IOG today announced a proposed placing and Subscription to raise gross proceeds of approximately £8.5 million through the issue of new Ordinary Shares of 1 pence each in the capital of the Company. The New Ordinary Shares will be issued to existing and new investors pursuant to the Placing at a price of 25 pence per Ordinary Share through finnCap Ltd and Peel Hunt LLP, acting as joint bookrunners.

The net proceeds of the Fundraise will primarily be used by the Company to pursue a high-return incremental opportunity in addition to its existing development assets portfolio, by funding its 50% net share of the cost of drilling a dual-lateral appraisal well at the Kelham North and Kelham Central prospects in licence P2442 (Block 53/1b). Management estimates that Kelham North and Kelham Central contain gross mid-case resources of 36 Billion cubic feet equivalent ("Bcfe") and 42 Bcfe respectively, while the wells have geological chances of success ("GCoS") of 80% and 70% respectively. If successful, these assets would form the basis of a new Southern Hub that, with the Abbeydale discovery tied back subsea, has an estimated IRR of 47% at the Company's base planning case gas price of 45p/therm, directly benefitting from the existing Saturn Banks infrastructure. In the Company's view, successful appraisal would also significantly de-risk the other discoveries and prospects in the P2442 licence, enhancing the commercial potential of the area.

IOG owns and operates 50% stakes in a portfolio of low risk, high value gas reserves and resources in the UK Southern North Sea ("SNS"). IOG's 50% JV partner is CER, a subsidiary of Berkshire Hathaway Energy.

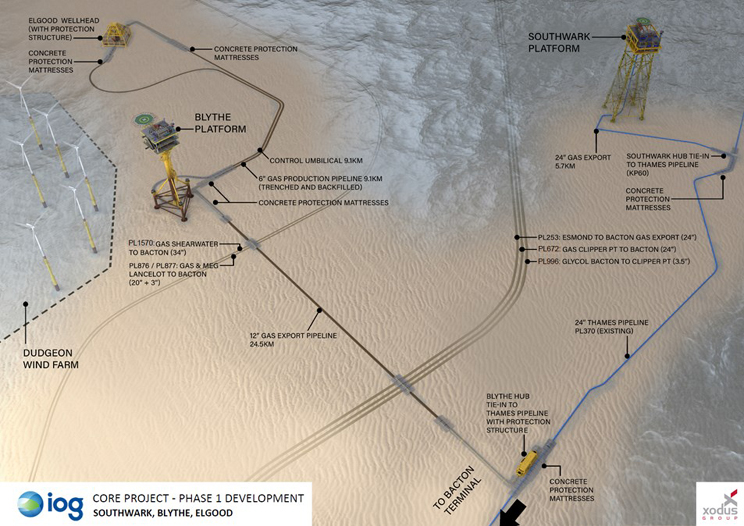

The Company's Saturn Banks Project targets a gross 2P peak production rate of 140 MMcfe/d (c. 24,000 Boe/d) from gross 2P gas reserves of 302 Bcfe (Source: ERC Equipoise Competent Persons Report: October 2017, adjusted by Management to account for updated project timing and compression) and management estimated 2C gas Contingent Resources of 132 Bcfe, via an efficient hub strategy based on co-owned infrastructure. In addition to its 2P reserves at Blythe, Elgood, Southwark, Nailsworth and Elland and 2C contingent resources at Goddard, it has management estimated gross 2C contingent resources of 23 Bcfe at Abbeydale and gross unrisked mid-case prospective resources of 36 Bcfe at Kelham North, 42 Bcfe at Kelham Central, 58 Bcfe at Thornbridge, 31 Bcfe at Southsea, 28 Bcfe and 19 Bcfe in the two Goddard flank structures, and 21 Bcfe at Harvey. The Orrell discovery, with management estimated gross 2C contingent resources of 42 Bcfe, also lies approximately 50% on the P2442 licence held 50% by IOG.

In December 2020 IOG was also awarded a 50% operated stake in Licence P2589, containing the Panther and Grafton gas discoveries with management estimated gross mid-case contingent resources of 46 Bcfe and 35 Bcfe respectively. In addition, IOG continues to pursue value accretive acquisitions to help generate further significant shareholder returns.

KEYFACT Energy

KEYFACT Energy