second quarter of 2017. Spending continues to be focused on sustaining capital and previously announced projects. Previous full-year guidance for capital expenditures was in the range of $1.5 billion to $1.7 billion. Spending is now expected to be at the low end of the range.

- Dividends paid and share purchases totalled $1,025 million in the second quarter of 2018, including the purchase of approximately 21.4 million shares at a cost of $893 million. Higher share purchases in the second quarter reflect the amendment in April to increase the share limit under the program that ended June 26, 2018.

- Renewal of share purchase program continues commitment to deliver shareholder value. In June, Imperial received Toronto Stock Exchange approval to continue its program enabling the purchase of up to five percent of its common shares outstanding, approximately 40 million shares, during the 12-month period ending June 26, 2019. The company’s cash generation capability supports its ability to flexibly return surplus cash to shareholders through share buybacks.

- Production averaged 336,000 gross oil-equivalent barrels per day, up from 331,000 barrels per day in the same period of 2017.

- Cold Lake bitumen production averaged 133,000 barrels per day, compared to 160,000 barrels per day in the same quarter of 2017. Lower volumes were primarily due to planned maintenance and production timing. Imperial completed its first major turnaround in three years at Cold Lake. Specifically, a planned 38-day turnaround was completed at the Maskwa facility, the second largest of Cold Lake’s five plants. In addition, production in the quarter was affected by later implementation of new solvent-based recovery technology.

- Gross production of Kearl bitumen averaged 180,000 barrels per day in the quarter (128,000 barrels Imperial’s share), up from 171,000 barrels per day (121,000 barrels Imperial’s share) in the same period of 2017. Production was impacted by 48,000 barrels per day (34,000 barrels Imperial’s share) associated with planned turnaround activities at one of the two plants. The company continued to progress reliability improvements during the quarter, including construction activities to add supplemental crushing capacity. Imperial continues to expect annual average gross production at Kearl of 200,000 barrels per day in 2018.

- The company’s share of gross production from Syncrude averaged 50,000 barrels per day, up from 27,000 barrels per day in the second quarter of 2017. Production in the quarter was impacted by about 25,000 barrels per day (Imperial’s share) associated with planned turnaround activities, focused on the largest of its three cokers. On June 20, Syncrude experienced a power disruption that resulted in a shutdown of all processing units. Shipments have since resumed with return to full production anticipated in mid-September.

- Refinery throughput averaged 363,000 barrels per day, up from 358,000 barrels per day in the second quarter of 2017. Capacity utilization was 86 percent, reflecting the impact of a 72-day planned turnaround at the Strathcona facility completed in mid-June. Excluding maintenance impacts, utilization was estimated to be 94 percent in the quarter. The turnaround at Strathcona, the largest in its history, impacted earnings by about $250 million relative to the first quarter of 2018.

- Petroleum product sales were 510,000 barrels per day, up from 486,000 barrels per day in the second quarter of 2017. Imperial successfully sourced product by leveraging its refining network, building inventory and third-party purchases to reliably supply its customers during the planned turnaround at its Strathcona refinery.

- Matched best-ever quarterly chemical earnings of $78 million, up from $64 million in the same period of 2017. Imperial continues to deliver excellent results in its chemical business through high reliability, price-advantaged feedstocks and strong market pricing.

- Successfully deployed the largest autonomous haul truck in the world at Kearl. As part of an ongoing pilot, Imperial along with its development partners moved the first payload using a fully autonomous 400-ton haul truck in June. This is the largest autonomous truck put into a productive operating environment. The company’s testing program is targeted to ramp up to a fleet of seven autonomous trucks by year-end.

- Imperial supports Indigenous leaders at the G7 Women’s Forum Canada. The company sponsored a panel discussion showcasing the accomplishments and leadership of Indigenous women at the Women’s Forum for the Economy and Society held in Toronto in May. Imperial is committed to the advancement of women across Canada and has invested more than $2 million in leadership programs over the past five years.

Second quarter 2018 vs. second quarter 2017

The company’s net income for the second quarter of 2018 was $196 million or $0.24 per share on a diluted basis, an increase of $273 million compared to the net loss of $77 million or $0.09 per share, for the same period last year.

Upstream recorded a net loss in the second quarter of $6 million compared to a net loss of $201 million in the same period of 2017. Improved results reflect the impact of higher Canadian crude oil realizations of about $280 million, partially offset by higher royalty costs of about $50 million and higher operating expenses of about $50 million mainly associated with planned turnarounds.

West Texas Intermediate (WTI) averaged US$67.91 per barrel in the second quarter of 2018, up from US$48.20 per barrel in the same quarter of 2017. Western Canada Select (WCS) averaged US$48.81 per barrel and US$37.18 per barrel respectively for the same periods. The WTI / WCS differential widened to approximately US$19 per barrel in the second quarter of 2018, from approximately US$11 per barrel in the same period of 2017.

The Canadian dollar averaged US$0.78 in the second quarter of 2018, an increase of US$0.04 from the second quarter of 2017.

Imperial’s average Canadian dollar realizations for bitumen and synthetic crudes increased generally in line with the North American benchmarks, adjusted for changes in exchange rates and transportation costs. Bitumen realizations averaged $48.90 per barrel for the second quarter of 2018, an increase of $10.68 per barrel versus the second quarter of 2017. Synthetic crude realizations averaged $86.31 per barrel, an increase of $21.24 per barrel for the same period of 2017.

Gross production of Cold Lake bitumen averaged 133,000 barrels per day in the second quarter, compared to 160,000 barrels per day in the same period last year. Lower volumes were primarily due to planned maintenance and production timing.

Gross production of Kearl bitumen averaged 180,000 barrels per day in the second quarter (128,000 barrels Imperial’s share), up from 171,000 barrels per day (121,000 barrels Imperial’s share) during the second quarter of 2017. Higher production was mainly the result of mining optimization, partially offset by planned turnaround activities.

The company's share of gross production from Syncrude averaged 50,000 barrels per day, up from 27,000 barrels per day in the second quarter of 2017. Higher production was due to the absence of the Syncrude Mildred Lake upgrader fire that occurred in March 2017, partially offset by planned turnaround activities and a power disruption that occurred on June 20, 2018, resulting in a complete shutdown of all processing units for the remainder of the second quarter. Recovery from the power outage is ongoing with partial production restored in July and return to full rates anticipated in September.

Downstream net income was $201 million in the second quarter, up from $78 million in the second quarter of 2017. Earnings increased mainly due to stronger margins of about $390 million, partially offset by the impact of increased planned turnaround activity of about $200 million, and the impact of a stronger Canadian dollar.

Refinery throughput averaged 363,000 barrels per day, up from 358,000 barrels per day in the second quarter of 2017. Capacity utilization increased to 86 percent from 85 percent in the second quarter of 2017.

Petroleum product sales were 510,000 barrels per day, up from 486,000 barrels per day in the second quarter of 2017. Sales growth continues to be driven by optimization across the full Downstream value chain, and the expansion of Imperial’s logistics capabilities.

Chemical net income of $78 million in the second quarter matched best-ever quarterly results. Earnings increased $14 million from the same period of 2017, benefitting from increased volumes and margins.

KEYFACT Energy

KEYFACT Energy