United Oil & Gas today announced its unaudited financial and operating results for the half year ended 30 June 2021.

United's Chief Executive Officer, Brian Larkin commented:

"During the first half of 2021 three successful wells were drilled on Abu Sennan and the Company reached record working interest production of 2,730 boepd, delivering strong operational cashflow."

"The success that we enjoyed earlier in the year has led to two additional wells being added to the 2021 programme; the recent positive ASX-1X well and the new Al Jahraa 13 development well due to be drilled later this year."

"As part of the long-term objective to realise the full potential of Abu Sennan, we are pleased to be planning the drilling programme with our partners for 2022 and beyond. This plan will include multiple development and exploration wells and has the potential to deliver large reserve and production upside."

"In addition, during the period, the Company has completed a portfolio review, refocusing United around its low risk, high return production business, complemented by selected high impact exploration opportunities."

"With a production portfolio delivering strong operational cashflow, and multiple organic growth opportunities available, the Company is well placed to capitalise on new opportunities emerging across the industry both organic and external. We look forward to the remainder of the year."

Year to date summary

Strategic

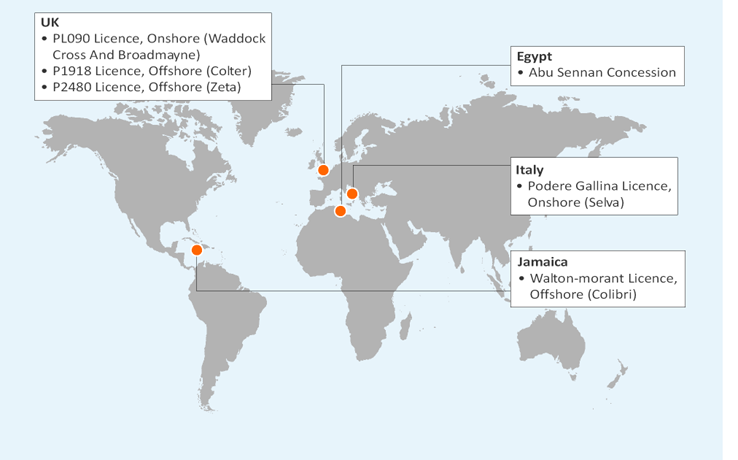

- Portfolio review completed refocusing United into a low-cost, low risk production business in Egypt and the Greater Mediterranean area complemented by selected high impact exploration opportunities in the Caribbean and Latin America

- Divestments of non-core assets in UK CNS and Italy signed post period end in line with the Company's strategy to reinvest the proceeds to support growth;

- Signed conditional SPA for sale of Italian interests for €2.165m (c. $2.54m)

- Signed conditional SPA for the sale of UK Central North Sea Licences for a consideration of up to £3.2m (c $4.4m)

Long-term plan in Egypt to realise full potential of the Abu Sennan licence

- Indicative long term drilling programme starting with four wells in 2022

- Potential to deliver large reserves, production and exploration upside

In Jamaica, the formal farm-out campaign for the Walton Morant licence, which commenced in early April continues

1H 2021 Operational summary

- Group working interest 1H 2021 production averaged 2,730 boepd (1H 2020: 1,975 boepd)1

- Highly successful ongoing drilling campaign on the Abu Sennan licence

- ASH-3 Development well came on stream in March 2021 at a gross rate of over 4,000 boepd

- ASD-1X Exploration well delivered a commercial discovery in May with gross rate of over 1,200 boepd achieved on test. Development lease and commencement announced in late May with the well coming on production less than two months from discovery and producing an average of 600 bopd gross in the second quarter.

- AJ-8 Development well (post period end) encountered over 40m net pay across three reservoir units and was immediately brought into production at an initial rate of 950 boepd

- ASX-1X Exploration well encountered at least 10m of net pay in a number of oil-bearing reservoirs (post period end)

Post-period end, United revised its full year guidance for the Abu Sennan licence to 2,100-2,300 boepd in early September. This was due to increased water cut in the wells in the ASH field. Following investigative processes during August, the water-cut and production from the ASH wells has stabilised . The wells are being closely monitored and further interventions are being considered.

1H 2021 Financial summary

- Group Revenue for H1 2021 of $10.2m (H1 2020: $2.4m)

- Gross Profit of $5.7m (H1 2020: $0.3m)

- Profit after Tax $2.0m (H1 2020: $1.8m)

- Realised oil price of $63.10/bbl (H1 2020: $28.26/bbl)1

- Cash collections in the six-month period of $8.2m (H1 2020:$3.6m)

- Cash operating costs of $4.61 /boe (H1 2020: $4.38/boe)1

- Repayments on BP Pre-payment facility $2.4m (H1 2020: $0.7m)

- Group Cash balance of $2.0m at the period end (H1 2020: $1.2m)

Outlook and Guidance

- Continued focus on capital allocation to support low-cost production and selected high impact exploration opportunities

- Group working interest production in Egypt is forecasted to average between 2,100-2,300 boepd for the full year as announced on 6 September 2021

- Group cash capital expenditure for the full year is forecasted to be $7.5-8.0m, fully funded from existing operations, with $7m to be invested in our low-cost production business and up to $1m across the other assets in the portfolio

- Preliminary four well 2022 drilling campaign planned and longer-term plans for accessing the significant upside reserves and production potential of Abu Sennan under discussion with partners

- Test results for ASX-1X exploration which has encountered >10m net pay in a number of oil bearing resevoirs. Evaluation of the ASX-1X well-data is continuing, and a comprehensive testing programme for the well is planned.

- New development well, Al Jahraa-13, has been added to the 2021 drilling campaign. This follows on from the success that was achieved at Al Jahraa-8

- $5.2m of upfront consideration for portfolio management transactions expected following completion of UK Central North Sea and Selva transactions plus an update on timing of receipt of $2.85m Crown milestone from Hibiscus Petroleum is expected before the year end

- In Jamaica, the formal farm-out campaign for the Walton Morant licence, which commenced in early April continues. The market environment for exploration remains challenging, and United are actively working to achieve the best path forward for this exciting high-impact asset. We look forward to further positive engagement with the Government of Jamaica to ensure the investment cycle has time to recover.

- With a production portfolio delivering strong operational cashflow, and multiple organic growth opportunities available, the Company looks forward to completing our divestments, working with partners on the realising the upside potential in the Abu Sennan licence and is well placed to capitalise on new opportunities emerging across the industry.

Operational Review

The first half of 2021 has been another strong six months in terms of operational performance. At Abu Sennan during the first half of 2021 three successful wells were drilled and record-high production levels of 2,730 boepd net (1H 2020: 1,975 boepd), were achieved.

There are seven fields in the Abu Sennan license. One of these fields, ASH, currently has three wells in production, and since the beginning of 2020 has performed exceptionally. As announced on the 6 September 2021, the water-cut increased on all three producing ASH wells, particularly on ASH-2, where it increased at a faster rate than expected. The increase in water-cut had been accompanied by an associated drop in production from the ASH field and led us to revise the Group's full-year guidance to 2,100-2,300 boepd. The joint venture (JV) partners have performed a number of operations to investigate options for controlling the water-cut and stabilising production. Since the end of August, the ASH wells have been left to flow on a constrained choke and encouragingly, both the water-cut and the production from the wells has stabilised.

In Jamaica, it has been encouraging to see the positive impact of our continuing technical evaluation, and to launch a farm-down process on the back of the results of that work, which has received interest from a number of companies. With the current phase of the licence due to expire at the end of January 2022, we are actively working to achieve the best path forward for this exciting high-impact asset.

Egypt (22% working interest, non-operated)

Production

Production for 1H 2021 from the Abu Sennan licence net to the Group's working interest averaged 2,730 boepd. The Group's full year production guidance was subsequently revised to 2,100-2,300 boepd in early September.

The first half of the year saw three successful wells being drilled on the Abu Sennan licence, as well as a number of planned workovers. Given this activity, and the success that we have seen from the drilling, production numbers moved positively in the first half of the year. In Q2 we saw record production highs for the asset, with net production averaging 2,937 boepd for the quarter - an increase of 17% compared to Q1 - and continuing the upward trend in production we have seen since acquiring the asset. This led to H1 2021 working interest average production of 2,730 boepd, of which c. 18% is gas.

Operational Activity Summary

Drilling re-commenced on the Abu Sennan licence at the beginning of 2021, with the ASH-3 development well. This was drilled into an area in the north of the ASH field, and after encountering over 27m of net pay in the targeted AEB reservoir, the well was tested and brought onstream at over 4,000 boepd gross (880 boepd net to United) in early March.

The contracted EDC-50 rig then moved to the north of the licence to drill the ASD-1X exploration target. This well targeted multiple reservoirs and after encountering 22m of net pay across four intervals (ARC, ARE, Lower Bahariya & Kharita), a commercial discovery was announced on 4 May, with gross rates of over 1,200 bopd achieved on test. Development lease approval and commencement of production occurred on 26 May, with the well averaging over 600 bopd (132 bopd net to United) to the end of June. The well was brought into production within two months from initial discovery.

The third well in the drilling programme was the Al Jahraa-8 development well, which spudded on the 2 May. This was a deviated well targeting multiple Abu Roash and Bahariya reservoirs in an undrained area of the Al Jahraa field. The results of this well were reported post-period (19 July) with preliminary results indicating it encountered over 40m of net oil pay across three different reservoir units - including over 30m of net pay in the Upper and Lower Bahariya reservoirs, significantly above pre-drill expectations. The well has now been completed in the Lower Bahariya, which on initial testing flowed at a maximum rate of 2,093 bopd and 3.63 mmscf/d (c. 2,819 boepd gross; 620 boepd net) on a 64/64" choke; and a rate of 1,189 bopd and 1.22 mmscf/d (c. 1,433 boepd gross; 315 boepd net) on a more constrained 26/64" choke. The well is now on production, and at the beginning of September was flowing at 977 boepd gross.

Given the success to date from the 2021 drilling campaign, the JV was encouraged to add an additional exploration well (ASX-1X) to the drilling schedule, which spud on the 14 August. This is located c. 7km to the north of the Al Jahraa field and is a similar structure to the nearby discovery that was made at ASD-1X. As announced on the 21 September the ASX-1X exploration well encountered at least 10m of net pay. Evaluation of the well data is continuing, and a comprehensive plan for testing and completing the well is now planned. If successful, this will be followed by an application to EGPC for a development lease.

Forward Plans

UOG are working with their JV partners to maximise value from the prospects and leads in the Abu Sennan licence and recently met with the operator to discuss the long-term drilling programme which is expected to start with four wells in 2022. The JV partners are aligned on realising the full potential of the Abu Sennan licence which has the potential to deliver large reserves, production and exploration upside.

An additional development well, Al Jahraa-13, has been added to the 2021 drilling campaign. This follows on from the success that was achieved at Al Jahraa-8 and will target the Upper and Lower Bahariya reservoirs within the Al Jahraa field. The Company are already in discussions within the operator on longer-term plans to realise the significant potential of the Abu Sennan licence, resulting in an indicative four well 2022 drilling campaign. The potential being targeted lies both within the existing fields, and in the identified exploration prospects. In the existing fields, 2022 drilling will focus on development targets and candidates for water injection to boost recovery at Al Jahraa, ASH and ASD with the aim of maturing the 7 .6 mmboe of net WI 3P reserves. The first exploration target is currently planned to be the ASF-1X structure, located c. 15km to the south-west of the ASH Field, which will build on our knowledge from the ASH Field, and target multiple Abu Roash, Bahariya and AEB targets. UOG are also keen to drill additional exploration targets, with unrisked mid case resources of 5.7 mmboe net and possible unrisked upside of up to 12.7 mmboe net, clearly representing a substantial value opportunity.

Jamaica (100% working interest)

The Jamaica asset is a high-impact frontier exploration licence. Our work on updating the regional source rock story, quantifying the basin-wide potential, and running economics based on an independent assessment of viable development options for the high-graded Colibri prospect and the costs associated with them was completed in Q1 2021. Following this, the formal farm-out campaign for the Walton Morant licence commenced in early April. The Walton Morant Licence in Jamaica contains over 2.4 billion barrels unrisked mean prospective resources identified across the licence area, while the drill-ready, high-impact Colibri prospect alone contains mean prospective resources of 406mmbbls. UOG are actively working to achieve the best path forward for this exciting high-impact asset.

Italy (20% working interest, non-operator)

In April the Italian Government granted Environmental approval for the development of the Selva natural gas field concession - a key milestone on the road to achieving first gas. Progress is continuing to be made on obtaining the required construction permits, and first gas is expected from the field in 2022.

In August (post-period) a Sales and Purchase Agreement (SPA), was signed with a subsidiary of Prospex Energy PLC, for the sale of 100% of the share capital of UOG Italia Srl for a consideration of €2.165 million in cash (c $2.54m). Under the terms of the SPA, the Company received an immediate deposit payment of €108,235. The remainder of the consideration is payable on completion which is progressing.

UK

CNS (100% working interests)

In the UK Central North Sea, H1 2021 saw progress made on the work programmes associated with the licences: new seismic data was purchased and interpreted, with the initial mapping providing positive indications on the existing Maria, Brochel and Maol discoveries, and on the identified prospectivity, including Zeta, Dunvegan, and the deeper Jurassic targets.

Post-period end, in August, a binding SPA was signed to sell United's UK Central North Sea Licences P2480 and P2519 to Quattro Energy Limited for a headline consideration of up to £3.2 million (c. US $4.4 million). Completion is expected during Q4-2021.

Waddock Cross (26.25% working interest, non-operator)

The operator has engaged with a third party who are currently working on finalising the well design, facilities specification, and commercial modelling for a possible phased redevelopment of the shut-in Waddock Cross oil field with the Operator indicating a Final Investment Decision is expected to be made by the end of 2021.

Crown

On 12 December 2019, Anasuria Hibiscus ("AHUK") completed the acquisition of 100% interest in the named blocks from United and Swift Exploration Limited ("Swift Exploration") for a total cash consideration of up to US$5 million, to be paid based on a series of planning milestones and production targets.

A payment of US$1m was received from Anasuria Hibiscus on completion in December 2019. A payment of US$3m (US$2.85m to United) is due to be paid within 7 days of the actual date of approval of the Marigold Field Development Plan ("FDP"), which includes the development of the Crown discovery as part of the overall Marigold development ("FDP Approval"), by the UK's Oil and Gas Authority ("OGA").

In January the OGA requested that the AHUK seek to work with Ithaca Energy Limited , holder of the P2158 Block 15/18b, which is adjacent to the Marigold field and contains the Yeoman discovery and propose a common development solution for the resources found in both licence Ithaca and AHUK have agreed to jointly develop the reserves in Marigold.

The joint development concept decision is expected later this year and update on the payment timing will be provided once that decision has been made.

KEYFACT Energy

KEYFACT Energy